Rebalancing is a simple but very effective strategy to continually increase the number of liquid tokens in your portfolio without delegating, staking, or freezing them in savings.

In fact, this strategy is so effective that you could have increased the number of liquid HIVE and HBD tokens by as much as 30% in the last year. And we're not talking about the dollar value of your crypto-assets, we're talking specifically about a 30% increase in the amount of tokens!

The strategy is so simple that it can be formulated in one sentence - keep the dollar value of both tokens at the same level.

That's it. That is the strategy.

Now let's see it in action

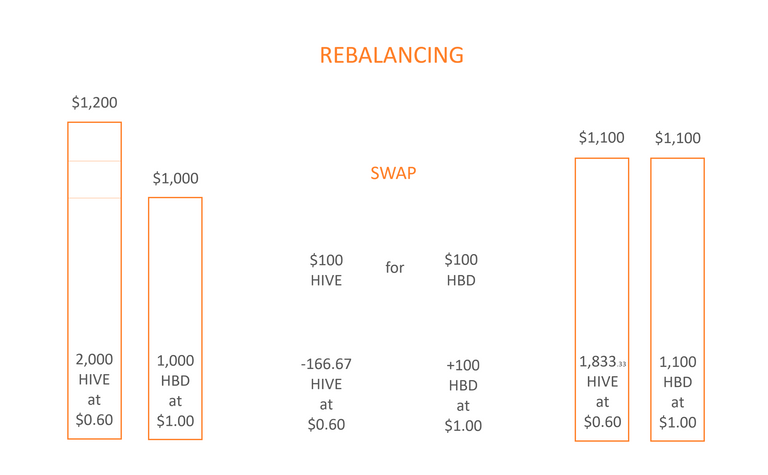

So, we start with two tokens in such a quantity that their dollar value is the same. For example, let's take $1,000 HIVE (2,000 tokens at $0.50 each) and $1,000 HBD (1,000 tokens at $1.00 each).

Now let's imagine that the price of HIVE has increased from $0.50 to $0.60.

We still have 2,000 HIVE, but at the new $0.60 rate, the value has increased to $1,200. The value of HBD remains the same at $1,000 (1,000 HBD at $1.00).

To rebalance the tokens, we need to exchange $100 HIVE for $100 HBD. After rebalancing, the portfolio will have $1,100 HIVE (1,833.33 at $0.60) and $1,100 HBD (1,100 at $1.00).

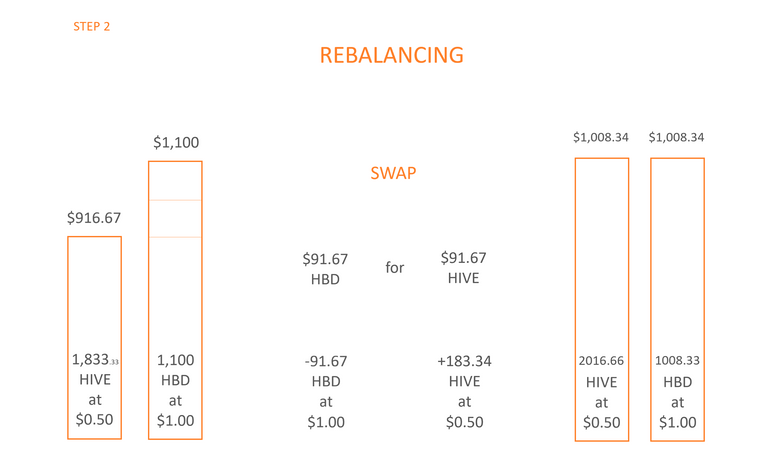

Next, let's imagine that the price of HIVE went back from $0.60 to $0.50.

In this case, the value of the portfolio would be $916.67 HIVE and $1,100 HBD.

Again, let's rebalance, but this time in the opposite direction: swap $91.67 HBD for $91.67 HIVE.

