Part 2 is now live! Click here to read it!

I have noticed that a number of well meaning posters seem to be paying taxes on Steem rewards immediately at the time of receipt. @jerrybanfield in particular released a video, I believe with absolutely good intentions, trying to show other people how he did it. His video certainly absolutely guarantees you will not understate your tax liability, but in reality, I think this video could have been titled "Maximizing Your Tax Liability Beyond Even What the IRS Would Expect 101". I fear that a paranoia over the tax-man is leading to a vast over-estimation of tax liability (at least, in the US).

In this series of posts, I hope to reason through a more logical tax option that will retain the "good faith" protection that prevents penalties for taxes paid with a consistent, defensible system in good faith. If I'm successful, perhaps I will help give Jerry and everyone for whom he is a proxy the tools to find a way to reduce their tax liability substantially!

There are a number of reasons that you cannot simply value Steem at the market rate when you collect it to your wallet for tax purposes.

The first, and most technical, is your rewards are not in Steem. You are paid either 50% SBD / 50% SP, or 100% SP. The clever may note here that while SBD has a market rate and is traded, thus allowing some hypothetical attempt at valuation, Steem Power is literally not tradeable. You cannot assign a value to it without layers of abstraction.

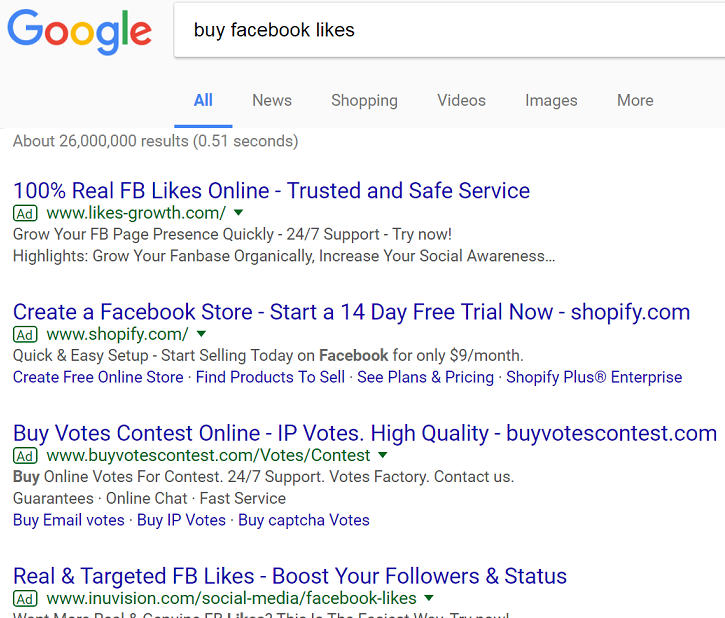

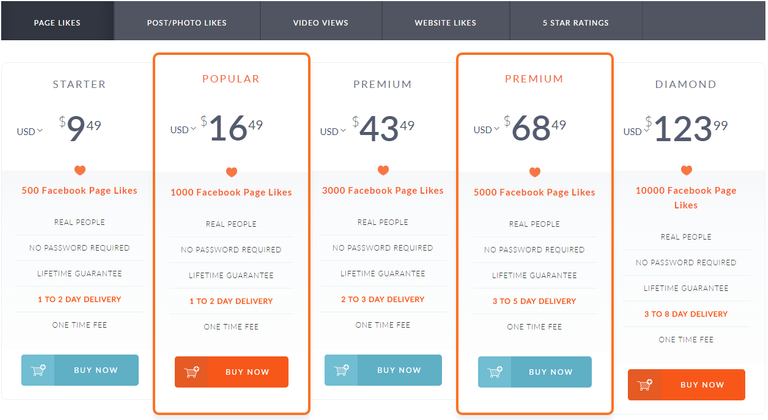

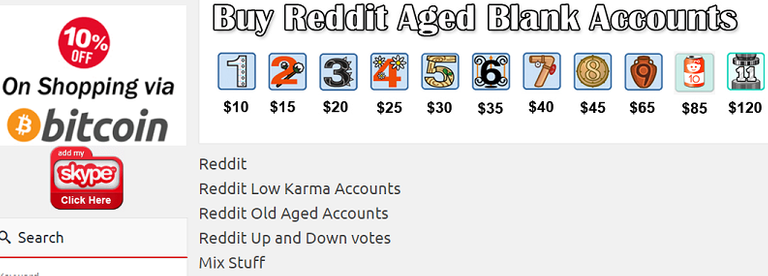

What do I mean by abstraction? Perhaps you're thinking "But Lexiconical, Steem Power can be converted into something that has a value, therefore it has that value!" Well, if you think that way, now Facebook Likes and Reddit Karma is taxable income. And, eventually, anything the government decides it wants to be income.

Given the number of results, I wouldn't be surprised at all to find that the "Facebook Likes" market does a lot more volume than $1.7 million USD, which is the 24h volume on Steem today.

It works this way at Reddit too:

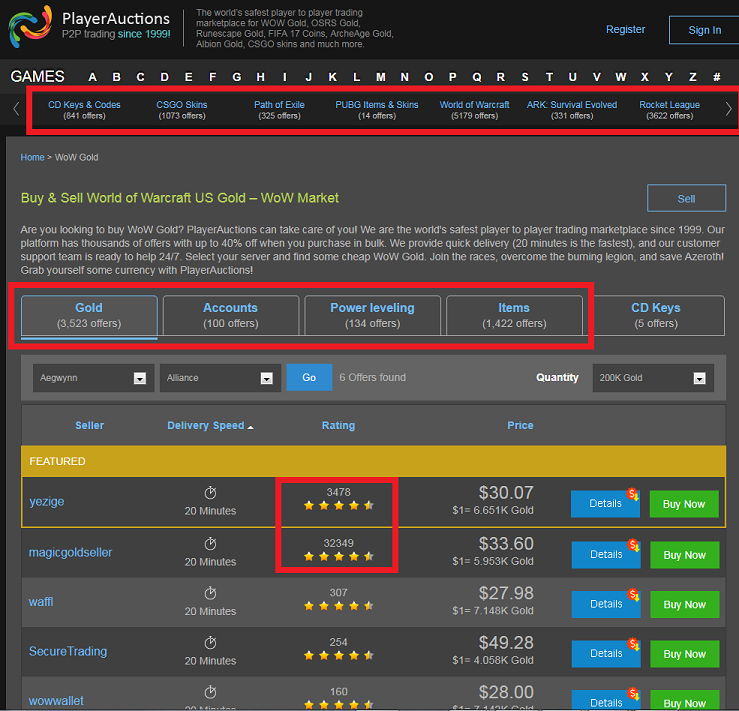

This exact sequence of facts holds true for a ton of other non-assets, plenty of which are bidirectionally convertible. Practically every single online game has a thriving secondary market. Do you want to be thrown in jail for not reporting taxable gains on your World of Warcraft Gold or your Counterstrike: Go Skins, or the thousands of other games and communities online? If you get a daily free pack in Magic The Gathering or Hearthstone online, did you just incur a $3.99 taxable gain? If Steemit is something you do for fun, to be part of a community, as most of the successful posters seem to do, how is it any different from "slaying teh (sic) dragon"?

Paying your taxes this way on Steemit endorses a support of this faulty and fascist line of reasoning.

How far will you let your taxing authority go down this rabbit-hole? Until they attach a value to everything in your life that is arbitrary and can effectively tax you as much or as little as they like regardless of the tax rate you (may or may not) have voted for?

There, I've cut to the chase, but wait, there's more!

In part three, I will cover the complication that powering down adds, requiring an average of 13-weeks of price data from the future to value SP currently, providing another reason why "valuation at the time of acquiring" is nonsensical.

In part four, I hope to give my own take on a fair way to file one's Steemit taxes. Those that I haven't yet bored to tears will hear all about the excitement of "qualified dividends being taxed at the capital gains rate".

