Investing.com - 5 things you need to know about the financial markets on Thursday, December 21:

- Market Attention 3.3% Growth Confirmation:

The US will announce the latest figures for the third quarter economic growth at 16.30 on Thursday.

The figures are expected to confirm growth of 3.3%, as in the previous forecasts of the economic growth in the quarter ending September 30th. In the second quarter, it registered a growth rate of 3.1%.

It is worthwhile to keep a corner of our minds that the third evaluations of the upcoming period from July to September. Nevertheless, the data will reflect how the economy is managed under the Trump administration.

General estimates for the fourth quarter GDP will not be announced until January 26th, and the markets are already considering the effects of the tax reform, which is yet to be enforced, to start next year.

- Before Dollar Dollars Near Two and a Half Weekly Abortions:

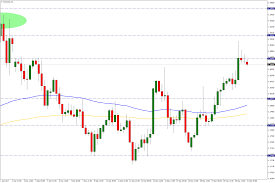

The dollar is close to two-and-a-half week lows against other major currencies on Thursday, while optimism about US tax reform plans continues to weaken before Christmas break.

The investors in the US dollar are also focused on a number of things to come in the end of the day.

Apart from the GDP revision, weekly unemployment insurance applications and the December data of the Philadelphia Fed manufacturing index will also have other significant valuation deductions.

At the latest hour 14.35, the US dollar index, which measured the performance of the US dollar against the other six major currencies, did not change at 92.94.

- Bank of Japan Stagnant, Kuroda Does Not Allow Early Exits:

The Bank of Japan did not change its monetary policy as expected on Thursday, and President Haruhiko Kuroda said that economic developments alone would not start the incentive program, assuring them that their overseas peers would remain well behind in their downsizing of crisis modes.

The Bank of Japan kept short term interest rate targets at 0.1% and kept 10-year bond yield targets at almost 0%, showing that the central bank made almost no changes this year in politics.

"Our most important goal is to reach our goal of 2% inflation as early as possible," Kuroda told the press conference. "We will not go to interest rate just because the economy is developing."

- Global Holiday Holiday Mode:

Global stocks quietly welcomed the passage of US tax cuts Thursday. Investors began to slow down in their trading activities before Christmas and New Year's holidays.

Markets While the elections and investors in the Spanish province of Catalonia focused on the recognition of US tax reform, European markets followed a mixed trade. Euro Stoxx 50 climbed 0.05% with slight gains.

In the beginning, the Asian feelings were closed with mixed signals. The Chinese Shanghai Union closed Thursday with a gain of 0.38%, while the Japanese Nikkei 225 closed down 0.11%.

Wall Street also had a quiet opening in trade with the approach of the holidays. At the latest hour at 14.35, Dow futures at 0.15%, S & P 500 futures at 0.17%, and Nasdaq 100 futures at 0.07% at precious corporate holdings.

- Catalonia Elections in Spain Attention:

The European markets and the euro remained calm on Thursday. Investors are following developments in Spain.

The election in Catalonia, which has become a genuine referendum in the independence movement, is under construction in the Spanish autonomous region.

The segregation movement has been shrinking considerably, but for Spain, massive separations or options like head-start are far from the view of regional elections.

If the pro-independence party wins the election, it will open the way to Catalan independence.

Spanish stock valuation IBEX 35 did not worry too much, as did other stock markets in the euro zone. Likewise, the euro remained flat against the Dollar.