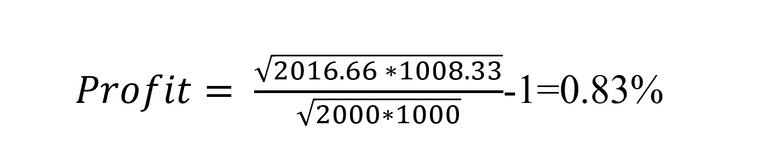

After the second rebalancing, there will be $1,008.34 HIVE (2,016.66 at $0.50) and $1,008.33 HBD (1,008.33 at $1.00).

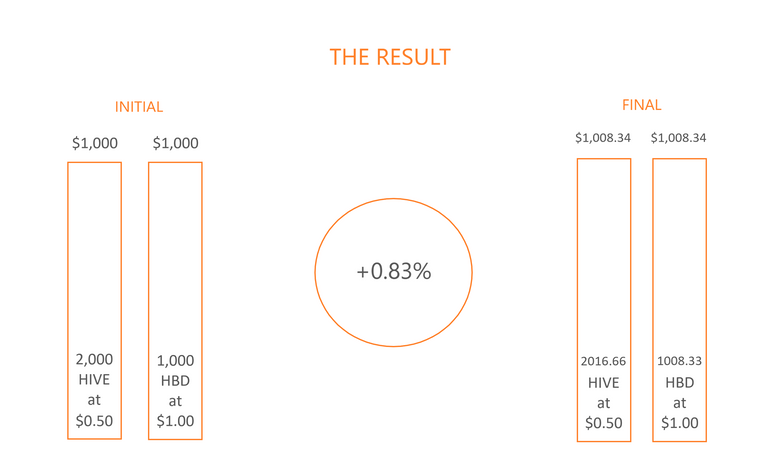

In two transactions, we went from 2,000 HIVE to 2,016.66 HIVE (a 0.83% increase) and from 1,000 HBD to 1,008.33 HBD (also a 0.83% increase).

You can either passively watch the prices of your favorite tokens change, or grow your portfolio every time there is a price change in either direction.

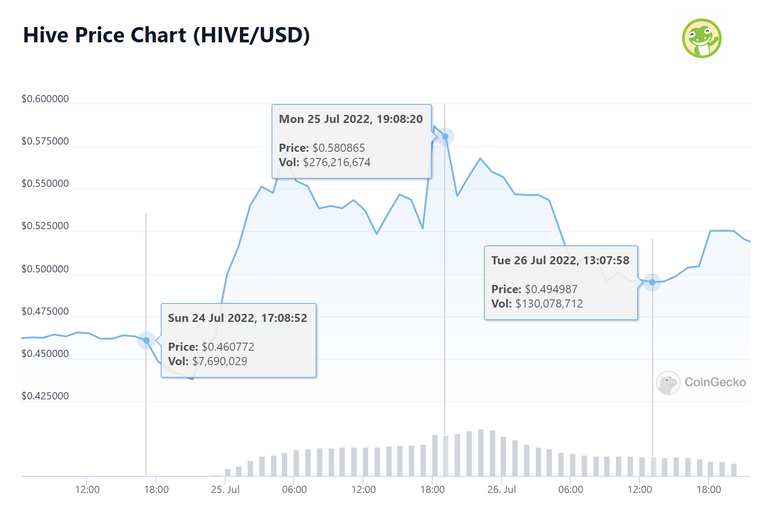

The past 48 hours

In the past 48 hours, the price of HIVE rose from $0.46 to $0.58 (+26%) before returning to $0.49 (-16%).

With the right swap timing, you could have increased your HIVE/HBD portfolio by 0.50% - 1.00% in just one day.

Where does the profit come from?

Imagine yourself on a big cruise ship, and you have a long stick with an electric generator at the end of it that you can dip into the water and generate electricity while the cruise ship is in motion. Whether the ship is going forward or backward, your generator works equally well.

What happens is that you generate electricity (profit) by slowing down the cruise ship (open market) with your small generator (tokens in your wallet).

When you rebalance your wallet, you stabilize the open market.

Since the liquidity in your wallet is probably small compared to the open market, the overall market impact of your swaps will be negligible. But if the liquidity in your wallet reaches a size comparable to the open market, the stabilization effect will become noticeable.

Arbitrage vs. trading

Rebalancing can also be seen as arbitrage between the open market and your own wallet. While the ratio between tokens in the market is constantly changing, the ratio in your wallet remains unchanged. Thus, the price of one of your tokens will be higher than its current market value and the price of the other will be lower than its current market value.