IMPORTANT NOTE: I do not advise making tax decisions based on this post. The IRS is an unconstitutional organization that most closely resembles the authority of a fascist state. You are guilty until proven innocent. You don't want to be a trend-setter in this area unless you have a legal team. I expect that whoever blazes the courtroom trail using these arguments will be bullied and potentially jailed. You must maintain a consistent tax reporting strategy that is internally logical and consistent if you wish to rely on the "good faith" clause to avoid penalties in the future:

"IRC 6664(c) provides a reasonable cause exception to the penalties under IRC 6662 and IRC 6663 where the taxpayer had reasonable cause and the taxpayer acted in good faith. The reasonable cause exception in IRC 6664(c) applies to all of the components of the accuracy-related penalty on underpayments and the fraud penalty, except for any portion of an underpayment that is attributable to one or more transactions lacking economic substance as described in IRC 6662(b)(6), or that is attributable to a gross valuation overstatement with respect to charitable deduction property. In addition, there are special reasonable cause rules outlined in IRC 6664(c)(3) for certain substantial valuation overstatements."

Tag @exyle, you're it! Sorry it took so long and I copped out by 4-part'ing it.

IMPORTANT NOTE AGAIN: I AM NOT A PRACTICING ACCOUNTANT. YOUR TAXING AUTHORITY IS PRACTICALLY ABOVE THE LAW. PROCEED AT YOUR OWN RISK WITH ALL TAX LIABILITY REDUCTION STRATEGIES. DO NOT BE THE GUY IN JAIL BECAUSE SOME DUDE WITH A LINK TO A FUTURAMA CLIP RANTED ABOUT TAXES TO YOU ON SOCIAL MEDIA. YOU CAN'T "FIGHT THE MAN" FROM PRISON.

Your argument seems anchored in the fact that SP and/or SBD are difficult to value immediately when awarded. But, as an attorney and CPA, I can tell you that's completley irrelevant. If I discover a buried treasure of one-of-a-kind ancient artifacts in my back yard, I MUST pay taxes on the fair market value of such artifacts even though, being one-of-a-kind, they may be very difficult to value with any degree of certainty. I must make a good faith effort to determine their value on the day I found them (even if that means hiring at great expense expert appraisers to do so), and I must report that determined value. I am not permitted to just claim or assume a zero value simply because valuing them may be difficult or costly.

The same is true for SBD and SP. Those cryptocurrencies are undoubtedly worth SOMETHING on the day they are awarded, and as a general rule we must all make a good faith effort to determine that value and report it. To the extent that determine that value requires some subjectivity, we must nonetheless employ a consistent methodology over time (as you have suggested is important).

I'm interested in reading more about your post, but SBD and SP are almost certainly taxable at some value when they are awarded. The difficult question is how much.

I agree completley that the IRS is a criminal enterprise, and it's precisely becasue of that that undereporting gross income should not be taken lightly.

what if i find a paper clip on the street. I know a guy who traded a paper clip for a house, so I need to claim the value of house for that paper clip.

Also with stocks you dont have to claim them unless you profited from them - they may be worth a million but if you do not cash them then they are just stocks - thats how I been doing it

You absolutely have to pay tax on stocks even if you don't sell. I get stocks as part of a yearly bonus where I work. I have to pay tax on them as soon as I get them even if I don't sell them. In fact, NYC employer takes some out of those stocks automatically for tax.

thats not tru! maybe for you in NYC youve been connd into paying taxes on things you havent ven made money on yet, but if you dont sell you stocks, you dont pauy capital gaisn tax yet! Thats why people never sell during december they wait till january because of the taxes...even my stocks teacher in colege taught us this and he was jewish! sorry that youve been conned into being forced to follow illegal laws that dont make any sense, its a shame

I don't live in NYC...and you are confusing 2 things. Yes, you pay tax when you sell...you don't pay capital gains as the stock gains or loses value. Agree with you on that...but you do pay tax when you are first awarded or gifted the stocks. Your stocks teacher in college is correct...but your stocks teacher didn't cover the scenario of getting a stock award. Most people don't get stocks awarded to them, so it's not a common issue covered.

this is exactly why im not in stocks, ur taxed if u win, ur taxed if u loose... im an anarchocapitalist and dont like for what the greedy IRS is doing. next thing u know, if your dog pees in a firehydrant, since the firehydrant could be federaly owned, its now a taxe everytime ur dog pees on the darn firehydrant...

Taxation in Western countries is used to fund mass immigration and welfare programs breeding native populations out of existence. It's a form of socialist wealth re-distribution. Income tax should be completely abolished as it dis incentivizes hard work. Only consumption should be taxed. That would be a much fairer system.

As for the stock market it's a rigged game. Stay away from it and just trade crypto ;)

Then you've been doing it very, very wrong.

Yes, if you find a paperclip, it's value is technically taxable income to you, though nobody reports paper clips as income because their value is so low and the chance of getting caught is near zero. Neither is true with SP or SBD.

There is no fathomable ethical or moral justification for this. You are just defining oppression's own fallacious argument. I am outlining a moral and philosophical justification for how things should be. Hopefully, by part four or five, I will be able to make that practical.

There is no fathomable ethical or moral justification for taxes, period. But that's rather beside the point.

You are a strange man. You on one hand say.. they are no bueno.. then on the other hand you are enforcing them wholeheartedly by fear-mongering things out of imagination land. Make a stand. Stop the unjust. Don't push your brothers over to trample on their backs.

I assure you, it's not imagination. It's black and white law. Not even a shade of grey. People can decide for themselves whether to obey the law or not, but they shouldn't be deceived into believing the law says one thing when it actually explicitly says the other. If you want to argue that the law should be different than it is, you'll get no objection from me. If you want to argue that the law is unjust and people should not obey it, I likewise won't object. But don't mislead people by misrepresenting the law to them.

If being wrong means getting wealthy, then.im wrong.

yes, if loving you is wrong ... then I don't wanna be right.

lol sexual chocolate

By you saying he is very, very wrong. Do you mean to say that if you purchase and hodl something, and it appreciates in value, you are expected to pay taxes on something even though you haven't actually had a taxable event?

OR

Are you saying if he finds money on the street and never reports the income, then he is very,very wrong.

Clarification there would be nice as I can see you saying either statement. Thanks.

As for finding the paperclip. Yes I agree. Any income found is taxable. However, the IRS has to prove it as well.

If you buy something and then it appreciates, you don't pay tax on the appreciated value until you sell/trade it. But you do pay tax if that something is gifted/awarded to you at the time of the award.

Right. I was just trying to get clarification from @sean-king.

One of those statements is wrong while the other is not. I can see him making one of them (the correct one) but the op misunderstanding.

This the asking for clarification.

Not looking to tear anyone down or anything! 🙂

sorry but people dont pay taxes on money people gift to them

if this was teru peopel would be paying taxes on every Borthday and Christmas! Do little kids also have to pay taxes on Cheristmas gifts from Santa?

maybe tahst why anta needs all those elvs to do all the tax paperwork for christmas gifts!

haha sorry but i knwo ur trying to helpo BUT people like u are the ons spreading theentire idea of having to pay taxes, its a social peer pressure situation, we police ourselves

no i mean it! if people refused to obey immoral orders the world would be abetterplace ...if people just stoped paying their taxe sthe IRS would have to just guve up and try raising taxes another way! its true! its up to al of us ! the IRS is NOT some unavoidable computer program like Agent Smith

the IRS is NOt some absolute gold like omniscent omnipresent organization that sees all and know sall, they are a criminal enterprise a mafia and they ue fear and intimidation and violence and they will be stopped and they will be made to heal under Trump and th American people will eventually show the world how we can end the income ytax and generate all revenue on tarrrifs and other sorts of taxes..we coudl also sel federal lands to raise money....we could shrink the federal government and we wouldnt need our icnome tax,

When you are gifted money or even stocks by family or friends (not an employer), then the rule is under about $14k per year you don't have to pay tax or report it. Over $14k you do have to pay tax. You can also have married couples split this up, so your dad could give you $14k and mom give you $14k for $28k total per year with no tax implications.

But, if your mom gives you $20k as a gift on xmas, you have you pay tax on that....or the IRS will come calling. This is not about being moral or immoral...it's about an existing US tax law and do you want to break it or follow it.

https://en.wikipedia.org/wiki/Gift_tax_in_the_United_States

I mean the latter, not the former.

