This year, I have set some fairly ambitious goals for my progress here on HIVE. Rebuilding my Hive Power, growing a passive income wallet, and building a savings fund in the form of $EDSD. Having historically been weak at setting and methodically working towards goals, I am trying to post weekly updates on my progress. The main reason for this is to keep myself personally accountable. It may also be of interest to others to see what tokens and methods I am using to build these positions.

This years goals I am tracking for the Saturday Savers Club in 2024 are:

- 2000 EDSD by year end.

- 10000 Hive Power by year end.

I am also targeting 10000 LEO this year, and tracking my progress.

Finally, I am working on building a passive income wallet - @jk6276.holdings - where I collect Hive layer 2 tokens that generate HIVE income. The income received there is intended to by my "cash out funds" which I convert to fiat each week to help improve my fiat finances and supplement my regular income. Currently this wallet holds BXT, SIM, EDS, DAB, SPI and LGN. I am always open to suggestions, so if you know of other tokens that pay liquid HIVE yield, let me know about them

So, lets look at this weeks progress:

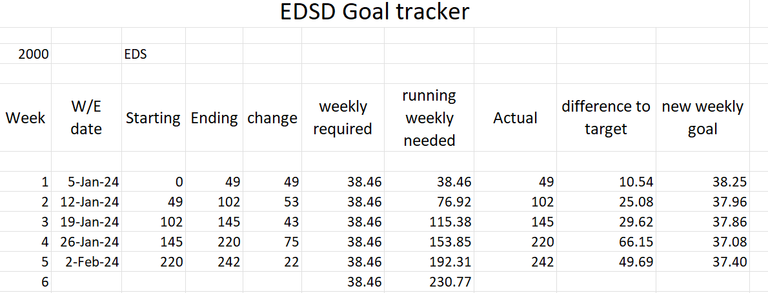

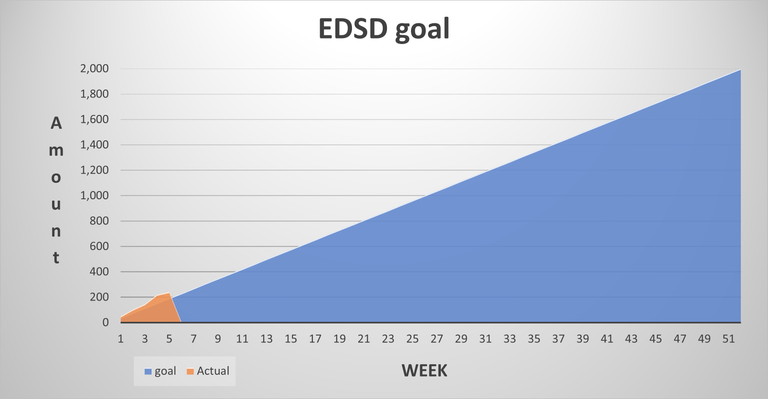

EDSD - goal 2,000

Over the last few weeks, I have pushed ahead of my target for EDSD. This week was a little slower, and I missed the goal and only collected 22 EDSD. My weekly target was initially 38.46 per week to get to 2000 by year end. Overall, however, I am nearly 50 EDSD ahead of schedule.

Need to post more to boost my HBD income, and this week I did not have any free funds from outside HIVE to bring in.

Happy with the progress here, and happy also with the amount of EDS these mint each week to add to my passive income wallet.