The act of rebalancing is selling an overpriced token to buy an underpriced token.

The fundamental difference between arbitrage and trading is that each arbitrage transaction is profitable at the time of the transaction. Arbitrage matches the market without any prediction as to the future direction of the market. And if the market quickly changes in the opposite direction - great, you can rebalance in the opposite direction and make a profit again.

Arbitrage is a profitable and highly competitive business. But when you arbitrage between the market and your own wallet, you have exclusive rights to your own wallet.

And this is where rebalancing offers a unique advantage over the open market arbitrage.

Maximizing profits by chasing higher spreads

Since you have exclusive rights to rebalance your own wallet, you can delay rebalancing until the spread between your wallet and the open market ratios reaches a higher level.

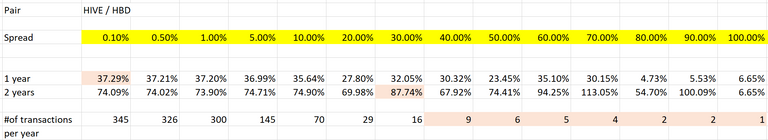

The following table shows accumulated profits over one and two years of HIVE/HBD rebalancing at various spread levels.

Chasing smaller spreads does not necessarily guarantee the higher profits. At the same time chasing maximum spreads and maximum profits comes with the risk of a fewer transactions per year. Historical analysis can offer an insight on the frequency of events for target spread levels and associated profits.

Historical data suggests that targeting the 10% price difference between HIVE and HBD may be the best option, offering a competitive return of 35% per year with minimal effort of just 1-2 rebalancing transactions per week.

Potential risks and security

The best thing about rebalancing is that it does not require any bots, and your funds always remain safe in your wallet.

Rebalancing also gives you more time to do research and assess the situation. For example, if the price of one of the tokens falls precipitously (like LUNA), you can take your time, read the news, and make an informed decision before confirming a swap transaction.

Manual confirmation of each transaction provides good protection against impermanent loss, a common risk associated with public DeFi pools.

As a rule of thumb, choose tokens that you want to keep for the long term. For example, if your long-term investment preferences are HIVE and BTC, you might want to consider rebalancing those two tokens.

Profitability assessment

In the previous example, it was assumed that the token ratio returned to exactly the same level as at the beginning of the rebalancing cycle. This made it easier to compare rebalancing results.

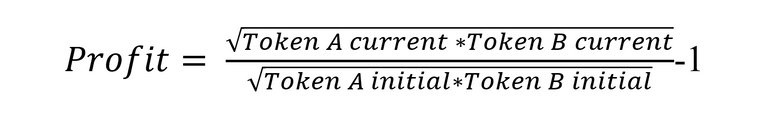

But if the token ratio remains different over a long period of time, you may need to use a formula to measure progress.

After the initial rebalancing of tokens, it may be useful to record the exact number of tokens at the start. Let's call them Token A initial and Token B initial.

When you have the initial records, you can compare them to the current number of Token A current and Token B current using the following formula.

Let's use the numbers from the previous example:

