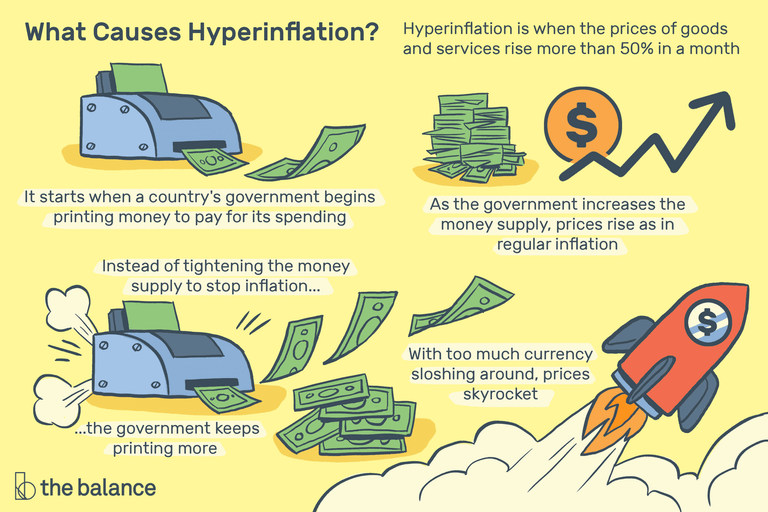

Is that even how it works?

Look at the infographic above. Is that how "inflation" happens? How do we even define "inflation" when the population can't even agree on a simple definition of the word? For example: is inflation when prices of things go up, or is inflation when money get printed?

Most people when asked on the street are going to give you the wrong answer (prices going up). But if perception is reality then the wrong answer becomes the right answer, does it not? Because that's how language and communication works. The entire conversation becomes muddled and confusing right at the ground floor, and this is largely by intelligent design. THEY don't want you to know how it works.

It starts when a country's government begins printing money.

That's exactly not how it happens because governments don't print money, do they? Banks print the money, and banks are not owned by the government. Maybe the government borrowed money from the bank, and now people are dumbing down the situation to the government directly printing money, but that's not how it works. It is an onion of complexity.

In fact I assume history classes still teach that money used to be backed by gold, and students continue to assume that money is still backed by gold because that is a system that actually makes sense. Only college level economic classes will teach a student otherwise, because again the people who decide what's get taught don't want people to know how it works. This has been the strategy for over 100 years now.

The internet will tell you that banks are accountable to the government and to their civilian populations, but when is the last time you ever heard of a central bank being fined or prosecuted by the law? I don't have a memory of that ever happening, which clearly implies they are completely unaccountable.

Of course retail banks being fined is much more common, but it matters not. When any bank at the top end of the spectrum gets fined, the fine is always less than the theft, making the punishment ineffective and simply paying protection money to the government to allow them to continue operations as usual.

So how to banks survive their own unsustainable policy?

The answer is always the civilians being saddled with debt and devaluation.

But the devil is in the details.

When most people think about how a loan works, they think about it in terms of peer to peer and the thing being loaned having intrinsic value. If I loan my friend $100 and they don't pay me back... I've lost $100. If I get paid back $100 much later but the price of goods and services has doubled, I indirectly lost half of my money through a loss of purchasing power.

This is why banking is extremely confusing to the layman because banks do not operate in this manner. What we consider "money" and "value" a bank considers "debt" and "liability". If a bank loans out $1,000,000 at 5% interest over 30 years maybe they get a return of $2,500,000 after the 30 years. But what if the value of the currency itself was devalued more than 5% per year? Did the bank lose money?

The simple answer is: no.

Banks do not lose money when their own currency is being devalued because they are the source of the devaluation. The bank printed the money out of thin air (or more accurately with reserves as collateral). So it doesn't matter if the currency loses value because it was printed out of thin air. $1.5M profit is $1.5M profit no matter how much $1.5M was devalued during the term of the loan. Not so coincidentally this is exactly what creates the inflation to begin with.

In a hyperinflationary scenario where the currency is being devalued 50% per month, the bank can still turn a profit without jacking up interest rates to the inflation level because all the money is being printed out of thin air to begin with. This also has an extreme benefit to the elite who are still allowed to take loans.

If I can take a $1M loan during a hyperinflationary death-spiral it doesn't matter what the interest rate I'm paying is. I'll end up making money because by the time I have to pay back the loan the principal won't be worth anything. If I can take out a loan at 50% APR but the currency is being devalued at 50% per month then after just 1 year the currency has already lost 99.97% of its value and the 50% loan-shark interest rate is meaningless; I can pay back the entire loan for basically nothing as long as I had an asset that maintained its value.

This allows not only the bank to syphon money away from the population it "serves" but also allows all the elites with bank connections to syphon that money as well, which is the only reason why hyperinflation is allowed to happen. If only the bank was profiting in this scenario the powerful people right outside the bank would shut it down instantly.

This is also why foreign banks love to hold US treasuries as their "reserves". There's a reasonable expectation that USD will not hyperinflate. So if your country's currency is losing value but your reserves exist as the dominate world-reserve currency that just means you can print more money because you have more reserves (the money you loaned out is worth less compared to your reserve bag as inflation continues).

