Maker and DAI have been one of the crypto OGs. The idea behind the decentralized DAI stablecoin and its implementation have been extremely useful for some users. A very complicated and innovative mechanics were put in places to achieve the DAI stablecoin. The protocol use to be on the top list for the TVL and the value it had accumulated.

However, since last year the protocol rebranded to SKY and USDS, with more ways for minting USDS, including so called RWAs (Real World Assets), such as treasury bills. This enables the protocol to basically drive demand for US debt, in the same way Tether and USDC are doing.

There is the new governance token on top of it SKY, that serve in governance, voting for new collateral and

The old version of DAI and MAKER are still around and they work but they are slowly being decommissioned and converted to the new version via an upgrade function. Its voluntary upgrade.

More to read on MakerDAO in there whitepaper on the link.

Here we will be looking at:

- Total value locked TVL (collateral)

- DAI supply

- Loan to value ratio LTV

- Top tokens used as collateral

- Defi protocols rank by TVL

- Number of users DAUs

- Price

The period that we will be looking at is 2020 - 2025.

The data here is compiled from different sources like DefiLama and Dune Analytics.

Total Value Locked | Collateral

In the case of MakerDAO the TVL is the collateral deposited to mint DAI. Here is the chart.

The TVL for MakerDAO was quite small back in 2020. It was under 100M. Then it started growing and in 2021 it has grown exponentially. The ATH for the collateral value in the MakerDAO protocol was reached at the end of 2021 with almost 20B in value.

The 20B was the ATH for Maker, as it never recovered back to those highs and with the latest happenings and transition to SKY/USDS it will never be at that point again. At the moment the TVL is at 6B.

DAI and USDS Supply

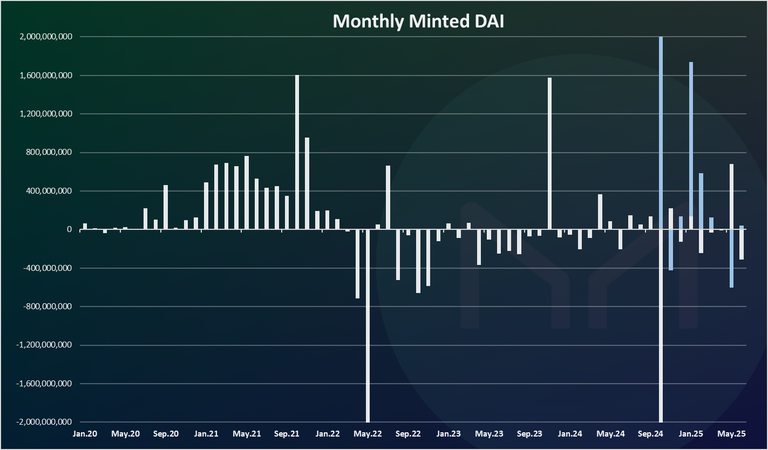

Here is the chart for DAI and USDS minted per month.

White bars for DAI, blue for USDS.

Here we can see the constant positive months back in 2021 with around 700M DAI minted on a monthly basis, and a record of 1.6B in October 2021.

In May 2022 there was a negative 2.2B DAI burnt.

In 2023 we can notice the big spike in November, when 1.5B new DAI was minted. The other months are with a lot less volatility.

We can notice the sharp drop in October when more than 2B DAI was burned, and I’m guessing a lot of it was converted to the new version USDS, since it has a big positive candle in the same month.

