Topics: Macro Fundamentals, indicators, theories of market behaviors. So, very complexs topics... Also lots of debates...

It'll be divided in two parts, one fundamental and another with practical stuff about monetary and fiscal policies been used.

I'll try to be the most impartial as possible.

It's also nice to see what theories have in common than to just debate their differences...

One thing was basis for the following ones, and is an evolutionary construction of models.

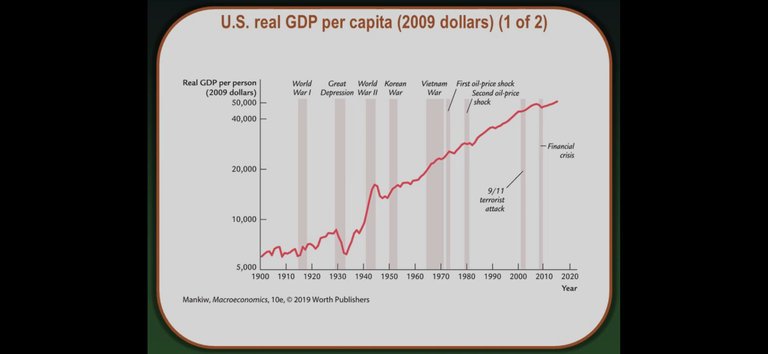

First we have classical thinkers like Smith; Ricardo... Others very controverses figures... With the beginners principles of market functions, like the autoregulated version that was believed, market equilibrium, and the intervention of the state (invisible hand).

About all that, take in consideration that Smith lived in sec XVIII, and monetary and fiscal policies were used since 33 AD, thats the first historic economic crisis we have related. We saw economical contractionism without inflation due to political disputes, that generated a crises, which was solved with quantitative easing, insertion of credits and low interest. Nothing new from what its done nowdays, there is a big historical gap between this. Besides, Rome empire just burned Babylon library, where they used to discuss a lot about finance, and had shorter proximity with asiatic and middle east, but that doesn't explain why this knowledge also didn't come out from others cultures.

Continuing... Those "classicals" were basis for the utilitarians, marginalists like Bentham; Menger; Walras; Jevons... They created the known concepts of supply, demand, price, value... This was basis for microeconomics.

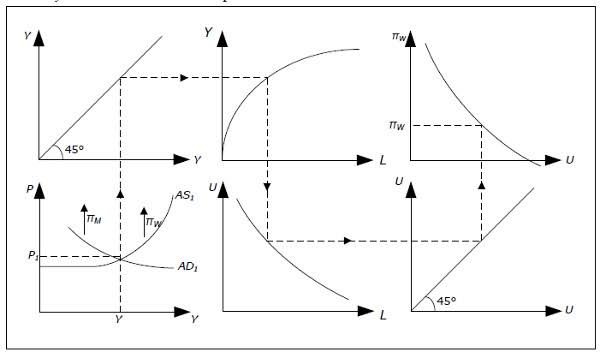

That by itself is base for Keynes; Mill, neokeynesians,... They come with the first model of how interests rates affects production (or by any other metric used as the first cause for the next changes), employment rate, aggregate demand (consumption), inflation, real wage, after that, neokeynesians brings aspects like tributation, average debt of families that is imputed on incomes.

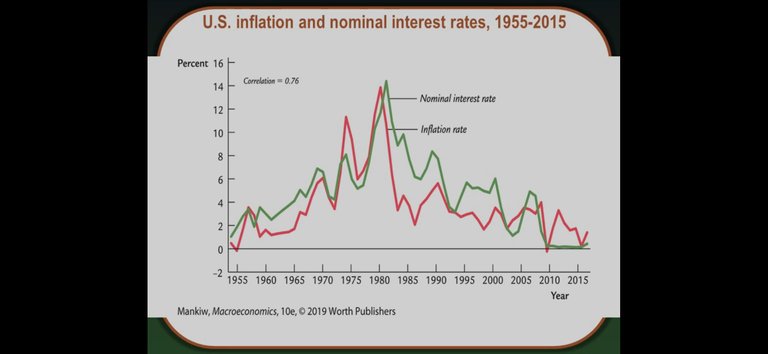

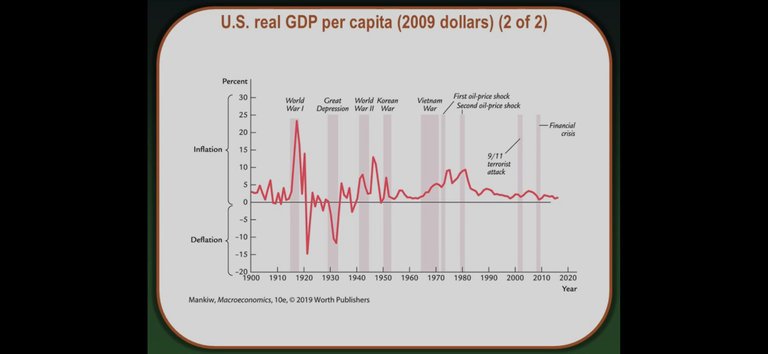

It's easy to interpret, basically, low interests rates encourages credit, production of companies, (also real state market financings), employment rate, consumption, which can lead to inflation (by principles of supply and demand) and decrease of real wage, so if it happens, they rise interests rates to deflate (that desestimulates the economy, by inversion of all metrics), those are the so called economic cycles. Besides fiscal policies, its also used monetary expansionism and contractionism that have similar effects.

