I've been selling some BTC to take some profits off the table, but I'm secretly wishing for a pull back down to that $3000-$2500 level ya know lol 😁 #InCrytposWeTrust

and BTC is so fast that others coins cant pull up ;p I was thinking that was end of panic, but it wasn't ;p Now when I'm reading Your text I lough because I have couple of bucks and other coins and no btc ;p Waiting it's boring :)

I was wondering how you deal with taxes and capital gains? Since I dont ever pull money out of the exchange to my bank account does the IRS consider every trade taxable one by one while its still on the exchange or does tax not come into play until year end? I trade coins as well as sell coins to USD but I have not pulled anything out and dont plan to for at least a year. Thanks.

Thank you, Luc! Another masterpiece! All Luc's videos are very helpful.

I noticed though that there are people who still don't understand his trading method. I've got a friend that criticized and had a twisted interpretation of it. I clearly noticed that he didn't understand it properly because since I started following Luc's teachings I didn't lose any money and I'm making free coins all the time. Although everything he explains is simple to follow, it still requires some dedication to master it. In this community, all the information necessary is explained over and over again in many comments. I wish everybody good luck in your trades!

I'm glad your having success and I appreciate your words of support. I knew, when I started making this video series that there would be many people who cannot grasp my methods, even tho they seem so simple to me. But its great to hear a few that grow there accounts and realize that it does actually work.

I believe some people won't grasp your method but the knowledge is here for anyone, anyways.

Some people may become frustrated for not being able to understand it quickly, but it's part of the game. Maybe the same person will check the information again in the future and then understand it. Not everybody is the same, not everybody has the same rhythm to go along the learning curve. In any case, what you are doing is amazing. Will change many people's lives, for sure!

Hey Luc,

I'm new here so I wanted to show you some current graphs with bases drawn. Would you please review the bases?

The first one is bitcoin. I was wondering whether (now it is below the base I have drawn) it is safe to buy?

The second one is Litecoin. Basically the same question.

Third one: GNO. I am not at all certain about this one so please help me out.

Last one: ETC. I hope to buy this one as it looks good to me. I forgot to draw the last base. (Around that argument, it has already passed that one as well)

Thanks Luc. I love your vids. Keep them coming. Don't spend too much time answering. Just some short feedback would be nice.

Again a great video @quickfingersluc. Very clear to follow and nice strategy. I'm new to trading and i've bought a share of IOTA coins which are now sky rocketing. I already took 50% out of the investment , breaking even. But indeed this leaves me with less margin for the future. Your strategy of selling 30% of your profits at these situations and buy back when sell-offs or corrections occur, is great. I will try to follow that 'rule'.

One thing however that is difficult still to master is when bases are broken. Your videos make it look like a child's game. You seem to be spot on all the time on the lows and the highs, but the only thing i see at a moment in time is.. ok this can be a base.. hmm what should I do.. is it falling, is it going up.. how long is it falling, how long is it going up, at which point do I take a position or a sell..

And next to that what I would also be interested in is how you deal with drops instead of rises. Let's say you have a position in BTC at 3800$ and now it starts dropping from 4100$ back to 3800$. Do you wait? do you anticipate at 3900$ to sell that trade ? What are the best options?

I would also like to add that it would be great to see you (Luc) drawing your basis in real time as the chart is unfolding so as to get a better feel and perception of when to draw a base. Like with etherem right now, I am not sure where the base should be, if at all there is reason to draw one right now.

Really appreciate your videos!

and also @quickfingersluc when do You feel that is the end of panic and drop. How You see it on the moves in sells/bays? and wherever you pay attention. I have seen ones "big fish" when they first took 200 $ from BTC to 3800$ and stops panic on few others coin and then pull up btc too 4040 in few minutes(other coins drops long red vertical line in minute).

And @quickfingersluc really thanks for everything what Your doing. You really changed my life ;)

Oh my, thank you very much for posting that link. I have been hearing warnings about tether and bitfinex from a few other followers and I love seeing stats and numbers. That article gives me alot to consider. As a safety, I will start moving money out of tether for now, I have way to much and I will investigate this further.. But if there is any truth to this, there would be such a huge dive in BTC when this tether thing implodes.. sheesh

Hi Luc and other more experienced fellow Crypto-traders,

I have a question:

I am currently trading only on Bittrex and do not intend to do multiple exchanges until I have more experience and more funds. I appreciate that there are only so many opportunities in a given day to buy positions and/or sell positions. What is the maximum trading per position before this cannot work? I imagine that I would be able to trade a larger amount of BTC per position in a coin like Ethereum due to its high volume. But with some other lesser Altcoins, I cannot be purchasing, say 10 BTC every time it cracks a base as otherwise I would be causing a surge in the price.

I guess what I'm asking is what volume/turnover of BTC is someone like Luc trading on a daily basis?

I've seen Luc say before that he just tries to fit in with an average buy for those smaller volume type coins. With many of the smaller coins you just don't want to stand out and you should be fine. If the coin itself has a volume of 50 bitcoins a day then yea putting 10 in as a buy could be a risky proposition. Putting 1/4 of a bitcoin would probably be just fine, but again it all really depends on the coin, the point to be taken is with the lower volume coins to just blend in with the other average buyers.

Thanks for answering for me.. Thats exactly right, blend into the normal action.. That's why all the big trades need to be in BTC and ETH and larger coins where you can execute large trades without effecting anything

How do you calculate "normal action" for a coin? In other words how can I determine the maximum amount I can put into a trade without effecting anything?

Look at the lvl2 data, compare the bis and the asks. You can also look at the market dept for visual conformation, although I find it only helps to identify where walls exist.

Hey Luc, I love your videos and am at the stage of playing with small trades to make sure I'm understanding how to find my bases; thank you so much for your time and effort!

I had a question on trading alt coins with bitcoin. Do you have a simple method for determining/adjusting your selling points when bitcoin is rising? I've noticed you mention you keep most of your account in USDT, but some things you'd have to use BTC for right?

I've posted a chart below for reference on my question. I made a small trade on EOS anticipating a bounce, only to see it fall way more than expected over the last three days. However, when i did the math of what i'd need to sell to break even, my selling price is lower now that bitcoin has shot up by 3 or 4 hundred. It made me realize the fall might not be as bad as it looks. I was just wondering if you might have already dealt with this problem and found a good way to process it.

First of all I see now that my bases marked blue were not as strong as the previous ones marked red so maybe I acted too hastily, but again it's a small trade just to learn so no worries. And I'm certainly learning :)

What I noticed after some calculation was that the green circle will currently net me back about the same amount I would have made if I'd sold at my original blue circle back when the buy was made at a low point. I basically just planned to sell back at my base to be safe. But at this point my base (in reference to USD dollar amount of payoff in bitcoin) is lower on the chart due to the price of bitcoin going up.

This is kind of hard to explain, but hopefully it's coming across. Just wanted to know if you had any guidance or methodology on this observation.

Yep, that's about what I was thinking. However with Bitcoin going up and Eos going down the spread is getting farther apart. So now I can move my sell point lower and still make roughly the same as if it had immediately bounced back to my base. It can get a little confusing trying to calculate it all though.

Just to revisit this for clarity, I bought EOS at 0.000491 when BTC was at 3570.

Right now I could sell my EOS at market at 0.000400 while BTC is at 4100 and I would almost break even. Though even when zoomed out to a full month on an hour chart the difference from .000400 to .000499 looks huge.

It's tripping me out a bit. On the chart it won't look like it came back to base, and I'll have less BTC if I trade it back now, but in relation to USD it'a about the same.

I agree, It seems that it will be difficult to make an actual profit in USD or EUR.

When BTC is going UP, EOS will go down and visa versa.

At the end you would like to exchange it to USD(t) or EUR but you can make fantastic trades in EOS/BTC but your result in USD could be the same as you bought it. I probably don't express myself clearly but I understand your question :-)

Now, it's time to create a strategy :-)

I have been following your advice and learning how to trade on the dips, but also doing some day trading when I have time. When I first started to play with cryptocurrency I lost 50% of my investment, but after following your advice I managed to 3x my initial investment! THanks a lot!

