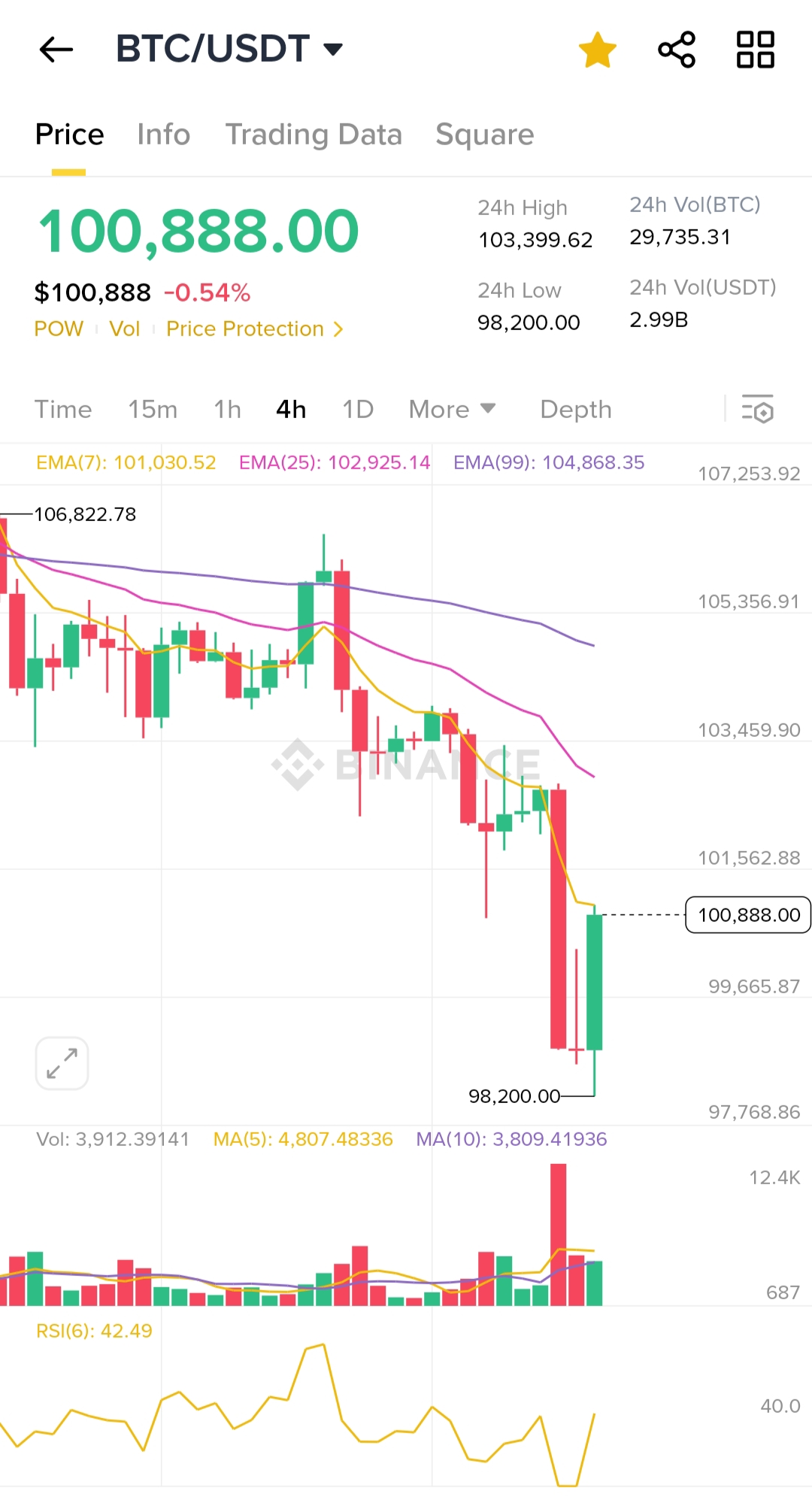

Technical Analysis (4H Chart):

Current Price: $100,888

Recent Low: $98,200 (24H low, marked strong support)

EMA Levels:

- EMA(7): $101,030 – Price currently under short-term trend.

- EMA(25): $102,925

- EMA(99): $104,868 – Clearly bearish as price is trading well below all EMAs.

Price Action:

- A sharp drop occurred after an extended downtrend, hitting $98,200 before a fast rebound.

- Current green candle shows a relief bounce but hasn’t reclaimed the 7-EMA yet, indicating the recovery is still fragile.

Volume:

- Spike in selling volume during the drop suggests panic-driven sell-off.

- Follow-up green volume bar indicates some buying interest (possibly bargain hunting).

RSI(6):

- 42.49 – Weak but recovering from oversold conditions. No clear bullish divergence yet.

Key Resistance Levels:

- $101,562 (minor), then $103,459 and $105,356 (EMA zones).

Key Support:

- $98,200 is a strong short-term support. If broken again, next support could be around $96,000.

Geopolitical Impact:

The sharp price drop aligns with news of a U.S. airstrike on an Iranian nuclear facility. Such geopolitical shocks typically drive risk-off sentiment in markets. Bitcoin, while sometimes viewed as a safe haven, often reacts with volatility during sudden escalations. The initial panic sell-off suggests short-term traders rushed to safety, but the fast recovery hints at long-term holders buying the dip.

Conclusion:

BTC dropped sharply due to geopolitical panic, found strong support at $98,200, but needs to reclaim short-term EMA levels to confirm recovery. Caution advised until it stabilizes above $102K.

You received an upvote of 29% from Precious the Silver Mermaid!

Please remember to contribute great content to the #SilverGoldStackers tag to create another Precious Gem.