Rebalancing service by Waivio

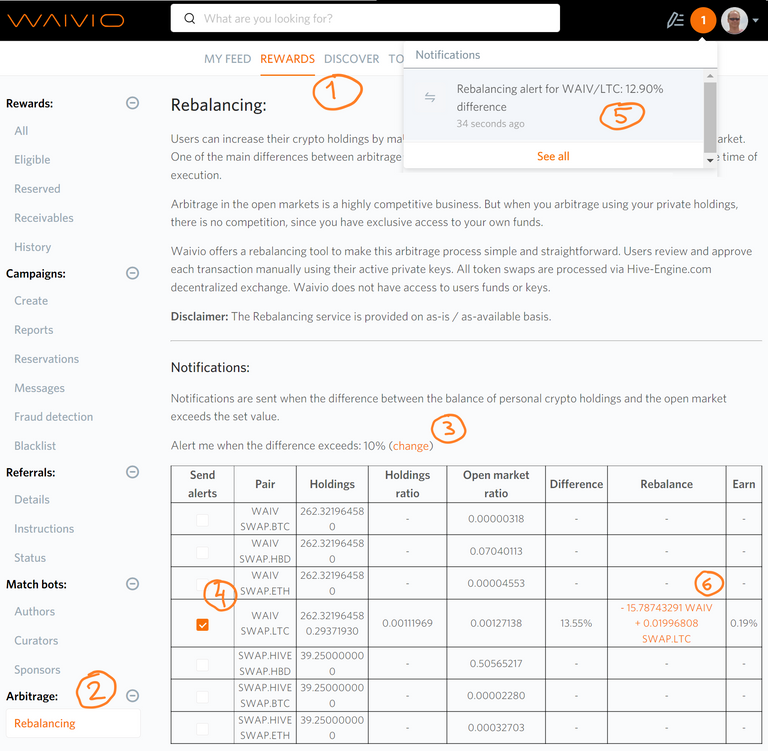

Waivio now offers a rebalancing service (select Rewards (1), then Arbitrage / Rebalancing (2)) that will notify you when the ratio of your holdings to the open market exceeds the specified difference (3).

Select the token pair (4) you want to monitor. Alerts (5) will be delivered to you through your Telegram channel: @WaivioNotificationsBot (subscribe to notifications by entering your Hive account name).

The rebalance service prepares a swap transaction (6). You will need to use active keys to confirm the rebalancing transaction. Alternatively, you can execute swap transactions using any other Hive-Engine service.

Disclaimer: The Rebalancing service is provided on an "as is" / "as available" basis.

Future development

Early users have already requested several features, including a reporting tool, additional pairs, and the ability to account for tokens stored outside the Hive-Engine.

Please feel free to ask questions and share your feedback.

GitHub - https://github.com/Waiviogit/waivio

Discord - https://discord.gg/KWnDRYpc

Twitter - https://twitter.com/waiviolabs

Blog - https://www.waivio.com/@waivio

Waivio #rebalancing #hive #hbd #arbitrage #trading #crypto #waivio

Hi, @grampo are there any fees for using the Waivio interface to do the rebalancing ?

This is a free service. And every swap transaction is authorized by users themselves.

Users pay only standard Hive-Engine swap fees: 0.25% for 1-step swaps and 0.5% for 2-step swaps.

For example, SWAP.HIVE-SWAP.BTC is a 1-step swap while WAIV-SWAP.LTC is a 2-step swap.

Unlike Ethereum and a number of other blockchains, there are no transaction fees on Hive, allowing users to make even small (1-3% difference) rebalancing transactions and still make a profit.

Waivio estimates the profitability of each transaction, including the impact of fees and even pool elasticity (larger transactions can noticeably affect exchange rates in pools).

Thanksss for your explicitation !PGM !PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Fantastic addition! That'll be super helpful for anyone who wants to try this out.

Pretty interesting stuff, the only problem is I don’t hold any liquid tokens…

Wow, your wallet history speaks volumes! You use a lot of tools to maximize your profits here on Hive. And yet it's doubtful that you can exceed the 30% potential APR from rebalancing HIVE/HBD or HIVE/BTC.

Impressive, very good post

Congratulations @grampo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 2750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!

I wonder, why this was downvoted by @buildawhale ?

What is the

open market ratioon your example screen?In this context, "open market" refers to crypto exchanges.

Every time the ratio between tokens in your own wallet differs from the ratio of those same tokens in the market, it means that one of the tokens in your wallet can be sold at a higher price in the market and another can be bought at a lower price.

And today was another perfect day for rebalancing, as HIVE jumped from $0.53 to $0.89 and back to $0.62.

The main difference between trading and arbitrage is that every arbitrage transaction is profitable and there is no need to bet on whether the token price will rise or fall. Rebalancing simply matches the market, and whether the ratio falls or continues to rise is irrelevant, you keep increasing your portfolio with each rebalancing.

One useful thing to remember is that a 10% rebalance gives you the same profit as a 5 rebalancing transactions at 5% difference.

PIZZA Holders sent $PIZZA tips in this post's comments:

@points-fr(1/10) tipped @grampo (x1)

Learn more at https://hive.pizza.