I am still learning so hopefully I can get some advice if my bases are correct.

Is my safe circle correct here, or I should follow the red bases?

Hi flofix, if you don't mind, what method did you use to get your pics to show up inside your reply? The few I've tried so far have just given me a link. Thanks.

Well, I hope this holds no water, because 1. He bought randomly without any thought 2. It was only the last 2 months (unless he's expecting to day trade?). If it does, my altcoin positions (even though I bought well below bases before they went down another 40%) are screwed

Yea this guy seems to have done it pretty poorly. It seems he had no strategy at all for trading. I feel like the majority of people who get into crypto investing and trading are similar to this guy. Thank God we here found Luc and his strategies.....btw nice find @tizzle

Avoiding the trading stress by just buying and holding. Bitcoin may dip but will be back . May lose some unrealized gains but I save many hours of trading and stressing out. With trading, one bad call and you lose all the gains you made.

Can't Downvote, otherwise I would. Lucs strategy is about using coins to make more coins, which you hold long term, allowing you to cash out your initial investments while growing your portfolio. It's a lot safer strategy than buying random alt coins whose investors made millions during an ICO with nothing more than a white paper with a promise that someday the project will be coded without any commitments.

Think of it this way : when was the last time you saw a major stock ipo with nothing more than a white paper and a promise? You would get laughed at for investing in a company like that on Wall Street, yet this happens daily in crypto. You gotta accept that this is a bubble just like the dot com bubble a decade ago, you can still make bucket loads of money in a bubble - by trading to exploit inefficiencies in the market. Buying a random project to hodle without any evidence of the company's product (ETH and NEO are legit) is gambling as I see it, but there is nothing wrong with trading that project to profit off the backs of others who are the "dumb money" in the marketplace.

Thank you again Luc for another video and some more pure nuggets of gold! I have started trading your method with absolutely free coins made from faucets and have invested nothing at all, so this has been and still is a challenge to make it grow, especially when I make mistakes! lol

I put my orders using coinigy my exchange is bittrex, usually i do this to find out what happens with my orders in coinigy:

Open coinigy and bittrex in another tab in my browser.

put an order in coinigy

Change to bittrex, this shows a small windows to the right informing how the order is filling up.

The orders are sometimes filled incrementally, bittrex shows that, for example I sell 100 eth but one buyer buys 30 units, another 30 and another 40 bittrex shows the three purchases. Bittrex show every movement in your order.

Coinigy only shows that the order was completed when it was filled to 100% in the last buy.

Sometimes an order seems to be stuck but what happens is that 90% was sold and the remaining 10% is not completed, nobody buys it because for example it lowered the price and they are buying new cheaper orders.

Also sometimes coinigy does not show when the purchase (or sale) was executed, that is fixed by clicking on refresh.

But the command was executed just coinigy does not show it in time

I recommend using refresh button every time you notice an inconsistency between the exchanger and coinigy.

Coinigy for Kraken sucks for me, it doesn't just delay my transactions, they fail altogether most of the time, and sometimes they 'fail to execute' but ended up executing. So I ended up double buying. No problems on Bittrex though.

It seems ok on Bittrex for me but I had a doubt when I compared Level 2 data from Coinigy to the one in Bittrex itself. Level2 on Bittrex seems to have a lot more activity and to be refreshed more frequently.

Hey @quickfingersluc, as @amaralluis here has pointed out, some alt coins are breaking bases due to the huge selling off to purchase bitcoins, and while I tried to catch those falls, some falls went deeper then expected, but as people are selling them to buy bitcoin (not really a panic sell), will those still rebound to their bases?

@amaralluis, I've been watching this too and have come to the same conclusion about the sell offs. Perhaps when BTC hits it's ceiling for this run up people will sell off their BTC and buy back into the other altcoins. Good reason to hold on to your altcoin position... I think.

ok, but why is that? because from the base i drew it went up almost the same % as from the 0.0006 base...

So i wonder why 0.0006 is more a base than the one I drew?

I'm a beginner so I'm just trying to understand what is the difference :-)

I'm by no means an expert at all, I actually just started trading as well! However, It seems that when it hit the 0.0006 mark, it actually went up past 0.001, nearly double what the run up from your 0.009 base that you drew.

interested to know if the base lane was drawn correctly.

Personally i think this was not a base as the price movement was so big before the the drop, but on the other hand I think the price will still reach the base.

Quick Question for Luc: I'm seeing different things in the charts depending on the view. Ie 1 hr and 1 day. 1hr and 3 days. 1hr and 1 week. In general you see the biggesting gains on the 1 week view. You see smaller gains on the 1 day view . What do you recommend for beginners. Which is the safest chart view to watch when first starting. Second does the overall trend line up or down matter. My guess is a trend line up could be a bit of an insurance policy on a trade? Thanks again for the posts. Thanks again for sharing. Your trading strategy is the best I'm come across to date.

Safe are very small purchases until You learn. Better 10-20 small in different coins than big in few coins. Even if You make mistake You will lose only cents. And look for Luc's favorites. He shows them in one of the latest videos.

P.S. Luc's recommended 1h chart. First You pull back the chart to see 2 month history and choose bases and if they have always pull back to the bases(if there always a pull back those are the safest). And You measure avarange panic to predict another drop.

btw Luc Are you Canadian? You mention a Canadian exchange in your video. My guess is you are from Ottawa. Would be great to do a group meetup but understand if your time is limited. You could probably follow the Chris Dunn approach and teach courses one day.

Im in Ontario.. And I did start a small group for stock trading, a few years back.. We organized a meeting place, and met 2 a month.. But it got very time consuming, because the room would fill with people who have never traded before, and I would spend hours explaining the basics, over and over.. Since I was really the only trader in the group, after a few months I ended it..

This is the 3rd time I am posting this question. Really sorry for this.. I originally asked this from Luc. but he seems a lot busy so anyone is welcome to answer. And please do :-D

I marked a base for XVG and guess what proving Luc is always correct it cracked the base on 9th August and bounced back.

I wasn't aware of this because I almost forgot to check and I marked that base on 2nd August at 11.25P.M GMT+5.30

It did bounce back but I have a doubt, Did I identify the base correctly? I don't take the very bottom of a dip I take sightly up before that where the price touched 2 or more times.

I also check for the same base in the past to see how many bumps it had.

Yellow is the base I drew and red is the lowest price of that dip.

Since now it bounced back up which point I should consider as the new base ?

White line (0.000000090) or Light blue line (0.00000093) ?

Nipuna, I drew out this pattern, Luc's pattern, to follow and I don't see it anywhere in these charts. There is no panic drop. You might consider looking at some other charts.

You measure a power of base by looking how big its a bounce from this point/base. If its huge almost straight green bounce it's a base. If the chart bounce a few small ones from line of this base, its weakening this base.

Where did Luc say that bouncing multiple times on a base (or multiple small ones) weakens the base? I thought bouncing multiple times on a base meant that the base was getting stronger?

In one of videos Luc mentioned something like that. I am paraphrasing. "Here was a base, but chart had here a few little bounces(before crosing base) so it isnt so strong now."

Late response - but this is when it helps to understand the reason 'why' Lucs method works, beyond just looking at the chart patterns.

The reason we are looking for cracks of the base, is because the buyers who supported that price are completely caught by surprise.

Keyword here being surprise.

Because of this surprise, those previous buyers now turn into panicking sellers, and dump their positions at unreasonable prices. These unreasonable prices then get bought up by the big guys (who we try and buy alongside with) who then drive the price back up to the cracked base.

The problem with price consolidation off a base - people begin to start expecting a big breakout or drop. Doesn't matter which direction - what does matter is people are expecting something soon.

So with consolidation, there's not nearly as much surprise.

