The iShares 20+ Year Treasury Bond ETF (TLT) is seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years.

Interest rates and bond prices move in opposite directions. When interest rates fall, bond prices rise and when market interest rates rise, bonds fall (which is known as interest rate risk).

Lets say a treasury bond offers a 5% coupon rate, and one year later, interest rates fall to 4%. The bond will still pay a 5% coupon rate, making it more valuable than new bonds paying just a 4% coupon rate. If you sell the 5% bond before it matures, that bond will be in demand, so that bond will sell at a higher price. But what if interest rates rise from 5% to 6% If you sell the 5% bond, it will be competing with new treasury bonds that offer a 6% coupon rate. That 5% bond will be in less demand and will sell at a lower price.

With all that said, lets hit the charts.

Monthly Chart (Curve) - price low on the curve, has been bouncing off of the monthly demand zone, but recently broke the upward monthly trend line that was establish in at the beginning of 2011.

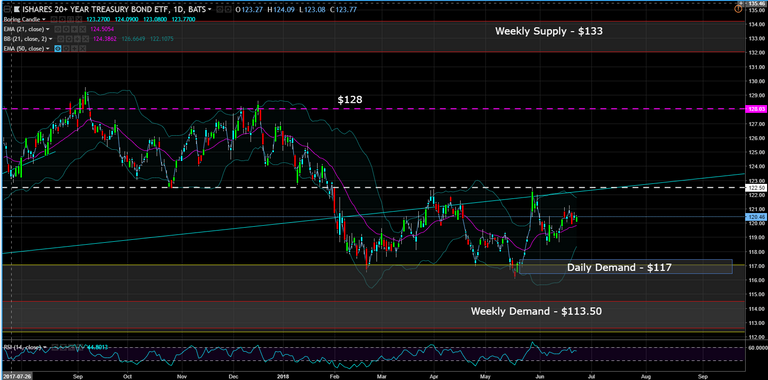

Weekly Chart (Trend) – price has been range bound ranging from a low of $116 to a high of $130 since the beginning of 2017. Thus you must trade the extremes.

Daily Chart (Entry) – the $122.50 price level has been serving as support and resistance since the beginning of 2009.

Price is currently sitting between the monthly demand and this major support/resistance line. Thus, there is no trade set-up at this time. Wait for price to come back down to the monthly demand zone to potentially go long or wait for price to break to the upside the long standing support/resistance line at $122.50 and buy on a pull back with a target at $128.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Upvoted ($0.12) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.