Exchange market size

The foreign exchange market is the largest and most liquid market in the world.

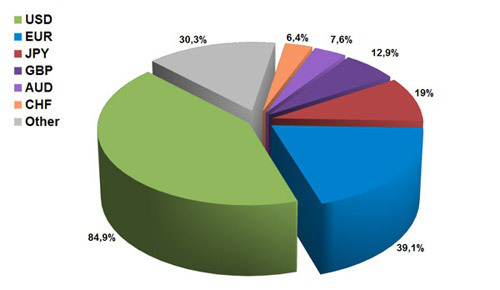

The US dollar constitutes a major part of foreign exchange transactions.

Deep liquidity in the foreign exchange market is good for traders, allowing them to enter and exit the market immediately.

According to the bank for International Settlements, foreign exchange transactions increase by an average of 5 trillion US $300 billion per day. From this point of view, the average value is 220 billion dollars per hour. The foreign exchange market is mainly composed of institutional investors, companies, governments, banks and foreign exchange speculators. About 90% of the money is generated by currency speculators based on intraday price movements.

Unlike the stock and futures markets on the Central Physical Exchange, the foreign exchange market is an over-the-counter market, and the decentralized market is fully electronic. The bank goes from Hongkong to Zurich, from London to New York. Although most investors are familiar with the stock market, they don't know how small the foreign exchange market is.

The foreign exchange market and other foreign exchange market are one of the largest decentralized markets, computerized, with trillions of dollars of trading volume per day.

In the chart above, it is easy to see how the $530 billion trading volume per day in the foreign exchange market dwarfs the stock and futures markets. In fact, the thirty day trading on the New York stock exchange is equivalent to a one day foreign exchange transaction.

Traders in other markets are attracted by the foreign exchange market because of their high foreign exchange liquidity. Liquidity is important because it allows traders to easily enter and spend 24 hours a day, 5 days a week. It allows large volumes of trading to enter and exit the market without price fluctuations in less liquid markets. This means that if you are short of buyers, you will never get the position. This liquidity can change from one trading period to another and from one pair of currencies to another.

The volume of money in the foreign exchange market is attractive because their liquidity allows traders to easily enter and exit.

As the most traded currency, the US dollar accounts for 85% of the foreign exchange volume. At close to 40%, the euro is close to 20% before the third yen. Since volume is concentrated in the U.S. dollar, euro and yen, foreign exchange traders can focus on a few major pairs. In addition, greater liquidity found in the foreign exchange market is conducive to long-term, well-defined trends and responds well to technical analysis and mapping methods.

To sum up, the scale and depth of the foreign exchange market make it an ideal trading market. This liquidity makes traders easy to buy and sell currencies. That's why the traders from different asset classes turn to the foreign exchange market.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.dailyfx.com/forex/education/trading_tips/daily_trading_lesson/2014/01/24/FX_Market_Size.html

you are so smart!