This is the first of a series of posts I will be making on trading, before I start actively sharing my trades and setups. There is a lot I want to share, and I cannot help but start with my favorite book on the subject.

"Market Wizards" By Jack D. Schwager is a compilation of interviews with some of the most successful traders in the history of the markets. It is by far my favorite book on trading and investing, full of golden advice and incredible stories. It actually includes first-person accounts behind sensational trading coups that made history, including one about a trader who turned $30,000 into $80 million, a hedge fund manager who averaged 30% returns every year for the past twenty-one years, and a T-bond futures trader who parlayed $25,000 into $2 billion in a single day!

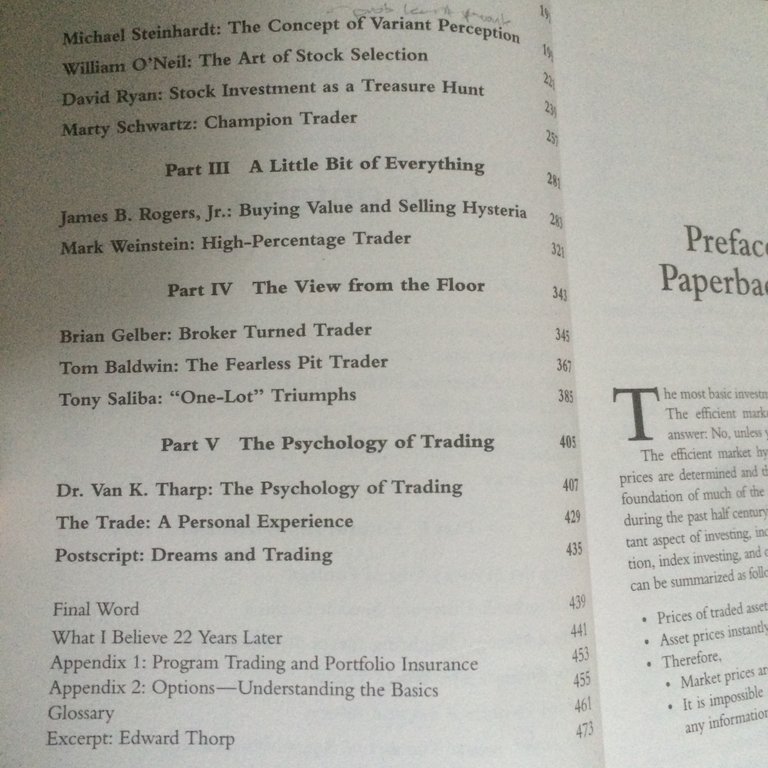

The list of superstar traders interviewed in the book includes Paul Tudor Jones (fucking legend!), Bruce Kovner, Richard Dennis, Michel Steinhardt, Ed Seykota, Marty Schwartz, Tom Baldwine and more - I am sure those of you passionate about trading will recognize some of these names. Here is the list of all the traders and investors covered:

Parenthesis: Brian Gelber, one of the legendary traders in the book, founded Gelber Group in 1982.

I interned as a discretionary trader at Gelber Group last summer, my first big experience in the field which immediately got me hooked. I heard some incredible stories from Brian Gelber himself - here's a really chill awesome guy. Close of parenthesis.

In this post I will go over everything I have learnt from the book (which actually highly resonates with my experience, mistakes and learning process throughout last year, where I have been trading full-time), a distillation for the fellow Steemian traders and investors!

Important Note: No matter how deeply one understands the principles and rules/recommendations laid out by these superstars, it is more often than not the case that people learn only from experience. And especially when it comes to things like "what to do" vs "what not to do" in trading, we almost always develop rigid strategies and frameworks after failing many many times - enough to have a principle deeply ingrained into one's psyche. This is a function of our emotional memory: remembering how much a specific mistake hurt ensures you will avoid repeating it. This is actually classic human nature: you need to fuck up (and perhaps fuck up the same way more than once, just to be sure) in order to actually learn.

