With potential regulatory overreach always knocking at crypto's door it's good to be cognizant of ways we can weave around the system to avoid the top-down approach of imperialist control that we are often subjected to. For the most part, the vast majority of all regulatory control is going to be focus-fired on the bottlenecks that are easier to wrangle.

Regulatory agencies are quite adept at flexing their strength against corporations and large institutions, not so much against actually decentralized architecture. We saw this first hand with how P2P torrenting essentially proved that IP laws can be neutered and rendered completely and comically ineffective. The strategy of trying to scare people into not downloading movies and music by going after the "top offenders" was an abysmal failure.

This is exactly why people talking about "being locked up for decades for using a VPN" if that anti-TikTok legislation passes is equally ridiculous, as this is basically the same exact concept. This is simply not how the real world operates on a large scale. It's been proven enough times in the field to show that "whatever can happen will happen" is quite the misnomer. Plenty of things never happen, and the reasons are already known as to why that is the case.

Why such focus on Venmo?

Venmo fits the demographic. Crypto is a younger demographic's game. Venmo has been adopted by the younger demographic for payment logistics. And while all payment providers are heavily regulated, I can't help but think that it wouldn't be that hard to engage in shadow banking within them while avoiding detection. That's exactly the kind of thing that crypto needs.

Unfortunately what crypto needs and what crypto gets are largely two completely different things. It's ironic that crypto needs open-source devs ready to pile in and work for free devoid of any financial incentives, but then aren't doing it because "it's a scam". I think the idea of a dev working for a financial gain that they can't capture is too much for them to handle... even that's exactly what they're doing on other projects (only indirectly without directly interfacing with currency).

Fiat ramps are key.

The only way for politicians to smother crypto is to go after the banks. That's how it always works. Control the flow of money through a bottleneck. In this case the banks in question are referred to as "centralized exchanges", but for all intents and purposes they are simply banks and are treated as such. They hold your money and are responsible for moving it around in the way we tell them to. We hope they do what we say but, no guarantees. That's a bank.

The thing about programmable money is that it's much more flexible than fiat in a bank. Fiat in the bank has to follow all these rules and regulations and will always be controlled by a centralized agent at all times. Crypto doesn't have to do any of that, and we can backdoor into the system at a moment's notice if it suits us.

At the end of the day using crypto banks is incredibly convenient so we've put very little effort into creating these backdoors. I still need to do more research on how P2P transfers on Binance works... maybe I'll have to ask one of my Nigerian friends to walk me through the process. Specifically: how do they stop scammers from saying they sent the money through the banking sector when they actually didn't?

This is the Crux: verifying the fiat money was sent and delivered. It is trivially easy to know if crypto was delivered or if it sits in escrow or another kind of smart-contract; while figuring out if fiat was sent is exponentially more difficult and risky. Ironic... that. The system that's been around forever is full of loopholes and patchwork nonsense.

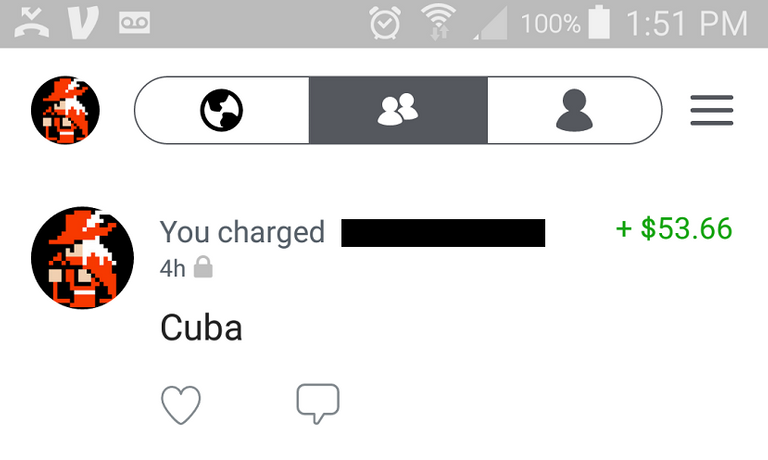

Venmo flags transactions and suspends accounts based on "Cuba" footnote.

