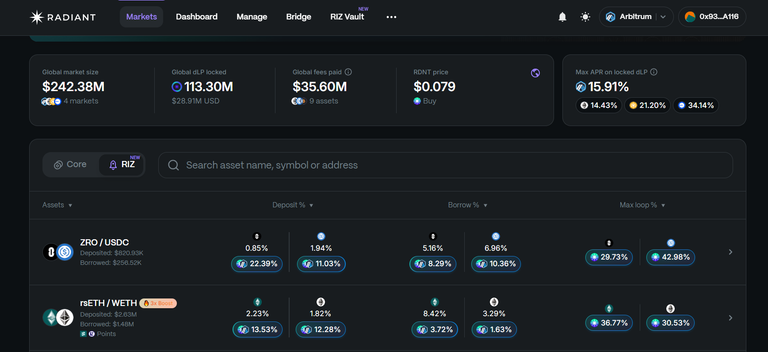

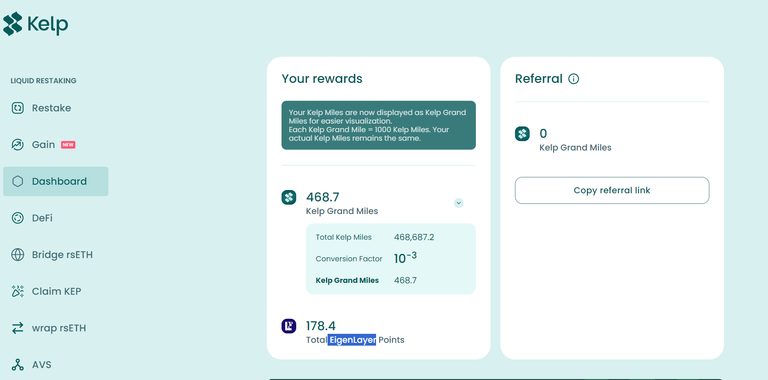

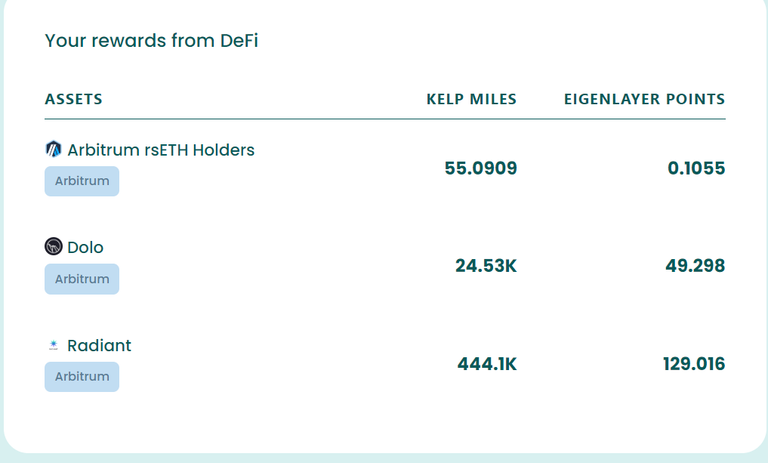

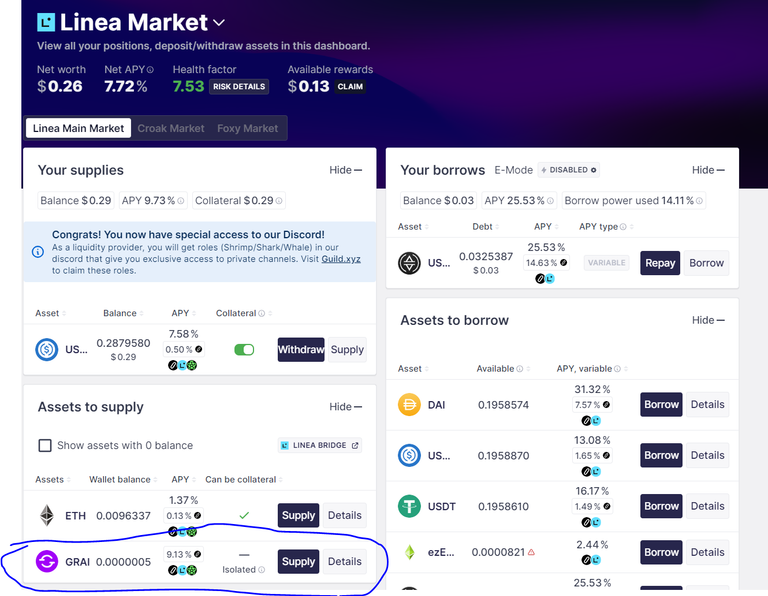

If you want to get multiple airdrops at once one strategy you can follow is using Kelp re staked eth on arbitrum locked in Radient's RIZ Vault which gives you all the benefits of rstETH plus a airdrop of rdnt, arb as well as 3x kelp miles for the kelp airdrop and EigenLayer points which is alone 4 airdrops in one. Then you can take it further and borrow weth at 3.29% less the 1.63% in additional arb and rdnt drops making your net cost about 1.66% on the borrow and that is less than the interest rate earned just on the restaking alone plus the supply rate on radient without incentives. When you have the borrowed weth you swap it into wstETH which is then deposited in a gravitas CDP vessel to earn gravitas marks for the vessel being open and also you can earn additional marks by borrowing grai at a fixed rate that does not change and either using the stability pool which may allow you to acquire discounted collaterol during liquidations from 10-20% discounts which gets you 3x gravitas marks. Also you can add grai liquidity on pancake swap and earn marks for that as well as CAKE and other swap fees. Another facet that you may want to consider is having the vessel on Linea as you can earn another set of points called lxp-l points for Lineas campaign for liquidity providers gaining you another potential airdrop.

use my referral link here for Kelp DAO if you are interested in utilizing the kelp protocol to obtain your rstETH for the position.https://kelpdao.xyz/restake/?utm_source=0x9328c78FDa563b91b97D6B7A27D179EA7585A116

