Hello EDSers and welcome to this week's EDSI report

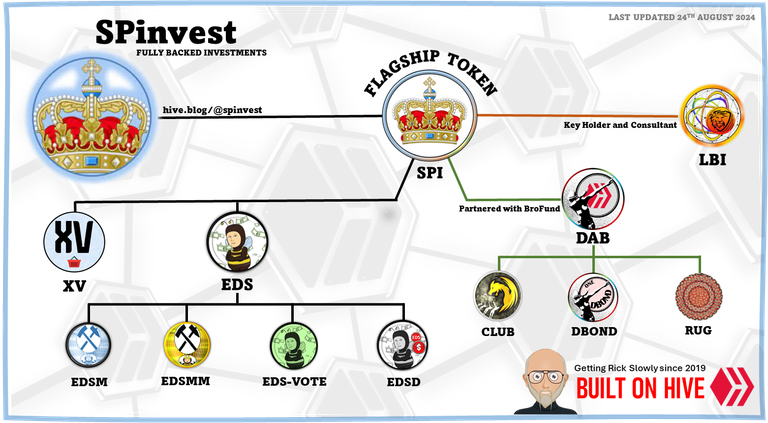

What Are EDSI Tokens?

Eddie Earner Income (EDSI) tokens are income-generating tokens on the HIVE blockchain that pay weekly dividends every Monday. These dividends come from 12% of the total HIVE POWER balance held by the @eddie-earner account, providing token holders with an impressive annual percentage yield (APY) of over 22%.

Token Supply and Mining

EDSI has a hard cap of 500,000 tokens, with an initial public sale of 20,000 tokens priced at 1 HIVE each. New EDSI tokens can be minted in two ways:

- Staking EDS Miners (EDSM) or EDS Mini Miners (EDSMM).

- Delegating HIVE POWER to @eds-vote.

- EDSM miners yield approximately 20% annually.

- EDS-vote provides returns of about 4-5% per year.

Focused on Growth

The EDSI project converts all earnings, airdrops, and tribe tokens into HIVE, emphasizing maximum HIVE POWER accumulation. Managed by @shanibeer (Saturdays Savers Club) and @silverstackeruk (wallet) for SPinvest, this long-term project encourages users to buy, hodl, and grow their EDSI tokens.

How to Grow Your Earnings

- Buy EDSM miners to mint EDSI tokens automatically.

- Reinvest regularly to increase your token holdings and boost your weekly dividends.

- Alternatively, purchase EDSI directly from the market. Place a buy order at 1 HIVE per token and wait for it to be filled—miners often sell their rewards to secure profits.

In summary, EDSI offers a simple, hands-off way to earn passive HIVE income. Buy miners, stake your tokens, and watch your wealth grow over time!

Complete EDS eco-system explained - CLICK HERE

This Weeks EDSI Report

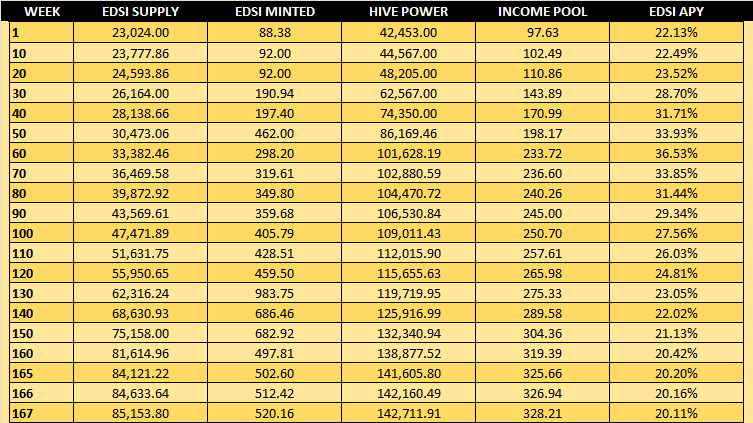

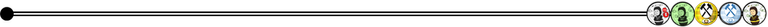

Another standard week with 520 EDSI minted into circulation. Mintage numbers over the past few months have been very consistent which is nice to see. The total EDSI in circulation is 85,153

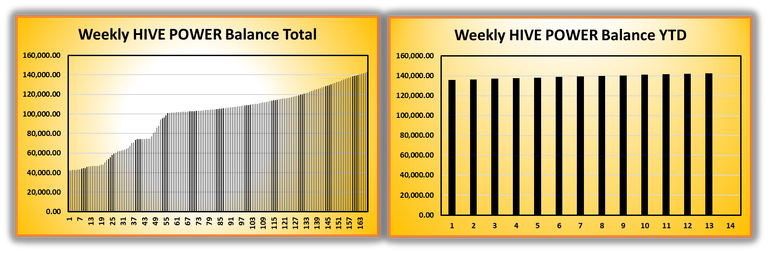

The account powered up 576.45 this week bringing the total HP balance to 142,711. This sounds pretty good to be powering up 550-600 per week but remember that all EDSI are backed with 1 HIVE so we powered up 576 HIVE but 520 of that HIVE was used to backed the newly minted tokens this week. This results in around 56 of the 576 being powered being extra and put toward growth.