Thanks! I was hoping that.

As someone studying to be a CPA one day, I followed you!

I was hoping to find some good tax-related stuff on his blog, found near-nude pics of his GF instead! Lol. :-)

By the way... If you actually found money on the street and not report it - yes, it is wrong.

What you said makes sense. If it is not converted into fiat the value is subjective right? What if the gold nugget I find in my backyard is actually fools gold.

@live2love

So what would you do when the time comes that you cash in your stocks? Just curious!

There's no argument a good straw-man can't defeat!

Great post! I've been curious about the impact that trading / investing in crypto currency will have on my already nightmarish tax reporting burden. And I don't even make six figures a year yet (close but not quite).

I'm sure the government will make it as difficult to comply and report as they possibly can. Furthermore I suspect I'll have to refile next year when I inevitably make some trivial mistake and they make me redo it all over $50 or less deviation from what they think I owe them. This has happened year after year. 2016 I got it all right but the previous few years they kicked the return back and ironically all but once they ended up owing me more than I calculated. So they screwed themselves by hassling me which is nice but it sucks having to waste my precious time.

Eventually my goal is to leave this police state (the United States) and find a country that is decent to live in which won't make my tax reporting burden an outrageous and inefficient nightmare. In the meantime i guess all I can do is report it as best I can and hope they don't audit me over some petty BS. like I said, I don't make enough money for it to be economical for them to even scour my return and make me refile as they lose money doing it. But they don't see it that way. If they can spend $500 paying some bureaucrat to pick through my return with a fine toothed comb to maybe gain $50 they will. And they have before. Needless to say I hate our government and the IRS. The founders never meant for the fed govt to be such a monstrosity that literally ruins people's lives on a daily basis. End rant.

I look forward to discussing this at some point with you Sean. You have a lot of good insight into things like this.

What if you happen to loose those buried artifacts right before its time to pay that "fair market price" then whjat? what if we looseour steemit kley or get "hacked" and someone drains our steem and sells it for bitcoin and we never get it back? we certianly wouldnt have to pay any taxes on it then would we???

oh and what about darknet drug dealers? are they paying thir taxes on all the bitcoina nd monero they earn from dealing drugs online?

Maybe the IRS should try and get those drug dealers to pay their taxes too on drugs they sell, right?

see how rediculous this whole argument can be made to apear? Always nbring up the darknet markets and how if they dont pay taxes we dont have to pay taxes

also u cant ever EVER prove that someone ownws a steemit acount! and just necause it has soemones name and information or even photos of them it could all be faked! anyoem could stela an identity or say theire osmoen to conceal their own identity! if someone ius runninga steemit account with ur name and photytos, and hapens to have 1 milion dollars in steempower, do u have to pay taxes on that account? how can they proive its not yopu or it is you? see how much grey area thrte is here? also whose to say the value of steem doesnt collapse and then how much taxes do we pay? also what if we can only sell our steem for HALF its current value because what if we hpen to use a very expoensive exchange and thats just how much we get? i man i now plenty of peopel who jhave to pay 20 percent or 30 percent fees to cash out theor bitcoins, do they factor that in too? se how crazy this becomes?

trump already told IRS to stop their "Coinbase Tax Hunt" bcause "Fishing expeditions" are frowned upon...you cant just go into a private company and go fishing around like the IRS tried to do with coinbaese and because Hillary was Not elected, we are safe! Trump will protect Bitcoin and crypto cuyrrency privacy, just watch! With monero and private walets on steemit soon, theer will be no way for IRS to determine how much money any of us has, if we decide to obfuscate iut! Son youll have steemit mixers and youl be able to geenrate hundreds or thousands of fake accounts and spread the money around tio multipel account and have them all delegfate their steempower back to your main account sio you can still take advntage of the steempower spread out through al ur accounts

ok i know my ideas have many holes sorry i just had to chime in! this is a vry passionaite sibject fior me and many of us bcaue we fel we should have a say in how oru own suppsoedly democratuicaly elected represetativvs make our laws and the IRS is not accountable and it should be, it sucks as we are slaves to this criminal organization and we haveto st and up top it! we CANt kep giving the IRS the benfit of the doubt and submit to them! we ALL HAVE to stand up to these bullies

The debate I'm having is about what the law requires, not whether it's advisable to break the law or not. So, yes, dark net people break the law all the time. Most are never caught. Regardless, if you earn $100 in tips waiting tables tonight and then lose your wallet tomorrow, do you still legally have to pay tax on the tips? Yes, of course you do. So, yes, you would still have to pay taxes even if you later lose the artifacts or your private crypto keys. Tax liability is determined at the time you gained/earned/found the asset. If you later lose the asset, you MIGHT be eligible to offset part of that income by deducting a casualty loss (at least in some circumstances) or you might not. Either way, losing the asset does not make formerly taxable income untaxable.

So whens the last time you ever heard of anyone paying taxes on $100 they found that they later lost?

just sounds like fantasy world to me

hey but disclaimer: U seem like a nice guy, my comments are just direxted at world at larhe not at you, im just real passionate about all this and i think we al are and yeah seems like some people like you just give up and give in to the men with guns at the IRS and live in fear while people like me still want to get people to say no and stop giving in to the criminals, its real y sad but whatever, it is what it is,

but when you talk about people paying taxes on bitcoins even after they loose the oprivate keys, its justr rediculopus

how would you even PAY that money?!?!?! You think if someone hmakes $1 million dollars from a few dollars investing in bitcoins in 2009, but looses the walet key, you think they can just pay the taxe son it even after they loose the key?!?! How would they??! they lost the mopney...

OH I get what you mean, so youre saying that this person should hyptehtically have top be in debt for the rst of his life to pay that money to the IRS, oh i see thats cool

tyeah that all makes sense, thats not total fantasy at all

I agree with you on Steem and SBD, but not on Steem power. That is a very subjective and intangible thing. The IRS is not going to pursue something like that....if they did, they would to pursue instagram accounts and fb accounts with a ton of followers because that is also intangible value.

I agree with you on that and sounds reasonable. Whats not reasonable is getting taxed on money that you really don't have yet until its in your checking or savings accounts as income. I just don't like being taxed on assets. Then again who does? :)

One question is whether SP are in mandatory escrow (i.e. not the escrow agent of the recipient) and thus the SP would not taxable until the minimum (i.e. 6.5 weeks weighted average) time it would require to power them down:

http://www2.econ.iastate.edu/faculty/harl/ald/HarlAgLaw20110218.pdf

However it appears the escrow must actually benefit the payer (i.e. escrow protects against non-performance of the recipient) or be forfeitable in order for the deferral of taxation to apply:

https://steemit.com/steem/@cryptotax/are-steemit-rewards-taxable-in-the-usa-part-2

Certainly any delay added before powering down is certainly not a valid deferral of taxation because the said delay is controlled by the recipient.

I've had my share of run-ins with the IRS over the years, and I agree with you both. The IRS is a crime syndicate run by the federal government. One thing I've taken away from said run-ins though, is that the IRS doesn't give two shits about a guy making 20 bucks a week(or less) making steemit posts, because it'll cost them way more than they'll get out of him in taxes/fees. When you start getting into the hundreds or thousands though (which looks to be a real possibility with someone like Jerry Banfield), that's real money, and they want their cut.

Thank you for contributing from a professional "in the field" perspective to help give us a bit more insight into what the law actually states vs the moral argument against it.

This probably differs from the system utilized in the Netherlands (where I'm from, obviously :)).

See, every revenue you might make from investing in cryptocurrency is seen as capital, for which you pay something like 1% according to the current legislation (I think that cryptocurrency-oriented legislation will take years to be developed let alone implemented, seeing as we still don't have a cabinet 6 months after the election).

So if you'd invest $1000 in bitcoin or whatever and the price soars and your investment is trippled, the taxes you'd have to pay would be roughly $30 as it stands now in my country. Therefore, I think that in the Netherlands the incentive to evade taxes on cryptocurrency is low as the taxes you'd have to pay are minimal compared to the taxes we pay doing our regular jobs (roughly 40%).

