Hello EDSers, today we take a quick look into how EDSI is performing in the current HIVE ecosystem and discuss if we need to adjust anything fundamental to ensure EDSI continues to be operating toward being sustainable long term.

Im going to assume that you have a basic understanding of how EDSI tokens work. and you will already know that the weekly HIVE pool paid to EDSI token holders is equal to 12% of the account's HP balance. The idea is that if we powerup HIVE each week, the income pool will always increase.

Let's go back to the start

When EDSI was launched in 2020, it was easy to earn 15-20% from delegating HP, there were many active games, tribes and other tokens. I chose for the EDSI HIVE income pool to be equal to 12% of the @eddie-earner HP balance because it was easy at that time to earn 18% APY from HP meaning 6% could be compounded so growth was built in. This model has served us well to date.

Today

There are projects that will still pay 15-20%+ but sadly these rewards come as HE tokens that have no liquidity to sell so these APYs can not be obtained. Around 6 months ago we switched from delegating our HP to using it toward curation which was 10% at the time. Today curations APY has fallen back toward 8-9% where it historically averages.

Today, our HP earns 8% from curation and 3% from inflation so 11% in total.

Do you see the problem?

Conditions have changed. If we earn 11% from our HP balance but pay out 12% as a weekly income pool, the HP balance over time will decrease. It's not sustainable long term.

Others things to facter in

Before we can look at possible solutions, we need to understand a few other things about how EDS miners, eds-vote and EDSD factor in.

- EDS miners

Combined both miners mint 296 EDSI per week with 300k EDSI allocated to pay out miner rewards for another 16-17 years. This means the account needs to power up at least this amount of HIVE each week to cover this.

We collected 75k HP from selling miners which used to earn 260 HIVE per week at 18% leaving us around 40 HIVE short per week. This shortage was made up using the surplus HIVE (HP balance - Circulating EDSI) in the HP balance. Today, that same 75k after 3 years of compounding is worth roughly 86k earning 180 HIVE (11%) per week leaving us with a 120 HIVE gap that needs to be made up eating into the surplus.

- EDS-vote & EDSD

Going to put these together because they both share the same model. In the most simple terms, for every 2 HIVE these accounts create, we mint 1 EDSI token. So if eds-vote earns 400 HP in a week, we mint 200 EDSI tokens. With around 180k EDSI allocated to these, they will add 360k HP to the @eddie-earner account.

For the past few months, eds-vote has been earning around 400 HP and minting 200 EDSI per week but, a few months before that it was earning closer to 600 HP a week. This means we currently have a powerdown of 550 HIVE per week coming from it. In around 5 weeks, this powerdown will end and the new powerdown will reduce to 450 per week to reflect what we are now earning.

Here are some basic inflow and outflow weekly numbers for EDSI

| Thing | Weekly Cost | Weekly Income | Gain/Loss |

|---|---|---|---|

| HP Curation | 0 | 235.00 | +235.00 |

| HP Inflation | 0 | 81.00 | +81.00 |

| Weekly Income Pool | 325.00 | 0 | -325.00 |

| EDS Miners | 297.00 | 0 | -297.00 |

| eds-vote | 200.00 | 550.00 | +350.00 |

| EDSD | 15 | 30 | +15 |

| Totals | 837.00 | 896.00 | +59.00 |

You can see that we are currently above break even by 60 HIVE per week but when the new eds-vote powerdown begins in 5 weeks, our weekly total will be -40 HIVE per week.

Solutions

There are a few but the most simple one is...

- Reducing the income pool percentage to under what the account earns.

As an example, if reduced from 12% to 10% while earning 11%, we would ensure at least 1% compounded growth per year. The result would be a drop in EDSI APY but more HP being powered up.

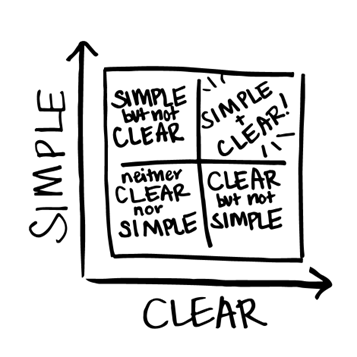

This is by far the most clear and simple amendment we can make to ensure EDSI continues toward sustainable growth.

Other solutions

Hmm, make more HIVE with another side hustle. eds-vote has been a great success for both minting EDSI tokens and pumping the HP balance. EDSD not so much but looking at current token allocations, I think we could easily reallocate 50-80k EDSI tokens to be minted via a new way.

Its hard to know what to do because we have all the bases covered already. We have EDSI which is an income token transacted for in liquid HIVE, we have eds-vote for HP and EDSD for HBD, what else do we need? There is only 1 more thing we can sell but its forbidden.

Rant

I still dont understand why we can lease HP but not sell upvotes. It's like saying, I can not sell you an apple each day but I rent you my apple tree and you can pick an apple each day instead.

