Hi my fellow Steemian!

In my previous posts, I have been consistently promoting Financial Awareness specifically with the series "The Seven Cures of a Lean Purse" taken from the book of Gearge S. Clason entitled The Richest Man in Babylon. In relation to this, I find this #thebudgetchallenge a great way to share to you what I am promoting together with @smaeunabs and @jcvertucio.

In response to @smaeunabs' challenge, I will be presenting to you my entry.

Let me start with,

"It's not about how much you earn, it's about how much you keep."

After graduation, I told myself that if ever I would have my own income through a job, what I'm gonna do with my money is that I would use it to help my parents, help my brothers with their education, to travel, to buy things that I wanted, and set a portion of it to save. I was so sure back then.

However, everything changed when I started reading books about finance. I have dreamed of providing my family well financially because I know we're not that financially advanced. I even finished high school and college with the help of full scholarships and some helps. So, I had to begin educating myself how would I achieve that vision.

I have known numerous authors who specialized their books in the area of financial literacy, one of them was Robert Kiyosaki. I bet you're already familiar with him. Have a glimpse of his "Rich Dad Poor Dad". It was a good book, I know. That was an eye-opener book but might give us misconception about some things if we won't continue to read the following books of that series. So, I encourage you to read the whole series.

As a consequence, I started tracking and observing my finances. It was hard though, especially I was so into traveling and hanging out with friends. It was also double hard since my job involves a lot of traveling and my salary cannot keep up with my expenses.

With all those reasons, I know I have to decide.

"Nothing changes without the germination of an idea. Nothing changes without a commitment to change, without a commitment to a cause." -Anonymous

I resigned and searched for greener pasture so that I could actualize my goals. I have come to appreciate insurance and health care. Since I cannot include it yet to my budget, I searched for a company that provides it freely to its employees with the privilege to make my parents as dependents at a lower costs.

So, how do I manage my cash flow?

I would like to note that a budget plan is aligned to your financial goals that you have set. Basically, a budget plan is relative to the ones who's creating it. It varies among each individuals.

So, here's how I manage my cash flow:

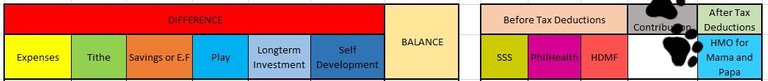

My Ideal Budget Allocations

Why did I emphasize "ideal"? Ideal because this is how I wanted my money to be budgeted. However, since I just started last year, there were many events that challenged me financially. I had to work out with my mindset and impulsive self.

I had to win the battle within me. Thankfully, little by little I could say I have improved in managing my money. Well, I have a separate notebook for my budgeting that's why I created the following tables to help you visualize how I am managing my cashflow.

Money In

The above photo shows you my kinds of incomes. As what I have mentioned in my introductory post, I am also a private Math Tutor. It is very important for us to determine the money going into our pockets because that is where we should start.

Budget Tracker

The purpose of this budget tracker is for me to track how am I doing with my cash flow management. It allows me to see and observe my progress in allocating my money for a said intent. If ever I spot such a poorly managed payday because of unexpected expenses which I do not have a choice, I often counsel myself. I remind myself why am I doing this and tell myself that it is fine, I can still improve next time. Yeah, I do that seriously. You can try it, too! It helps.

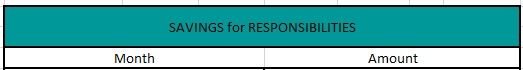

I also have target responsibilities which I look forward achieving in the future. It includes the big events in the family and other responsibilities of myself as an elder sister and a daughter. I list them down so that I could prepare for it and also to prevent debts when time comes. I often remind my parents and brothers that if ever they need something that is excluded from my monthly budget for them, they have to inform me a week or two ahead so that I could include it in my budget and prepare for it.

Responsibilities that need preparation

Yep, that is how I manage my cash flow. I excluded my small business here since its profits is not yet that much. Hopefully, in the future.. It will be no longer negligible.

So, what are those Budget Allocations?

Let me elaborate each one of them.

