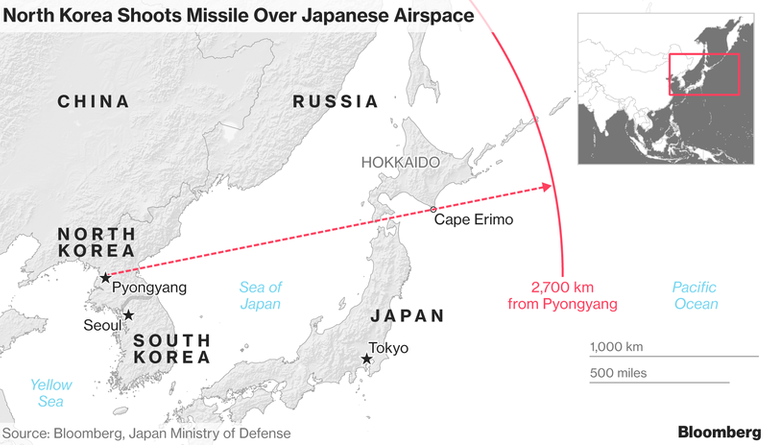

South Korea’s stocks and currency fell after North Korea fired a ballistic missile over Japan and landed off the eastern coast of Hokkaido.

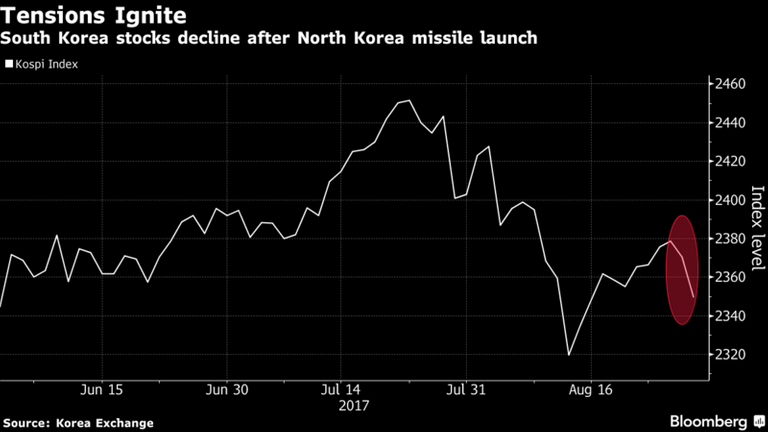

The Kospi index fell 0.2 percent at the close of trading in Seoul, paring an earlier decline of as much as 1.6 percent amid buying from individual investors. The won weakened 0.6 percent against the dollar. The cost of insuring five-year South Korean sovereign bonds from nonpayment has subsided to 62 basis points in the afternoon after shooting up to as much as 63.5 in the morning, according to prices from Nomura Holdings Inc.

“It’s just another negative for markets to be wary of at this point, in many ways it’s impossible to price into markets,” said James Soutter, a fund manager at K2 Asset Management in Melbourne. “We’ve had high tensions before and it amounted to very little. At some point in the future it will be different, but will it be different this time? God only knows, to be honest.”

Overseas investors withdrew a net $236 million from South Korea’s equities market, according to Bloomberg data using official figures. By contrast, retail investors bought a net $216 million.

Pyongyang had threatened earlier this month to fire a missile over Japan toward the U.S. territory of Guam, prompting U.S. President Donald Trump to warn he’d retaliate with “fire and fury.” Trump has also said military force is an option to prevent Kim from gaining an intercontinental ballistic missile that could deliver a nuclear weapon to the U.S.

Japan is in complete agreement with the U.S. to increase pressure on North Korea, Prime Minister Shinzo Abe told reporters after speaking with Trump for about 40 minutes this morning.