Hello again,

I decided to rerun the weighted stochastic measurement, just 5 days apart, to see how much the high variability in cryptocurrency value altered the buy results. This should help me understand if the weights are appropriate.

As a reminder, this method will do no favors to the those that speculate, and it won't tell you to buy-in as long as the price is on a huge upswing (like BTC and ETH), as it will analyze them as overbought in the short term. In the meantime, this method will help find the coins that have stabilized, neared their floor, but are likely to return to another run.

FYI - Everyone should be prepared for whatever fallout the potential Fork in Bitcoin may cause.

So if you're doing cost dollar averaging with crypto, as I am, you'll still buy-in to ETH and BTC - just not as high of a percentage as you typical would carry in your portfolio. Once they hit a snag in their run, and a panic hits, thus finding a new floor, is when you'll buy more heavily back into these two. In the meantime, you'll spend a much higher percentage of your purchases on the value coins.

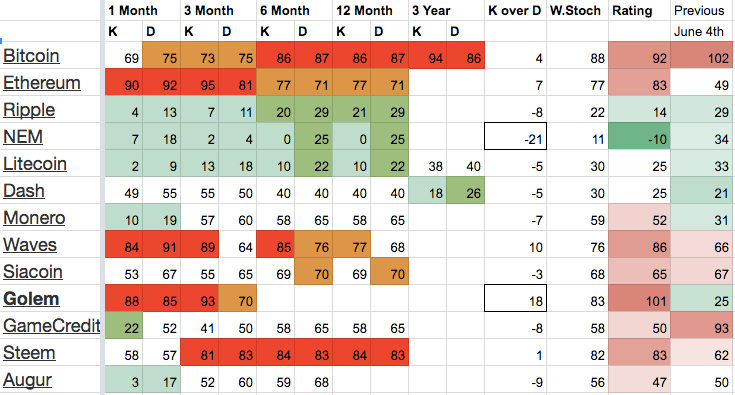

What to note in the chart below:

- First, may I tout that the ETH for Golem trade I made 5 days ago was well worth it. It's a horrible buy today, so I just beat the run up on value on Golem which has outpaced the ETH growth.

- NEM looks like a screaming buy right now. I'd check to see if their is good reason for why that's the case, as I don't follow that coin closely. But it is worth a very strong look. It was a BORDERLINE BUY just 5 days ago. The W.Stoch at 11 is already a great signal, and that is compounded with the falling K:D score.

- Ripple, Litecoin, and Dash also look very good, and have been as such for a long time.

- Dash is interesting due to the long term, 3 year values, saying it's time to buy. This to me looks like a long term strengthening of Dash against the BTC which is impressive.

- Monero, GameCredit, and Augur are good examples of tricky short term analysis. If you only looked at the past month worth of data, it's a good time to buy. But in reality, long term, it's rather blah. With that said, strong falling K:D could mean so bad news recently broke and people are bailing.....so if you know that any of those three have plans to fix said issue, and the value will rise then decent value to be had there. I believe something similar will happen with SIA moving forward.

- And then there's STEEM - not exactly what I'd buy in on due to an overall appearance over being overbought. But, if you're into speculation, and believe in STEEM, as I do. Then instead of lowering your rate of purchase, maintain what your normal level of buy-in.

As for weighting Bias, I'm clearly more comfortable with the coins that have been around for three years.

- 3 year coin movement: Max 10; Avg 7.

- 1 year coin movement: Max 44: Avg 25 (wow)

- 6 month coin movement: Max 3: Avg 3 (only one)

- 3 month coin movement: Max 76: Avg 76 (yuck; only one)

Right now, the 1 & 3 year coin movement may be what I ultimately land on as optimal for my purposes. I'll run another one of these in another 5 days or so.

Please let me know what I may be overlooking.

welcome to the steemit family. Upvoted and followed you! That is some good portfolio and analysis!!!

NEVERDIE ICO is LIVE.

The first block chain based Virtual Reality gaming crypto! NEVERDIE coin will allow monetizing the game items in real cash economy game Entropia Universe. NOW game player can cash out their in-game money earned by playing game and can exchange NEVERDIE coin with other ERC20 tokens such as Gnosis, Golem, and Frist Blood.

https://steemit.com/ico/@maxtill94/nevedie-ico-full-analysus-why-you-should-buy-neverdie-coin-gaming-cryptocurrency-coin-comparision-with-gamecredit-mobilego-first

Nice post. I fully understand what you're talking about. Sell the coins that you know nothing about. Do proper research on any coin you buy. If the market falls at least you can hold your coins knowing they have a long term future. Does anyone know about: https://www.coincheckup.com It's a great site that gives in depth research on every tradable cryto in the market.