If it's a good chart, you should still get a bounce, but it'll be weak and may not fully return to the base.

This is also why buying "slow grinds" don't really adhere to Lucs method either.

Even if a slow grind 'cracks' a base, nobody will be surprised by it.

The greater the market is surprised, the bigger the overreaction (and panic) will be, which both makes the trade safer and more profitable.

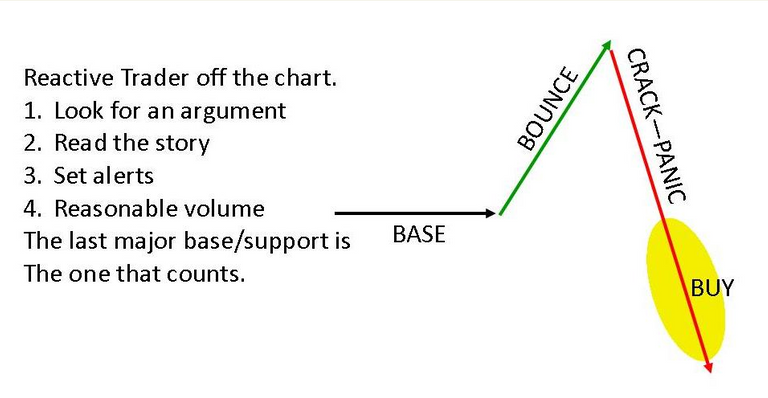

@fulloflife, if you look at one of Luc's original videos he discusses the argument. It means there are a lot of people involved in trading a particular coin, there are a lot of buyers and a lot of sellers. The argument is what the price to buy at or sell at should be. There is a lot of activity and good volume. Hope this helps.

Luc made his method very clear and I thought I understood that but what did I miss? How this much of a simple method became so complex for me ? :-( When I am watching Luc's videos and when he looks at a chart, I draw the bases in my head before he does and most of the time Luc also marks the same bases as I do. I am so confused now :-(

I dont know how you can find fault with this chart..

After a serious sell off and panic from 09s all the way down to 04s.. (that was an insane painful panic) it gives you a huge monster bounce back to 085ish.. That is screaming "i respect my bases!!!" ... like no matter how hard you push down XVG, it just gives you that monster bounce.. beautiful

Thank you man Thank you very much.. For your valuable time and all.. I am studying your chart very well now..

Even now I just found my biggest mistake (I hope)..

I am so stupid that I zoomed in the chart and marked the bases, with your chart I see how much of a fool I am...

Next time I'll zoom out as much as I can and mark the bases. You are always right.. These are so obvious bases that I missed. The reason was I thought those bigger bases won't brake again so I zoomed in and found little ones and thought they are the bases.. How fool I am :-D

Now I see clearly..

Next time expect me with a good marked chart :-)

Thanks to you I think now I have a clear mind..

Thank you again marking the chart for me that was what I really wanted, I can't thank you enough..

Thank you all others who replied me also.. upvoted all

Hi Luc. Please, If you have time (a bit), help me with this. I realized if there isn't a good fight (the method doesn't work - APM x example). When a coin suddenly increase its value, it is like a snowball, everybody wants it. I tried tried your method in this kind of coins, and I got a lot of action (and didn't fail) because it is very easy to read, the % are huge. It works even in a 3min timeframe so I am testing as much coins of this as I can. It is like ETH/USDT for a short period of time. So, this is the way that I look for an argument. What do you think about this? Thanks for any help on this idea.

great video thanks! been watching some of your youtube videos. Most of your videos are based on finding bases and them being cracked which happens on a downtrend but are you implementing a similar strategy for a coin thats on an uptrend?

Just wanted to say thanks Luc. I started following your blog and youtube videos a couple of weeks ago and I've reached a big milestone for my account. Thanks for sharing the knowledge with all of us.

Great post! Thank you so much for providing your continued insights. You provide a great blend of theory, examples, and exercises such as this to help cover so many aspects of smart position trading and profit retention.

I have a question in regards to the tax aspect of taking profits. I am considering converting profit coins to dollars and taking out this year into an account outside of trading. Have you taken out and deposited in a bank account? If not, have you researched this and decided how you would approach come tax season? Boring question I know! But this is something I hope you could shine some light on from your experience as a trader for many years. I know that it is a grey area right now in crypto, but I would prefer to be safe than sorry in case law becomes more solidified as the market is being looked act by larger institutions for investing. Trying to do this with all angles covered. Thanks!

It will depend on your country. Here in Canada, I declare any coins that I switch to fiat, as regular trading income. However, I do believe for most investors, they would be able to declare the profits as capital gains, and then you pay tax on only half the profit and the other half is free and clear.

Like you I would rathar be safe than sorry, so I declare all coins that get converted to fiat as income.

Ok thanks. I have read different perspectives, such as how if you buy bitcoin with USD, then when bitcoin rises you purchase an altcoin, you would have to capture those gains in your tax return for that year. I also know the perspective that you only need to capture gains if you convert to fiat. Could be this year or in a few. Since exchanges are constantly changing, your gains or losses can't be presented as a proper picture until returned to fiat. Also using other examples, if you sold a house, then bought another house, you aren't taxed on same asset type. Does this make sense? You trade a lot as your charts show, there is no way I could see you being able to capture every gain as you convert one crypto to another. I know Canada has a different tax code than US (where I reside), but believe there are similarities to how the timing with both. Thanks again for your time, the past month or two has been a great learning experience and trading philosophy that could perhaps change many lives that see your method. As a side I researched into several including Neo, and when I saw the rebranding from ants and a couple other points I bought in, only a couple weeks ago but that's all it took, man things go fast.

@constipatedbear, I think, as we've seen, we're going to have to wait until BTC levels off or pulls back a bit. People have sold their altcoins to buy BTC and have caused drops in altcoins. I've seen it in 6 coins I'm holding now. Patience is a requisite until some normalcy returns to the marketplace. Just my opinion.

I sure hope so. One of the altcoins I bought 12% below a base went to 50% and is now slowly climbing back. I wished I had bought at that 50% but I didn't know it was going to be such a deep dive. @quickfingersluc, any tips on catching bottoms?

thank you for all your videos!!! I am really enjoying watching them and learning to trade cryptos. Its fun, exciting and a real gift.

A thing i am curious about are taxes. Do you and if so, how do you file taxes regarding trading cryptos and trading stocks? This is very new to me, so any pointers would be appreciated.

Really stupid question but I just started to use coinigy and my chart box is way smaller than your box is. Is there away to increase the size without going full screen?

Luc also was wondering if you could give some of the details (behind the scenes ) of your trading set up. What works for you, what equipment you use etc. I just saw a pic of it on youtube and wanted to know what it consisted of and how you use it.

I take trading pretty seriously, so my set up is elaborate.. I have my computer build for me (completely overkill) then I have 5 monitors.. 4 are over 40 inch screens.. Basically a wall of tvs.. Even a carpenter built my desk for me. I do this for a living, so I want good tools. I like to think of my office set up like a airplane cockpit. Everyday I sit down and get ready to play this giant video game that pays me in real money.

Thank you so much for getting back to me. I have just started your video series and have only been trading for about a wk now. If ever you have another meet up .... this Mississauga, Ontario resident would love to attend. I think what you are doing is awesome and would love to learn. I am really interested In the crypto side and hope it last for years to come. I am starting with about $500 and hope to follow your advice to grow it. Thanks again

Sorry for jumping into this Luc.. But could you please check my above reply and make a comment there. It would really help me... Because I am clueless and confused of what did I miss..

Hi Luc what do you think about the current panic (in BTC terms) that's happening. I'm using your method for LTC, ETC, DASH, XMR and BitBay (all great charts) but I'm feeling the heat because I bought a little early and they haven't re-bounced yet and are dipping even lower (knowing how deep a coin is falling is really hard to tell ;).

Do you think some will not bounce back and we have to work from a new lower base (like what happened with AMP) or because it's such a big panic it can take a week or something to go back to the previous base?

