In this video, I sit down with author and economic analyst John Sneisen to talk about the most recent bail-in on the world stage. Banco Popular was just bought by Santander for a stunning ONE EURO!

It will be raising almost €7 billion to clean up the latter’s balance sheet.

Banco Popular reported nearly €37.4 billion in gross non-performing assets and a coverage ratio of 44% at the end of fiscal year 2016!

Holders of Additional Tier 1 (AT1) and Tier 2 (T2) securities are to be completely wiped out under the deal as part of the EU's “bail-in” mechanism.

This is one of many bail-ins we've reported on at WAM over the years. We saw the introduction of bail-in regimes into the Canadian budget under Prime Minister Justin Trudeau. We've watched bail-ins in Cyprus, Austria and attempted bail-ins of Monte dei Paschi in Italy.

This time it's bond holders that are getting the brute of the bail-in.

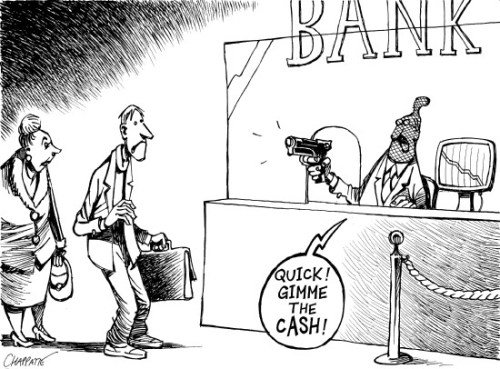

For those unaware, bail-ins are basically the banks seizing the depositors' money instead of government stealing the taxpayer's money. Both are terrible. This has become a more commonly used method to pay off massive debts by banks with risky investment portfolios, which means basically every bank.

It's important to mention as we have before that if your money's in the bank, it's not yours, it's the bank's. This is a dangerous way to insure your wealth as it can be grabbed from right underneath your nose if the bank feels it's necessary. Or unnecessary. No one said banks are moral entities.

Private vaults provide much more safety than banks as we've gone into so many times before. It's an individual's responsibility to understand this information and apply it likewise.

Spain is being bought up by globalist bankers like so many places we see in the world. Santander just started released Auto Backed Securities in the United States following their recent scandal where they skipped income verification on 92% of loans.

This is the beast we're up against and they will not rest until the vast populace has fallen down the bottomless pit of debt, forced to ask for a latter up from the state and banking system. That is servitude folks and that's precisely how the script is playing out.

You can see the FULL video report here:

Stay tuned for more as we continue to break this issue down! Don't forget to Upvote & Comment! :)

If you like what we do you can donate to our Bitcoin below!

Love the cartoon---just wish it wasn't true! For those who haven't yet diversified into gold/silver and crypto---don't wait any longer. Upvoted and resteemed.

Exactly! Gold, silver and a few different cryptos should do the job :)

Excellent report. Highly appreciated. Upvoted and following. Unfortunately not enough SP to make a difference on your payments, therefore please support me so that I can make better upvote contributions in the future. You may like this one: https://steemit.com/bitcoin/@lucky.digger/from-2017-bitcoin-and-other-digital-currency-will-no-longer-be-taxed-twice-in-australia