Here's a long overdue update on the property market in Australia. I've been putting a lot of my time into more urgent cash flow activities to keep the proverbial lights on in my coaching business, but I do hope to post a little more frequently in the coming weeks.

Key Highlights:

- Home auction supply shot up to well over 3000 for the first time this year.

- Only Melbourne was able to clear more than 70 percent of auctions this week.

- Home prices fell over 1 percent for the quarter Australia-wide.

- High household debt levels have even the most optimistic economists questioning whether the RBA can raise rates anytime soon.

Housing Supply and Demand

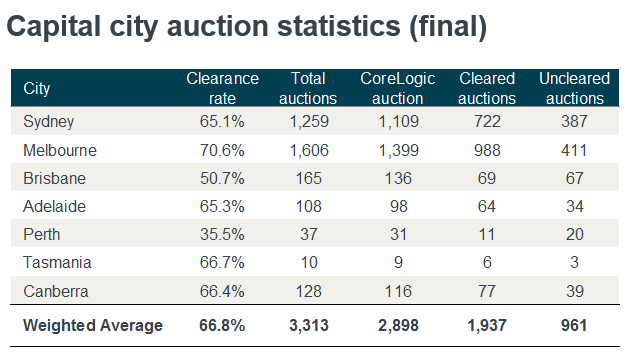

Sellers were back with a vengeance last week as the number of auctions across the country soared to 3,275. After the final reports came in this morning, almost 67 percent of sellers nationwide had found a buyer at auction. Sydney barely cleared 65 percent, and Melbourne sellers cleared just over 70 percent.

Here areCoreLogic's latest capital city results:

CoreLogic

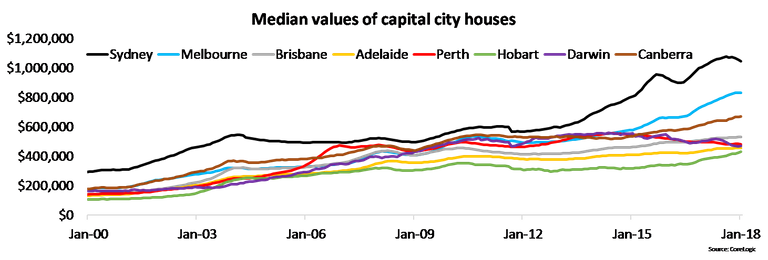

Recent Changes in Home Prices

As you can see in the following chart, Sydney home prices are now clearly trending down. Tighter lending restrictions imposed by APRA, stricter capital controls from China, and weak wage growth are all putting a strain on buyers. Even in Melbourne, where the population is growing fastest, home price growth appears to be flattening out. It seems there may truly be a limit to what people can afford to pay.

CoreLogic

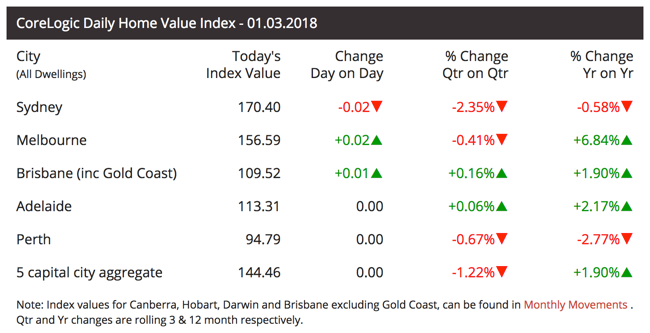

Looking at the latest quarterly changes to home prices, Sydney has declined 2.35 percent since November, and all capitals except Brisbane and Adelaide have fallen.

CoreLogic

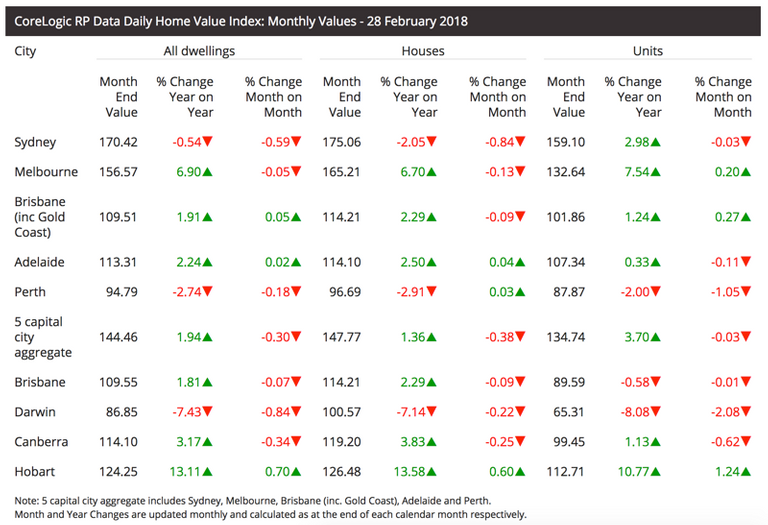

The latest data monthly data for February shows Sydney prices falling 0.59 percent and Brisbane, Adelaide and Melbourne all looking fairly flat. Unit prices in Sydney have been more resilient than house prices, but they too fell slightly in February.