I Like your opinion on this because we're dealing with a serious dip here.

If you read the chart effectively and buy in when you really see a panic, then you should be fine on most trades, regardless of BTC.. but no trade is ever 100% guaranteed, and you have the adavntage of understanding why these alts are falling (because BTC is running up hard).. This is a big advantage, because your alt coin could be falling off a news type event, and that would trump all the technicals. But if its falling off BTC then nothing is really wrong with the coin.

so consider this.. take your trades to the next level, by taking into consideration BTC... let me explain..

So if your in Alt trades and you know that its a result of BTC running hard.. then when BTC corrects, you should be able to sell at a profit, but what happens if a few of your trades don't bounce as high as there bases, then you should sell at break even or even a small loss, If you feel that BTC has made its low, and your other alts have made the bounce you expected, then you have to assume that you might need to peel off some of the weaker ones... BTC is your guide in this case.. also next time you see that BTC is running up hard, you should allow for deeper panics on the alts before you start positions..

Im my case, as soon as I realized that BTC was starting to breakout, I sold whatever Alts that were in trades, and I have been only trading BTC since then.. All the Alts that I have free coins in, I am not touching. I only closed out the trades that I was presently in (a few days ago). Once BTC corrects and settles down, I will resume trading alts and creating free coins to add to my portfolio..

Thanks quickfingersluc! I feel like this basically covers my question above. Thanks again for taking the time. I feel very grateful to have this access to your way of seeing it all. Steem is great!

Just a quick question ---- Your thoughts on trading in and out of bitcoin vs Fiat?

Like riding a upward moving elevator- while trying to find a faster one? Some coins break bases with no bounce because btc is trending up? Couldn't find any thing on this in any of your videos. I do love your videos!!

@quickfingersluk I'm convinced to come into criptos, I've Been day trading penny stocks from time to time, with some success, nothing explosive but mostly greenish, only parabolic set ups , after seeing your videos I'm amazed on the simplicity of your trading.

However it is amazing and you made me realize that I'm getting late to jump here I'm opening accounts on every exchange that a-pears on your videos, I have no idea about cryptos but I'm researching, if I were to fund one to start building my account and test the waters which one will you recommend , I'm planing to open one per month. Thank you!

My favorite is Bittrex, mainly because there panic dives on BTC and ETH usually go lower than many other exchanges, yet they are very liquid.. Kraken is the safest exchange in my opinion, and works with Fiat (usd) instead of tether (usdt) which is getting some bad rumors lately of legal troubles.. Hitbtc uses Fiat also, but i constantly have issues with there platform freezing up.. Poloniex is another big one, but they have had issues lately, entire site going down and I have moved all my money out, while they resolve out there issues. Cryptopia and Liqui are pretty small, and most of there coins have thin books..

@quickfingersluc Tx, I just opened a Bittrex account but I'm from Europe.. so I'll have to buy usdt first with my eur before I will be able to start trading?

Would it be better for me to open a Kraken account and work there directly with fiat (eur?)?

Bittrex and HitBTC have much much more opportunity if you have a small account.. but Kraken is safer if you are going to start with a big account (no USDT risk).. So i don't know, depends what your plan is..

@quickfingersluc, I want to start trading crypto and experimenting with your strategy with a few EUR100.

Not having to buy coins immediately before I can trade on Bittrex seems the easiest, but I don't trust Kraken that much... Any recommendations?

I'm also from Europe and using both Bittrex and Kraken. You could buy coins with fiat on Kraken and move them to Bittrex either directly or first to your own wallet and then to Bittrex. Directly moving between exchanges seems not advisable, not sure why. I moved some small amounts of bitcoin from Poloniex and Hitbtc to Bittrex directly, takes a couple of minutes (maybe 15 max). You should know that every transaction always has a (small) fee. You can find your exchange wallet address in your account at the exchange or create one, mostly found under an option called something like 'Fund'.

Thanks @ludocoinz ! Do you also trade directly on Kraken? I read a lot about problems with errors and lost coins at the platform..

And would you trade at kraken with eur (or usd?) or buy usdt - move them to bittrex and trade there?

I have eur at Kraken, one of the reasons I chose Kraken so I can deposit and withdraw eur. Haven't got any usd(t) and also didn't move anything from kraken to bittrex. only from poloniex and hitbtc to bittrex. Two exchanges is enough I figured and Bittrex has a lot of coins.

I do use coinigy to trade because of the very good interface and it's the same for any exchange. Connection with the Kraken API is not 100%. Seems to be a problem at the Kraken side because I did some scripting against their API and their I get several timeouts per day. Haven't lost any coins, but sometimes tried to cancel a buy or sell and that timed out. That could cost you a trade..

Coinigy to Bittrex is very stable and fast. Another reason to conclude that it is the Kraken API that has issues. I am on a paid subscription for Coinigy.

Do remember though that Coinigy is always a little behind the real data. So you might want to have your exchange logged in as well if it were only to get near realtime updates. But I prefer to use the Coinigy UI.

He is removing his precious time in making these videos and replying to us. So we should also give back the favour and make his blog visible to as many people as possible.

Even if you are brand new on Steemit and have 0 followers, Steemit algorithm will make Luc visible higher because of our upvotes.

Thank you for helping promote my blog... I really don't have much extra time, as a full time trader. But as long as I see there is interest in my blog, I will find the time to keep making videos and answering questions.

Your videos are amazing ! the 'base' technique makes sense and it really looks so simple, but we (trading newbies) need more experience in these chart's as most time we setting up our bases in wrong place ;)

Anyway, my question is about daily ROI which we could achieve from position trading. If we set up the alerts, many alerts, from your experience how many trades its possible to do on daily basis and what ROI we can expect from each trade? like 1% , 5% or even 10% maybe ?

thats an impossible question.. Its always different.. sometimes I make 10% on a trade and sometimes I make 250%.. its all over the place.. what I can tell you is, I dont even set any type of goals.. I just make sure each trade has very very high odds.. and I dont worry about return on investment, or how much I make for the week or month..

Think of it this way: lets say you have $500 to start, and on your first trade your buying $50 worth of XYZ coin and you make a great 10% trade profit of $5.. awesome!! but now are you going to start to focus your attention on how much you can expect to make each week? (5 x 20trades =$100 per week if every trade is perfectly the same) $100 a week seems like alot of work for nothing... However if you just focus on really trading awesome, following rules, buying at the right spots.. then in 6 months you will be sitting on a balance of 5,000-20,000 and you wont believe how fast it grows.. then in a year, you may have $50,000 in your account and you will still be making the same trades, just with an extra few zeros attached.

With a market like cryptos your account can ballon so fast..

Hi, I am a young trader. I have done well trading the markets so far but who hasn't lol. I would like to have someone to bounce ideas off of and look to for advice. Do you have a steemit.chat, discord, or email I can reach you at?

there is a slack chatroom that one member of our group created: quickfingerstraders.slack.com .. I'm in the room sometimes, not today, (just too busy) but i visited yesterday..

I struggle with these situations where you have the sharp spike but since its not from the result of a panic dive would you feel comfortable using that as a new base? And if so where would you start buying? This looks like a chart that can yield some sweet position trades.

A sudden spike like that does not create a base usually, it can be the result of sudden news or rumor that runs the price up, but the price where the news came out does not hold much significance for the big investors. Its just where the news broke...

When the price is falling and then stops and reverses with a huge spike, thats tells us that buyers are sitting at that low and would not allow the coin to go any lower. Thats a price that is significant.

But if a coin just suddenly takes off, without hitting a support level, then we are left wondering what changed? why did it just take off all of a sudden? You see, we don't know the story, and we don't know for sure if the take off price is significant. Trading shouldnt be a guessing game, you need the odds always skewed huge in your favor. I only take trades where I understand my odds.

Thanks for the reply Luc, makes perfect sense. So the story were watching for now is where we will get the spike from what seems to be an inevitable panic dive at some point, then we have a clear base to start working off of again with this chart.

