The following is not financial advice.

Welcome to back The Scoop!

This is the next post at a place where we share analysis and opinions for interesting coins, tokens and pure gems in the vast landscape of the blockchain world. There's so many coins out there, but not a lot of free information (looking at you, paid groups) and analysis on them. The Scoop aims to change that by sharing and improving the data available for a given coin by focusing on evaluating instead of predicting.

What are VeriCoin and Verium?

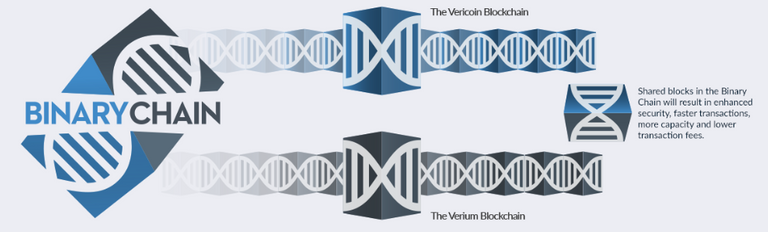

One for payments, one as a commodity and linked together via a Binary Chain with both chains being self-sustaining and creating "no single point of failure". VeriCoin also has PoST (Proof of Stake Time) with is a type of DPoS yielding higher staking rewards, yet low inflation.

No ICO or premine.

More on how it works:

Roadmap:

http://www.vericoin.info/downloads/roadmap_V1.pdf

Year in Review:

Where's the wallet?

Windows, Linux and OS X wallets available:

https://portal.vericoin.info

Along with the Proof-of-Stake-Time whitepaper:

http://www.vericoin.info/downloads/VeriCoinPoSTWhitePaper10May2015.pdf

How many of them are they?

CMC says ~30m circulating supply for VRC and ~1.4m circulating for VRM.

More details:

https://bitcointalk.org/index.php?topic=602041.0

Who's the team?

Full of developers and a some marketing folks.

More info:

https://portal.vericoin.info/vericoin-team/

What motivates them?

Without a premine, it looks like they rely somewhat on crowdfunding for projects and supporting devs:

https://portal.vericoin.info/crowdfunding/

Marketcap and Competitors?

VRC sitting at ~80m as of now (had a big run recently) and VRM at ~16m. Small and even smaller caps, ripe with potential.

Similar projects or target industry...

None come to mind immediately, although there's some general ones out there we're sure.

How are VRC/VRM different?

Well, there's two of them to be sure: one for payments, one for store of value. That's unique and could appeal even more to traditional investors.

Pros

- longevity

- steady growth

- new tech

- detailed marketing

Cons

- competition

- relatively unknown

Any constructive criticism?

Having two coins is always harder to explain and takes more to peek many people's interest, especially those new to crypto. More campaigns and giveaways might help here, as well as potentially splitting off teams and having VRC and VRM become their own products, with binary chain or a heavy version of it. But together they do make a package, so there's pros and cons to decoupling them.

Where is it traded?

Both are listed across the gambit of exchanges, from Bittrex to Cryptopia.

https://coinmarketcap.com/currencies/vericoin/#markets

https://coinmarketcap.com/currencies/veriumreserve/#markets

The Final

Based on the FA, VRC/VRM look like a low to medium risk with high reward potential if they continue to deliver and distinguish themselves in the industry. Picking it up under 18k sats(VRC) and 80k sats (VRM) would be bargain or around $4 and $15 respectively would be an upper entry while still expecting solid, crypto-style gains.

And that's your scoop!