CoreLogic

CoreLogicWhat It Means For Investors

With supply rising, auction clearance rates softening, and home price growth topping out, it seems the winds are finally changing. We’ve had a great 26-year run here in Australia with the winds at our backs, but signs of some significant approaching headwinds are now evident.

The greatest threat to investors and highly indebted homeowners is, of course, rising interest rates. We owe our good fortune since 2008 to the RBA who has suppressed interest rates to ultra-low levels. Low borrowing costs encourage short-sighted homebuyers to overextend themselves and unskilled investors to speculate on unending capital growth. Historically, that has not been a winning combination.

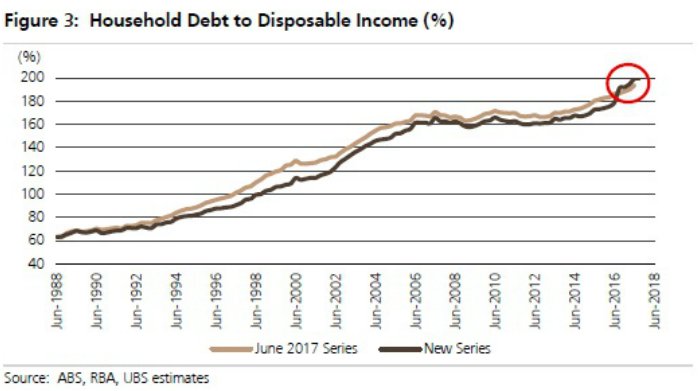

The outcome of this home buying spree has been an Australian household debt to discretionary income level which has surged to over 200 percent – one of the highest in the world.

Source

So where will interest rates go from here? Eventually, they will go up. It’s a statistical certainty. The more prudent question for investors to answer is “when?”

A growing chorus of economists are now questioning the RBA’s ability to raise the cash rate later this year. Some say we can expect one rate rise, others none at all. Anaemic wage growth and fears of mortgage stress from rising interest rates will be bearing down on any reserve bank hawkishness.

Although the central bank outlook is becoming increasingly dovish, it’s important for investors to remember that the RBA can only control short-term interbank lending rates. Mortgage rates are more directly tied to bond prices (and yields). While central bankers like to think they have direct control over the bond market, the reality is that the free market is always the ultimate winner.

7 Rules for Navigating the Coming Headwinds

As I instructed my mentoring clients at a recent workshop, here are seven points a prudent investor will be sure to follow in light of the likely coming headwinds:

If you’re buying for growth, time your entry wisely. Captial growth is as much about timing the market as time in the market. Holding a low yield asset in a flat market will likely lead to losses.

Give yourself more than one way to win. If you don’t get the capital growth you hope for, can you still win through positive cash flow or a future renovation or subdivision opportunity?

Factor in higher interest rates before you buy. Only buy what you could afford to hold if the market turns against you. I fear many maxed out homeowners will face considerable pain at some point soon.

Consider a strategy with limited exposure to the market. An example would be to renovate or subdivide to sell. That usually means holding a property for less than a year.

Leave yourself a margin to break even. Don’t embark on a value-add venture that requires capital growth to get an acceptable outcome. I've seen a lot of developers run their numbers assuming the market will be their friend only to see a flat market wipe out their hopes for a profit. How much worse will it be if the market goes down?

Have a Plan B that you can afford. If your Plan A goes wrong, make sure you’re not a forced seller in a falling property market. That's a terrible place to be.

Be careful sitting on the sidelines. While we know interest rates will someday rise, if the RBA cuts rates or your bearish outlook turns out to be wrong, your cash in the bank may lose considerable buying power. The powers that be have kicked the can down the road this far. Who's to say they can't prolong the inevitable for another five years?

This post was adapted from an article I published on PropertyInvesting.com.

Jason Staggers

Good article on propertymarket @jasonstaggers. enjoy 1st march

Nice one Jason! The housing market is absolutely crazy in Sydney the last few years. Here is to hoping it cools down consistently over the next few years!

Let's hope so. I shutter to think what would happen if prices go higher.

Sounds like it's time for me to short housing stocks!

I think bank stocks will get hit hard once debt stops growing. Many believe the deleveraging will begin once debt to income hits 205%. We're nearly there.

Wawww apkah itu brbahaya

Thanks for the update jason, the numbers are starting to get very scary. I think when we inevitably go into a recession, this central bank induced debt binge is going to destroy the last 20 years of growth, It's not going to be pretty my friend, cheers.

Outstanding! Thanks for the comprehensive assessment and analysis. Always quality!

I like your picture it reminds me of the cruise we just went on of sydney.

I am gobb smacked at sydney prices, i live on the midnorth coast of Nsw . Our urban sprawl and devolepment is in growth and with the the pacific hwy from sydney to Brisbane close to completion will only encourage investors to broaden their portfolios.