Learning from one's mistakes and experience is infinitely more powerful than 'learning' from simply reading a book. So, going back to the book for a third read, a year after reading it for the first time, it's funny how I myself only came to form a rigid approach, in the end actually closely following a lot of the rules in the book, only after I messed up many times doing some of the things one is not supposed to do. And trust me, the learning process never stops. It's an inherently iterative process (every trade is one iteration cycle).

The knowledge you will get from reading the book comes from collectively hundreds of years of trading experience. But it's funny how you will come to appreciate a lot of it only after failing in the market repeatedly (hint: it's healthy to fail here - as long as it's risk managed and every trade follows your approach). Trading is one of my passions, and I am proud of all the progress I've made up to date. I hope some of this advice enables you to one day also become a successful trader! But disclaimer: you cannot avoid losing first.

Qualities common amongst the best traders in the book:

- Discipline

- Patience

- Flexibility (going short as easily as going long, across every market - being agile)

- Ruthless risk management (often involves getting out of a losing position right before the market turns around).

- Cut down on losers and ride the winners.

- Act independent of the crowd and follow one’s own mind

- Don’t overtrade. Don’t need to be in the market all the time.

- Understand the importance of execution and that one is not paid just for being right on an idea.

- Appreciate the importance of position sizing and the merits of partial liquidation.

- Understand that losing is part of the game.

- Trade around a position.

- Reduce volume when on a losing streak and liquidate positions to push away confirmation bias and achieve mental clarity.

- Love trading.

The two traders that resonated with me the most

Those are Michael Marcus and Paul Tudor Jones. Michael Marcus’ resilience and active self-reflection on his behavior and mistakes is a practice I always try to emulate, while I particularly like the way he formulates what occasions constitute an edge and a time for scaling up: when all three of fundamentals, technicals and market tone are aligned – really the way to trade anything in the world as he puts it. I look up to his more holistic and cerebral understanding of the markets, coupled with objectivity and open-mindedness, while I also very much appreciate his interest and engagement in spirituality, which resonates a lot with me. Take-away quote: “Trading is emotion. It is mass psychology, greed, and fear. It is all the same in every situation”.

Paul Tudor Jones’ advice is pure gold in my opinion. “The most important rule in trading is to play great defense, not great offense”. Think of what you could lose, not what you could make. Reduce position size when trading starts going poorly and be cautious of overconfidence after winning. It is easier to get back in than to get out. Don’t average losers. Develop an idea and approach the market from a very low-risk standpoint. Use not just a price stop, but also a time stop. Don’t be a hero, don’t have an ego. Use Elliott Wave theory for incredibly favorable risk/reward opportunities. Last but not least, “prices move first and fundamentals come second”.

Some of my favorite quotes throughout the book

Michael Marcus:

On what his 'edge' is:

I think the secret is cutting down the number of trades you make. The best trades are the ones in which you have all three things going for you: fundamentals, technicals and market tone. First, the fundamentals should suggest that there is an imbalance of supply and demand, which could result in a major move. Second, the chart must show that the market is moving in the direction that the fundamentals suggest. Third, when news come out, the market should act in a way that reflects the right psychological tone. For example, a bull market should shrug off bearish news and respond vigorously to bullish news. If you can restrict your activity to only those typs of trades, you have to make money, in any market, under any circumstances.

I enjoyed 'the game' too much [resulting into mistakes]...However, the thing that saved me was that when a trade met all my criteria (fundamentals-technicals-sentiment alignment), I would enter five-to-six times the position size I was doing on the other trades.

Bruce Kovner:

On making mistakes and confidence:

One thing that is absolutely critical: you have to be willing to make mistakes regularly; there is nothing wrong with it. Making your best judgement, being wrong, making your next best judgement, being wrong, making your third best judgement, and then doubling your money.

On trading breakouts:

As a trader who has seen a great deal and been in a lot of markets, there is nothing disconcerting to me about a price move out of a trading range that nobody understands.

Tight congestions in which a breakout occurs for reasons that nobody understands are usually good risk/reward trades.

