Not Gonna Lie...

Even though we are trading at all time highs and all my bags are significantly up... I'm a bit worried. I'm worried because my predictions are falling a little short. I'm worried because the Ides of March is here and it doesn't look like we are going to get a blow off top in two days. I'm worried because I'm convinced that April is going to be a bad month for crypto, or at least a sell-the-news event. I'm worried that the stock market and banking sector are signaling extreme warning indicators. I'm worried that I need to sell off a couple thousand dollars to pay down my credit card because I was using that debt to go proxy long in crypto. I'm worried that meme/AI coin FOMO is signaling a top. Worry worry worry.

Legendary Trendline

And yet the trendline of up just keeps going and going. This thing was forged back in late February and is still relevant today. It's a day-trading wet dream. This is free money on the table. All one has to do is short when we are trading above the trend and long when we go below it. The longer the trend continues the more likely it is to break and stop being relevant... but the fact that it's continued strong for so long already is impressive.

Yesterday I was trading the 1-hour candles and we got this Bart Simpson pattern. I was not happy about this really at all. Seemed like the market might be finally signaling a trend reversal. Still, I've come to realize that gut feelings in this market are almost always wrong, so I counter-traded myself and doubled down on a long, then I tripled down on the long as the Bart completed. Today I'm up like $100 on this position. Not too shabby. Again it just feels like free money for very little risk at this point. Number go up.

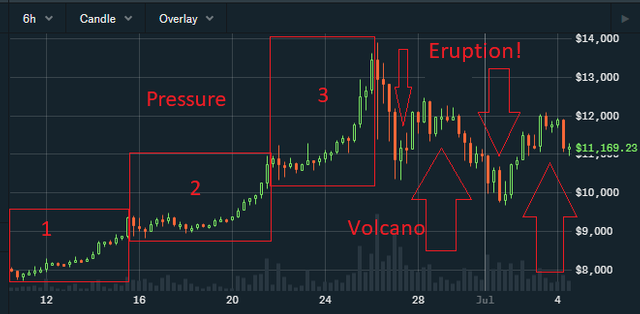

Volcano?

If we are indeed still approaching supply shock and about to go parabolic with a blow off top it's going to need to happen pretty soon in my opinion. One might look at the charts I've posted thus far and think that this trendline is going up at a 30 degree angle or something like that, but it's not. If we zoom out we get a more accurate perspective.

see?

If we zoom out to February it looks like a 45 degree angle up, and if we zoom out to October it looks like a 60 degree angle going up. This trendline is obscenely aggressively up, but when we zoom in it looks normal. Do not get tunnel vision. Something like this can never last for very long.

Up or Down?

That has yet to be seen. It's obvious that the trendline will break one way or the other. Looking at the zoomed out versions it very much looks like it could be a bearish head-and-shoulders pattern. If that scenario played out we'd eventually crash back to $50k (-30%) and then $42k after that. Then again with this much unrelenting buying pressure from the ETF I still have to assume we will break upward into a parabolic blow off top. Even in the case of a 30% drop from here to $50k we have to wonder if another drop is even probable or if we should just buy the dip as they say.

BTC summer 2019

The best possible example of the Volcano pattern was Summer 2019. Why was it so great and perfect? Because there was nothing else going on. It was just the one thing: Bakkt institutional investment FOMO. Also the baseline started at the doubling curve, which at that time was around $4k.

The problem with this using this fractal as a template for the current run is multi-pronged. First and foremost... this volcano completed and ended basically the day Bakkt was launched. The expectation did not live up to the hype in any way. The number were terrible. The final dump occurred and it was over.

The run we are in now is the opposite of that. The EFTs have already been approved, and they are exceeding our wildest expectations. In addition, the entire 2019 summer run occurred underneath all time highs. This time around, ATHs have generated an epic amount of selling pressure that a perfect volcano pattern could not account for. And yet still the price has just been a solid trendline up with very little deviation, even with the ATH selling.

Another way of putting this is that the current run we are in now is being fueled by actual fundamental development and tapping into liquidity pools that were previously cutoff. Whereas the normal volcano pattern is just one of pure speculation and unadulterated FOMO.

What about the liquidity gap?

Because there was so much selling in the $65000-$69420 range I assumed that coiling would take place. This is were price trampolines upward past the next level of resistance. I was quite sure we'd spike out of the $70k-$75k range quite quickly... but here we are just following the trendline like always. This is significant, and I'm not quite sure what it means or how to interpret it. Perhaps we just chalk it up to Blackrock being a diamond-handed buyer that isn't going to FOMO and push the price parabolic. Unclear.

"Top Signals"

Never forget that this is a 4-year cycle. This year is 2024. Last cycle was 2020. What was going on in 2020? Oh yeah, DEFI 2020. We were gambling on a new shitcoin every other day and acting like the kings of the universe. I'll never forget those days. Entire fortunes were created, lost, and created again within 1-week timespans.

What many are failing to realize this run is that 4 years ago during DEFI 2020 FOMO nobody was crying about top signals. Wanna know why? Because we all understood it was a 4-year cycle and the real bull market was going to be 2021. Just like this upcoming bull run is going to be 2025. Nothing has changed except for the psychology of the market.

The PTSD of 2022 should not be underestimated.

