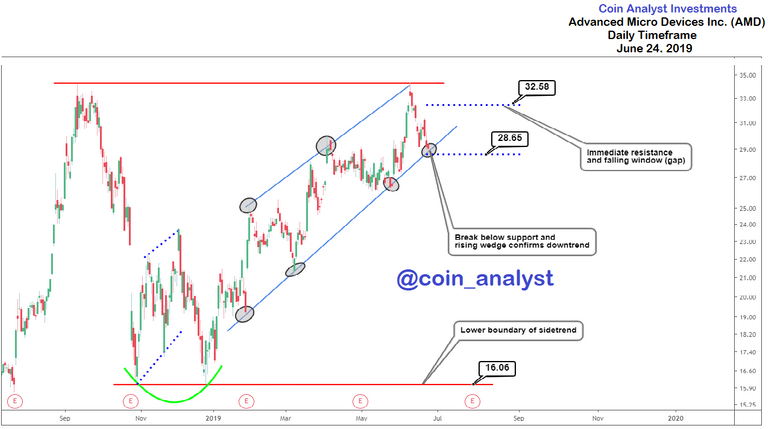

Conclusion for today’s AMD analysis: Price action closing below ~28.65 confirms lower prices.

The Daily timeframe chart (Log scale) of Advanced Micro Devices Inc. (AMD) is presented with analysis covering over 11 months of price action.

AMD’s bullish price swing from a price low of 16.44 to a price peak of 34.30 on June 10, 2019 is captured using a rising wedge chart pattern that is ideally bearish.

Instagram: https://www.instagram.com/coin_analyst/

Twitter: https://twitter.com/Cryptotrader029

In addition the upper boundary and lower boundary for price is highlighted on the chart to help define the range (side trend) for price action over the past 11 months. Immediate resistance is marked on the chart at ~32.58 which is just above a falling window (gap).

Price closing below ~28.65 implies a breach of support and also confirmation of the wedge, both of which indicate strength to the downside. Minimum profit target in this scenario is the lower boundary of the wedge at ~16.06.

Our previous Bitcoin analysis (BTCUSD) before the current price rally was also posted for FREE and can be found below.

https://coinanalyst.investments/2019/04/26/btc-analysis