The Heisenberg principle in physics provides an analogy for the markets. If something is closely observed, the odds are it is going to be altered in the process...The more a price pattern is observed by speculators, the more prone you are to have false signals. The more a market is the product of nonspeculative activity, the greater the significance of technical breakouts.

The less observed, the better the trade.

On position size and S/L:

Whenever I enter a position, I have a predetermined stop. I know where I'm getting out before I get in. It's the only way I can sleep. The position size on a trade is determined by the stop, and the stop is determined on a technical basis. For example, if the market is in the midst of a trading range, it makes no sense to put your stop within that range, since you are likely to be taken out. I always place my stop beyond some technical barrier.

I place my stop at a point that is too far away or too difficult to reach easily

On advice to novice traders:

First, I would say that risk management is the most important thing to be well understood. Undertrade, undertrade, undertrade. Whatever you think your position ought to be, cut it out by half. [Novice traders] are taking 5 to 10 percent risks on a trade, when they should be taking 1 or 2 % per trade.

Note:

Personally, the one thing I ask myself to determine my stop (along with my technical analysis) is the following question: "Where am I wrong?". Stop Loss = Where you are wrong. Not where the price corresponds to the minimum dollar amount you wanna lose. Instead, where you know your idea was wrong. If the meaningful stop point implies an uncomfortably large loss per contract, trade a smaller number of contracts! Or wait for a better price entry. The philosophy here is that it is better to allocate the predetermined maximum dollar risk in a trade to a smaller number of contracts, with a wider stop. And this is actually the exact reverse of what typical traders do, trying to limit the loss per contract, but trade as many contracts as possible -- an approach which results into many good trades being stopped out before the market moves in the anticipated direction.

Paul Tudor Jones (*my personal favorite)

What are the trading rules he lives by:

Don't ever average losers. Decrease your trading volume when you are trading poorly; increase your volume when you are trading well. Never trade in situations where you don't have control. For example, I don't risk significant amounts of money in front of key reports, since that is gambling, not trading.

[There are a lot of smart-asses trading FX macro updates like central bank interest rate decisions or stocks at the time of company earning reports or during the London Fix. And here and there it's sometimes 'too easy' to make money doing those. But you don't have control: during such an event (even if you are using a trading algorithm fetching the released data), the volatility is too high, your slippage on your entry price will probably be huge, your stop loss may not be triggered but instead flown by and in the long-run you will probably be losing money. Sure you can trade blue-chip index futures during after-hours on days tech companies report earnings, yeah sometimes that's 'free money', but generally trading high vol during key report releases is gambling. So don't fuckin (over)do it. Or go ahead and do it, you are a free person. Instead, what I suggest is, use those events, use the volatility movements, as opportunities to get a better entry price for your pre-developed idea. ]

The most important rule of trading is to play great defence, not great offense.

Don't be a hero. Don't have an ego. Always question yourself and your ability. Don't ever feel that you are very good. The second you do, you are dead.

I don't just use a price stop, I also use a time stop. If I think a market should break, and it doesn't, I will often get out even if I am not losing any money.

It's always easier to get back in than to get out.

Don't focus on making money. Focus on protecting what you have.

And one of my favorites from Paul Tudor Jones (one of the biggest proponents of technical analysis, especially Elliot Wave Theory):

I always believe that prices move first and fundamentals come second.

On whether his trading system is contrarian or trend-following:

Trend following. The basic premise of the system is that markets move sharply when they move. If there is a sudden range expansion in a market that has been trading narrowly, human nature is to try to fade that price move. When you get a range expansion, the market is sending you a very loud, clear signal that the market is getting ready to move in the direction of that expansion.

Reminds you of anything? Of course it does; BTC and ETH breakouts over the last two months (couple that with Kovner's view on breakouts and their explanation, or lack thereof, at the time.

Being on the subject, here's a screenshot from trading ETH/USD CFDs during the late April breakout. The natural tendency, as per Paul Tudor Jones, would be to fade the move. We all know that wouldn't have been a smart move...!