That is ridiculously fair. I wish the rates in Canada were that low. I’d be happy to pay 1% to get rid of the headache of trying to figure out these grey areas!

I agree with what you have stated here.

I think Steem Power is, in particular, even more difficult because of the power-down that is required. It is physically impossible to immediately convert to a currency via a fast sale, which is not true even of your hypothetical cache of artifacts. They could be sold at auction or pawn almost the same day.

I hope to explore these complications in the future parts, and consider a possible formula for valuing power downs that takes 13 price snapshots over the next 3.25 months.

Thanks for giving us more qualified advice. I'm only exploring ways to potentially or even philosophically minimize tax liability, it may turn out that none are able to withstand legal scrutiny. In fact, that is perhaps even the most likely outcome.

If @sean-king's assertion that value of rewards should be accounted ''on the day they are awarded'', and my supposition that Steem Power should be treated as capital asset (such as stock) are both true, then would it mean (according to the article below) that it should be first taxed in full as normal income, then again declared as capital gains or losses when powered down, and thus making a profit or a lost compared to when it was first rewarded (or redeemed?)?

Meaning that if I was to make $100 of Steem Power author rewards at $0.10/Steem, I would be right away taxed for $100 of income, but when come the time to Power Down this same SP now worth $1000 (price having evolved to $1/Steem), I would again be taxed on a capital gain of $900? I don't know.

http://time.com/money/3571313/irs-taxes-stock-you-didnt-buy/

I also like your comparisons with online gaming values, because after all Steemit is a lottery. You never know what you're gonna get as a reward. And, first and foremost, it's a game of attention.

I'm an accountant myself, but I live in Canada, and still I'm having a hard time wrapping my head around how the entire Steemit economic system could be viewed by fiscal authorities. It's a brand new concept and can't be considered the same as Bitcoin. This ain't no big faucet, we put in efforts but there is no guarantee of retribution, hence can't be considered as counterpart for services rendered.

You are very prescient to note the lottery factor, as they actually discus how Steemit is a lottery in the white paper. There is no guarantee for work done and no pay agreed upon.

The sad truth is that the first half of your post may be what the IRS expects. I hope to show that that is not an acceptable taxation strategy through this series, but the reality is some people may end up audited and effectively double-taxed, just as you point out.

There is no ethical or moral justification for this and stopping it begins at creating an internally consistent logic for taxation that is far less repressive, given that taxes are a reality we are probably all stuck with for now.

Thanks for your thoughts!

I'm 100% with you about finding a fair tax interpretation for Steemians. Specifically considering that most of us are in for the long run and will keep on sitting on our time investments without really getting significant short-term financial benefits.

One other thing we should also consider: it doesn't make sense for the IRS to pay an employee hundreds or thousands dollars of man hours in order to get their hands on about the same or even less amount that it would cost them. Can you imagine the time an agent could spend going through all of one account's transactions on the blockchain for the duration of an entire year? This leave us with the advantage of developping a justified tax strategy that they could be forced to accept. I'm looking forward to see the one you'll be proposing.

It seems you are right about how the IRS treats the discovery of a treasure:

http://www.foxbusiness.com/features/2014/07/03/found-money-is-awesomebut-must-pay-uncle-sam.html

Steem Power is not a cryptocurrency, @lexiconical mentions something to that effect:

If I understand the SteemWhitePaper correctly, Steem would be inflationary liquidity, Steem Power the company's long-term capital (vesting), and Steem Dollars convertible notes (debt) making interests. It could probably be argued with the fisc that those three should not be treated in the same way. As to whether or not the IRS would interpret Steemit Inc.'s return of value to its members similarly to what the white paper might suggest, I would say is anybody's guess.

in case people are questioning the source. as someone who's passion is taxation, I'll vouch that the OP was correct in treasure valuation.

I'll be following this with a lot of interest!

@sean-king If what you state is true then wouldn't the IRS have a strong incentive to crack down on the Facebook/Reddit accounts which are sold by users who spent time creating them, much the same way Steemians spend time creating their Steemit accounts? I would imagine that the taxes they could gain on them would be an order of magnitude times higher than what they could get from a small bunch of top Steemians like @jerrrybanfield.

If they haven't done so yet, might that not suggest that the IRS cracking down on Steemit payouts is extremely unlikely any time soon?

Perhaps, but do you really want to bet your freedom on the whims of some IRS agent? The penalty for underreporting income is steep, especially when you're talking about tens of thousands of dollars (as many Steemsters are). And there's no statute of limitations for underreporting income.

Furthermore, unlike sales of Facebook or Reddit accounts, the Steem blockchain is a public record and lasts forever. It's as easy for the IRS to to read the chain and see who made what and when as it is for you or me to do so.

The IRS is already cracking down on unreported crypto income. Witness its sweeping subpoena issued to Coinbase.com. Cracking down on Steem would be so much easier for them--no subpoena required.

I admire your desire to be legal, lawful and moral all at the same time :)

I myself have concerns about the well being of the witnesses to steem.

You know I'm not starting like that without a "However"....

On your point about "blockchain is a public record and lasts forever" for records of earnings:

Have you ever used the "Convert to Steem" tool?

Have you noticed it does no make a record of when the transaction was started or How many SDBs were used to buy the steem? ... Did you also know that the conversion is a process subject to the decisions of the witnesses? If all the witnesses agreed one day, they could set the value of SDB to one cent.

@sean-king, that's interesting... seems to me you're supposing SBD and Steem to be "currency" rather than an "asset class" or "property" here.

To that end, I'm pretty sure the IRS treats cryptocurrencies as "property." True, property can be taxable under certain circumstances... but let's remember we are not employees of Steemit; we are also not "independent contractors" which require an agreement that some non-employee service is provided in exchange for remuneration. No such condition exists here... when I make a post, I may or may not end up with a reward-- we have zero contractual agreements. An exception might be something like "steemgigs" where there IS an arrangement to receive "compensation" for a "service;" or when an artist uses "steemshop" to sell a piece work... even that is a bit dodgy, though.

If we really stretch reality a bit, we could argue what we get here are "gifts," but it's not (technically speaking) Steemit giving us gifts... it's a network of thousands of individuals throwing a few cents in our tip jars. Since the IRS exemption for reporting gifts is $14,000 for the giver, not the recipient... that would get pretty nebulous to track.

But we are getting something of value, however. It seems most likely that we are getting an "asset" in which our cost basis (at the rime of receipt) is zero, assuming we are only talking rewards here, not actually buying Steem and powering up. We'll assume these are assets held for gain... not like a painting we're just going to hang on the wall... meaning we do have to keep track.

So that puts us over in a similar asset class to collectibles... all we have is a "thing" in which we have a cost basis, and the next action that triggers a taxable event is the sale of that asset... presumably for a gain. But until we actually sell the asset, all we have is an unrealized gain.

Just like the IRS isn't going to come around to my house and say "we think your stamp collection went up in value by $4000 in 2006, so you owe taxes," or even less likely "your house value went up $10000 this year, so you owe taxes!" I would imagine something similar would apply to cryptocurrencies until the IRS changes their classification to "financial instrument" or "currency."

But when you sell your Steem... then you trigger a taxable event. You now have a capital gain (presuming you've held your Steem for at least a year) or a short term capital gain (less than 12 months-- taxed as ordinary income) on what you sold. Only.

Bottom line... under current rules, it doesn't seem to me any taxable events are triggered till we actually turn our cryptos into fiat.

You must not have read all my prior comments. Please go back and do so. The law is clear, and it doesn't matter whether SBD and SP are considered property or currencies, the tax effects are the same.

As I indicated in prior comments, if (for instance) you find a treasure of one-of-a-kind ancient artifacts (that is, property) in your back yard, you must must pay tax on the fair market value of that property as of the day you found it, and you must make a good faith effort (including hiring appraisers if necessary) to determine that fair market value. The property is taxed at its fair market value in the year you found it even if you never sell the property but instead just hold it. Furthermore, the value of the property is considered ordinary income and taxable at ordinary income rates. The fair market value on the day you found it then becomes your tax basis in the property.