Before I break down my income to each of the budget allocation, I take the money for my parents' healthcare and my savings for the foreseen responsibilities ahead.

Tithes - Tithe means, "a tenth". I allocated 10% for my tithe. All of these blessings are from Him. Last year I started with 5% tithe to develop the habit, and now this year, I am making it 10%. It is not a must though, but I consider this allocation a must.

Expenses - This is where most of my money goes. It includes my lodging, daily allowance to work and the portion that I give to my parents every payday.

Savings - This where I am pooling my emergency fund. I do not invest this money because I have set this money to be my safety net for some unexpected expenses. It is said that at the age of 20-30 years old, our emergency fund would be 6x to one year worth of our salary.

Investment - This is my allocation for the longterm investments which I want to invest. I have set this money to have an investment horizon of 10years. That means, whenever I invest this, I do not set to use it or what until 10 years. With the investment horizon that I have set, I invested this money to high risk investments.

Self Developmet - Yes, I allocate money for this. This funds goes to saving up for the next book I want to read, the workshop that I want to attend and to the various seminars or talks that I want to listen to in order for me to grow, develop and improve.

Play - Haha one of the best allocation! This is where I get the money for rewarding myself. Eat that dessert you've been craving! Or that milk tea that you have really liked to drink. This is also the fund that I joint with my boyfriend's, for our next date or travel.

Retirement - I only set a portion of 2%. This is because the company to which I'm working now offers this in addition to their retirement programs for the employees.

That's all, and thank you for reading my entry!

Great info for the financially conscious!

Thank you @rina.tours.world! Yes, I am financially conscious heheh hope to see you around! <3

Grabi na gyud. Te grats. G mingaw na raba kos leche flan.heheh

Hahahah uuuyyy, lahi napod akong mga baligyaaa ;) mas consistent na kaysa sa leche flan hahah ^_^ palit nya hahaha :D :D Aja @thinkvincent!

It is always good to keep a chart which helps you in maintaining a balance between your earnings and expenses. I sometimes run out of my money because i don't plan a budget. Your post has helped me realized that it is very smart to do prior budget planning.

Indeed, @mmasim! We should track our finances so we could maximize it. Thank you for appreciating @mmasim! Aja to us!

Teach me more sensei! This is very nice and informative. Congrats in advance @namranna. :)

Wow, Just wow! Hahaha.

Yes, the same thing happened to me too. I realized I really do have to save for myself, and not give my all out to the people I love.

Yes, I agree with you @caratzky! Congrats to you, too! Aja and let's declare financial discipline this 2018 💪😊

Congrats to you, too @nikkabomb! Thank youuu 😘

Bongga kay ka @namranna! hahaha Ayaw ko kalimti ha haha.

Hahahaha ngano kalimtan man tika @nikkabomb? hahaha

nakadumdum mn gani ka sa akong dagway after 3 years? hahaha so sure nako d nako nmu kalimtan haha labyu @namranna. hope to see the girly side of you as we venture this road to financial freedom.

These are the exact things that you were telling me about the budget plan that you have made man!

One thing that really surprised me is the Self development part. I actually consider this part as self rewards (buying books and attending seminars), when in fact, they it should be considered as a great part of my pie! I really admire you for being able to come up with such allocation. I will definitely incorporate this in my budget plan man!

Thank you soooo much for participating in this challenge man! I greatly appreciate the efforts of sharing your personal finance strategies with us! I have learned so much from you guyses! Thank you soooo much

Looking forward to more finance articles from you man!

Cheers to Financial Freedom!

You are most welcome @smaeunabs! Thank you so much, too!!! 😭 Kudos to this challenge of yours! It enabled me to share finacial budgeting to our fellows. Hoooo never thought this event would happen! Thank yoi soooooo much!!!

Hey there. "The Master" (@markangeltrueman) asked me to drop by and let you know that this post will be re-steemed on the @steemsearch blog. It's good to see a quality post like this get recognition from the Curie guild. Well done.