Ed Seykota

On using fundamental analysis:

Fundamentals that you read about are typically useless as the market has already discounted the price and I call them "funny-mentals". However, if you catch on early, before others believe, then you might have valuable "surprise-a-mentals".

This immediately brings to mind all the awesome news and analysis on the cryptocurrency market that the community shares on Steemit. You guys are awesome

In order of importance to me are: (1) the long-term trend, (2) the current chart pattern and (3) picking a good spot to buy or sell.

The elements of good trading are (1) cutting losses, (2) cutting lossess and (3) cutting losses. If you can follow these three rules, you may have a chance

Everybody gets what they want out of the market

This last one means that those who get a rush from trading and trade for the fun or gamble, but not trade to make money, are gonna get what they want ouf of the market (eg lose). And it also implies that all winners who fall short of their goals are fulfilling some inner need for a constrained threshold of success. This echoes deeply with a lot of posts by @rok-sivante on abundance, the importance of our mindset and shattering our programming of scarcity.

And for the lovers of stock trading (not me):

William O'Neil: The Art of Stock Selection

Wiliam O'Neil has devised a neat model for picking winning outperforming stocks. I will give you a quick overview, but also attach below the actual couple of pages of the book because I think it's worth to go through these. Note that anyone with an access to a Bloomberg Terminal can easily screen stocks to use this selection methodology, and run a nice back-test (*hit me up with your findings if you do). As per Kovner's words however, I would suspect that given the visibility of this methodology and its extent of copying, it probably won't hold anymore. Or does it?

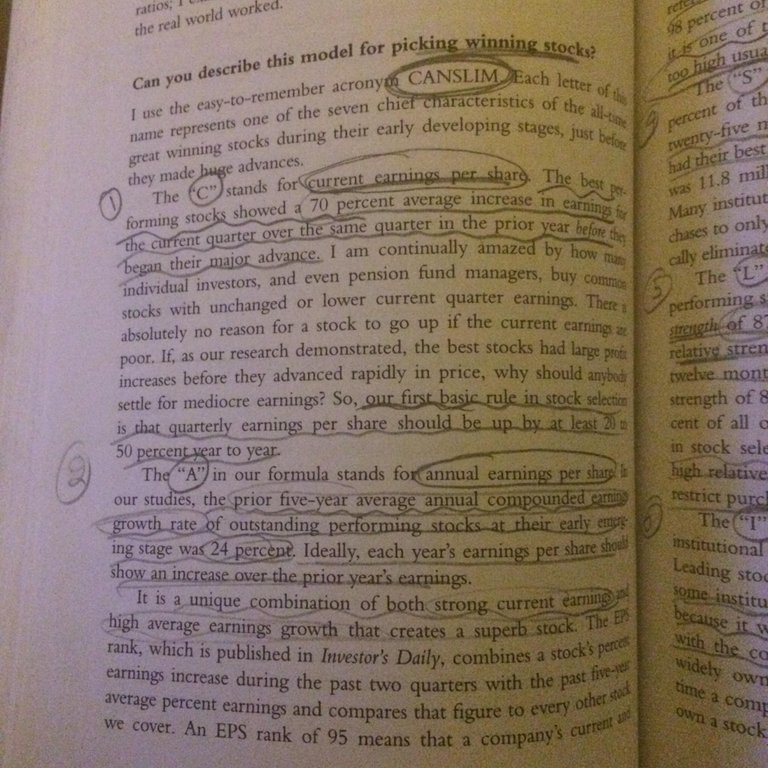

The acronym is CANSLIM, each letter represents one of the 7 chief characteristics of all-time great stock winners during their early developing stages, just before making huge advances.