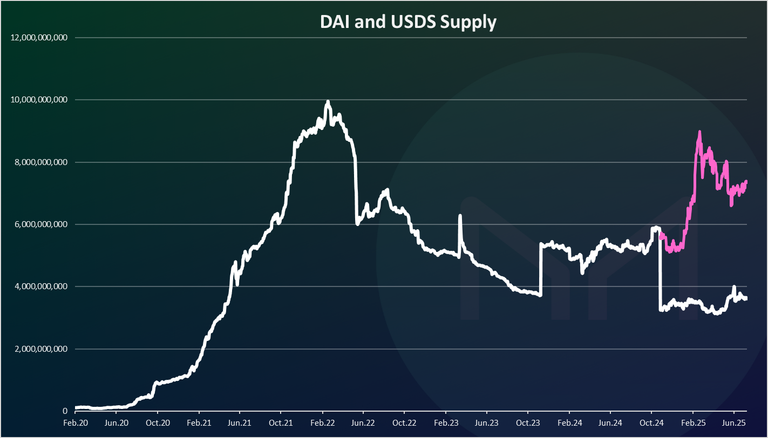

The cumulative DAI and USDS in circulation chart looks like this:

I have added the USDS supply to this chart for context. As we can see, in October last year there was a drop in the DAI supply, while USDS started at 5B. It has grown fast since then and it is now at 7.3B, while DAI is at 3.6B.

The DAI supply has grown massively in 2021 and the first half of 2022, reaching an ATH of 10B. Then UST happened, the stablecoin marketcap dropped a lot in May 2022, and has continued to go down ever since. A short spike in March 2023, due to the USDC situation. Another spike in November 2023 and almost constant with even a slow decrease in the last months with around 4B DAI in circulation.

It’s interesting to see that with the increase of the crypto prices the amount of DAI in circulation has stayed relatively same. DAI has shown that it is resilient and survived bear market, but its grow has been somewhat stale.

Loan to Value Ratio LTV

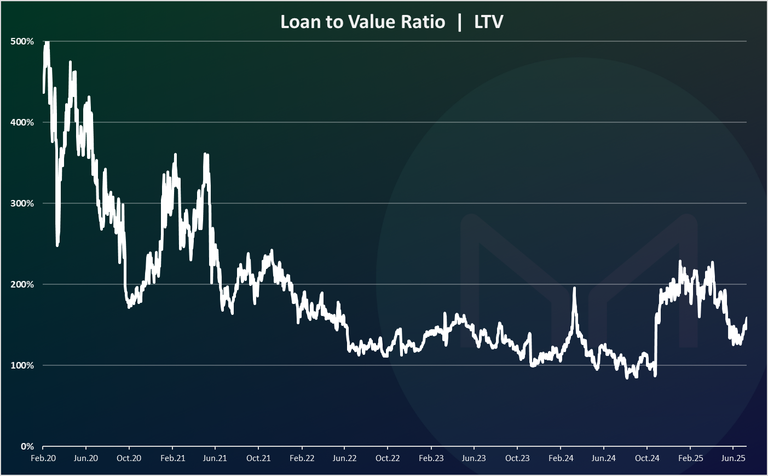

The LTV value is often used for MakerDAO and DAI, to access the overall health of the ecosystem and the collateral position. It is a ratio between the value of the collateral deposited and the DAI minted. For example, for a 10B in collateral and 5B DAI minted the LTV ratio is 10/5 = 2, or 200% percent. Here is the historical chart.

From the chart above we can notice that the LTV value has dropped over time. At the beginning of 2020 this ratio was at 500%, while in the last year it is around 150% or less.

While this ratio might seem low and might show that there are a lot of vaults close to liquidation, we should bear in mind the type of collateral that is being used over time. At first ETH was the number one collateral and was dominant. But as time progressed USDC became a large share of the collateral to mint DAI. Since USDC is pegged to the dollar there is no need for overcollateralization like in the case of ETH and users are minting DAI for 1 to 1 ratio. This lowers the overall LTV ratio.

In the last period the collateral structure for minting DAI has changed and migrated back from USDC to mostly Ethereum. Because of this we can see a recent spike in the LTV ratio.

