Understanding the History

Not many people know how bitcoin and blockchain came about and there are many stories out there which in my opinion is untrue. The most ridiculous one that I have heard was quite recent from a speaker that told the audience that blockchain existed even before 2004 and was not known to the public except for the gaming community. The most outlandish claim was that Satoshi was not the first to introduce blockchain to the world.

Well, my mind is not shut to new and shocking news but it must first pass a few logical process. If a person makes a positive assertion it must contain the following:

- What are the grounds or facts that lends support to the assertion

- What is the person's background lend credence to such claims

Distrust in Central System

We all know that Subprime crisis happened in the America in 2007 and lasted a few years. This lead to one of the worst drop in the real estate industry in America and a few countries that were involved got their fingers burnt as well. We know that the money that we save in the banks are used to finance economic activities and they retain a small portion in the event some depositors want to cash out. The banking industry is a tightly regulated industry because a country cannot afford any banks to be wound up. A bank that is unable to pay its depositors would be called a 'bank-run'.

So what lead to the sub prime crisis was the lackadaisical attitude of the banks in loaning out money to lenders who are classified as 'risky' borrowers. People who will not be able to pay their mortage should there be any change of circumstances in their finances. There must be enough buffer for the banks to ensure that they take minimal risks. To the bankers, they are happy with the collateral. The real property. In their eyes, the collateral can be sold to make good the money lent. But this will not be the real situation when the property market crash. What was previously worth $100,000 could now be worth only $50,000 and the amount salvaged through an auction would be unable to cover the loan disbursed.

So when shit hits the fan, everyone realised that the banks are running into massive losses and wishes to make their withdrawal. The massive queue to the bank gave a sense of panic and more people started to rush to the bank to make their withdrawal for the fear that the bank may be wound up from the losses they suffered from the unserviced loans.

So, any failure of the bank to meet their depositor’s request would paint a very ugly picture on the government of the day. So what the government did was to perform a bailout. The issue about a bailout is whether the government of has enough reserves to perform multi billion dollar bailouts. Even if the government has enough, it would deplete its reserves which are from the coffers of the tax payers.

So as an exercise to allay the panic amongst the public of a collapse in the banking sector which will spill into any other industry because almost every business depends on banking facilities and the continuity of the banking industry is absolutely essential to any country.

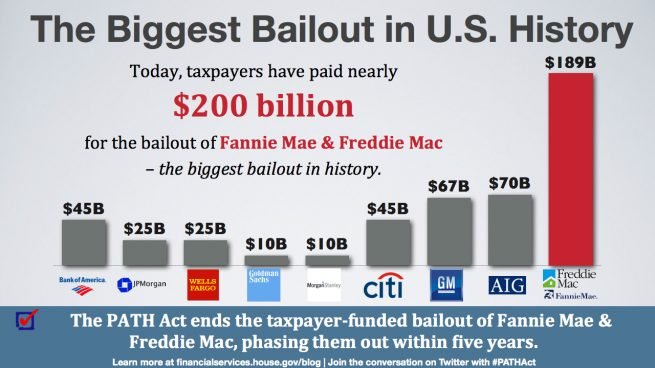

Bailout and the Price of Bailout

The Government now steps in and bail the banks out. The government then takes loans from other countries to ensure that they have adequate money to bail these banks. Now the question arise, who will foot the costs of borrowing. Borrowing is not free, it comes with its terms and conditions. Since the government is making the decision to borrow, they are the borrower and when the government borrows, it will eventually be the liability of the country.

So what was previously a callous decision to borrow by bankers by taking unreasonable risks, it has now escalated to become a national debt. So where is the exchange of favour? There is no exchange. If the risk returns a positive result, the bankers get their fat paycheck, and if it is negative the bankers run to the government and request for a bailout. So in either situation, the borrowers and the citizen stands to lose. What was risked is their savings. The citizens without any involvement with the banks suddenly found themselves having to face inflation and higher taxes.

How to Return Monies Borrowed

Monies borrowed must be paid back. So in order to do so, the government can resort to 2 fast ways. To print more money which will result in inflation or to raise taxes which would undoubtedly burden its citizens.

Distrust in government was at an all time high and a lot of decisions made by the bankers are questionable. That is when the call for a decentralised ledger is strong. One that is trustless and incapable of manipulation.

Great reading... is this how they came out with the cryptocurrencies idea?

Yes...that was what gave start to bitcoin. First used by the gaming community and people start seeing utility in a decentralised system.

You've got some good points..