"Trading shouldnt be a guessing game, you need the odds always skewed huge in your favor. I only take trades where I understand my odds." --- words to live by, this simple statement is what most traders get wrong.

Hi Luc I am so grateful for all the things I am Learning from you everyday,

I just want to note that I subscribed with Coinigy but I had a big issue regarding Latency when I contacted Coinigy they confirmed it, I just wanted to let you know, I have the full post here you can check it and see for yourself: https://steemit.com/coinigy/@carlblue/coinigy-delay-on-realtime-trading-confirmed

I did not make a specific video on that because I want this blog to focus on my main method of trading. Its not easy to judge true breakouts, they often are false breakouts and fall right back below the break out point.. 1st you have to be sure that there is a huge volume increase, to signify that there is some type of catalyst, like news, or a pump room, or something big driving the price. Then the first pullback near 50% of the initial move is the safest spot. However you need a quick run back above the present highs to keep you in the game, otherwise if volume dies off and its been a few minutes without atleast some signs of extra bidding and or some buying, then you have to be looking for the exit fast.. Its tricky to trade breakouts safely...

hey luc! where's today's video! we want daily videos! haha! rewatched your market scanner video after a rough trade today. wanted to show you what made me go 'woo' out loud just an hour later!

Thank you for the reply. I've zoomed out as much as I can. But in your chart I see you are only looking at a one month chart. So your chart is zoomed in than mine. Is that OK? I am pretty confused right now.

I'm also a newcomer but I think you should zoom out a little more to see the history of the trade. From what I understood I think that (going from left to right):

1st drawn base: ok

2nd: it doesn't have a good runner up

3rd: If you have a base right at the bottom of the whole graphic in the last days of August it's ok

4rd: (first one after the runner up) is not a good base, you don't have a strong depression nor a good run up

5th: same as the 4th, a little better because it has a nice drop but not a good runner up

6th: it's a nice base.

I have added about 30-40 price alerts and after a day i havent reached any alert point. I am doing something wrong? Should i start getting alerts after one day if i put alerts in right place and determined the base correctly?

check to see if the price has hit your alert. Sometimes I dont get buy-in alerts which isnt very good so i have to manually refresh my account like here

Hi Luc,

I am just a newcomer and I bumped into your articles recently. Great job you have been doing so far. Please, I have been trying to access the past videos since the inception of your trading articles, but i was told the videos are no longer available. Is there any other way they can be viewed? Thanks

Congratulations @quickfingersluc! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIs there a slack room for this type of trading? If so can I get an invite please.

check previous post and comments.

QuickFingersTraders.Slack: https://join.slack.com/t/quickfingerstraders/shared_invite/MjIyNDkzMDk4MzU4LTE1MDE3NTM5ODctOTA0NTNiZTc1OQ

Fully deserved! Thanks Luc

Well deserved! Thanks a million Luc.

This reply is just to thank Luc for all his time,support and good will :-D

Thank you very much man you are changing lives of all of us!!! :-D

Upvoted ++

I've been selling some BTC to take some profits off the table, but I'm secretly wishing for a pull back down to that $3000-$2500 level ya know lol 😁 #InCrytposWeTrust

and BTC is so fast that others coins cant pull up ;p I was thinking that was end of panic, but it wasn't ;p Now when I'm reading Your text I lough because I have couple of bucks and other coins and no btc ;p Waiting it's boring :)

I was wondering how you deal with taxes and capital gains? Since I dont ever pull money out of the exchange to my bank account does the IRS consider every trade taxable one by one while its still on the exchange or does tax not come into play until year end? I trade coins as well as sell coins to USD but I have not pulled anything out and dont plan to for at least a year. Thanks.

Thank you, Luc! Another masterpiece! All Luc's videos are very helpful.

I noticed though that there are people who still don't understand his trading method. I've got a friend that criticized and had a twisted interpretation of it. I clearly noticed that he didn't understand it properly because since I started following Luc's teachings I didn't lose any money and I'm making free coins all the time. Although everything he explains is simple to follow, it still requires some dedication to master it. In this community, all the information necessary is explained over and over again in many comments. I wish everybody good luck in your trades!

I'm glad your having success and I appreciate your words of support. I knew, when I started making this video series that there would be many people who cannot grasp my methods, even tho they seem so simple to me. But its great to hear a few that grow there accounts and realize that it does actually work.

I believe some people won't grasp your method but the knowledge is here for anyone, anyways.

Some people may become frustrated for not being able to understand it quickly, but it's part of the game. Maybe the same person will check the information again in the future and then understand it. Not everybody is the same, not everybody has the same rhythm to go along the learning curve. In any case, what you are doing is amazing. Will change many people's lives, for sure!

Luc, Would you be kind enough to do a video these days explaining a bit about this massive drops in alt coins?

All my alt coins position have broken bases and are in a free fall.

Now, the question is to keep on buying more or just wait for all this mayhem to finish and wait for the coins to reach it bases and sell.

And as an experience trader what would be your suggestion to newbies like us? Thanks in advance :)

Hey Luc,

I'm new here so I wanted to show you some current graphs with bases drawn. Would you please review the bases?

The first one is bitcoin. I was wondering whether (now it is below the base I have drawn) it is safe to buy?

The second one is Litecoin. Basically the same question.

Third one: GNO. I am not at all certain about this one so please help me out.

Last one: ETC. I hope to buy this one as it looks good to me. I forgot to draw the last base. (Around that argument, it has already passed that one as well)

Thanks Luc. I love your vids. Keep them coming. Don't spend too much time answering. Just some short feedback would be nice.

Again a great video @quickfingersluc. Very clear to follow and nice strategy. I'm new to trading and i've bought a share of IOTA coins which are now sky rocketing. I already took 50% out of the investment , breaking even. But indeed this leaves me with less margin for the future. Your strategy of selling 30% of your profits at these situations and buy back when sell-offs or corrections occur, is great. I will try to follow that 'rule'.

One thing however that is difficult still to master is when bases are broken. Your videos make it look like a child's game. You seem to be spot on all the time on the lows and the highs, but the only thing i see at a moment in time is.. ok this can be a base.. hmm what should I do.. is it falling, is it going up.. how long is it falling, how long is it going up, at which point do I take a position or a sell..

And next to that what I would also be interested in is how you deal with drops instead of rises. Let's say you have a position in BTC at 3800$ and now it starts dropping from 4100$ back to 3800$. Do you wait? do you anticipate at 3900$ to sell that trade ? What are the best options?

Still a lot to learn :)

Cheers and happy trading !

I would also like to add that it would be great to see you (Luc) drawing your basis in real time as the chart is unfolding so as to get a better feel and perception of when to draw a base. Like with etherem right now, I am not sure where the base should be, if at all there is reason to draw one right now.

Really appreciate your videos!

and also @quickfingersluc when do You feel that is the end of panic and drop. How You see it on the moves in sells/bays? and wherever you pay attention. I have seen ones "big fish" when they first took 200 $ from BTC to 3800$ and stops panic on few others coin and then pull up btc too 4040 in few minutes(other coins drops long red vertical line in minute).

And @quickfingersluc really thanks for everything what Your doing. You really changed my life ;)

I would strongly suggest to check this:

https://medium.com/@bitfinexed/are-fraudulent-tethers-being-used-for-margin-lending-on-bitfinex-5de9dd80f330

It might explain why we have this rally on BTC and why Tether is hot potato.

@quickfingersluc could you please comment on this one?