CANSLIM FORMULA:

- "C" stands for current earnings per share. The best performing stocks showed a 70% average increase in earnings for the current quarter over the same quarter in the prior year before they began their major advance

- "A" stands for annual earnings per share. The prior five-year average annual compounded earnings growth rate of outstanding performing stocks at their early emerging stage was 24%

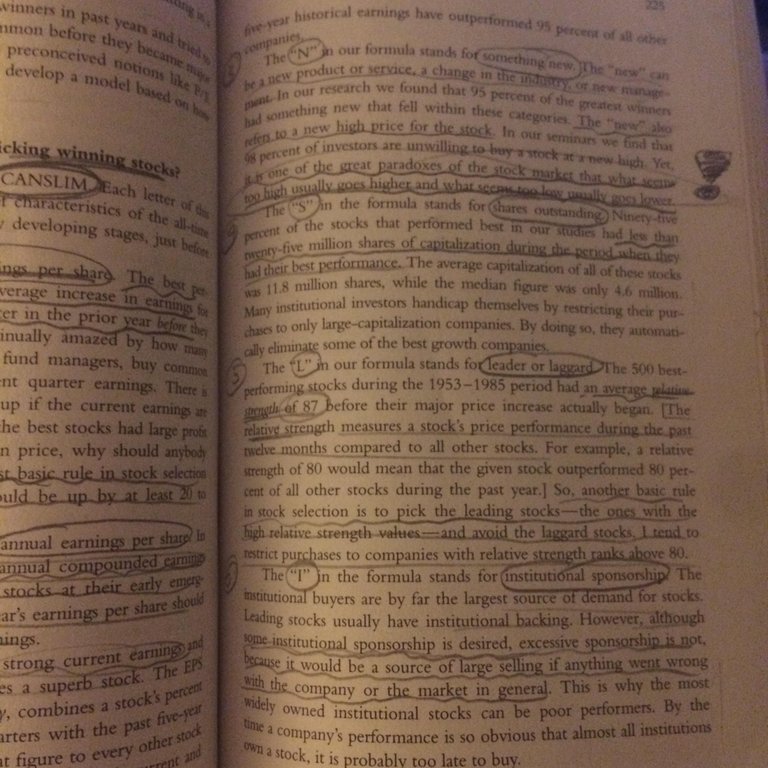

- "N" stands for something new (ex price High). It could be either product/service-related or price related.

One of the great paradoxes of the stock market is that what seems too high usually goes higher and what seems too low usually goes lower

- "S" stands for shares outstanding. 95% of the best performing stocks had less than 25M shares of capitalization during the period when they had the best performance.

- "L" stands for leader or laggard. Relative strength can be used as indicator.

- "I" stands for institutional sponsorship. Having solid sponsorship / endorsements.

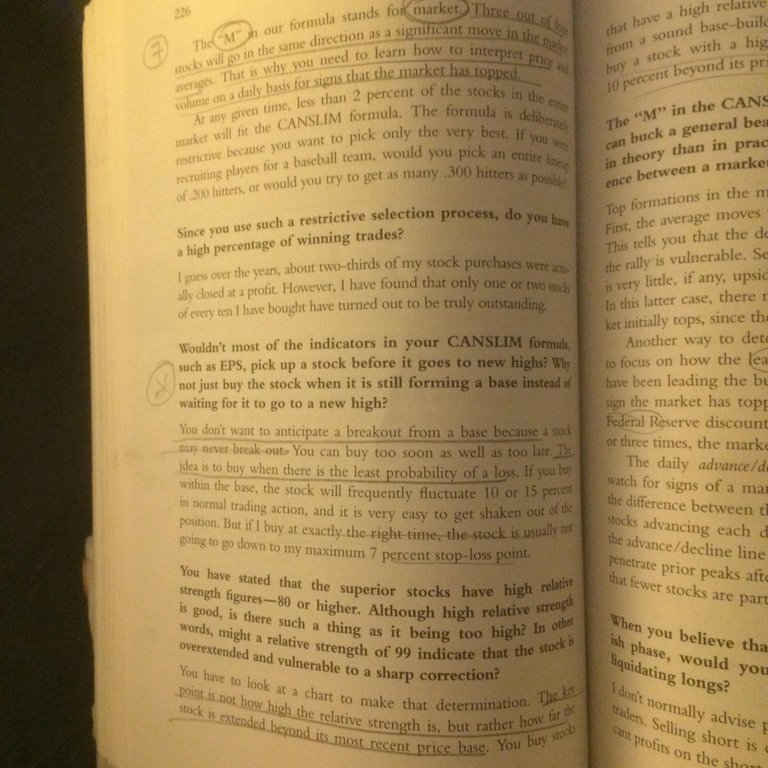

- "M" stands for market. It relates to market correlations and explanation of movements.