Top Tokens in the TVL

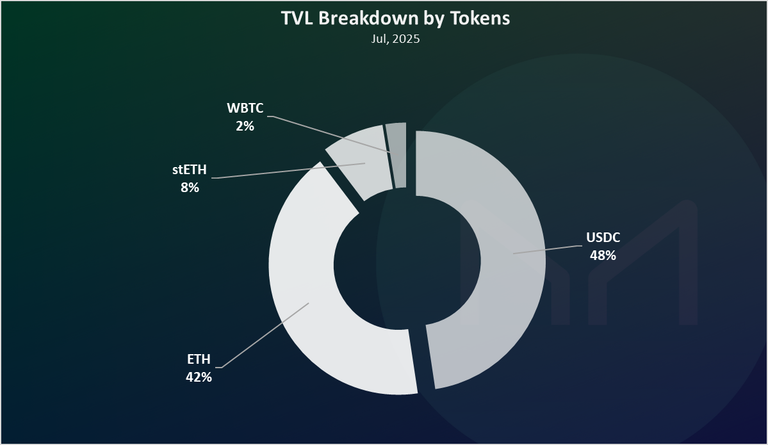

Which tokens are mostly deposited in the protocol? Here is the chart.

As we can see USDC an ETH are dominat tokens in the collateral now as TVL. For Ethereum if we summarize ETH and stETH it will be the dominant token. A small share of BTC is also used on the protocol.

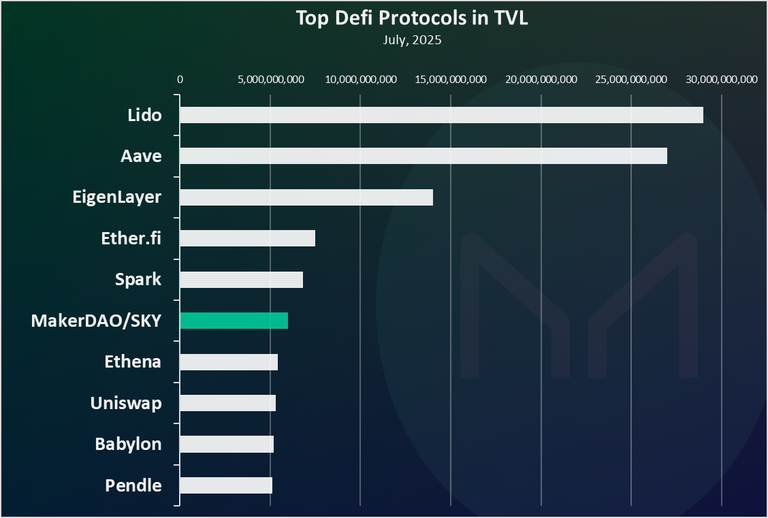

Top Defi Protocols Ranked by TVL

How is the MakerDAO/SKY protocol doing when compared to the other ones? The total value locked is usually one of the metrics these protocols use.

Here is the chart.

MakerDAO/SKY is now in the middle of the chart. Back in the days it was number one for a long time. It has dropped down in the last period and lost its high spot. The centralized version of the stablecoins have basically overtaken it.

Price

When it comes to prices, we will be looking at the chart for the governance token MAKER and the stabelcoin DAI.

Here is the chart for the MAKER token.

Quite a wild ride for MAKER, going from 400 to more than 5k in 2021, and down to 600 in 2022.

There was sharp growth again in the first half of 2024 and a drop afterwards, especially during the transition period in October 2024.

In 2025 the token price has increased again and It is now trading around 2k that is somewhat a middle ground, still far from its previous highs, but also not at the lows.

All the best

@dalz

This post has been shared on Reddit by @acidyo through the HivePosh initiative.

Used to hear about this protocol quite a bit, not so much lately...

Yea, it was the thing back in the days... still is to certain level, but other protocols provide similar function and seems to work well and give more options, like aave

Oh cool! That's a new one to me.. I thought I knew all the crypto.. I guess NOT. :P This is an OG coin, huh? 😎👍

Scanning through this doesn't help me grab it full. I hope to read through it so I can benefit in anyway I should. Thank you for sharing this

This $WINE command is not a spam, I am leading a curator here