Oh my, thank you very much for posting that link. I have been hearing warnings about tether and bitfinex from a few other followers and I love seeing stats and numbers. That article gives me alot to consider. As a safety, I will start moving money out of tether for now, I have way to much and I will investigate this further.. But if there is any truth to this, there would be such a huge dive in BTC when this tether thing implodes.. sheesh

I sent a private message to you on the Slack regarding this topic. Check it out when you have a moment. Thnx

Another article on the same topic: https://hackernoon.com/meet-spoofy-how-a-single-entity-dominates-the-price-of-bitcoin-39c711d28eb4

Hi Luc and other more experienced fellow Crypto-traders,

I have a question:

I am currently trading only on Bittrex and do not intend to do multiple exchanges until I have more experience and more funds. I appreciate that there are only so many opportunities in a given day to buy positions and/or sell positions. What is the maximum trading per position before this cannot work? I imagine that I would be able to trade a larger amount of BTC per position in a coin like Ethereum due to its high volume. But with some other lesser Altcoins, I cannot be purchasing, say 10 BTC every time it cracks a base as otherwise I would be causing a surge in the price.

I guess what I'm asking is what volume/turnover of BTC is someone like Luc trading on a daily basis?

I've seen Luc say before that he just tries to fit in with an average buy for those smaller volume type coins. With many of the smaller coins you just don't want to stand out and you should be fine. If the coin itself has a volume of 50 bitcoins a day then yea putting 10 in as a buy could be a risky proposition. Putting 1/4 of a bitcoin would probably be just fine, but again it all really depends on the coin, the point to be taken is with the lower volume coins to just blend in with the other average buyers.

Thanks for answering for me.. Thats exactly right, blend into the normal action.. That's why all the big trades need to be in BTC and ETH and larger coins where you can execute large trades without effecting anything

How do you calculate "normal action" for a coin? In other words how can I determine the maximum amount I can put into a trade without effecting anything?

Look at the lvl2 data, compare the bis and the asks. You can also look at the market dept for visual conformation, although I find it only helps to identify where walls exist.

Hey Luc, I love your videos and am at the stage of playing with small trades to make sure I'm understanding how to find my bases; thank you so much for your time and effort!

I had a question on trading alt coins with bitcoin. Do you have a simple method for determining/adjusting your selling points when bitcoin is rising? I've noticed you mention you keep most of your account in USDT, but some things you'd have to use BTC for right?

I've posted a chart below for reference on my question. I made a small trade on EOS anticipating a bounce, only to see it fall way more than expected over the last three days. However, when i did the math of what i'd need to sell to break even, my selling price is lower now that bitcoin has shot up by 3 or 4 hundred. It made me realize the fall might not be as bad as it looks. I was just wondering if you might have already dealt with this problem and found a good way to process it.

First of all I see now that my bases marked blue were not as strong as the previous ones marked red so maybe I acted too hastily, but again it's a small trade just to learn so no worries. And I'm certainly learning :)

What I noticed after some calculation was that the green circle will currently net me back about the same amount I would have made if I'd sold at my original blue circle back when the buy was made at a low point. I basically just planned to sell back at my base to be safe. But at this point my base (in reference to USD dollar amount of payoff in bitcoin) is lower on the chart due to the price of bitcoin going up.

This is kind of hard to explain, but hopefully it's coming across. Just wanted to know if you had any guidance or methodology on this observation.

Thanks again for being such an awesome teacher!!!

EOS_question_8-13_marked.jpg

So you put your base at 0.00051? I did as well and bought at 0.00047+ and now it went deeper than I expected.

Yep, that's about what I was thinking. However with Bitcoin going up and Eos going down the spread is getting farther apart. So now I can move my sell point lower and still make roughly the same as if it had immediately bounced back to my base. It can get a little confusing trying to calculate it all though.

Just to revisit this for clarity, I bought EOS at 0.000491 when BTC was at 3570.

Right now I could sell my EOS at market at 0.000400 while BTC is at 4100 and I would almost break even. Though even when zoomed out to a full month on an hour chart the difference from .000400 to .000499 looks huge.

It's tripping me out a bit. On the chart it won't look like it came back to base, and I'll have less BTC if I trade it back now, but in relation to USD it'a about the same.

I agree, It seems that it will be difficult to make an actual profit in USD or EUR.

When BTC is going UP, EOS will go down and visa versa.

At the end you would like to exchange it to USD(t) or EUR but you can make fantastic trades in EOS/BTC but your result in USD could be the same as you bought it. I probably don't express myself clearly but I understand your question :-)

Now, it's time to create a strategy :-)

I hope Luc replies soon, but I am not too worried waiting it out as all these are supposedly 'good' charts that will rebound one way or another.

Lovely video again, very informative and simple!

I have been following your advice and learning how to trade on the dips, but also doing some day trading when I have time. When I first started to play with cryptocurrency I lost 50% of my investment, but after following your advice I managed to 3x my initial investment! THanks a lot!

I am still learning so hopefully I can get some advice if my bases are correct.

Is my safe circle correct here, or I should follow the red bases?

Is this safe circle correcT?

Hi flofix, if you don't mind, what method did you use to get your pics to show up inside your reply? The few I've tried so far have just given me a link. Thanks.

To post image you have to download your image from coinigy on your computer.

Then go on http://postimg.org then upload the image. Get the png extension named as direct link.

Then come to steemit and post this code:

You will need to keep the links in the brackets ()And you will see your image uploaded on Steemit.

Cheers!

Cheers to @cryptotradings I used his mentioned method.

This is a must read @quickfingersluc :

Well, I hope this holds no water, because 1. He bought randomly without any thought 2. It was only the last 2 months (unless he's expecting to day trade?). If it does, my altcoin positions (even though I bought well below bases before they went down another 40%) are screwed

Yea this guy seems to have done it pretty poorly. It seems he had no strategy at all for trading. I feel like the majority of people who get into crypto investing and trading are similar to this guy. Thank God we here found Luc and his strategies.....btw nice find @tizzle

Avoiding the trading stress by just buying and holding. Bitcoin may dip but will be back . May lose some unrealized gains but I save many hours of trading and stressing out. With trading, one bad call and you lose all the gains you made.

Can't Downvote, otherwise I would. Lucs strategy is about using coins to make more coins, which you hold long term, allowing you to cash out your initial investments while growing your portfolio. It's a lot safer strategy than buying random alt coins whose investors made millions during an ICO with nothing more than a white paper with a promise that someday the project will be coded without any commitments.

Do you think that most alt coins are false promises or that there are some out there that are legit?

Think of it this way : when was the last time you saw a major stock ipo with nothing more than a white paper and a promise? You would get laughed at for investing in a company like that on Wall Street, yet this happens daily in crypto. You gotta accept that this is a bubble just like the dot com bubble a decade ago, you can still make bucket loads of money in a bubble - by trading to exploit inefficiencies in the market. Buying a random project to hodle without any evidence of the company's product (ETH and NEO are legit) is gambling as I see it, but there is nothing wrong with trading that project to profit off the backs of others who are the "dumb money" in the marketplace.

When it starts to fall, will be a free fall.

No matter how much it'll fall, that's just one more reason to buy.

Excellent video! I have been crying for about to trade crypto currency and foreign exchange currencies. So much great information

Thank you again Luc for another video and some more pure nuggets of gold! I have started trading your method with absolutely free coins made from faucets and have invested nothing at all, so this has been and still is a challenge to make it grow, especially when I make mistakes! lol

I don't know how you do it, but you make these big drops look very fun. MATH FTW.

Thanks for the info. As usual, love your work. Cheers. Upvoted.

Simple question for everyone: do you prefer to place your buy/sell orders through Coinigy or directly in your exchange (ie. Bittrex) ?

Up to now I've been using Coinigy but I am not sure if it adds delays to my transactions.

I put my orders using coinigy my exchange is bittrex, usually i do this to find out what happens with my orders in coinigy:

Open coinigy and bittrex in another tab in my browser.

put an order in coinigy

Change to bittrex, this shows a small windows to the right informing how the order is filling up.

The orders are sometimes filled incrementally, bittrex shows that, for example I sell 100 eth but one buyer buys 30 units, another 30 and another 40 bittrex shows the three purchases. Bittrex show every movement in your order.

Coinigy only shows that the order was completed when it was filled to 100% in the last buy.