And that's why I'm so fascinated by Venmo

Because the more research I do on it the more I realize that it could be integrated into a shadow banking system that completely flies under the radar. Until such times that we can buy things directly with crypto from the vendor themselves, these are the kinds of integrations we need to be thinking about. Should the crypto banks become absurdly regulated to the point of moving over seas and giving the kiss of death to USA, wouldn't it be nice to have another ramp that can't be so easily targeted?

https://www.bleepingcomputer.com/news/security/paypals-venmo-app-exposes-most-transactions-via-its-api/

The Venmo API does share a lot of data for a financial institution.

- Sender

- Receiver

- Note describing transfer

Of course anyone that opens the Venmo app can see that it doesn't actually tell you the amount of money that was sent... which is legit the only piece of information we actually need to build a shadow ramp into the fiat world.

Example:

- I have 1000 Hive.

- I want to trade my 1000 Hive for $370 on Venmo.

- I find a buyer within a P2P matchmaking system.

- I lock my Hive in escrow until I'm paid on Venmo.

- If all goes well I get paid and unlock the money from escrow.

- Everyone gets what they want; trade accomplished.

Unfortunately the devil is in the details.

It doesn't matter how it's supposed to work: it matters what the edge cases are and how hard it would be for scammers to exploit the network (which is why I have to do some research on Binance P2P). How does the entity holding the crypto in escrow know one way or another if the fiat is sent? Again, this is the crux of the issue. It is the hinge for everything in terms of building a ramp to fiat.

Contested charges.

Another reason why I think Venmo is an amazing opportunity sitting right in front of us is that payments on Venmo can not be reversed. As crazy as that sounds: it's true. If you send money to someone (and you actually have that money in your Venmo wallet) then it's extremely difficult to have the transaction reversed. This is by design, and it's great for crypto because crypto transactions also can not be reversed, making swaps between the two platforms much easier to navigate.

The exception to this rule is if Venmo extends you a line of credit.

Notice how I said "and you actually have that money in your Venmo wallet". What if you DON'T have the money in your Venmo wallet? That's pretty standard. Most people keep a $0 balance and just use their linked checking account to pay others. In this not-so edge-case a user can send someone money on Venmo and then contact their bank and demand them to decline the charge coming from Venmo. The bank will cancel the transaction.

The problem here is that Venmo extended a temporary line of credit to the person who sent money. If Bob sent Sally $1000, what really happened is Venmo sent Sally $1000 and then sends a $1000 charge to Bob's bank, which will end up clearing days later. When Venmo realizes they are down $1000 they'll demand that Bob pay up and freeze his account until he does. It's also been shown that if Bob doesn't pay then they'll try to take back the money from Sally as well.

This awkward situation created a way for scammers to game the Venmo system. A scammer would send money to someone randomly then contest the charge at the bank. Then the scammer would contact the person they sent money to asking for their money back because it was an "accident". If Sally sends the money back: it's essentially a binding contract in Venmo's eyes. She sent the $1000 to Bob and then Bob went and cashed that $1000 out to his bank account (other line of credit). Now Bob has $1000 in his bank account and he doesn't have to pay the $1000 Venmo charge, and Venmo is pissed. More on this situation in an old link below.

So what would we need to create shadow banking on Venmo?

- Hive gets locked in an escrow smart contract.

- The arbiter can see not only who sent money to who on Venmo but also how much and if a line of credit was extended to them.

And actually this extends to any fiat platform whatsoever. If the arbiter can confirm for a 100% fact that Bob sent Sally $1000 and the $1000 charge can not be reversed then the system will be secure and actually work.

Create a mobile app that can hack into Venmo app?