All the vote-selling ban did was kill a once-thriving economy where you could lease HP for 22-25% to people who sold upvotes to people who used liquid HIVE and HBD to buy them. Yes, HIVE and HBD used to have a use case other than to stake them. People thought it was shit that anyone could buy their way to the top of trending posts but it's no better today with all the top trading posts from the same accounts that receive huge auto votes. At least back then you had to pay to get into trending and if you used voting services, you could slowly grind and build your account/wallet for bigger and bigger votes. In all honestly, it was a better time.

.

Moving on

One thing we could explore is creating an EDSI buyback wall. Each week instead of powering up all our earned HIVE, we use some to create an EDSI buyback wall at 1 HIVE each. These EDSI could either be sold back into buy orders over 1 HIVE for some insta profit while holding some in a separate account and receive a weekly liquid payout equal to 20% APY. It's rare for EDSI to trade down to 1 HIVE but it does happen sometimes if someone needs to sell off 1000-2000 tokens. I think this is worth exploring, the main upside would be liquidity and the main drawback would be we'd probally kill the EDSI premium and it would overall trade closer to 1 HIVE. We take from 1 hand to feed to the other in a backward way.

Apart from that, im licked. Hell, we could start an upvoting service EDSI burning service. Burn 0.5 EDSI and get a 1 HIVE upvote from eds-vote, haha. I bet that would work and it would increase the EDSI APY because there would be fewer tokens plus, oh and plus...it would be free because voting costs us nothing. Yeah, I like the sound of that, EDSI token burning cause its not spending, you see? That my friends is what we call a loophole.

Of course, any other solution or new side hustle would only be kicking the can down the road until hardcap time. With that said it would be great to mint more EDSI tokens faster. Sadly and as mentioned we are limited in what we can do because 1, EDSI is 100% HIVE and 2, Hive engine is dead. We could release a new project side hustle and maybe sell 5000 HIVE worth of tokens and it would just be a waste of time.

To Round Up

-The EDSI weekly HIVE income model pays equal to 12% APY of the @eddie-earner HP balance

- We used to earn 15%-18% which left us with 3%-6% to compound

- Now we earn 11% APY and pay out 12% which is not good

1/ Amend the EDSI model to a lower percentage. eg, 10-11%

2/ Start a new side hustle and or EDSI buy back wall

3/ HE is dead and I could probably sell more tokens at the local blockbuster

Overall, a small adjustment on our end keeps us good. Things dont last forever and as someone mentioned to me last week, HIVE inflation and curation APY will decline over the years as more HIVE is created and circulated. A new side hustle would be amazing but to be honest, there is no motivation because there are less people than ever on the blockchain and even fewer buying HE tokens. Our best course of action would be to take the hit on the EDS APY and ensure we remain sustainable.

Please share your feedback below.

I wouldn't say H-E is dead. Some people, including @ecoinstant are working on keeping it alive. That said, it seemingly isn't improving very much. Perhaps, as @shmoogleosukami writes, VSC will be the answer to this problem. I haven't actually read about that so I have no idea what that even is, but I have heard the word being thrown around enough these past few months as a H-E replacement that I know it's a thing.

Anyway, I'd favor #1 as a first step. For the growth of this project, I might even suggest a lower rate. 8% maybe. I don't know if investors were be happy about that, but it would help the project survive and grow, and the rate could always be adjusted back up if things improve in the future.

Thanks for tagging! Its funny because it is in fact confirmed that VSC will not replace H-E, they have no current plans to do a contract for making a token. (edit: within their current proposal)

That said, I am working - not only on hive-engine but also some other things that could help bridge or transition. Let's see what happens.

Thanks for chiming in when I put the call out 😃

I should perhaps alter my wording and rather than refer to VSC as a replacement refer to it as being a competitor, co-existence is always possible and frankly Hive-engine will never actually go down so long as it's bridges and witnesses are maintained. It's still not perfectly decentralized but hopefully competition will help kick some life into H-E as well. funding permitting ofcourse.

One can hope someone comes along and takes a punt at contributing improvements.

This, to be honest.

But to put pressure, we actually do need to be honest.

This is incorrect, so I'd like to clarify. Our immediate goal is not to release standards for token contracts from the get go. Our main concern is launching an HBD-HIVE LP as our top priority after network launch. We will be tackling community tokens in the near future, but not immediately after network launch

Hey - no offense intended - I am all about priorities.

I think its important for all to understand that this is not within your current proposal, and while you would do it - anyone else could and should consider this into their plans. And of course - can write their own smart contract, sharing the load.

I totally agree!

Just wanted to clarify that bit is all :)

Yeah, the 8% kinda makes sense if we want the compounding we had before.. was just thinking a variable rate (adjusted at x interval to make it manageable) where curation rewards are used to distribute and the general inflation is what's being compounded.