If you do later sell the property, then your taxable gain (or loss) is determined by subtracting the sales proceeds from your tax basis (that is, from the fair market value on the day you found it). And, any gain or loss would then be a capital gain/loss.

Again, then tax treatment of found property is not even a tough question. It's black and white law. You'll find numerous examples here: https://www.google.com/search?q=if+I+find+treasure+is+it+taxable&rlz=1C9BKJA_enUS677US679&oq=if+I+find+treasure+is+it+taxable&aqs=chrome..69i57.4504j0j4&hl=en-US&sourceid=chrome-mobile&ie=UTF-8

So again, it doesn't matter whether SBD/SP is considered a currency or property, the tax treatment is the same.

Is it taxable only because I'm converting to FIAT currency? What if I don't convert ever? I've seen these Visa cards that holds BTC, ETH, STEEM. If I put all the STEEM there, is that taxable (even though I'm not concerting to FIAT)?

It's taxable as ordinary income when you receive the rewards regardless of whether you convert to fiat. It later taxed again (assuming it has gone up in value since it was awarded) as capital gains when you trade it for something else of value. Whether that "something else" is a good, a service, a Visa card or fiat doesn't matter.

Ah, I see. Thanks for the info!

Loving your contributions to this thread, Sean. Excellent stuff.

On this: what about trades in crypto between the time of receiving rewards in Steem and cashing out in fiat, if trading/investing in other tokens?

i.e. take Steem, trade over the course of the year for a few dozen other coins before converting some to withdraw in fiat... would precise records need to be kept for every trade in between, and capital gains/losses calculated and paid on each of those single trades, regardless of that it’s still all kept in crypto?

(To my understanding, the answer is YES - though I’m curious as to whether with your insight, there may be any other possibility, and what specific terminology of the protocol you use in the answer.)

a note on taxes. The tax codes have become too complicated and burdensome even for irs employees. Did you know you can send the same return to 100 different tax preparers and get 100 different results - with variations of thousands of dollars? Its a crapshoot.

You're absolutely right. That's why the good faith clause is so critical, because without it, we could all end up criminals. When you need a clause that says "our laws are so complicated to understand that it's only breaking the law if you meant to", you may need to scrap everything and start over.

Sorry to be so blunt, but... Fuck the IRS, leave the US. and go to some more reasonable country, you have Mexico right next to you.

if you do not live in USA but you are US citizen you are still obligated to pay Taxes in USA on money you make in other countries

You are obliged to, yes. However, the IRS has no ability to check on your earnings when you're away. You can just tell them that you're a hobo and have no income. So just leave and go to a proper soveirgn nation, not some that's dependent on the US.

In some countries they do - they can look into your bank accounts in some countries - you be surprised

Renounce your Citizenship. TAXATION IS THEFT. Complying with criminals makes you a criminal also. You gotta be blinded by all the propaganda to not realize you are being robbed by criminals who also kill innocent people and are behind the greatest cause of violence in our world.

Well, I admit it is a little extreme to renounce your citizenship but my point is that if its possible to do so without any implications then it is good to keep the thought in mind. Some people have learned to travel the world with almost no money at all, and I think that's really cool ultimately we should have the right to walk anywhere we want but governments and borders are there to divide us as a race so that we never rise up against the cabal together. It is essential to keep the world divided thus the wars and religions

governments, borders and religions are there to divide us I had to ad religions since they are the cause of all wars

" if its possible to do so without any implications" -- its not. There is always a government that will say you owe them money, your philosophical arguments will not save you.

not a great idea to renounce citizenship. No matter where you live there are taxes - pay offs, bribes, paying for protection

Yep.

Think the US is bad? Go live in a third-world country for a few years. Begin to understand the degree of chaos and corruption there. Then, come back and tell us how bad we have it. Ha.

Just the US and Eritrea tax their citizens this way. It's bloody insane.

O-b-l-i-g-a-t-e-d

Huh. I've never seen coercion spelled that way.

I can't argue with your logic. I have a job that, despite being online, will terminate me if I leave the US. For the moment, a cost/benefit analysis seems to require me to stay.

Try to hold on for a while, make some savings and get out of there soon. I've been there once and it's just scary how brainwashed many are there. Good luck.

Thank you for the kind words! I am working on exactly that, and I hope Steemit can help!

I hope fondly to follow this wonderful poster into an island paradise:

https://steemit.com/anarchocapitalism/@sean-king/i-m-moving-to-paradise-on-jan-1-to-legally-pay-no-tax-on-cryptocurrency-gains-true-story

The IRS is a scam because they use deceit (technically fraud) to manufacture consent. When you attempt to circumvent the fraud by educating yourself, the IRS will resort to threats of violence to force consent (coercion and extortion). Thus, they are no better than mafia gangsters. But, rather than leave your country, you can leave the farm, so to speak. The term "US" refers only to the 75 square mile area of Washington D.C.. The term "employee" refers only to one's status as an employee of the "US" - not an employee of the company for whom you work. So, do not declare yourself to be an employee or resident of the US and you have no tax liability. The other option is to demand "lawful money" in exchange for your "legal tender." That remedy works.

have you tried it? many have tried and now rest 6 feet under. What is upsetting is that these things exist only as long as people comply with them. If there was a national never pay irs again day and the majority participated, that would be the end of the racket

Yes, I have used the lawful money remedy and I have read that many other have as well. I have never heard from the IRS since using lawful money. The problem with the other methods is that people don't understand WHERE they are becoming parties to a contract with the IRS. Anytime you use a SSN or most businesses connected to money, you are entering into a defacto contract with the IRS. So, if you try to leave this contract after the fact, they will grind you to a fine paste. Contract is LAW. It is the only law in existence now. As you say, the real problem is that people's compliance give the scam life. Most people are too lazy and unable to group together in meaningful ways to bring real change. Take gay marriage for bad example. What did they gain? The "right" to a piece of paper from the government. Some tax breaks. There are easier ways to get married and there are easier ways to get a tax break without involving the government. And what has changed? Everybody is still in the same prison of the mind. Deeper in fact.

please do some posts on this ! interesting stuff. you have tested it and it worked I would like to learn more

I just saw what Ken Okeefe is trying to do. check him out on youtube

I do not advocate listening to to anybody - including myself - on this subject. You must read and understand contract law, federal "code" and IRS "code" and the relevant definitions. MUCH of US code is built on ignorance of the true definitions of words and the impact of implied contracts. Nobody can help you or save you. You must help and save yourself. That is the real price of freedom.

you can watch Aaron Russo's documentary : America from freedom to facism

According to it there are millions of Americans that do not file for the income tax

I think it's mostly the public figures like William Cooper that get offed

They absolutely ARE mafia/gangsters.

That kind of argument is from the tax protest movement of the 1990s. I know because I watched them with great interest and even attended their meetings. You would do well to get better legal counsel.

As much as I agree what is the strategy for maximizing tax avoidance? It still seems damn near impossible to do so properly.

Sorry to burst your bubble but simply leaving doesn't remove your tax burden.

The US is one of 2 countries (as far as I know) on the planet who taxes their citizens regardless of where they happen to reside.

There is the Foreign Earned Income Exclusion (your first $101,300/year in 2016) if you can prove residence and income source somewhere else but you still gotta pay Soc Sec.

If you want to renounce your citizenship, there's a monetary penalty to that too and you had better have a residency visa somewhere else first, at most, you're lucky to get the first 90 days somewhere without needing a visa.

renouncing - you need to have a good security team and a plan to avoid assassination. Remember they are the military arm of the world gov and have tech that reach far and wide

You're not worth the cost of a bullet. They just want your money.

lol, it's not that bad. The average person is not worth the trouble.

maybe not now, but soon. It already costs nothing to exterminate populations. When you print money, you have no costs really. look at some examples of people who tried to get out of the system... waco, ruby ridge,the list goes on and on and 99% of the cases no one has ever heard of.

Citizenship in the corporate United States is based on Domicile. This is voluntary and can be changed at any time without paying a fee. If you were born in one of the 50 states of America then you become an American National who is not a US citizen. You can still maintain a USA passport this way. However, you must first renounce all US franchises (medicare, medicaid, ebt, social security, etc.)

have you done this or known anyone who has and is still alive?