First off the 2021 bull run was very small compared to both 2017 and 2013. I assume the reason for this was COVID and shutting down the economy. Printing funny money could only carry us so far within that environment. Then when we got rugpulled in 2022 all hell broke loose. Three Arrows Capital was destroyed. TERRA LUNA was destroyed. FTX was destroyed. Triple threat, potentially the worst bear market we will ever see, and yet Bitcoin was still only down 77% from top... because again the top wasn't very high to begin with.

Many assume that being at ATH how before the halving for the first time ever is an achievement (or a double top signal). It's not. It just confirms that 2021 sucked. 2025 is going to swing the opposite way and no one will be ready for it. Max pain is selling to Blackrock at $500k and watching the price go up to $5M. Mark my words.

Sell-the-news

Another outcome I must consider is that the halving event isn't actually bearish even though it's been over-hyped to the moon and back. It could end up being the exact same outcome as the ETF launch. Remember that the ETF launch was also a sell-the-news event. We cratered from $49k to $39k in 12 days. That sucked, did it not?

The problem here is that it immediately V-shape recovered and now we're at all time highs a couple months later. My my my how the tables have turned. The halving event could be the exact same situation... a super temporary dip that just V-shape recovers. In fact I might have to assume this is going to happen if we just keep following this trendline into April.

What if the stock market tumbles 30%?

Another thing to be worried about is legacy finance. There's trouble brewing in the banking sector and the stock market. I've even heard rumors that big institutions are trying to fudge the numbers and manipulate the law in their favor to avoid liquidations during high-volatility periods of the market. They even went so far as to cite the Gamestop short squeeze as a reason why they should be allowed to go underwater without getting margin called.

On top of that billionaires have been selling their stocks pretty aggressively. Politicians have also been selling stock and they don't even bother to pretend anymore: it's 100% guaranteed insider trading. They know something that we don't. It's very obvious that the market expects volatility.

The problem with all this is that it very much might not matter for Bitcoin anymore. This flood of ETF money changes everything. If the stock market crashes 30%, sure Bitcoin might also crash 30%, but also a 30% dip in Bitcoin is nothing while a 30% dip in stocks is max pain. Then stocks might recover 5% while Bitcoin moons 60% and wipes out all the losses and then some. The correlation is less-than-worthless at this point. It means nothing. Bitcoin is in.

Kolanovic argues that Bitcoin's jump above $60,000 "may keep monetary policy higher for longer." His reasoning is that premature interest rate cuts could further inflate asset prices or reignite inflation.

And then there is JP Morgan that makes absolutely absurd statements like a FED pivot might be delayed because Bitcoin is going up. In what universe does this make any sense whatsoever? And yet here it is staring us in the face. Why would anyone assume FED policy should revolve around a $1T asset that doesn't even exist within the walls of the legacy financial system? It's batshit insane. What game are they playing here? Something is up.

Conclusion

March is coming to an end and I'm still convinced that April is going to be bad for the market for a dozen different reasons. Regardless of this feeling, it is not logistically possible to justify going short while a trendline of this bullishness continues to be proven right week over week. If it breaks downward, expect fuckery. If it breaks upward, expect a parabolic blow off top. I'll keep yall posted.

Wow good views and thoughts from many angles.

Time to take profits and cut the risk I would think. Credit card debt to gamble on a long? No wonder you are worried. That is like me taking the mortgage payment to the casino because I am desperate for short term profit!

Crypto vets like you become trading and financial indicator savvy and can see the writing on the wall for sure. All I know is Crypto goes /, then it goes , then it goes / again. The grey hairs we have earned over the last few years surely makes us avoid rose-colored glasses and wise enough to hedge and take profit rather than get caught in the fomo.

The trend is your friend til the bend at the end. Let's protect ourselves and make the most out of the corrections by being liquid!

The bend at the end is just another trend, friend.

The angle may vary but in my experience, it is best to trade in the direction of the trend No matter how convinced you are about a reversal. Even the basic wisdom of technical analysis says to believe what you see, not what you feel.

A hype can go really high. FOMO drives it even higher.

But a hype will end some day and then it goes down.

But timing when, is difficult.

Crazy thing is that I don't see FOMO anywhere.

Most people are like "this is a top signal"

I think we are about to go much much higher based on this newfound "disbelief".

I'd kind of be okay if things slowed down or took a small dive in April. I think the past couple of weeks has shown us what has the potential to be hot as far as alts go come the next cycle. It might be a good idea to pick some of those up.

Yeah that would be fine.

I don't think Blackrock cares though.

They're going hard and there's no reason to quit right at the start.

The trend seem to be everyone’s friend now until it bends and that is when we will see some people running away from crypto again and even some people not running their Hive account again, lol

The trend is being stupid

Flowing in the direction of the trend is wisdom. Though there is anticipation that it will come down, let us trade in the direction of the yrend

😁👊 Bart!! that's a good one! (the volcano is cool too)

yea, i didn't expect this btc run..

First put your mind and emotions to rest and try to get some sleep, don't overthink or try to be over worried there by disabling your system.

Crypto isn't a small place but just know things can change no matter you are feeling or seeing now. I would just say keep fingers crossed because it might not be as you planned or thought

This is not a superable assumption. It also entirely neglects the exponential increase in value the derivative market creates, which ETF's are the foot in the door of. The question traders and HODLers alike have to have an answer to is at what point do legacy financial institutions decide to take profits?

Ya'll won't get bailed out like they will, so better to bail early than late, IMHO.

Good luck!

Crypto is standing, it won't come down so low anymore. There might be some shaking here and there during the bear, but sure it will level comfortably.