Not sure if it would be good in practice but in theory it ensures sustainability and prevents making false promises on X percent rate forever while still allowing for clear communication

We have a few weeks to play with so i might throw out a vote and let the tokens holders decide on a percentage.

Sounds fair to me!

Hats off to you for all you do.

Loved your rant as you have been here a fair while!

Hive is no different to life out in the real world. Any chance for the little guy to catch up, the big boys decide that is not the way you do things. So yeah gotta have the same accounts taking the rewards with their autovotes lol

As for HE it is funny that even though I have been here coming up for 4 years I have not really been enamoured with the L2 tokens / projects here compared to other chains.

As for the APR I think it is a no brainer to drop to 10%.

Another side hustle as you rightly say would just be another side hassle for you.

Your comment is upvoted by @topcomment

Info - Support - Discord

That is so kind of you, thank you @friendlymoose and @topcomment

Reduce the APY to 10% and keep under review.

We know that, long-term, EDSI income is simply going to increase.

I am not interested in i) fancy side-hustles which are simply obscuring the fundamental problem, take time and energy which could be put to better use, risks the integrity of EDSI and then there are the issues around Hive-engine.

ii) artificially boosting the EDSI fund through another miner, this exacerbates a problem which we will eventually have to face.

Hive-engine is disappointing, especially as it continues to take fees for transactions. However, in the great scheme of things, Hive-engine is only a mechanism for demonstrating ownership of tokens. When there's a better option, we'll take advantage of that.

I'll drop it down in 3-4 weeks just before we start to get a smaller payout from eds-vote each week.

Agree a new side hustle would become a new side hassle. lol.

I would say do what's needed for sustainability for at least the next year or two.

With VSC on the horizon (soft launch around end of march early april) while it'll take a bit to get settled in and get going, it could being about many enhanced options to solve this issue further into the long run.

Since we're working on the scale of years I think we can afford to wait a while on a few issues as you say kick the can down the road and hope for some external factor to actually breath some life into HIVE and/or L2 tokens, while also exploring options in more detail.

It might suck to have a reduced APR but when times get tough you just deal with it.

I'm hoping that VSC in essence simply replaced Hive-Engine, I'd hope everyone sees how great it'll be and perform and migrate to it asap.

Them perhaps.. we'll see tokens actually thrive.. Well the ones that are worth a damn anyways.

will you be writing the smart contract for sub tokens?

I personally don't have anything to do with VSC, I'm just planning on running a node from day one and as such keep close tabs on what's going on.

I do plan to look into working with smart contracts and VSC at some point depending on how well the launch goes, if it turns out uptake and smart contract development is sluggish I may just get off my arse and do things myself. Assuming I can wrap my head around it. XD

I also donno about sub tokens. Not heard of it before I assume its basically tokens within tokens. So main token is token A and it can have any number of subtokens associated with it? But honestly why not just make multiple normal tokens? unless there is a specific thing trying to be acomplished, not sure what the goal with sub tokens would be if I'm honest.

Thanks for your feedback, im aware of VSC but not up to date. All this sounds like great news, cant wait to see it impact.

I totally agree with that!

10% is my vote. Thanks. !GIFU

kk, cool. Thanks for the feedback.

Personally, I'd say keep it simple. Everything in crypto is already far, far too over-complex. 10% APY is still a very healthy return rate for a long-term investment.

Of course, with my cynical hat on, I'd say that the biggest thing killing Hive right now is that the DHF isn't under control. It pulls out so much it reduces the amount left over for ordinary Hivers to earn in curation and author rewards. So play along; create a proposal that asks for enough HBD to sell and cover the shortfall in EDSI. Everyone who holds EDSI would vote for it, and that might be enough to get it over the threshold. It's the ultimate way to game the system 😁

😂

Thanks for replying,

lol, yeah we should start a DHF to create HIVE income for everyone! Ask for $1M and then pay it back to active HIVE users, lol.

all i can thing is:

turbo charge eds vote again

or sell more miners

and maybe cut down apy a bit... 1% max

I think we could sell more EDS miners but would it be worth it to collect 10-20k?

you are the man with the spreadsheet, does that make a difference? 🤣

nah, no difference

No. 1 is the simplest and most responsible solution.

It does need to be understood, though, and I say this as a larger crypto investor, that if Hive Engine is dead, Hive has major problems. EDSI is well and responsibly run, but the whole chain is suffering because of all that dead weight. And we are in a bull -- imagine what 2026 and 2027 in the bear could be like. Putting it at 10 percent and leaving it there might be the first thought in preparing for the storm to come ...

exactly, you understand where im going from.

Yes. I do. As a prudent investor, it is good to see such prudence when clearly Hive's token creators lack it elsewhere. Keep up the good work here.