I have been able to live in other countries while completely ignoring anything to do with the US. I haven't cared to look into anything at all, I am comfortably oblivious and I feel no need to report back to criminals what is none of their business. Sadly this may only be true for me because I have citizenship in other countries, while one who is purely a US Citizen may find a different experience and I can't speak for them. Perhaps I have missed another factor which is that I have is that I never once worked in the US until later so I never knew what taxes were and didn't care. This means that one can grow in another country and forget about the theft of taxation, what are they going to tax you for if you have no business with them? Maybe that is the key here, to cancel all agreements and all businesses you may have before leaving the country. In any case one should really inform themselves as much as they can regarding how inextricably evil laws are weaved like webs in order to enslave people, rob them so that they can perpetuate all the evil they do around the world. Here is a really good website for starters http://losethename.com/

Thank you

Oh I'm sorry I just realized the website is down ! I didn't know . They do provide some good links there though im sorry if it seems scattered. Here is a good place to start http://legalnametruth.com/

No problem, I hope you like the website. It helped me feel liberated when I got into it I hope it helps you too

Yes, I changed my domicile to outside the US and gave back my SS#. I have now been effectively blacklisted from all corporations. When HR does a background check on a new hire they use the SS# as the the key for the history search. Not giving them a SS# is a red flag. Then the corporate lawyers get involved and block HR from hiring you. Even private companies where you know the owner and he/she is sympathetic to what you have done will generally not hire you or pay you as a consultant because their accountant doesn't know how to deal with it and is afraid of the IRS.

Changing your domicile and giving back your SS# is only for someone who is willing to take full responsibility for their existence on this Earth at all times, provide for themselves and confront fraud, lies, hypocrisy, etc. at all times. It is not for the faint of heart.

we need to hear more from you! I encourage you to share more of your story!

I'm with you on this one Bro!

Agreed. SP may have potential value but it is still just that and nothing more until you power down. And we got to draw the line somewhere between money and not money. And Bitcoin, Steem, and crypto money is not Rothschild money.

.

Tax is for people with Rothschild money and with centralized money currencies. Liability can or should not be attributed to an unrelated cousin. In other words, tax is already bad. Tax is theft. Tax comes from the IRS. People need to study the history of the IRS, FBI, CIA, the NWO. People should go back to the origins of these foreign agencies that infiltrated the USA this past century or longer.

.

I strongly believe that the Internal Revenue System (IRS) is focused on specific definitions of revenue. Rothschild money is exchanged on the normal exchange markets but crypto is NOT traded on those same markets and therefore are not qualified to be taxed or audited or whatever the case may be. Bitcoins and dollars are not the same animals. IRS was created for the dollar and not for BTC. There was no BTC when the IRS started. The IRS was not created to go after BTC. The IRS was created to go after USD and stuff.

Unfortunately, I think the IRS thinks they are created to go "after all potential forms of revenue" at this point.

I'm with you on everything you said, though!

USA citizens need to call congress and gov people and pressure them each day concerning taxes and laws and the IRS and everything. We got to make videos, memes, photos, websites, articles, emails, real life marches, activities, letters, speeches, parties, rallies, protests, and everything as often as we can and vote drain swamps out in 2018 and stuff.... encourage people to share this stuff each day... we are stronger together as we try our best to make things better..... as we try to educate and share stuff with others.... what we do is helping and we are part of global revolutions against bad globalist people like Soros and Rothschild

Very well said, namaste

Well put! Many of us are trying on Steemit to do just that! With blockchain technology, we can't be censored anymore.

Very reasonable @lexiconical. I thought about it the same way you describe it.

Lets imagine you all of a sudden get a $10,000 payout in Steemit account. You go to pay your taxes say 5% or $500. The next day for some reason Steemit drops 10 times in value. Will you get a $450 cashback from IRS? ))

Anyways, will be waiting for your next post with your proposal how to count it.

Nope, you definitely won't! And I hope to cover this exact phenomenon in part 3 where I cover the complications around powering down! With the volatility that is normal in the cryptocurrency markets, the 13 week power-down delay can often create exactly the situation you describe.

Here's a quick link to part two:

https://steemit.com/taxes/@lexiconical/valuing-steem-rewards-as-taxable-income-is-a-vast-overstatement-of-tax-liability-part-2-the-thin-order-book-and-flash-crashes

Due to overwhelming demand (which I am very thankful for!), I have posted part 2 here:

https://steemit.com/taxes/@lexiconical/valuing-steem-rewards-as-taxable-income-is-a-vast-overstatement-of-tax-liability-part-2-the-thin-order-book-and-flash-crashes

Thanks for sharing!

Great post plus. It is good to see steemit i a place that is also good for correction and enlighting others of truths that may be hidden. This was a great post dispit in not from the Us and certain topics doesn't really affect but i like the argument and line of reasoning.

Thank you, I'm glad you enjoyed it! I hope the ideas are not too US-specific and can be helpful for everyone. We've all gotta deal with the tax-man eventually.

Enjoyed your post it really gets you thinking ,but i'm still confused over tax and people's attitude towards tax. I'm from the UK, I don't agree with taxes. But i thought that America came to be as we know it today by originally escaping the clutches of a greedy English king and his unfair tax system.The world we live in today just doesn't make any sense.

Yes, we Americans have to pay a lot of taxes to help buy food stamps and provide housing for immigrants. I dont like it, but have no choice.

dont forget the part about paying taxes to wage continuous child killing wars

Your honesty has just won over a follower.

But like live2love I ask, what about the hurting of children with ritalin, gender neutral education and pro-abortion avocation?

I'll be nice enough to give the benefit of the doubt to the US military men overseas.

Yes, luke490, I really want to benefit the US military men and women. I appreciate all that they put on the line for our safety and freedoms.

I know what you mean. Taxes here in the US managed to sneak their way in gradually. First, it's just a percent or two for firemen or roads, and hey, everyone thinks that's reasonable right? Then it's police, schools, defense, social security, and subsidized condoms. Once the camel's nose is in, you're on the way to single-payer everything.

Gotta love the United States IRS tax code! They make everything harder for businesses and individuals, one of the only debts you cannot avoid too :/

It is typical of advanced autocratic institutions to have made enough rules that practically everyone is a criminal. I'd say the IRS is effectively following that playbook.

Please link to folow up articles in this post.

I just wrote myself a note to do that! Thanks for the suggestion.

Here's a quick link for ya:

https://steemit.com/taxes/@lexiconical/valuing-steem-rewards-as-taxable-income-is-a-vast-overstatement-of-tax-liability-part-2-the-thin-order-book-and-flash-crashes

If you're worried and generally have turned over $20,000 in transactions into US dollars from Steemit then it might pay to get a cryptocurrency lawyer on retainer for a few hundred bucks. If you need one, I can provide you the information to the top one in the US right now, just text me, find me on the CONNECTIM app: @Avvva or on Discord app: @Avvva.

I totally agree! Thank you for the reference, I'll look you up if I need one. For the moment, I'm a mono-directional investor in that I dump all my money into Steem and never cash it out!

Boy that is interesting. Well, my question is, if you don't withdrawal anything, is it even taxable? Like you're saying if it is all steem dollars, how do you even evaluate it's dollar based purchasing power. It kind of operates more like stock, some kind of IRA with "dividends" being distributed based on your blogging skills, and immediately reinvested. Maybe its better to treat it like a capital gains tax.

Or we can go down the fun route of the U.S. having a voluntary tax system, which means if you don't voluntarily report your income you cannot be taxed. Screw the IRS man, its completely illegal, per the constitution as it was originally intended. They don't really have the power to tax income.

I intend to cover your question in my next post.

I hope that, ultimately, we can create a consistent and legal filing strategy wherein the answer is "no". There are so many hurdles to filing it as income that capital gains with a cost basis at the time of acquiring will at least be a "halfway" point of sorts between "full taxable income liability" and "screw the IRS!"

An even better option, hopefully, will be the classification of Steem rewards as a qualified dividend, which I will discus in part 4.

Why would you want to use a legal strategy against a fucking criminal organization that operates ILLEGALLY LOL. The fact that the president does nothing about this crime should speak billions of truths.

