Description: The primary purpose of this Minerva is to provide an additional revenue stream to merchants that use it as a payment method. Here is all you need to know about OWL.

Minerva; The World’s First Reverse Merchant Processor

Digital currencies are all about solving problems and Minerva is no different. The primary purpose of this new platform is to provide an additional revenue stream to merchants that use it as a payment method. Hold on, we are moving too fast, let’s start from the beginning.

WHAT IS MINERVA?

Minerva is a platform that was built with smart contract on the Ethereum blockchain. The aim is simple, convince approved merchants to use its virtual currency as a new payment method. These merchants are supposed to receive newly minted OWL as incentive when they adopt this payment method.

This new platform was created to solve a problem; the rare usage of cryptocurrencies. This problem is even more compounded by the volatile cryptocurrency market, which poses a significant risk to merchants. Minerva addresses this issue using smart contract.

ADVANTAGES OF MINERVA

There are four benefits of using Minerva. They are;

• Addresses Price Volatility

• Incentives for Merchants

• Clients Enjoy Discounts from Merchants

• Trial and Monthly subscription partnership based on Smart Contract

In a nutshell, think of Minerva as Ripple, but whose application extends to all industries, not just banking. And without the unpredictable price fluctuations often associated with virtual currencies. Except in this case, the merchant and the customers get to enjoy rewards in the form of incentives.

HOW MINERVA WORKS

To fully understand this platform, you need to know the technology behind it, service and application layer and the financial security audits that will be implemented. Let’s delve a little deeper.

The Technology

The first thing you should know is this; OWL and Minerva are not exactly the same. While OWL is an ERC20 token, Minerva is a payment processor that runs on smart contracts on the Ethereum blockchain. Consequently, OWL can be transferred between approved merchants and their customers provided the wallets are ERC20 compliant.

Service and Application Layer

A specified amount of OWL will be issued to approved merchants as signing bonuses. However, this bonus will be distributed on a first come-first serve basis. What’s more, it’ll be subject to a slow-time-release.

In addition to this signing bonus, approved merchants are also expected to receive an additional bonus through Proof-of-Transaction at a variable rate. This rate is expected to ease inflation and control violent price swings.

This means that when OWL is exchanged for services on a merchant’s platform and released back into the market, its monetary value increases.

Please note that, the only way of generating OWL is through the private pre-sale and final, public crowd sale.

Financial Security Audits

The developers of Minerva seek to provide a high level of transparency in the management of assets. As such, they have committed to subject the platform to financial security audits. What is the goal of this financial security audits, you ask? The answer is simple;

• To ensure proper record of merchant profits

• Funds possessed by company is declared

One of the ways in which the team intends to achieve these goals is through a view-only API key. Merchants would use this key to verify the balance and check the trade history of their accounts.

OWL DISTRIBUTION AND SUPPLY MODEL

There are two methods used by Minerva in controlling the supply of OWL. These methods are outlined below.

Through Minting

This involves the minting and inserting of new OWL into circulation went an approved merchant accepts it as a method of payment. The rate at which OWL is added into circulation is known as “reward rate”, and there is a direct proportionality between the reward rate and the price of OWL.

What does this mean, you ask? It means, the reward rate increases with the price of OWL. The reward rise will rise to a level that the total supply of OWL will prevent violent short-term price swings.

What happens when the reward rate is greater than zero (0)? Two things; a first part of the reward is taxed, which is necessary to sustain Minerva. The other part of the reward rate is sent to a smart contract to be stored as incentive for voting participants and future MVP.

By Taking OWL Out of Circulation

This method is used when the price of OWL is decreasing. Rather than using a negative reward rate, the developers devised a system which rewards users for taking their OWL out of circulation. Users receive a bonus when they freeze their funds in a MVP contract for a certain amount of time. The bonus received depends primarily on how drastic the price decrease is.

That means, the more severe the price decrease, the higher the bonus, and vice versa. However, if the MVP vault funds are exhausted, users must wait for OWL to naturally regain stability.

Distribution and Supply Math Model

There is also a distribution and supply math model which is based on a Minerva cryptocurrency circulation equation;

MtVt =PtYt

There are a bunch of other equations that you’ll probably find boring. But, what it says is simple. The rewards given is expected to increase the supply such that it catches up to a rising potential demand.

THE TOKEN SALE

Those that want to cash in to this new cryptocurrency do it through a token sale on Minerva.com. An initial OWL of 60,000,000 out of 100,000,000 will be distributed in two token sales, a private presale and a final token sale. The remaining 40,000,000 Minerva will be in the OWL reserve.

There are discounts given based on the amount of OWL purchased in the private presale structure and final token structure. The whitepaper should explain that better.

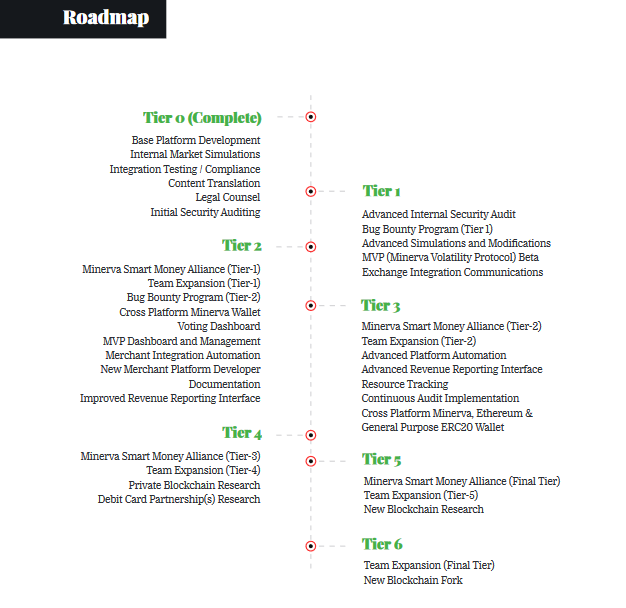

THE FUTURE OF MINERVA

The most significant thing in the future of Minerva is the hard fork to a more suitable blockchain. According to the whitepaper, this is due to the cost and scalability issue associated with the current Ethereum protocol. Of course, the fork date would be announced in advance.

However, before this fork takes place, the team is expected to ensure the stability of the Minerva Volatility Protocol by enacting a minimum OWL/USD spending requirement on approved platforms.

The risk mitigation effects of OWL increase its appeal significantly. But, will this new cryptocurrency be widely adopted? Time will tell.

Sources

Website: https://minerva.com/

Whitepaper: https://minerva.com/whitepaper.pdf

Facebook: https://www.facebook.com/MinervaToken/

Twitter: https://twitter.com/minervatoken

Telegram: https://t.me/minervachat

ANN Thread: https://bitcointalk.org/index.php?topic=2072362

Authored by: gbenga88

Bitcointalk URL: https://bitcointalk.org/index.php?action=profile;u=1874687

Eth Address: 0xdcef7d27bbaae609accdaf43ccf41b042beaffb4