Thank you

I believe that the most important is to keep it simple (and stupid). The reason I stayed away from ESDI was that it felt it was too complex and each time I said to myself: Oh, I need more time to understand the mechanisms - time that I never managed to allocate.

I think EDSI is pretty simple, haha.

Don't complicate things, do the easy APY reduction to 10% now and we should be fine for a good while.

Agreed, i'll probally make the change in a few weeks cause we still have 5 weeks for the bigger powerdown from eds-vote

Still reading through my feed here and there, @eddie-earner, this post stood out to me. Share my thoughts?

Hmmm.

Being charitable, I will simply point out the obvious. At least to me. If this trend is not reversed, I am not sure what viable options you have long-term.

No. They don't. That they will change for the better? Based on what? I guess we'll find out, soon enough.

Yep, was thinking knocking it down to 10% should fix it for the foreseeable future and leaves room for some compounding still. It's got my vote 👍🏼

Great, thanks for checking out the post and dropping some feedback.

10% makes sense to me - perhaps with a statement that the rate will be reviewed annually (or 6 monthly or whatever).

Questions: What sort of impact will this change have on EDSI apr? Am I correct in assuming that it would decrease APR by around 3 - 3.5%. (from 20% currently to 16.5-17%) would this bring forward the flippening, where APR starts to increase each week. Maybe even a bigger hit in the short run would be enticing if it put the flippening in sight?

Another thought, maybe the return for eds-vote and eds-d needs to be reviewed. Paying 50% of income makes it a hard sell. Perhaps a move to 75% would attract more funds. a 25% profit on 20K HBD for example is better than 50% profit on 2K. Just something else to consider.

Just a few random thoughts, LBI will be happy with whatever you decide and continue to support EDS.

Yep, the EDSI APY would decline to around 17%. It will speed up the flipping but only by a little. After throwing a few numbers in the spreadsheet and factoring in we'll be getting 100 HIVE less a week from eds-vote powerdowns soon, it looks like the decline would be 0.04% a week. Not really much closer to the flipping to be honest, it will speed the process up but it really depends on how much income will can produce. If there is nothing we can delegate to, we're stuck with HP curation.

Had thought about upping the returns for EDSD but not so much for eds-vote. When I set them up, the eddie-earner account had around 120k HP. So i allocated 180k EDSI tokens thinking if eds-vote and EDSD got 2 hive for each EDSI minted, that would be 360k HIVE powered up to eddie-earner ensuring that the account would have at least 500k by the time all EDSI were minted.

I'd be reluctant to see this. The purpose of eds-vote was two-fold - another way to distribute EDSI and to gradually pay off the deficit that was always there and covered by compensation from @spinvest. If we increase the reward structure, we'd be robbing Paul (paying off the existing deficit) to pay Peter (75% rewards), before we even start to look at what's happening with the drop in curation.

I'd also be reluctant because many of the accounts delegating to eds-vote are not interested in either saving, EDSI or the long-term stability and well-being of the fund. They're delegating for a vote. I haven't checked but I'm guessing they're selling their EDSI ... and their HIVE, which is an even bigger problem. I'm loathe to get into self-voting by proxy - here's a good post about it - and I wouldn't want to incentivise that behaviour by increasing rewards. In reality, the rewards are still there, in the fund, and adding value to every EDSI held.

I'm not up to date with the hive engine thing, someone shares a link?

My take on hive-engine:

With regards to hive-engine, generally on the technolagy level it's been in maintenance mode for the past 3 years, there has been zero development and improvement of the platform.

In addition to that 90% of L2 tokens on hive-engine have poor liquidity and questionable management of projects related to them. Most are simple abandoned or just in a state of stagnation.

Most tokens actually have very little backing their value.

Baring game tokens, and the 4-5 income, dividend token projects.

I personally try not to get involved in any L2 tokens now aside the ones I already have as I despise Hive-engine and don't think it's a safe place to have assets of value anymore. But since it's all we have for now until VSC anyways we got to live with it.

How has VSC evolved since the last hivefest? I mean has it evolved? I'll check their profile, no need to explain.

If I can give a suggestion for the "side hustle" investment aladdindao's concentrator for staking stablecoins and pools on curve.fi

Their stablecoin is aFXN and it's slightly over 30% apy for staking, then the vault for the stable curve.fi pool tokens are just under 50% Apr

https://concentrator.aladdin.club/

Take a look at https://peakd.com/@vsc.network for more information about VSC!

We could try that...

Please guys vote my new post 🙏🙏🙏

!PIMP

(1/3)

@eddie-earner! @dkid14 wants to share GiFu with you! so I just sent 20.0 SWAP.GIFU to your account on behalf of @dkid14.

Some mechanism to reduce the EDSI supply doesn't seem off track completely.

Congratulations @eddie-earner! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 80000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP😍

👍