For example if I loan out a billion dollars as a bank and I have $200M in USG bonds to collateralize that loan... but then the billion dollars I loaned out loses half its value... that just means I can print out another billion dollars for free and still meet the collateral requirements for my fractional reserve. Neat trick, eh?

Conclusion

Thus is the cycle of unsustainable fractional reserve policies that crypto is supposed to solve, but thus far has been unsuccessful in that endeavor. When money isn't debt and can't be printed out of thin air, hyperinflation can't happen. I even forgot to factor in how technology creates hyperdeflation, so any inflation on top of technological advancements are essentially stealing from all the progress we are making on a scientific level. The ultimate goal of crypto is to turn money into technology so this theft is no longer possible. One day!

~~~ embed:economy/comments/1llo90v/how_do_banks_survive_hyperinflation/ reddit metadata:fGVjb25vbXl8aHR0cHM6Ly93d3cucmVkZGl0LmNvbS9yL2Vjb25vbXkvY29tbWVudHMvMWxsbzkwdi9ob3dfZG9fYmFua3Nfc3Vydml2ZV9oeXBlcmluZmxhdGlvbi98 ~~~

This post has been shared on Reddit by @stekene, @blkchn through the HivePosh initiative.

Might be true for US with it´s special FED construction but it is true for most other countries, isn´t it?

Is it though?

It's funny because if you ask the internets all the governments with full control of the central banks... they are hands down the worst ones with the worst reputations and history.

Seems like most of them are partially controlled.

But that's a very vague and generic statement that doesn't convey a lot of information.

Main point is to distinguish the difference between central and retail banks.

Central banks don't even print money; they print reserves.

Retail banks print all the money in circulation.

And then the reserves can be leveraged to print actual money so it's all a clusterfuck of nuances and weirdness.

It's even worse than this!

When the bank creates a mortgage.

The bank gets given a house, a promissory note & a promise to pay monthly payments.

And the bank created some money on its balance sheet, and gave it to the escrow (after they got the house and put it on the books)

And, in the mortgage, there is no mention of the house being the buyer's house.

In fact, some don't even give back ownership after the mortgage is paid off.

The other total scam is the "national debt".

Which, everyone in the banking industry knows cannot be paid back.

There isn't enough money in circulation to pay back all the debt.

And, from the losses in the printing system, now, there may not be enough dollars in the world to pay off the national debt.

Paying debt off destroys the currency that the bank created out of thin air.

We could pay off everything we could, and there would still be debt left, and no dollars left.

Nice analysis. But like in every hyperinflationary situation, the financial system will reset itself eventually and everything will start over again. True assets (farming land, Raw materials, energy, etc) are the answer to keep wealth Through those events.

!BBH

I hate banks for good reason.

Thanks!

I got a good edumacation on a lot of the money craziness the other day by Catherine Austin Fitts, who I know people have known about for years I’ve certainly heard the name regularly. Essentially the chaos going on with the money system is the parallel system is being set up and they are using money laundering with HUD loans and recycling massive amounts of money to the new system. If what happened over the last few years didn’t happen, I would think it’s excessive but I think she’s spot on. Pretty fucked up.

She was on Danny Jones the other day, give it a listen!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Ah, excuse me sir, isn't the very definition of inflation that prices go up? The cause of inflation could be a range of things (money printing, supply chain issues, etc) but surely the actual definition of inflation about prices going up.

Oh, but the simple answer to " how do banks survive hyperinflation?" is "they don't".

I've seen hyperinflation in our 90s after USSR collapse, banks appear and disappear at the speed of light.

They certainly don't survive if their assets are also being devalued along with the currency.

But this brings up more topics to discuss.

Like do bankers care if their bank goes bankrupt if they can still walk away filthy rich?

Would be nice to have at least one banker's name who survived hyperinflation and walked away "filthy rich".

I'm surprised I'm expected to provide evidence that bankers make money when they print money out of thin air.

But Rothschilds controlled banks in different countries, and after hyperinflation they had great losses in those subsidiaries. I cannot explain it here simple way, but the banks are merely intermediaries between money owners and borrowers. To some extent, they are constrained by official central bank rates when setting the price of money (because they keep reserves with the central bank), and thus, the interest rates they can offer to clients or charge to debtors.

When the price of money rises—even without hyperinflation, as we now see with high rates in Russia and Turkey—bad debt accumulates, and companies gradually become unable to service their loans. Even if a bank eventually obtains something from a company through court after several years, the losses are substantial. What’s more, even companies that had no debt suffer when suppliers or clients start going bankrupt one after another. And when a bank seizes a company for unpaid debt, it still lacks the resources to keep that company afloat.

You know, it’s a bit like that joke where a man can’t sleep because he owes his neighbor money. So his wife calls the neighbor and says, “My husband won’t repay the debt tomorrow.” Then she hangs up and says, “Now let him lose sleep.”

That’s exactly the situation with banks: they’re constantly at risk of not getting their loans back, yet they must keep servicing deposits at roughly the same rates. Under normal economic conditions, that’s fine—it’s day-to-day operations, and risks are priced into the interest rate spread. But in extreme scenarios, everyone ends up without their trousers.

Dear @edicted !

Thank you for article!

That is a good way to explain how the inflation occurs

I hope one day launched hive bank card and crypto payment.....yeah