All this leads me to wonder if a third party app could be installed so that the escrow service knows for a fact that they money has been sent securely. I don't know much about phone security but it's possible/probable that it would not be allowed (especially on iPhone).

Of course it won't work very well.

Why has a system like this not been built yet? Well for one there's no money in it. The person that builds it has nothing to gain. We would expect something like this to be paid for by the dev fund, as a service like this would have great value to Hive itself but very little value to the dev that builds it (unless they are cranking out massive volume and charging escrow fees: which is legally dangerous... unfortunately the thing about p2p systems is that no one entity is supposed to be getting that kind of attention... kind of the entire point as the centralized account will almost certainly be frozen and interrogated).

Another thing to consider is liquidity.

If I want to sell $20000 of Bitcoin on Coinbase, that's a trivially easy thing to do. Meanwhile, I think the maximum transfer on Venmo is capped at something like $4000 or $5000. Not only that... how are you going to find a single person that wants to make that big of a trade instantly? Long story short not going to happen. This is why centralized worldwide liquidity pools are so convenient and valuable.

FedNow & CBDC

Another issue to consider are the products that the legacy system is bringing to market in direct response to the exponentially increasing popularity of crypto. This is yet another reason why I find it comical that people are afraid of CBDC. Because CBDC is exactly what we need. Crypto gains more value within a CBDC environment, and CBDC has very little value without a proper integration to actual crypto.

The entire purpose of FEDNOW is to settle transactions instantly. Well guess what? If transactions are settled instantly then VENMO never has to extend Bob a line of credit to begin with. This would make all transactions final immediately with no reversals allowed, which would be an amazing thing for crypto integration.

CBDCs are more of a solution than a problem for the crypto world, which is funny considering how people react to it. If you think the government can make CBDC legal while making all legitimate crypto's illegal: you are wrong. It's like saying:

The military industrial complex has the power to kill me so I should probably just beat them to the punch and kill myself. Yeah that'll show 'em!

There's actually so much ridiculous logic in play here that I'm overwhelmed by it and refuse to dig any deeper on the subject. Don't even know where to start.

Conclusion

Crypto is an evolving reactive network. Many are disappointed about our "reliance" on centralized exchanges. Yes, well that's not a problem, as we are not reliant on centralized exchanges. Centralized exchanges are simply very convenient. When they stop being convenient we will stop using them and find a less convenient solution. In case you haven't noticed there are very few convenient aspects of decentralization in general. It's a slow grind to build up the infrastructure in a suitable way for the long term.

Ideally none of this matters and the bridges to fiat will all erode and collapse given actual adoption and the ability to trade money p2p directly to the vendors we are buying from. The goal it to make it to that point without having to stumble through p2p shadow banking and the like. Will we make it? No idea but it's always good to have some kind of plan in the back pocket.

Related Articles:

https://peakd.com/@edicted/chargeback-disputes-on-venmo

https://peakd.com/@edicted/shadowbanking-on-venmo

I have always been interested in Hive's escrow operations. The fact we have this functionality is pretty nice but I haven't seen anyone actually use or make something with them.

escrow_transferescrow_approveescrow_disputeescrow_releaseare all in the broadcast ops.I'm not a high level programmer so I just wonder what could be made.

Solid and valuable on chain reputation solves all this. I would trust anyone on Hive as my payment partner if their visible Hive account value is 10x the transaction I'm doing.

Indeed I was going to talk about that but it ran a bit long thanks for adding it to the comments.

We can all make up our own minds about who we deal with and trust here.

Money in a bank is actually traceable, at least by the banks themselves. So in a situation where a seller says the money hasn't been received and the buyer claims to have paid, the buyer would need to provide certain transaction informations like a reference ID or something like that, of which any of the banks involved in the transaction can trace it.

Binance I believe really can't do anything than simply keeping the assets locked and wait for the buyer to provide the necessary informations. At a refusal to comply, it's then easier to tell that its a fraud in play.

!PGM

!PIZZA

$PIZZA slices delivered:

@torran(1/10) tipped @edicted