When it comes to personal finance many of us are essentially playing the game without tracking our score.

Picture a ship sailing the ocean without charting it's course. How can the captain determine progress of the trip? How can he tell if they're headed toward the destination?

This is what many people are doing while sailing their financial ship of life.

Tracking Net Worth

The funny thing about tracking net worth is that it's literally one of the easiest financial tasks you can do!

Let's break it down real quick:

- Assets minus Liabilities = Net Worth

What are those things?

If you are wondering what an asset or liability is, let me give you some quick examples.

Assets:

- Home

- Savings

- Investments (stocks, bounds, crypto, etc)

- Vehicles

Basically anything that holds a value.

Liabilities:

- Debt (mortgage, credit card balance, car loans, etc.)

Basically anything that you owe on.

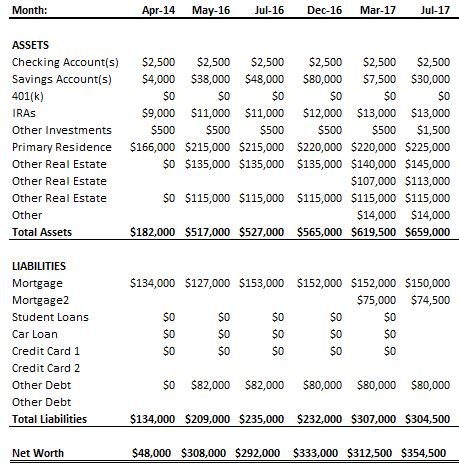

Example of Net Worth Spreadsheet

As you can see in the example above it is a simple calculation that can be thrown into a spreadsheet.

Tracking Progress

I personally try to update my spreadsheet once a quarter, but even semi-annual will do the trick. This allows enough time for so actual movement in the number and is still frequent enough to see if your financial ship is still on course.

Best Regards,

Your ScaredyCatGuide

Great idea! This idea is very much a part of what has led to and is come part of @virtualgrowth. :)

Heck yeah. With a name like virtualgrowth how could it be any other way! :-)

:) you are right on it... Thank you

Thanks, my pleasure

great and informative post

some great tips

thanks for sharing

Man, I'd take that jump from apr 14 to may 16...epecially with that real estate without added debt! lol. Smart tip for sure!

Yeah, that was a nice two year jump. 2014 was the prior reference point, also when first property was purchased.

@scaredycatguide I'd like to put my bank held assets in real estate. I own a home debt free in Manorville and was thinking of buying a 2nd home in north eastern Pa. I'm always looking in eastern Long Island, but expensive, no bargains. I'm retired and getting on in age, maybe this would be to ambitious . But I want to get the money away from the banksters. Any suggestions on buying a second house to use and possible rent.

If you want to get your money out of the bank and into real estate there is certainly nothing wrong with that idea. Just make sure you buy a solid property and if you plan to rent it, be sure it's in an area that has solid rental demand.

Along with that, make sure the numbers make sense as a rental, which you can check using the property calculator. It's on my http://scaredycatguide.com/ site if you want it. You can download it there.

As for the nuts and bolts - reading the blog posts on my site (or on here if you can find them from last year.) will give you most of the info you need.

Of course, you are more than welcome to grab a copy of my e-book that walks you through it from step 1 of buying to then renting it . It will be available on paper back too in about a week, which I will announce.

I like your new black scaredycat///

Thanks man. My neighbor does design so she gave it a professional upgrade.

THANKS I want the paperback and Good Luck with all forms of the book.

Great tips and post! Very informative.

Thanks for sharing!

Thank you!