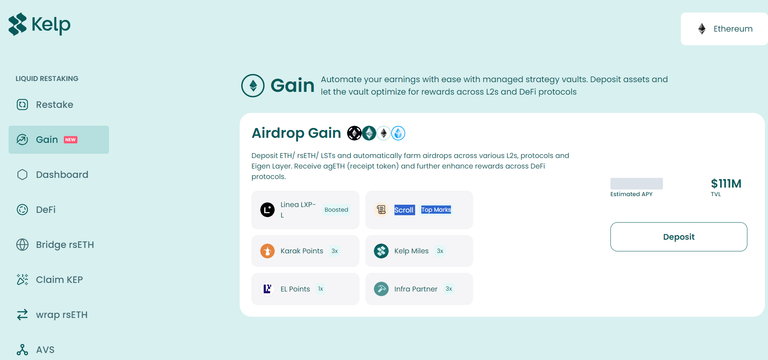

Also going though Kelp DAOs Gain managed vaults you can earn 6 different airdrops as well if you would like to go that route or use both methods. You can also navigate to the DEFI tab and see other opportunities on other platforms with rstETH as well and many of them have there on unique benefits.

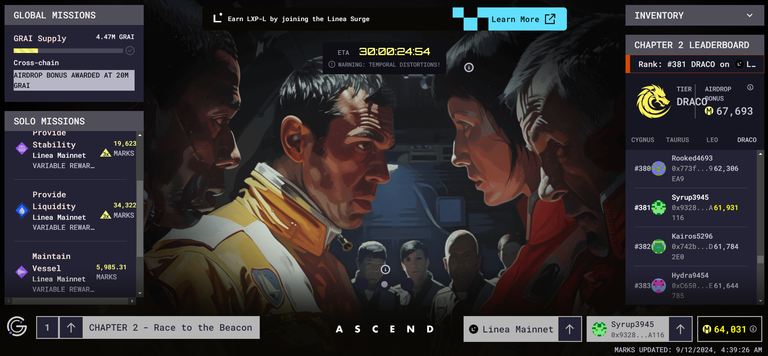

The rewards for the gravitas drops are segregated by chain as well so you can strategize to maximize your tier bonus by moving chains once you hit the draco bonus which is 67.693 points and you can get that for each chain and I have hit it for Linea so right now im working on getting more bonuses on Arbitrum to get that to a higher tier bonus hopefully at least leo before the drop happens supposedly in September for gravitas. Once the gravitas drop is over i will be closing my vessel and moving it to Linea to possibly use in any on going drops on gravitas for continuing to use grai and maintain my vessel but that is not known yet. If not I will likely re arrange my positions to focus on a new airdrop like scroll marks and bridge the weth from Radient to scroll and find a similar set up with multiple defi protocols to earn there tokens as well along with scroll marks for there future airdrop as well as move some liquidity back to Linea to keep earning lxp-l points as well as airdrops for some of the linea protocols. You can also sign up and register for Lineas lxp-l points which needs to be done in order to receive them so use the link here to do so if you are using the Linea method.https://referrals.linea.build/?refCode=x3oti1ylN8

