It usually happens that we have to face some kind of emergency and we need money and if we don’t have money then what options we use

- Gold : We take loan by mortgage our gold or take money by simply selling it.

- Property : We take loan by mortgage our property or take money by simply selling it.

There are many other options we use but those people who work in crypto currency or have crypto assets , what options they have ?

Suppose today i have an emergency and need money and I know that crypto market is down today and I have no other option than selling my cryptocurrency. I will be helpless in this case even I know market is down now and it is better time to buy at dip rather than selling , but I have to sell my coins.

To overcome this problem there is a new project by which I don’t have to sell my crypto assets in case of emergency and I will get money without actually selling it.

Yes you hear it rite, now we can get loan by mortgage our cryptocurrency.

MoneyToken comes up with a beautiful concept. MoneyToken provides crypto-backed loans, stablecoin MTC and a decentralized exchange service.

We can see some big names on advisory board of this project including Roger Ver (Founder of Bitcoin.com) and some others.

As per Roger Ver "MoneyToken is a bright example of the real use of blockchain technology, as well as offering a massive boost for crypto market liquidity for all market players, and especially for businesses."

Let us have a look at what problem does Moneytoken solve

The problem has been obvious for some time - spending crypto assets today prevents cryptocurrency holders from gaining on any future growth in asset value; holders who buy low need to hold on to their investments in order to benefit from selling high.

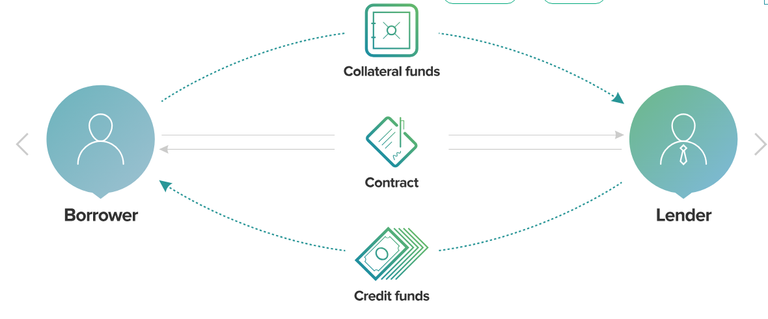

This is where MoneyToken steps in. The MoneyToken platform allows you to borrow liquid funds instantly, based on the current value of your cryptocurrency asset holdings. You take out a loan, collateralized with more volatile assets such as Bitcoin or Ethereum - and in return you receive an agreed loan amount in a stable currency.

And after repaying the loan you receive your whole collateral back; even if the collateral has increased in value multiple times.

This way, you're able to acquire liquid funds for immediate needs, and save your crypto position, all at the same time.

Who will handle Loan operations on platform ?

Behind MoneyToken is Amanda. Amanda is an Artificial Intelligence Assistant who will provide automated loan operations within the platform.

Amanda is powered by a deep learning AI algorithm, and her goal is to provide human-like services for the platform users. Besides functioning as a loan assistant, Amanda acts as a true AI, analyzing clients activity on the platform from their first steps, through to loan completion in order to generate predicative actions; for example being able to offer additional financial services, tracking collateral performance, monitoring loan repayments and due dates – all the functions required within an ecosystem that is not managed by any central authority.

Amanda helps remove the need for middle men and managers, hidden commissions and fees, and obscure terms written in the ‘small print’ of contracts; all the bad practices of traditional banking.

Who can take advantage by using this platform ?

- Miners

- Traders and investors

- ICOs

- Exchanges

For more detail visit

Website

Whitepaper

Telegram

Github

Written By : https://bitcointalk.org/index.php?action=profile;u=1091429