How are the top DEXs doing compared to each other.

Uniswap is now the incumbent in the DeFi industry. It has been around for five years. A long time in crypto. In the last period it has expanded to multiple L2 chains providing cheap swaps. It even created its own chain Unichain.

Jupiter launched almost two years ago and has grown fast in the booming Solana ecosystem. It launched a token in January 2024 that further increased its growth. In the last period the overall activity on Solana seems higher than Ethereum and it looks like it is the case for Jupiter as well.

Let’s take a look how is the protocols are performing under the current market conditions.

Here we will be looking at:

- Total value locked

- Trading volume

- Top exchanges

- Number of users

- Top Pairs

- Price

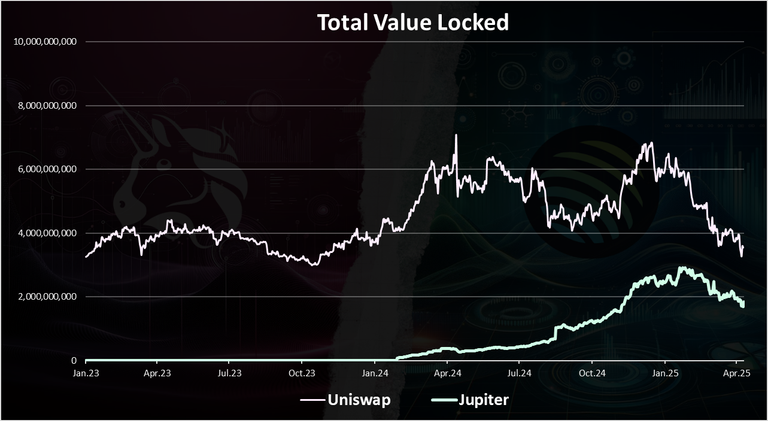

Total Value Locked

Here is the chart for the TVL on Uniswap and Jupiter.

The chart is from January 2023. Uniswap has a much longer history, but Jupiter has a shorter one, ergo the period.

We can see that Uniswap is leading when it comes to TVL. It has been in the range of 4B to 6B lately, but Jupiter has grown a lot and at one point it was at 3B in TVL. In the last period it is around 2B, while Uniswap at 4B.

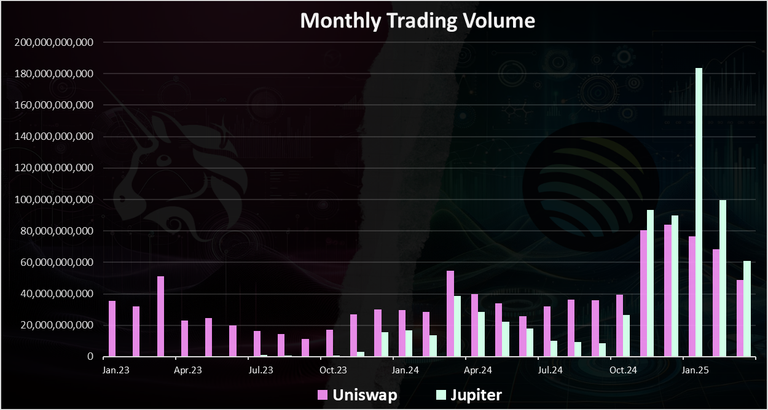

Trading Volume

Trading volume is extremely important. That is where the fees come from and the APR for liquidity providers. No trading volume means no fees and no capital in the protocol.

The chart for the trading volume looks like this.

This is a chart for the daily trading volume. It’s quite volatile.

Here we can notice that Jupiter has basically reached the trading volume on Uniswap, especially in the boom in Q4 2024 and January 2025.

In the last months these two seems very close to each other with a lot of volitily in the volume going from 1B to 10B per day.

The monthly trading volume looks like this:

A clearer picture here than the daily volume.

Here we can notice that since November 2024 Jupiter has basically overtaken Uniswap in terms of trading volume. Quite the moment in the DeFi space. Seems like Uniswap has finally found its match. Although this probably goes for the whole Ethereum ecosystem, it has been heavily challenged from Solana and its apps.

In January 2025 Jupiter reached an amazing 180B in monthly trading volume. This is due to some high profile meme coins launched including the TRUMP token that went live on Solana. In Marh 2025 the trading volume is around 60B on Jupiter, while 50B on Uniswap.