Well I'm looking at it like this, yeah they're fucking criminals and operating illegally, but they also have all the power. Even suggesting that I shouldn't pay income tax makes the a-typical person go berzerk. So for now, until the general public actually gains an education, we have to operate in their corruption. You can go be a martyr, cool, but you'll be nothing more than fuel for the media's propoganda. It will be pointless. I'll say this, if Trump can destroy the mainstream media we're 1 step closer. Who knows, he could be a hack, at least for now he's whittling away at media propoganda.

Unfortunately, the practical reality is that many of us are still stuck filing taxes each fiscal year, lest an audit wrench that money plus penalties from our accounts by force anyway.

Awesome man. Right now its kind of a free for all i would assume. Theres really no legal basis for taxing it one way or the other. We'd need some kind of case law study of how judges ruled to establish proper procedure. I'm going the cheapest way until we have some justified direction. Although I'm but a wee minnow right now, so no body would even look twice at my pull.

Thank you for this. It's a different perspective to what we normally read. I'm not sure it makes calculating a tax liability any easier though. That said, if you don't reveal your account details to your local tax authority, I'm not sure they can track you down anyway.

You're absolutely correct. Minimizing tax liability, particularly in a legally defensible way, will absolutely be more work than simply paying a higher gross amount.

I hope to make it as simple as I can in future posts, but it has many times more calculations required than a flat rate like Jerry does.

Last I read, the IRS hadn't considered digital tokens as currency. It was being classified as property. Income and property have two totally different tax implications.

That's correct, but it depends entirely on how you get it.

Crypto you just own or buy is property, subject to capital gains after 1 year, or normal income tax if sold the same year.

Anything that you are paid in as a proxy for income (like, our Apple stock executive example) is taxable as regular income.

Steem earned from posting is a gray area, as there is nobody paying you, and Steem Power has no market value. That's the point of this series - finding out how we can use this to our advantage, legally.

That is just hilarious. We are all in Crypto-Land just to get away from the IRS. What's the point of willingly submitting to their control and oppression? Right now, Crypto assets are still not classified as anything taxable. The gov has absolutely no right what so ever to try and tax your assets in any way. Why anyone in their right mind, would willingly go begging to them, to take his/her money? This is exactly how, oppression prevails.

Oof, that is one depressing movie.

I agree with you in theory. In practice, the IRS taxes all property it decides is "earned as compensation". I hope to establish by the end of these articles that this is not a viable or logically consistent way to tax Steem.

Indeed! We should all fight oppression and tyranny. Blockchain is the powerful answer to all of our problems . One day we won't need to believe/trust in a government, or banks, or any institution that we don't like . The blockchain revolution will free us all.

you know, of the feds just create their own bitocoin farm, and other cryptocurrency farms and just mine the hell out of coins, they wouldn't need to tax the average american citizen... darn u woodrow wilson!

I bet it would be too late to catch-up with the Chinese mining operations now, plus most Bitcoins are already "out in the wild".

On the other hand, I have heard of a few Bitcoin mining farms in the Mid/Western US getting government grants or loans for setup. Somewhere like...North Dakota? I forget.

Actually, I'm pretty sure the IRS recently acknowledged that Bitcoin was considered "Property". That means they're going to tax it. They just don't know how to find it efficiently yet, so it looks like they're working on the good faith principal for now that you'll just report how much you make. Which is the beauty of crypto currency in the first place! People just need to make sure they are being diligent and not leaving an obvious paper trail about what they do with their coins.

Edit: Yeah, I was right. https://www.irs.gov/uac/newsroom/irs-virtual-currency-guidance

I don't speak legalese, but that sounds pretty clear that they consider any profits you make from crypto (well, bitcoin at least) is taxable as either income or gains, whatever the circumstance dictates.

thank God it aint..

Well said brotha! I am not huge on IRS stuff...so won't reply on that!

But enjoyed the post a lot in a fun way as well! ;)

Thanks! This .gif always makes me smile. =)

Let me just Putin my glasses into my pocket and ill leave... :P

No prob! ;)

i love this post

Thank you! I hope I keep your attention all the way to "qualified dividends", because that's really the best part!

Unfortunately, it's not exactly meme-worthy, but maybe I'll get it there.

This might be ignorant Lex but I thought when I dealt with crypto I was giving a middle finger to the government in a sense...why are we so paranoid that we're putting aside money for people who in the end intention is to fuck us over and regulate the damn coin in a way that makes the win... Just wondering?

Well, not to be too blunt about it, but the reality is if you are cashing out of crypto into US Dollars (or, in a lot of cases, other national currencies) and filing no taxes, it's only a matter of time until men with guns come to stick it to you.

Steem is not exactly the crypto of choice for privacy, given the un-censored blockchain and the relative ease with which any of us can be doxxed. All your transfers are public domain.

Hmmm...interesting. No dam escape from getting screwed it seems. IRS is a leech criminal organization,. Shits crazy we have to put their share aside without even them asking for it...just in case...man...wow...smh....

Recently Ive been meditating on the concept that we are here to struggle and suffer. Yes there is joy, but overall life has been a struggle. Interestingly the happiest people I have seen are the poorest.

Guaranteed no one living off $100 or less a month has the headache of figuring out these types of taxation issues...

Yep, guilty until proven innocent. It's amazing that this continues to go on, frankly.

Wow! What an interesting argument you have made. I agree that the IRS has overstepped its bounds in many areas this being one of them. I'm not a tax expert but taxing us on assets that fluctuate is putting the government at risk. I mean its like taking a bet on a horse race. Sometimes the pony wins but then again.... I don't know. But I do know this- there are only two things that are certain: Death and taxes! (ugh...)

The problem is, we end up losing either way. That's not constitutional or ethically valid, but it's not going to change if we don't all know what's up!

Upvoted, resteemed, and followed. This is an awesome tool for considering our liability to government, through it's clear reasoning and specific considerations of practical extent.

Thanks very much!

Thank you very much!

I mean how will the IRS know how much you earned if you keep the steem in a cryptocurrency and never turn it into cash. More and more places are allowing for purchases in bitcoin, but then again tax evasion will ruin your life if you do get caught

Yes, the cost is high if you are caught. Plus, Steemit saves everything into a public block-chain. We are all susceptible to dox'ing, and the IRS can probably dox any of us relatively easily by subpoena IP records.

the idea of hiding or anonymity is no longer valid. Blockchain may help some believe they are not being tracked, but I dont believe it. Blockchain gives gov new tools to be sneaky. Now we are in the list making stage. The people rated highest will be taken down 1st. They will complete the list exponentially faster over time. No one will be able to hide. They have always been able to take anyone they wanted down. Each person has to decide what they are willing to consent to and what price they willing to pay for dissenting to any policy of the state. Taxes are a joke. If they want their debt notes - just let them take them. They were never yours anyway. Focus on bigger picture items like your character. Dont give them an excuse to take yu down over worthless money.

Lots of wisdom here, for those who would see it.

Looking forward to reading this series @lexiconical

I have a strategy in mind but I'm a long way from needing to even consider Steemit income for tax purposes (other than as deductible expenditures).

@exyle must be a harsh taskmaster if he knocks you for not eating this elephant in one bite.

Hah, not at all! I just promised him a faster turn-around in a previous comment, but I had a busy week.

You're one of my favorite commenters, you've always got something clever to say. "Finding a nut more than once in awhile", eh?

I've had a similar week.

Opened my mouth too many times and somehow "volunteered" for a few posts.

I think that's what Steemit is for me now.

Ah, well, at least that is one way to hold yourself accountable. I tend to want to read and comment more than author, because I hold all my posts to a pretty high standard and all the editing and drafting is time consuming. This way, I'm forced to keep my word (sorta).

Here's a quick link to part two:

https://steemit.com/taxes/@lexiconical/valuing-steem-rewards-as-taxable-income-is-a-vast-overstatement-of-tax-liability-part-2-the-thin-order-book-and-flash-crashes

Great, thanks.