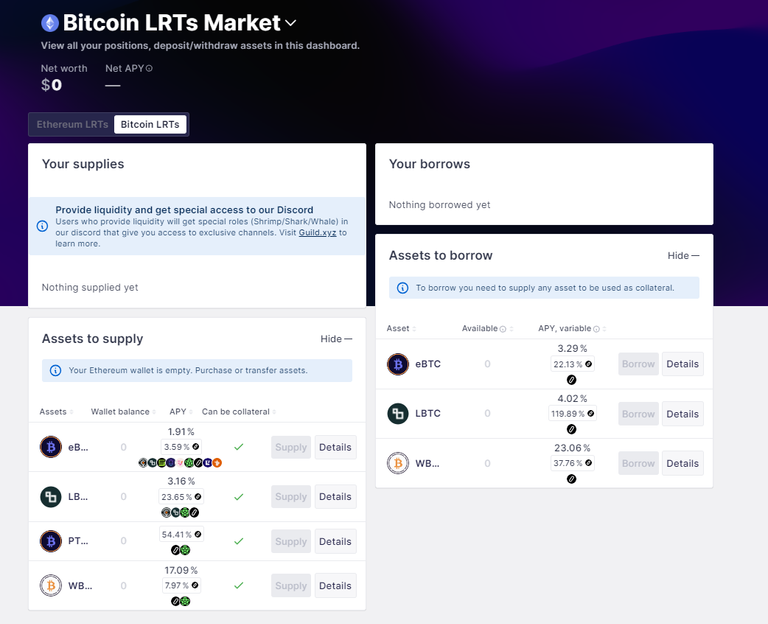

Another option on Linea is to deposit grai on Zero Lend to Earn the ZERO token in its on going airdrop as well and you earn ZERO at about 9-10% on the grai while receiving lxp-l and gravitas marks along with it. I have already hit my target on the gravitas drop for Linea for now so I am not currently depositing on Zero Lend for the drop but may do so soon in the future as they just came out with there bitcoin markets that have btc lst and lrts that appear to offer some options that earn 7-8 airdrops in one like eBTC for etherfi BTC. Check out below for the btc markets that I will be likely utilizing at some point in the future very soon.

Also on Zero Lend with the ZERO token staked you are entitled to earn x% of various airdrops the protocol receives as well like PYTH is one coming up very soon for anyone with staked ZERO as well as you also earn daily staking rewards in ZERO and also ETH if you supply to the ZERO/ETH lp on Zero Lend you receive protocol fees earned as well. I dont have to much on there staked so I usually get a dollar or so a day from them right now but that will grow as I farm additional airdrop's form them with the btc options they have now as those have very high drop rates in the high apr % range for BTC lrts and lsts. See below for a snip of those options as they are now.

Setting up your capital to farm multiple opportunities at once has been a strategy I have used for a long time to get additional income for my gaming purchases since it costs me nothing really if you do it correctly and do not fall into some of the traps like borrowing at high rates with airdropped tokens offsetting those rates you must be careful of that as sometimes it may look like a good deal to farm something but it ultimately may end up costing you money if the farmed assets decrease below the cost of any borrowed capital plus you would need to sell them right away to cover that cost if its high and a lot of times there are lock ups so you are taking a risk with that which is why i prefer it to make sense even with out the airdrop even if the percentages is only slightly positive overall as long as it does not lose money with no airdrop then its a really good position or if it loses very little then its likely worth the risk but having it suck out a ton of interest is them mining you so be careful. Potentially a good idea to cash out some of your splinterlands income and put it into things like this to build up positions and airdrops which can later fund some of those cards you want and decrease your risk and exposure to all SPL assets like say the lps which are much riskier than investing in eth and other eth related assets in my opinion and having your cash flow diversified is important especially in times of uncertainty having things that are not correlated or may hold up better as well can enhance your returns. I also hedge my portfolio with short ETH on perp exchanges so that the position is market neutral all the way or to some extent depending on if im bullish or bearish at the moment since with perps you can use a little leverage and I only usually go as high as 3/1 for my hedges to make sure i do not get liquidated. You can also accomplish similar things with cross margin positions and borrowing against usdc etc to short eth or other tokens so that you can have a market neutral or hedged position while you are farming air drops.