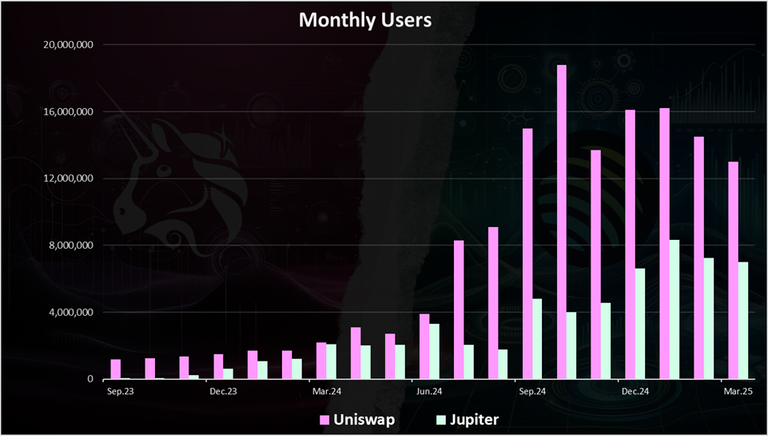

Active Users

How are the protocols doing in terms of active users? Here is the chart.

Impressive growth from Uniswap in the period! From under 1M MAUs up to 18M in October 2024 when it reached its ATH.

Jupiter has also grown and reached 9M MAUs in January 2025. In the last month Jupiter is at &M, while Uniswap at 13M.

Uniswap has grown its users thanks to the expansion on other L2s where the fees are cheaper.

In terms of DAUs, the numbers for the both apps are now around the 1M mark.

Top Exchanges in Trading Volume

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

We can see Uniswap and Jupiter here. Jupiter is now higher ranked than Uniswap, but just by a little bit. Amazing that there are now more than one DEX that compete with the CEXs and are in the top 10.

Top Trading Pairs on Uniswap

Here is the chart for the top trading pairs ranked by liquidity.

The USDC-AETX pair is on the top here, followed by the WBTC-USDC. Then comes ETH-USDC etc. Amazing that an ETH pair is on the third spot.

Top Trading Pairs on Jupiter

Here is the chart for the top trading pairs ranked by trading volume.

The USDC-SOL is on the top here followed by a stablecoin pair USDC-USDT. The memecoin Fartcoin comes on the third spot.

It’s worth noting that Bitcoin is still missing liquidity on the Solana chain.

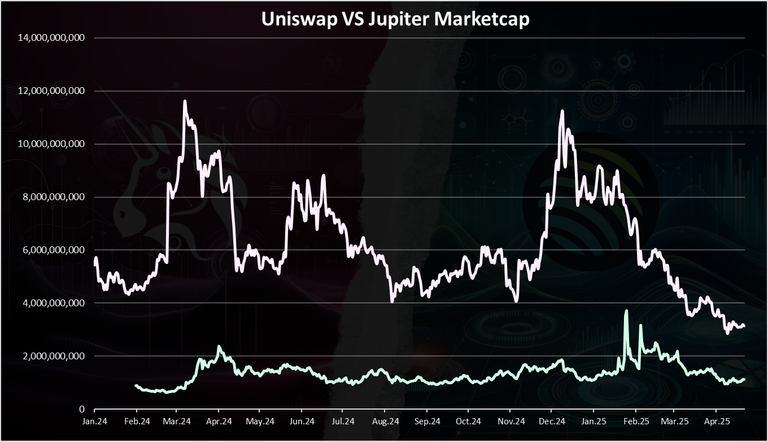

Marketcap

The chart for the Marketcap of the platform looks like this.

Obviously Uniswap is leading here with a Marketcap of 3B now, after a massive pullback while Jupiter is 1B.

Overall we can notice that Uniswap is leading in all the metrics, TVL, users, marketcap, except for the trading volume where Jupiter now has overtaking it.

All the best

@dalz

As Eth fades, Uni will shrink in volume and Sol with Jupiter dex will rise this cycle.

I think Jupiter will win this battle. But it would be important for both of them to grow.

The rewards earned on this comment will go directly to the people( @tsnaks ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Uniswap seems like a good token than Jupiter, much needed information to invest in, thanks for sharing

I myself have been using Swab for a long time and it is a very trusted platform. I don't know about other platforms, but after and your post, my knowledge has increased a lot. But people trust things that are older more.

!PIZZA

$PIZZA slices delivered:

@danzocal(8/10) tipped @dalz

Come get MOONed!

Pretty amazing that a governance token like UNI can reach a market cap of $10 billion.