Hello, this will be a short tutorial on how to buy and trade stocks, like most of recent and futur posts will be.

This poces is quiet easy, all you need to do is START, and when you start just invest into something you would like to own and not only earn money fast (live we all want ;)

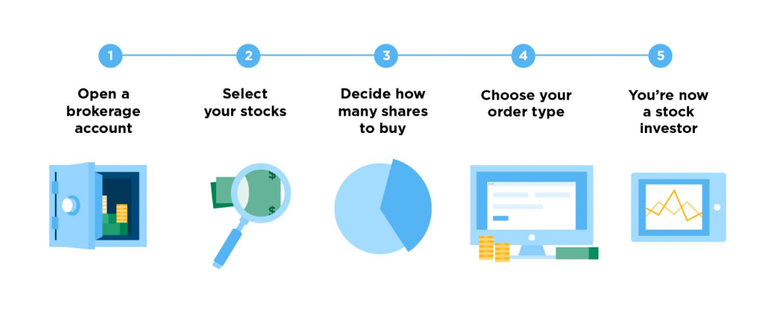

1. Open an online brokerage account

First thing you need to do is open an brokerage account and best sites to do that are listed on my previous post that you can find right here: Sites for brokerage accounts and traiding

Setting up a brokerage account is a simple process — you can typically complete an application online in under 15 minutes.

Once you’ve opened the investment account, you’ll need to initiate a deposit or funds transfer. The broker will walk you through the process. Once the transfer is complete and your brokerage account is funded, you can begin investing.

You might be asked if you want a cash account or a margin account. A margin account allows you to borrow money from the broker in order to make trades, but you’ll pay interest and it’s risky. Generally, it’s best to stick with a cash account at first.

2. Select the stocks you want to buy

Don’t let the deluge of data and real-time market gyrations overwhelm you as you conduct your research. Keep the objective simple: You’re looking for companies of which you want to become a part owner.

Start with the company’s annual report — specifically management’s annual letter to shareholders. The letter will give you a general narrative of what’s happening with the business and provide context for the numbers in the report.

3. Decide how many shares to buy

Consider starting small — really small — by purchasing just a single share to get a feel for what it’s like to own individual stocks and whether you have the fortitude to ride through the rough patches with minimal sleep loss. You can add to your position over time as you master the shareholder swagger.

4. Choose your stock order type

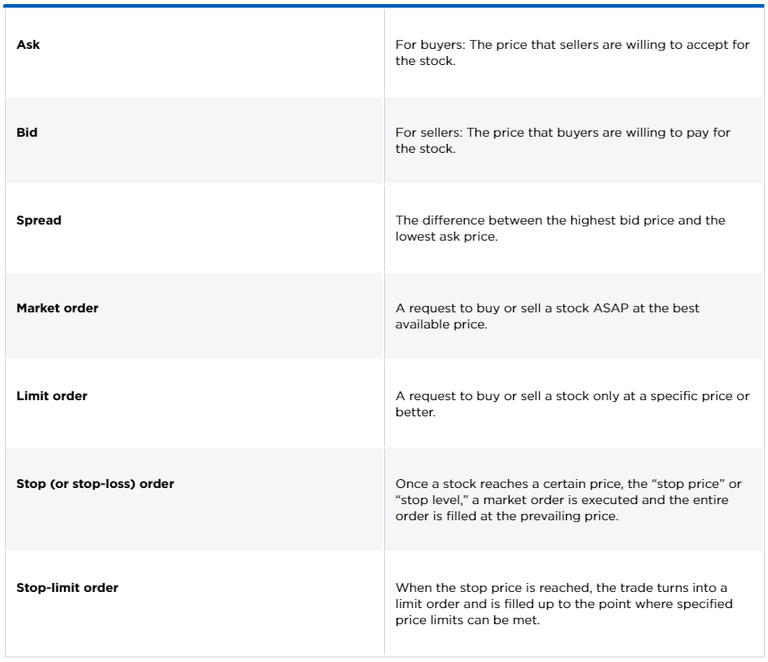

Don’t be put off by all those numbers and nonsensical word combinations on your broker’s online order page.

There are a lot more fancy trading moves and complex order types. Don’t bother right now — or maybe ever. Investors have built successful careers buying stocks solely with two order types: market orders and limit orders.

A) market order is best for buy-and-hold investors, for whom small differences in price are less important than ensuring that the trade is fully executed.

If you place a market order trade “after hours,” when the markets have closed for the day, your order will be placed at the prevailing price when the exchanges next open for trading.

Check your broker’s trade execution disclaimer. Some low-cost brokers bundle all customer trade requests to execute all at once at the prevailing price, either at the end of the trading day or a specific time or day of the week.

With a market order, you’re indicating that you’ll buy or sell the stock at the best available current market price. Because a market order puts no price parameters on the trade, your order will be executed immediately and fully filled, unless you’re trying to buy a million shares and attempt a takeover coup.

B) limit order gives you more control over the price at which your trade is executed. If XYZ stock is trading at $100 a share and you think a $95 per-share price is more in line with how you value the company, your limit order tells your broker to hold tight and execute your order only when the ask price drops to that level. On the selling side, a limit order tells your broker to part with the shares once the bid rises to the level you set.

Limit orders are a good tool for investors buying and selling smaller company stocks, which tend to experience wider spreads, depending on investor activity. They’re also good for investing during periods of short-term stock market volatility or when stock price is more important than order fulfillment.

There are additional conditions you can place on a limit order to control how long the order will remain open. An “all or none” (AON) order will be executed only when all the shares you wish to trade are available at your price limit. A “good for day” (GFD) order will expire at the end of the trading day, even if the order has not been fully filled. A “good till canceled” (GTC) order remains in play until the customer pulls the plug or the order expires; that’s anywhere from 60 to 120 days or more.

5. Optimize your stock portfolio

Remember that every investor goes through rough patches. The key to coming out ahead in the long term is to keep your perspective and concentrate on the things that you can control. Market gyrations aren’t among them. What you can do is:

Make sure you have the right tools for the job. NerdWallet’s list of the best stockbrokers can help you identify the right brokerage account for you.

Be mindful of brokerage fees. These can significantly erode your returns.

Consider also investing in mutual funds, which allow you to buy many stocks in one transaction. Here’s our list of the best brokers for mutual funds.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

tnx