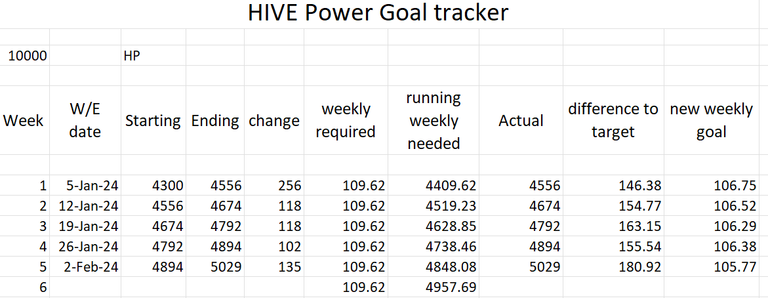

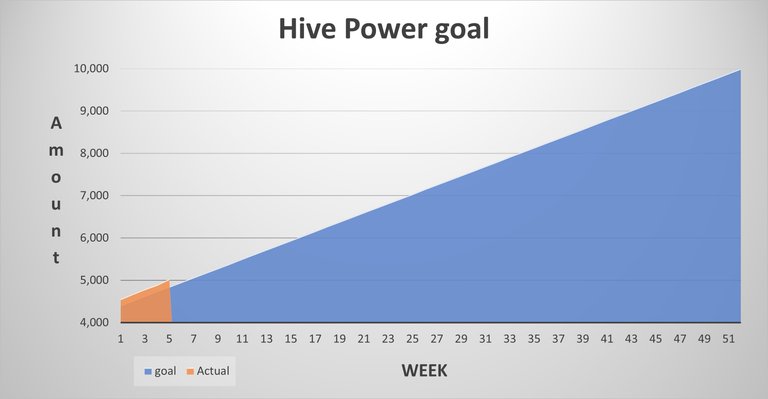

HIVE Power - goal 10,000

My weekly HIVE power goal is 109.62, and so far I am tracking 180.92 ahead of schedule. The first week in, I did the January HPUD, which started this goal off with a bang. Since then, each week has been on or very close to the mark. I didn't have the chance to do anything special for HPUD February, but still managed 135 for the week.

5 weeks in and this goal is comfortably on track.

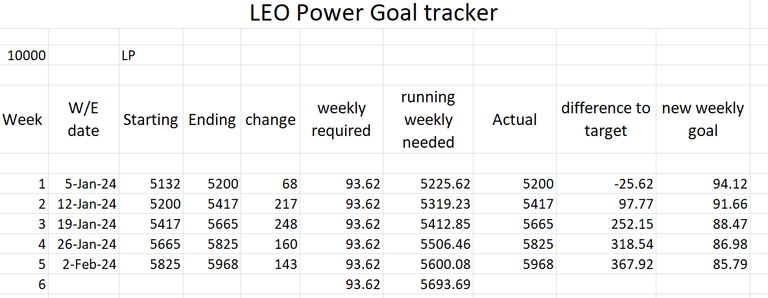

LEO Power - goal 10,000

My third major target for the year is to get back over 10K LEO power. So far so good for this goal also, with 143 powered up this week. With the exception of week 1, I have been well over target each week, and should be able to keep pushing this goal and potentially even re-asses down the track to possibly increase the target. Shouldn't get ahead of my self this early, consistency will be important.

On track and ahead of schedule.

Passive Income Wallet

My passive income wallet is the other focus for me on HIVE this year. @jk6276.holdings is where I collect all my Hive income tokens, and I have gathered some extra data this week to see how it is going. I have started tracking the APR that each token generates, just out of interest. The results where basically what I expected with DAB having the highest yield and SPI the lowest. Some outcomes may be different to the official project numbers, as I just took the income across the week, and the token amount at week end.

Anyway, I just found this to be an interesting bit of information, and thought I'd share if anyone is reading this post. Overall APR for the wallet is just over 30%, which is real nice for passive holdings. DAB yield will decline over time, as this is how its tokenomics are structured. EDS also drops a little each week, for now, but the EDS APR flippening is on the horizon, and then its yield will be up only.

Looking forward to watching these numbers over time, and seeing the long term trends.

| Token | Holding | HIVE Price | HIVE Value | Income | Weekly Yield | APR |

|---|---|---|---|---|---|---|

| DAB | 310.715 | 2.5 | 776.79 | 10.532 | 1.36% | 70.50% |

| BXT | 500 | 1.2729 | 636.45 | 2.287 | 0.36% | 18.69% |

| SPI | 120 | 4.61 | 553.20 | 0.25 | 0.05% | 2.35% |

| SIM | 2,800,000 | 0.0001848 | 517.44 | 3.661 | 0.71% | 36.79% |

| EDS | 303.51 | 1.193 | 362.09 | 1.43 | 0.39% | 20.54% |

| LGN | 310 | 0.9 | 279.00 | 0.37 | 0.13% | 6.90% |

| TOTAL | 3124.96 | 18.53 | 0.59% | 30.83% |

I hope you enjoyed this post, with new shiny charts and extra data from my savings goals. If you did, be sure to give me a follow, and hit the upvote button.

Thanks for reading, have a great week.

JK.

Looks like you are making steady progress there JK!

The only one I have producing daily HIVE income, which is missing from your list is ecoinstant's INCOME.

Onward and upward into the month of February!

Hello good morning, I really liked your post and I've been reading a lot about your evolution and idea of an income portfolio, which inspired me to try to create one too, but don't worry, I'm doing it at my own risk.

Now I would like your help, how did you calculate your Weekly Yield and APR in this table at the end of your post? Could you please explain it to me if possible? I want to set up my spreadsheets too and understand more about the subject, thank you very much!

Hello @shiftrox - happy to see you enjoying these series and the passive wallet updates.

When setting up my little spreadsheet, the formula for weekly yield is simply the income/hive value as a percentage. To work out the APR, I use the income * 52 / hive value.

They are just a guide, as yield will constantly change, and not 100% accurate, as my number of tokens can change through the week - but I find it interesting.

Thanks for your interest.

I understand, thank you very much for the explanation, I am always keeping an eye on the tokens and increasing my stakes and liquid holds. I hope we can grow a lot this year! Thanks!