Hey Guys,

As I mentioned in a previous post, I’m working on diversifying my portfolio. One area I’m particularly interested in is real estate. Let’s be real—most of us want a piece of it.

However, I definitely didn’t want to buy a house and run an Airbnb or something similar. Why? Because that’s not just an investment—it’s a job. And I’m not looking for a job.

So, I found something close: I invested in REITs (Real Estate Investment Trusts). This way, I hold shares in a real estate company, and from their profits, I receive monthly “rents” (dividends).

Of course, the stock price can go up or down, which affects my investment’s value. But I’m okay with this risk because I’m not actively doing anything to earn those dividends or benefit from potential price appreciation.

Markets in Turmoil

Lately, there’s been a lot of turbulence in the markets, and the main reason? The latest developments around the Federal Reserve and those long-anticipated interest rate cuts—or, should I say, the ones that aren’t happening.

One thing is for sure: investors are overreacting yet again. Why do I say that? Because the fundamentals of companies haven’t changed at all.

But let’s be real—when panic takes over the markets, it creates the best opportunities.

REITs

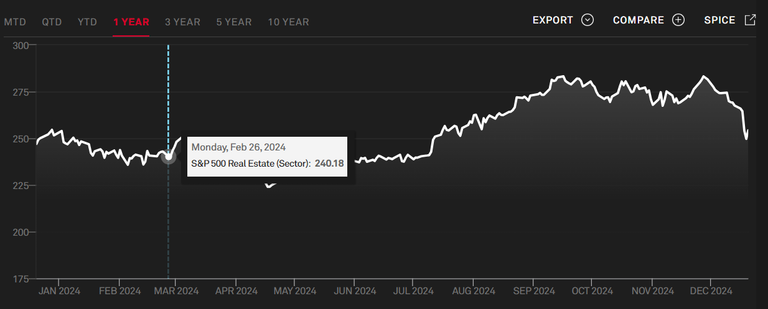

After Wednesday’s news, the index tracking REITs in the S&P 500 wiped out all the gains it had built up since summer. “And what does that mean? It means it’s flat for 2024—basically back to where it started almost a year ago.

The reason the index climbed earlier and then slid back down this past month is, without a doubt, the FED and its stance on interest rates. Let me break it down for you.

As we’ve discussed before, REIT growth relies heavily on borrowing. What does this mean in practice? When interest rates are low (making borrowing cheap), REITs borrow and pour money into their growth. But when interest rates are high (like now), REITs avoid taking on large amounts of debt, so their growth slows down.

And that’s exactly where the problem lies. The FED shifted its stance on upcoming rate cuts. Now, instead of expecting four rate cuts in 2025, we’re only looking at two. Because of this, REITs will take longer to grow more dynamically.

But is this really a problem? I say NO. In fact, this is where things get interesting for us.

Realty Income

The only thing you need to see is the following chart:

Well, this charts shows us the stock price trajectory with the company’s earnings (FFO). Normally, these two lines move almost parallel to each other.

But here, we see a disconnect. Realty Income’s ($O) earnings are trending up, while its stock price is dropping. This indicates significant potential for the stock price to rise!

Why is this happening?

This is happening because, while Realty Income’s fundamentals are excellent, the broader sector is under pressure from high interest rates. Naturally, this drags Realty down with it.

Investment Takeaway

So, where does that leave me? In my view, Realty Income ($O) currently presents a fantastic opportunity.

And there are other reasons. For starters, the stock has dropped nearly 10% since the beginning of the year.

This means that anyone who’s had their eye on it for a while now has the chance to invest at a very attractive price.

Plus, let’s not forget Realty Income’s trump card: its MONTHLY dividend. Its dividend yield is now back up to 6%! Yes, you read that right—6%!

For a REIT of this size and reputation, this is an incredible opportunity. We’re talking about a stock that offers not only steady dividend income but also significant long-term capital appreciation potential.

Sure, the FED might not cut rates as much as we’d like in 2025, but eventually, it will lower them.

Posted Using InLeo Alpha

Reality Income is also my top pick on the sector. High Reputation, good fundamentals and a juicy monthly dividend. 👍🏻

I will definitely have to give this one a look and see what type of RE they hold. I've been considering getting some REIT exposure rather than re-invest back into my real estate holdings.