I am beyond thankful! Thank you thank you!!! I have been pouring great efforts to my posts regarding financial awareness, and I am so glad that you guys find this post helpful! Thank you so much! This inspired me more to share about financial stuffs. More power to the Curie guild! 💕

Wow, you are too awesome @namranna. Congratulations. I got a feeling this was bound to happen hehe. But it was a pleasant surprise for this to happen so soon :) Praying for more of your success. Proud of you!

Thank you for being supportive @jazzhero! I did not see this coming, too! I am beyond thankful. Thank you! ✨😊

It is good to see that you are alloting 10% for your tithes,

I started with 5% last year though. I am alloting 10% this year because I want to offer more. Though I have improved with the habit, I still think I have to improve with this allotment. Thank you so much for dropping by 💕

Omg girl! Congratulations to you :)

Thank you @thegaillery! 💕Waaahhh thank you!

Congrats Ann! I believe this post is very helpful to most of the people (that includes me) who want to gain more ideas in handling money. Keep it up!

Thank you @jsmalila!!! Thank you for appreciating this post. Glad this helped you, too! 💕😍

Congratulations @namranna, this post is the second most rewarded post (based on pending payouts) in the last 12 hours written by a Newbie account holder (accounts that hold between 0.01 and 0.1 Mega Vests). The total number of posts by newbie account holders during this period was 5325 and the total pending payments to posts in this category was $4216.39. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

Thank you so much @bitgeek for this great information! Gotta check the link 😊 Thank you! More power 💕

wow..congraaats

Thank sir @fojrance! 🙌🏻

Congratulations @namranna!

Your post was mentioned in the hit parade in the following category:

Thank you for this news @arcange! Gotta check the link provided 😊. Thank you for dropping by 💕

oh my gosh..Congratz to you cutie @namranna for being curied..Grabe nice kaayo imo #thebudgetchallenge bai. bow to this girL.

Thank you @jonnahmatias1016! 💕Bow to us for being here in Steemit! ❤️

Libre 1sbd lang akoa cutie @namranna .. hehhe You deserved it...

This is a fantastic article with a solid plan! I hope you continue to keep up with the updates and advice.

On personal finance, my father had me read The Millionaire Next Door when I was much younger (so it's a bit dated), and the principles really helped give me a great understanding on how to respect and use money to create a better life. Highly recommended.

Thanks for appreciating @digitaldruid! Oh yeah, haven't posted for awhile because of some busy schedule at work and personal stuff. Hope you'd check out my posts regarding the series I've mentioned 😊. Gotta update later ☺️. Thank you and hope to see you around here @digitaldruid!

With regards to The Millionaire Next Door, maybe I'm gonna feature it sometime in the future. I've had a line up of books to be shared in my blog, hoping you'll have time to check those soon. Thank you again! 💕

Thank you so much namranna for supporting my post you have a kind heart to everyone. God bless you and your family.

No problem @lorner! I really find your posts informative and helpful. Thank you so much for dropping by 💕

Ur welcome as always it really help me a lot this community and to all of us here and also to others.

Budgeting is impossible if your living with minimum salary... try to budget you're 350 rate or 510 rate. Expenses are food, transpo, rent, bills, and etc... that chart is not applicable. Above minimum will do... thanks for sharing by the way. I am not against this is just my opinion.

I got your point @cloudspyder! I have thought of that, too! Actually, in my first job, I was just paid minimum. So I had to do many over time at work to have extras to cater other things in my goals. That's why, I searched for greener pasture to be able to actualize my goals. :)

I have nothing against with minimum, and neither I am pushing this budget plan to everybody. My financial goals helped me to identify my plan ^_^. Thankfully, I am still single that is why I do not have that much of expenses. Also, even if I am where I am now, I still do many sidelines like tutor and selling some goodies, all of it -- for my financial goals.

Thank you so much for sharing your sentiments! I really appreciate it. ;)

Congratulations! You were nominated for a TROPHY TOKEN award HERE Please comment your Bitshares address to receive your reward! You can also contact us on Discord @Trophy-Token. Thank you for being a great Steemian!