Sometimes an order seems to be stuck but what happens is that 90% was sold and the remaining 10% is not completed, nobody buys it because for example it lowered the price and they are buying new cheaper orders.

Very interesting observations :)

I will definitely try it. So if I understand correctly, Coinigy is not really adding delay but simply not reporting every movements.

Also sometimes coinigy does not show when the purchase (or sale) was executed, that is fixed by clicking on refresh.

But the command was executed just coinigy does not show it in time

I recommend using refresh button every time you notice an inconsistency between the exchanger and coinigy.

Yeah, I even had an order that was filled that still showed unfilled and I was wondering why it didn't sell when it hit my target price.

Coinigy for Kraken sucks for me, it doesn't just delay my transactions, they fail altogether most of the time, and sometimes they 'fail to execute' but ended up executing. So I ended up double buying. No problems on Bittrex though.

Thanks for your feedback !

It seems ok on Bittrex for me but I had a doubt when I compared Level 2 data from Coinigy to the one in Bittrex itself. Level2 on Bittrex seems to have a lot more activity and to be refreshed more frequently.

I'm 100% sure it's a problem on kraken's side as I'm having exactly same issues when using theirs cryptowatch site.

Everbody seems to be buying bitcoin by selling the alt coins, they are all going down. I am hoping for a rebound so the alt coin prices climb again.

Hey @quickfingersluc, as @amaralluis here has pointed out, some alt coins are breaking bases due to the huge selling off to purchase bitcoins, and while I tried to catch those falls, some falls went deeper then expected, but as people are selling them to buy bitcoin (not really a panic sell), will those still rebound to their bases?

Case in point: https://www.coinigy.com/s/i/598fc9f59f61c/

I had drawn my base at 0.0000052

On another note, thanks so much for taking the time to post all these videos, I have been actually making money and it's hard to believe.

I stuck with 2 altcoins! i am waiting the same.

@amaralluis, I've been watching this too and have come to the same conclusion about the sell offs. Perhaps when BTC hits it's ceiling for this run up people will sell off their BTC and buy back into the other altcoins. Good reason to hold on to your altcoin position... I think.

Me same but it will be long run. All my bases were broken and I was thinking that I choose greedily 20-30 % for safe, but it wasn't ;p

thanks again for all the video's.

I'm a bit in doubt about GAME...

https://www.coinigy.com/s/i/599010225f5d8/

Was that a base, or did i read the chart wrong?

Thanks

That base is a bit too weak. 0.0006 is more like a base!

ok, but why is that? because from the base i drew it went up almost the same % as from the 0.0006 base...

So i wonder why 0.0006 is more a base than the one I drew?

I'm a beginner so I'm just trying to understand what is the difference :-)

I'm by no means an expert at all, I actually just started trading as well! However, It seems that when it hit the 0.0006 mark, it actually went up past 0.001, nearly double what the run up from your 0.009 base that you drew.

interested to know if the base lane was drawn correctly.

Personally i think this was not a base as the price movement was so big before the the drop, but on the other hand I think the price will still reach the base.

Quick Question for Luc: I'm seeing different things in the charts depending on the view. Ie 1 hr and 1 day. 1hr and 3 days. 1hr and 1 week. In general you see the biggesting gains on the 1 week view. You see smaller gains on the 1 day view . What do you recommend for beginners. Which is the safest chart view to watch when first starting. Second does the overall trend line up or down matter. My guess is a trend line up could be a bit of an insurance policy on a trade? Thanks again for the posts. Thanks again for sharing. Your trading strategy is the best I'm come across to date.

Safe are very small purchases until You learn. Better 10-20 small in different coins than big in few coins. Even if You make mistake You will lose only cents. And look for Luc's favorites. He shows them in one of the latest videos.

P.S. Luc's recommended 1h chart. First You pull back the chart to see 2 month history and choose bases and if they have always pull back to the bases(if there always a pull back those are the safest). And You measure avarange panic to predict another drop.

And in some video he listed the safest. But I dont remember witch one. I know ETH-BTC pair.

btw Luc Are you Canadian? You mention a Canadian exchange in your video. My guess is you are from Ottawa. Would be great to do a group meetup but understand if your time is limited. You could probably follow the Chris Dunn approach and teach courses one day.

Im in Ontario.. And I did start a small group for stock trading, a few years back.. We organized a meeting place, and met 2 a month.. But it got very time consuming, because the room would fill with people who have never traded before, and I would spend hours explaining the basics, over and over.. Since I was really the only trader in the group, after a few months I ended it..

You may think I'm crazy, but i'd travel all the way to Ontario just to do a crypto trade meetup....just can only go once a year :)

That is crazy.. because you have access to all you need here, online, with our community.. But I can see how a meetup could be fun..

i was thinking more along of the lines of hanging out for a couple of drinks and visit the city

I think, he lives in toronto

Hi Everyone!!!

This is the 3rd time I am posting this question. Really sorry for this.. I originally asked this from Luc. but he seems a lot busy so anyone is welcome to answer. And please do :-D

I marked a base for XVG and guess what proving Luc is always correct it cracked the base on 9th August and bounced back.

I wasn't aware of this because I almost forgot to check and I marked that base on 2nd August at 11.25P.M GMT+5.30

It did bounce back but I have a doubt, Did I identify the base correctly? I don't take the very bottom of a dip I take sightly up before that where the price touched 2 or more times.

I also check for the same base in the past to see how many bumps it had.

Yellow is the base I drew and red is the lowest price of that dip.

Since now it bounced back up which point I should consider as the new base ?

White line (0.000000090) or Light blue line (0.00000093) ?

https://www.coinigy.com/s/i/5989fd5834334/

https://www.coinigy.com/s/i/5989fd8eaf75d/

Thanks everyone and I really hope someone will help me this time :-)

Nipuna, I drew out this pattern, Luc's pattern, to follow and I don't see it anywhere in these charts. There is no panic drop. You might consider looking at some other charts.

Someone could please draw a base for me in this chart to explain? So I can see clearly and that's a great help also. I highly appriciate that..

You measure a power of base by looking how big its a bounce from this point/base. If its huge almost straight green bounce it's a base. If the chart bounce a few small ones from line of this base, its weakening this base.

This is Luc's explanation.

Where did Luc say that bouncing multiple times on a base (or multiple small ones) weakens the base? I thought bouncing multiple times on a base meant that the base was getting stronger?

In one of videos Luc mentioned something like that. I am paraphrasing. "Here was a base, but chart had here a few little bounces(before crosing base) so it isnt so strong now."

@quickfingersluc correct me please if I'm wrong.

Late response - but this is when it helps to understand the reason 'why' Lucs method works, beyond just looking at the chart patterns.

The reason we are looking for cracks of the base, is because the buyers who supported that price are completely caught by surprise.

Keyword here being surprise.

Because of this surprise, those previous buyers now turn into panicking sellers, and dump their positions at unreasonable prices. These unreasonable prices then get bought up by the big guys (who we try and buy alongside with) who then drive the price back up to the cracked base.

The problem with price consolidation off a base - people begin to start expecting a big breakout or drop. Doesn't matter which direction - what does matter is people are expecting something soon.

So with consolidation, there's not nearly as much surprise.

If it's a good chart, you should still get a bounce, but it'll be weak and may not fully return to the base.

This is also why buying "slow grinds" don't really adhere to Lucs method either.

Even if a slow grind 'cracks' a base, nobody will be surprised by it.

The greater the market is surprised, the bigger the overreaction (and panic) will be, which both makes the trade safer and more profitable.

@newrealms What do You mean, when You say "argument"?

@fulloflife, if you look at one of Luc's original videos he discusses the argument. It means there are a lot of people involved in trading a particular coin, there are a lot of buyers and a lot of sellers. The argument is what the price to buy at or sell at should be. There is a lot of activity and good volume. Hope this helps.

None of them. I'm afraid they are not bases at all. Look on previous bounces and %s and then you will see they don't qualify for being a bases.

