The end of the first quarter of 2018 witnessed a weak performance in the digital currency market only, losing about 50% of the total market capitalization, but also a weak start in the second quarter of traditional markets, with the S & P 500 index shed 2.2% On Monday (April 2nd), recording the lowest figures in early April that have not been seen since before the Great Depression of 1929, according to data from Bloomberg.

It can be said that the weak performance of the markets during the first quarter can be attributed to the increased regulation of the area associated with digital currencies, while the weak performance of traditional markets starting from the second quarter revolves around more direct political actions causing the decline.

The founder of the investment management company "Doubleline Capital", Jeffrey Gendlash, told Reuters on Monday, April 2, the beginning of the second quarter, that the company has become the "main horse" of risk assets and thus act as a "new" index of the stock market:

"Petcown closed at its lowest level last week, and now the Standard & Poor's 500 Index (SPX) is at its lowest level this year.

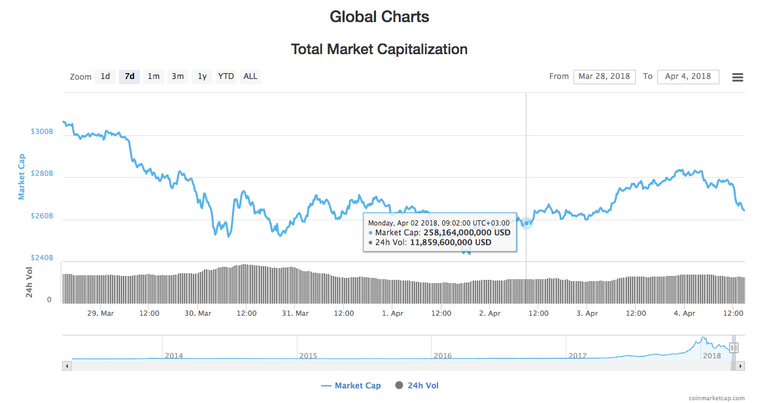

It is alleged that Petequin and Ethrium have seen their worst quarters in the history of digital operations, with PeteCwin losing about 52 percent of its value since Jan. 1, while etherium lost about 48 percent.

At the beginning of the second quarter on April 2, KFH traded at about $ 6924 at the beginning of the day, and atrium was around $ 383. The total market value is currently about $ 266 billion, according to data from the Queen's Market Cap, a slight rise from the beginning of April 2 at about $ 258 billion.

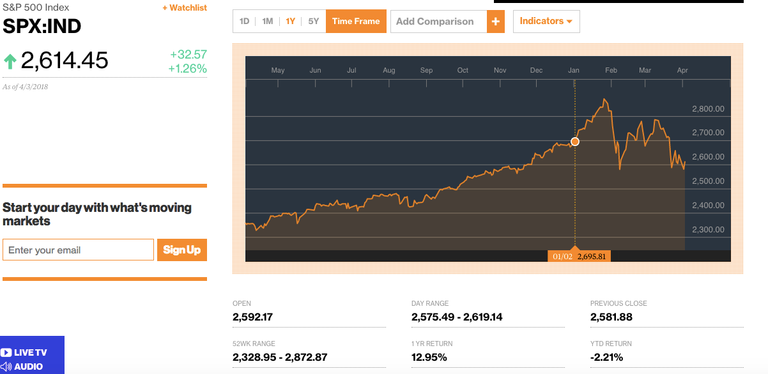

At the beginning of January, the S & P 500 index was at 2,695 points, while yesterday's market closed at 2,614 points, up more than 23 points, but with a year-to-date return of slightly more than 2.2 percent.

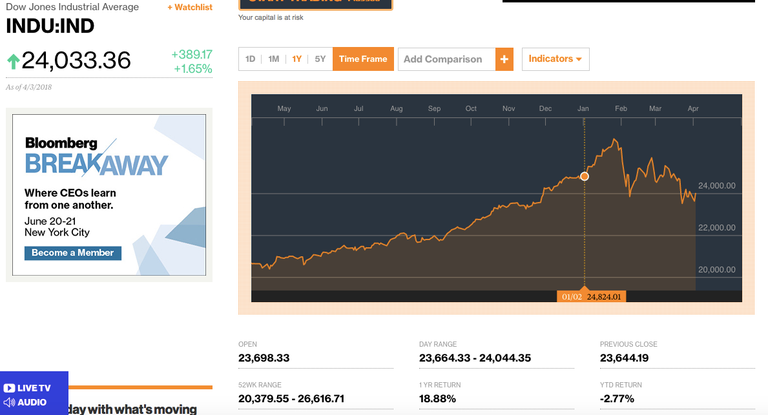

The Dow Jones industrial average fell more than 1,100 points in early February 2018, its biggest drop since 2011. On April 2, the Dow closed down 459 points, down 758 points on the first day of the second quarter, according to figures from CNN Money.

The Dow Jones Industrial Average is expected to drop by 600 points when markets open due to China's announcement of new US $ 50 billion tariffs on US exports, according to CNN Money today. China's new tariffs appear to be a response to Trump's tariff on Chinese exports worth $ 50 billion, announced yesterday.

Among other potential contributions to the weak start of the traditional market in the second quarter, Trump's criticism of Amazon comes at the end of March, bringing the US retail giant down 7% since Trump's criticism.

The Dow closed yesterday at 3,240 points, up about 389 points, but fell by 2.77% on the year to date, after trading around 24,824 in early January.

Since the fall of PeteChoen on February 5, below $ 7000 - which was consistent with the Dow Jones' record low during the day.

While traditional markets are preparing for the upcoming forecasts due to China's new tariffs and the ongoing Trump Review of Amazon, PeteChoen is still above $ 7,000, and Etrium is approaching $ 400, both of which are psychological points for digital traders, slightly higher than the first day of the second quarter.

Currently, KFH is trading at 6831 USD, down 8.19% during the day. Ethrium dropped by about 4% during the day, trading at around $ 379 by the time of publication.

je pense que c est le moment d investir mon ami