Here are the actual book pages:

Important note: these market wizards made their fortunes at a time when electronic trading was in its infancy and traders were mostly found in pits at exchanges.

Yet, the fundamental trading principles are time-less.

Despite the outdated mechanics of trading, the reality of Market Wizards still gives us great perspective

Markets are a reflection of human nature, and human emotions are a constant. At the same time, one cannot necessarily speak of a one-to-one correspondence of the outcry informational system of the pit into the realm of electronic trading. This nonetheless points to the structural plasticity of the market, which is evident by the many different, evolving perspectives, roles and approaches of market participants, as also evident by the testimonies of Market Wizards in the book. In the same vein, we see how the availability of information and speed of its propagation changed the rules of the game (also compounding mass psychology, herd-like behaviors and convergence of strategies) and how high-frequency trading superimposed and embedded itself onto the markets. At the same time, long-lasting relative pricing relationships between asset classes can still get rapidly redefined under new market conditions (as we have seen with equities and bonds trading similarly under either ‘risk on’ or ‘risk off’ market sentiments, while also anticipating regime shifts in the relationships between currency exchange rates and asset prices in this new world of negative yields).

My view

The markets are parallel distributed networks of information exchange, whose emergent qualities and laws tend to repeat themselves in time. Similar to the natural (and metaphysical) world obeying universal laws and emerging from the quantum level via conscious observation in linear time, the market systems also follow their own emergent rules, responding to mass psychology, emotional memory of the past and the principal component of volume. The frequencies and mathematical ratios of growth and information flow of the natural world are evidently also observed in the financial markets. It’s a system that is constantly re-parameterizing itself from within, dynamic as well as self-repeating, fractal-like in its behavior. At any given point in time, the biggest two truths of the market are its past price and its current price.

****

I will be authoring new posts on trading, including the long-term importance of risk:reward ratios, using Elliot Wave Theory and my favorite and most successful trading strategy (gotta keep the suspense!). I will also start sharing my trades and trade setups in the near future.

***

If you enjoyed this post, and would like to see more relevant content, Follow me at @irf1 :)

And my favorite also.

:)) Which platform are you using for trading? Curious to learn about your approaches. Btw just authored a new trading post with my recent trade on an ETH/USD CFD in case that would interest you :)

I am not familiar with this issue - trading. But this one seems a good read for people interested in this. Resteemed. Hope it helps. Thanks for sharing.

Thank you so much @deanliu ! I very much appreciate your time and kind support :))

I actually think outside of investing, trading is also something everyone should know how to do on a minimum basis, and engage with. It takes a lot of time, effort, blood and tears to become successful no doubt, but it is a very worthwhile sport.

You don't have to day-trade and be in front of the screens 24/7. But consider having a small amount of capital ready and armed, sitting on a trading platform, for speculative trades when opportunities arise. This could be a leveraged dip buy during a correction in cryptocurrencies (I just made a new post with such a trade on ETH/USD if you wanna check out), trading Forex on leverage when big events happen (Brexit for instance, a good amount of traders at the prop trading company I worked last summer made $250,000 that night, or other geopolitical-economic events, such as elections), or perhaps stocks over big events like a CEO departing.

It really all comes down to discipline, patience, risk management, favorable risk:reward and a constant approach (that is iterated upon). Psychology is also huge. Again I highly recommend you consider looking further into trading if you find the time :)

If you do start, check out Elliot Wave Theory, Fib retracements and using Ichimoku clouds for technical analysis, and for Forex fundamentals there are myriads of resources online. I can forward you specifics if you would like!

Thanks again for your help fam :)