Wow good read. I think at the end of the day....Talk to a CPA of a financial professional professional. We can talk about it and go back and forth but what ultimately matters is what a CPA thinks. If Jerry is smart and really making a significant amount of money he is going to hire 2-3 accountants, and a few lawyers.

Never rely on one persons opinion-get two or three opinions.

Lastly, the correlation point of WoW Gold and Counter Strike Skins is a stretch BECAUSE it is not an INCOME producing Asset. It does not generate revenue for the user. Revenue generating is a TOP focus for the IRS. Because if ANYTHING its making money they want to know that you are making money.

I am not a CPA or a financial adviser. I am sharing my personal story.

Thanks

Most CPAs literally do not know anything about cryptocurrency. They have no idea what they are doing in this space. You're talking about dealing with people who are still at the level of "the internet is a series of tubes".

WoW Gold is just as income producing as Steem Power is. There are thousands of companies generating MMO gold and selling it. It is immediately fungible, much more so than Steem Power. There's no meaningful distinction here.

In fact, the argument for taxing all WoW gold is even stronger than for taxing Steem. Just like the IRS thinks it deserves to tax you on $100 if you find a $100 bill.

In case of Russia, for example, officials supposedly going to officially treat cryptos as foreign currency. With all the repercussions.

Interesting. I don't know Russian tax law, but I suspect this will lead to cryptos being taxed frequently as speculative vehicles, the same way Forex trades would be taxed. However, being legally classified as currency can sometimes also carry advantages - for example, the special taxation benefits on US Gold coins in the US due to their status as legal tender (they trigger less IRS reporting requirements than foreign gold coins).

END THE IRS!!

Next stop, Federal Reserve!

Heh, good one!

I wish to comment here only to reinforce what you are saying and bring even more reality to light in regards to taxation. I have posted an article titled "What if Income Taxes were voluntary?" on my my steemit blog. Please give it a read and maybe a vote or resteem. Cheers!

Boy, that would be great, wouldn't it? I will take a look at your article.

Nice and elaborate article. Though I'm not an American myself I found it to be very informative. I am very curious as to how other countries will handle this.

Thank you! I hope some of the logic here can help others formulate a strategy for their tax struggles as well.

Very well written. If you don't tell them, they don't know........

Thank you!

Amazing post! Very informative and rightly explained. Thank you!

Upvoted and Resteemed!

Thank you! Stay tuned for part 2.

Oh,,, I am tuned and waiting anxiously!

Check out my post too

Exposing The Real Beauty OF Pakistan!!! (Part 1-Lahore)

Very pretty shot!

Thank you! :-)

Folks sometimes like to get ahead of themselves. Better to be safe than sorry, yes, I get it.

But, too many projections and uncertainty. Even professional tax accountants and auditors would have a hard time with the valuation.

Love the disclaimer, Hehehe

Thanks, I wanted it to be a very clear disclaimer, so I put in two!

gracias por la información me servirá de mucho

De nada!

if this is true about facebook likes being taxed for everyperson who owns a like page or tax page, then everyone should leave facebook. including the "likers"

It's not a practical reality now, but there's no reason the IRS couldn't decide to make it one based on the same logic I am arguing against in this series of posts.

Thanks for bringing this up. I'm looking forward to the rest of the series.

I was thinking the other day that I was going to have to talk to my tax accountant about this before next April, and wondering if he's up to it.

Thanks! It's definitely going to be a concern for more and more people going forward.

Here's a quick link to part two:

https://steemit.com/taxes/@lexiconical/valuing-steem-rewards-as-taxable-income-is-a-vast-overstatement-of-tax-liability-part-2-the-thin-order-book-and-flash-crashes

Very nice posty things! Resteemed Followed all persons that responded in this thread feel free to follow me too!

Love the Macho Man!

Fuck income taxes!!! Raise sales tax and make weed and prostitution legal with a tax.

I definitely think opening up new taxation strategies is better than squeezing blood from a stone. Many people would be happy to pay taxes for legal access to vices, as they might end up still saying money overall, and certainly crime would be reduced.

Portugal is an excellent case study in the value of drug legalization.

i think they do that in las vegas and california bub.

Thank you for this

I'm glad you found it useful!

Looking forward to the future parts.

Thank you! I'm working on #2 as we speak.

Here's a quick link to part two:

https://steemit.com/taxes/@lexiconical/valuing-steem-rewards-as-taxable-income-is-a-vast-overstatement-of-tax-liability-part-2-the-thin-order-book-and-flash-crashes

You know I have to share this! Based on the reasoning of the IRS the air you breath would be taxable! Incoming and out going!

thats called carbon credit tax.

That thought would probably get a few of the suits over at the IRS all atwitter.

I am a bit excited on this post good read!😍

I'm glad you liked it!

Thank you for sharing this and helping me come up with a plan of atrack!

Make sure you take a look at the future parts, where I intend to talk through some practical solutions.

awesome post........its very informative thanks for this , waiting for the next part........ i like your post. keep it up.

Thank you! I'm hoping to get it posted tomorrow.

my pleasure.........

Here's a quick link to part two:

https://steemit.com/taxes/@lexiconical/valuing-steem-rewards-as-taxable-income-is-a-vast-overstatement-of-tax-liability-part-2-the-thin-order-book-and-flash-crashes

thanks.....

Wow this is a very meaning full post that a lot of people need to read and support we don't want our successful steemit members to be discouraged down the road keep up the good posting. I will be following as well as up voting this post.

Thank you for your support!

I concur with your post,...more importantly - you should report steem or SBD or whatever when you SELL them or trade them, even for another crypto or FIAT at the fair market value in case of trading for another crypto or fiat value...

If you have put your Steem/SBD from an exchange into Steemit, you should consider that as your BASIS before paying the taxes. If you held on to your Steem for a year or more (using FIFO) method - you should be able to take advantage of long term cap gains.

Of course these apply to US tax laws...each country is different...

Of course, above should be read as an opinion and NOT as an advice!

Yep, you got it! I plan to discus cost basis in a future post, and the potential of classifying rewards as a qualified dividend, for which the tax rate can be as low as 0% depending on your income bracket!

Very well written and informative post with great examples. Thank you for educating people with this information.

I appreciate your reading it!

Consider the possibility that until cryptocurrencies are legal tender, they are really just securities, capital as the guy from the Netherlands suggests.

If that's the case, and I've seen other articles here in Steemit to support this idea, then Steem Dollars and Steem and SP are really just a form of capital and that you pay tax on the gain, nothing more.

This is definitely something I will be exploring in later parts. However, capital gains only applies if you hold the asset for over 1 year. Under 1 year is considered trading income and taxed like normal income. (In the US)

I found what I think to be a relevant article, citing the IRS as a competent authority, and a ruling issued by the same. Bitcoins are considered "intangible property", so it received capital gain or loss treatment

https://www.forbes.com/sites/greatspeculations/2017/02/21/if-you-traded-bitcoin-you-should-report-capital-gains-to-the-irs/#19d5013ae3d8

I hope you find this of interest and to be useful.

Thanks.

Omg I live in Orlando and I won some money with steemit, I did not think I should pay taxes on what I charged here thanks @lexiconical for the information. Upvote and rt.

Glad I could help? Strictly speaking, your winnings probably are similar to other gains such as lottery, and technically speaking, should be reported to the IRS. It's one of those things very few people actually do, though, like reporting your savings from not paying sales tax at places that used to not charge it like Amazon and NewEgg.

PS - We are having a Steemit Meetup in Saint Pete/ Tampa next month, maybe you can make it. Check Jerry's posts or my feed since I resteemed it.

Thank u very much for your help @lexiconial It would be wonderful meetup but right now i haven't a day free in my work

Taxes bum me out.

I heat that.

Love this post. Things operating in that manner go against everything that this platform is founded upon, dont you think?!

It is decentralized for a reason.

Looking forward to hear more of what you have to say. And dont worry if you ruffle feathers.... that means you are doing something right 👌👊😎

Thank you! I am in complete agreement with you.

I've posted part two here:

https://steemit.com/taxes/@lexiconical/valuing-steem-rewards-as-taxable-income-is-a-vast-overstatement-of-tax-liability-part-2-the-thin-order-book-and-flash-crashes