Many others economics concepts were created, GDP, GNP, public debt, curve of Phillips... I'll talk later about economics indicators.

All that leads us to the actual debate that spins around two vertents, the modern monetary theory (MMT), an heterodox difusion on keynesianism, been currently used by the fed, BCE, Japan... and the neoliberal model vertent of less intervention, based on Smith, Friedman, Mises, Austriac Economic School thinkers.

Both models have the pursuit of the optimal level of all variants as an objective (lvl of production, jobs, aggregated demand, without inflation)...

I'll resume boths,

MMT intends to impress money in a continuous basis (not been an scarce commodity) and direct it to measures that tends to increase gdp per capta, jobs, quality of life with technology improvements, but can lead to inflation, however we see nowdays, during C19 pandemic, direction for EV car transition for ex, besides subsidies, which can cut future operational cost and distribution of companies in comparision with the actual combustion cars expenditures, that might permit lower prices and increase future real wage. It's more a "developmental" model. The other question is that public debt gets higher, but arguably it can be issued more money to pay its own bills and bonds, can also lead to higher tributes to control it, besides credit risk of the country... They seen to not care for that to the point at open hand from its own development... And if it generates inflation they ponderates gov spendings and tax policies.

If you read the research part in the Fed's site, which surprisingly have great economics articles, you'll see that they use keynesian model as basis.

Next, about neoliberalism, they intends to decrease the role of the state as much as possible, considering that many times it much more gets in the way of the population than helps somehow, which is true for many economies, so there are libertarian principles, like the tax decreasing. However, they also proposes some moderated quantitative easing, by low interests rate, for keeping on production incentive, jobs, consumption (they are similar somehow)... No model totally prevents inflation, if it happens, there is an internal debate if they just wait and let it autoregulate itself or rise interests to deflate.

There are also political economical questions like the debt trap diplomacy that happens (search for it), that shows problems in the floating exchange rate, and exposition to others countries protecionism if the public debt is also exposed to the other economy... Also monetary and fiscal policies effects will depend a lot on which countries we are talking about, their job laws, tributation system, market structure...

Obs I: Lots of it (both models) are criticized for the term "economicism", which means to look in a methodic way, pragmatic, only by supply and demand, some kind of human math, without context, social facts, distortions, irrational behaviors...

II: There are many disagreements between thinkers of same sides, like liberals on what was the cause of 29 crise and what should've been done, some austriacs even said that US should've contracted the economy earlier (yeah, bigger intervention, huh?!), you can google all the context... So try to keep an open mind for all facts...

Next post will be about macro indicators, how the currency exchange rate works, commodities... Market behavior theories... Some fundamentals too, like the dissolution of gold standard, bretton woods and smithsonian agreement.

The description of MMT that you gave seems to be based on the incorrect views of other people rather than a reading of the materials by MMT scholars.

I see that it's like neokeynesian model, which I explained before, so that was implicit. I only talked some differences... I understand that I have a limited knowledge about that, and haven't really read some full article theory whitepaper, just some wikis and sites's summaries. What should I increase or change? What is incorrect? Thanks for your feedback!!

Wikipedia is wrong?

One of the things you said was "if it generates inflation, they rise interest". That's a monetarist/neoliberal approach. MMT would look at Government spending (switching from a quantity rule to a price rule) and taxation, using buffer stocks (such as a job guarantee program) as a price anchor.

Bill Mitchell wrote a couple of good blog posts to explain MMT's relationship with inflation and he wrote about some policy considerations at the end of this one:

http://bilbo.economicoutlook.net/blog/?p=13035

He ends by saying this: " The only way that demand-side policies should be used to effect when there is a supply-side motivated inflation is when there is an employment buffer stock system in place."

Hey sir, I just got back here to say that I read some articles and you are right, they would control gov spendings and rise tributation. Sorry for my missception. Lots of people disagrees also, like Greg Mankiw, Paul Krugman, Warren buffett, saying it would lead to inflation and etc... (What is not ocurring at Japan). But what we are actually seen is the rise of interests, an ortodox keynesian fiscal policy, crazy, huh?! But thanks for the informations you provided early.

Hey bro, I really apreciate any thoughts that can agregate me.

Take this !PIZZA in advance

PIZZA Holders sent $PIZZA tips in this post's comments:

@dstampede(1/7) tipped @penston (x1)

Join us in Discord!