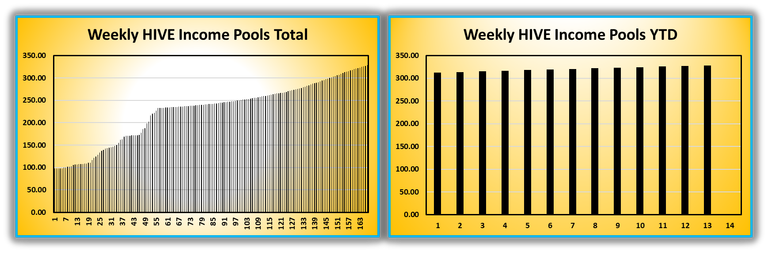

The HIVE income pool this week is 328.21 HIVE. This pool only increases and has been done since launch but if we need to tweak the EDSI model from the income pool being equal to 10% APY of the account HP balance instead of its current 12%, we'll take a 1-time drop for the adjustment and then start its uphill climb again.

I am very proud that the income pool has grown a little each week for over 4 years, never having a week where it's dropped so this kinda pisses me off. Infact it's annoyed me so much that I've thought of a way that we can change over from 12% to 10% and not have the income pool drop during the process. It might go sideways, perfectly sideways for a few months but it will not drop by 1 single HIVE cent are whatever to call 0.01 HIVE.

Im not a control freak, but image people! your reputation is #1. If I claiming for 3-4 years the HIVE income pool will never have a declining week, I must make it so.

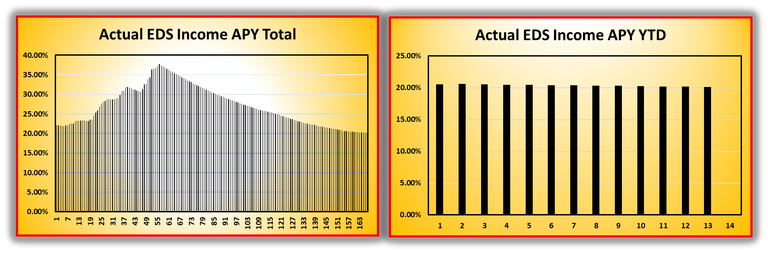

Decline of -0.05% this week down to 20.11%. This is the final countdown, we have 2 more weeks before the APY drops to under 20%. I cringe at the thought but we knew this would happen and it's all part of the game. It's been over 3 years since we've had a lower than 20% APY so to think about its, thats pretty damn impressive we've been able to hold it that long considering we sold out of EDS miners nearly 2 years ago.

I told you all back then the APY decline would be slow and it would get slower each week and 2 years on, the APY has dropped 16% and is now dropping by 1/20th of 1% per week. You can see clearly in the chart on the left that we peaked at around 37% on week 55. If you compare the APY decline between weeks 55-79 with weeks 145-163, you'll see what I said is happening. Looking out another 3 years, I'd predict that the APYs decline will continue to decline and in 3 years, we might be at flat lining at 0% before the flip when it starts to only increase.

Anyways, APY this week is 20.11%.

Weekly Roundup

I put a post out last week explaining that a few things within the HIVE ecosystem have changed that affect us being able to grow sustainably. I wrote the post with a suggestion to lower the HIVE income pool from 12% down to 10% and the feedback received back was excellent, thank you to everyone who took the time to read the post and leave a comment.

As no changes need to happen within the next month, I will have time to put out another post about this. The post will lay out 3-4 different options for EDSI token holders to pick and vote on.

Thats about all I think of, I'll get that post out in a few days I hope.

Thank you for taking the time to check out this weeks EDSI report!

Getting Rich Slowly from June 2019

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDSI |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| EDS-vote | @eds-vote | n/a |

| EDS DOLLAR | @eds-d | EDSD |

| DAB token | @dailydab | DAB |

| DBOND token | @dailydab | DBOND |

| RUG token | @rugem | RUG |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server

SUB FOR WEEKLY EDSI UPDATES

Ask in the comments below to get tagged to these weekly EDSI update posts

@siddhartaz, @dkid14, @noctury, @stickupboys, @ericburgoyne, @shanibeer, @riandeuk, @thatcryptodave, @relict, @curatorcat.pal, @oldmans

This is the only project group on Hive I've encountered that actually treats investors like we have the right to know what is happening with our investments ... you know, like real investment managers who are above board keep their investors up on what is going on. It is appreciated.

Thanks for the nice words. Yeah, im a rare breed 😁

What do you reckon the average APY has been overall - if it was 37% ATH and now 20.11%?

Be good if we are able to maintain the income pool even with a drop in APY! 😍

27.07% average over the past 167 weeks, higher than I would have guessed to be honest.

Should beable to just freeze the income pool for a few weeks until it works to 10%.

Wow, that is very good! 😍

With my simple brain, I just look at the APY and compare it to other investments. In particular, my two key metrics are HBD interest and non-crypto ISA interest.

Right now, EDSI's look good compared to both !

!BBH

Straight to the point,

The APY will still be very good when compared with other HIVE tokens.