Luc made his method very clear and I thought I understood that but what did I miss? How this much of a simple method became so complex for me ? :-( When I am watching Luc's videos and when he looks at a chart, I draw the bases in my head before he does and most of the time Luc also marks the same bases as I do. I am so confused now :-(

I dont know how you can find fault with this chart..

After a serious sell off and panic from 09s all the way down to 04s.. (that was an insane painful panic) it gives you a huge monster bounce back to 085ish.. That is screaming "i respect my bases!!!" ... like no matter how hard you push down XVG, it just gives you that monster bounce.. beautiful

Thank you man Thank you very much.. For your valuable time and all.. I am studying your chart very well now..

Even now I just found my biggest mistake (I hope)..

I am so stupid that I zoomed in the chart and marked the bases, with your chart I see how much of a fool I am...

Next time I'll zoom out as much as I can and mark the bases. You are always right.. These are so obvious bases that I missed. The reason was I thought those bigger bases won't brake again so I zoomed in and found little ones and thought they are the bases.. How fool I am :-D

Now I see clearly..

Next time expect me with a good marked chart :-)

Thanks to you I think now I have a clear mind..

Thank you again marking the chart for me that was what I really wanted, I can't thank you enough..

Thank you all others who replied me also.. upvoted all

Hi Luc. Please, If you have time (a bit), help me with this. I realized if there isn't a good fight (the method doesn't work - APM x example). When a coin suddenly increase its value, it is like a snowball, everybody wants it. I tried tried your method in this kind of coins, and I got a lot of action (and didn't fail) because it is very easy to read, the % are huge. It works even in a 3min timeframe so I am testing as much coins of this as I can. It is like ETH/USDT for a short period of time. So, this is the way that I look for an argument. What do you think about this? Thanks for any help on this idea.

great video thanks! been watching some of your youtube videos. Most of your videos are based on finding bases and them being cracked which happens on a downtrend but are you implementing a similar strategy for a coin thats on an uptrend?

Just wanted to say thanks Luc. I started following your blog and youtube videos a couple of weeks ago and I've reached a big milestone for my account. Thanks for sharing the knowledge with all of us.

Great post! Thank you so much for providing your continued insights. You provide a great blend of theory, examples, and exercises such as this to help cover so many aspects of smart position trading and profit retention.

I have a question in regards to the tax aspect of taking profits. I am considering converting profit coins to dollars and taking out this year into an account outside of trading. Have you taken out and deposited in a bank account? If not, have you researched this and decided how you would approach come tax season? Boring question I know! But this is something I hope you could shine some light on from your experience as a trader for many years. I know that it is a grey area right now in crypto, but I would prefer to be safe than sorry in case law becomes more solidified as the market is being looked act by larger institutions for investing. Trying to do this with all angles covered. Thanks!

It will depend on your country. Here in Canada, I declare any coins that I switch to fiat, as regular trading income. However, I do believe for most investors, they would be able to declare the profits as capital gains, and then you pay tax on only half the profit and the other half is free and clear.

Like you I would rathar be safe than sorry, so I declare all coins that get converted to fiat as income.

Ok thanks. I have read different perspectives, such as how if you buy bitcoin with USD, then when bitcoin rises you purchase an altcoin, you would have to capture those gains in your tax return for that year. I also know the perspective that you only need to capture gains if you convert to fiat. Could be this year or in a few. Since exchanges are constantly changing, your gains or losses can't be presented as a proper picture until returned to fiat. Also using other examples, if you sold a house, then bought another house, you aren't taxed on same asset type. Does this make sense? You trade a lot as your charts show, there is no way I could see you being able to capture every gain as you convert one crypto to another. I know Canada has a different tax code than US (where I reside), but believe there are similarities to how the timing with both. Thanks again for your time, the past month or two has been a great learning experience and trading philosophy that could perhaps change many lives that see your method. As a side I researched into several including Neo, and when I saw the rebranding from ants and a couple other points I bought in, only a couple weeks ago but that's all it took, man things go fast.

How is everyone dealing with the surge in price of BTC?

I think its causing all other coins to drop in BTC and creating a lot of "false positives" in terms of cracking bases.

Does Luc's method still work in these situations?

@constipatedbear, I think, as we've seen, we're going to have to wait until BTC levels off or pulls back a bit. People have sold their altcoins to buy BTC and have caused drops in altcoins. I've seen it in 6 coins I'm holding now. Patience is a requisite until some normalcy returns to the marketplace. Just my opinion.

I sure hope so. One of the altcoins I bought 12% below a base went to 50% and is now slowly climbing back. I wished I had bought at that 50% but I didn't know it was going to be such a deep dive. @quickfingersluc, any tips on catching bottoms?

Hi Luc,

thank you for all your videos!!! I am really enjoying watching them and learning to trade cryptos. Its fun, exciting and a real gift.

A thing i am curious about are taxes. Do you and if so, how do you file taxes regarding trading cryptos and trading stocks? This is very new to me, so any pointers would be appreciated.

Thx!

-Clem

Luc has answered about tax a few hours back. Just scroll down to read his reply.

thx!

LUC,

Really stupid question but I just started to use coinigy and my chart box is way smaller than your box is. Is there away to increase the size without going full screen?

No

thanks @melsporty. I wonder why my chart box looks smaller ... maybe a mac vs pc thing?

Nope, depends on your screen size

Luc also was wondering if you could give some of the details (behind the scenes ) of your trading set up. What works for you, what equipment you use etc. I just saw a pic of it on youtube and wanted to know what it consisted of and how you use it.

I take trading pretty seriously, so my set up is elaborate.. I have my computer build for me (completely overkill) then I have 5 monitors.. 4 are over 40 inch screens.. Basically a wall of tvs.. Even a carpenter built my desk for me. I do this for a living, so I want good tools. I like to think of my office set up like a airplane cockpit. Everyday I sit down and get ready to play this giant video game that pays me in real money.

Thank you so much for getting back to me. I have just started your video series and have only been trading for about a wk now. If ever you have another meet up .... this Mississauga, Ontario resident would love to attend. I think what you are doing is awesome and would love to learn. I am really interested In the crypto side and hope it last for years to come. I am starting with about $500 and hope to follow your advice to grow it. Thanks again

Your set up is amazing and does indeed look like an aiplane cockpit. Th and for shRing your skills with the rest of us.

@quickfingersluc

Sorry for jumping into this Luc.. But could you please check my above reply and make a comment there. It would really help me... Because I am clueless and confused of what did I miss..

Thank you..

i responded, and drew up a chart for you

Thank you very much Luc. I can't thank you enough..

You really helped a poor guy :-)

Hi Luc what do you think about the current panic (in BTC terms) that's happening. I'm using your method for LTC, ETC, DASH, XMR and BitBay (all great charts) but I'm feeling the heat because I bought a little early and they haven't re-bounced yet and are dipping even lower (knowing how deep a coin is falling is really hard to tell ;).

Do you think some will not bounce back and we have to work from a new lower base (like what happened with AMP) or because it's such a big panic it can take a week or something to go back to the previous base?

I Like your opinion on this because we're dealing with a serious dip here.

If you read the chart effectively and buy in when you really see a panic, then you should be fine on most trades, regardless of BTC.. but no trade is ever 100% guaranteed, and you have the adavntage of understanding why these alts are falling (because BTC is running up hard).. This is a big advantage, because your alt coin could be falling off a news type event, and that would trump all the technicals. But if its falling off BTC then nothing is really wrong with the coin.

so consider this.. take your trades to the next level, by taking into consideration BTC... let me explain..

So if your in Alt trades and you know that its a result of BTC running hard.. then when BTC corrects, you should be able to sell at a profit, but what happens if a few of your trades don't bounce as high as there bases, then you should sell at break even or even a small loss, If you feel that BTC has made its low, and your other alts have made the bounce you expected, then you have to assume that you might need to peel off some of the weaker ones... BTC is your guide in this case.. also next time you see that BTC is running up hard, you should allow for deeper panics on the alts before you start positions..