I was reading that the Reserve Bank of Australia (RBA) again raised interest rates, as expected, by a full 0.5% today. This means that those who have exorbitant loans are going to be facing increasing pressure, especially in the face of rising costs of living in pretty much all other sectors also. The combination of increasing prices is going to put significant extra costs on millions of households.

For those that remember, we collared our loan for 10 years, which means that there is a "cap" on how high the interest rates are able to go on our home loan. For this possibility, we pay a higher interest rate than the current (Referencing the Euribor) as a fee for the collar.

Last year, we found out that they hadn't actually collared it in the contract, meaning the protection we thought we had, wasn't in place and we were screwed, as they were no longer offering the collar at all. However, after a lot of complaining and a few months of negotiation, we did end up getting the 10 year collar we originally wanted at a not quite as good, rate, but still not too bad. For me, this was important, as while we do pay more for our loan, the rates are already so low that locking them in here makes sense and, if it never goes up, the additional cost is negligible. However, if it does go up significantly, we are covered for a decade.

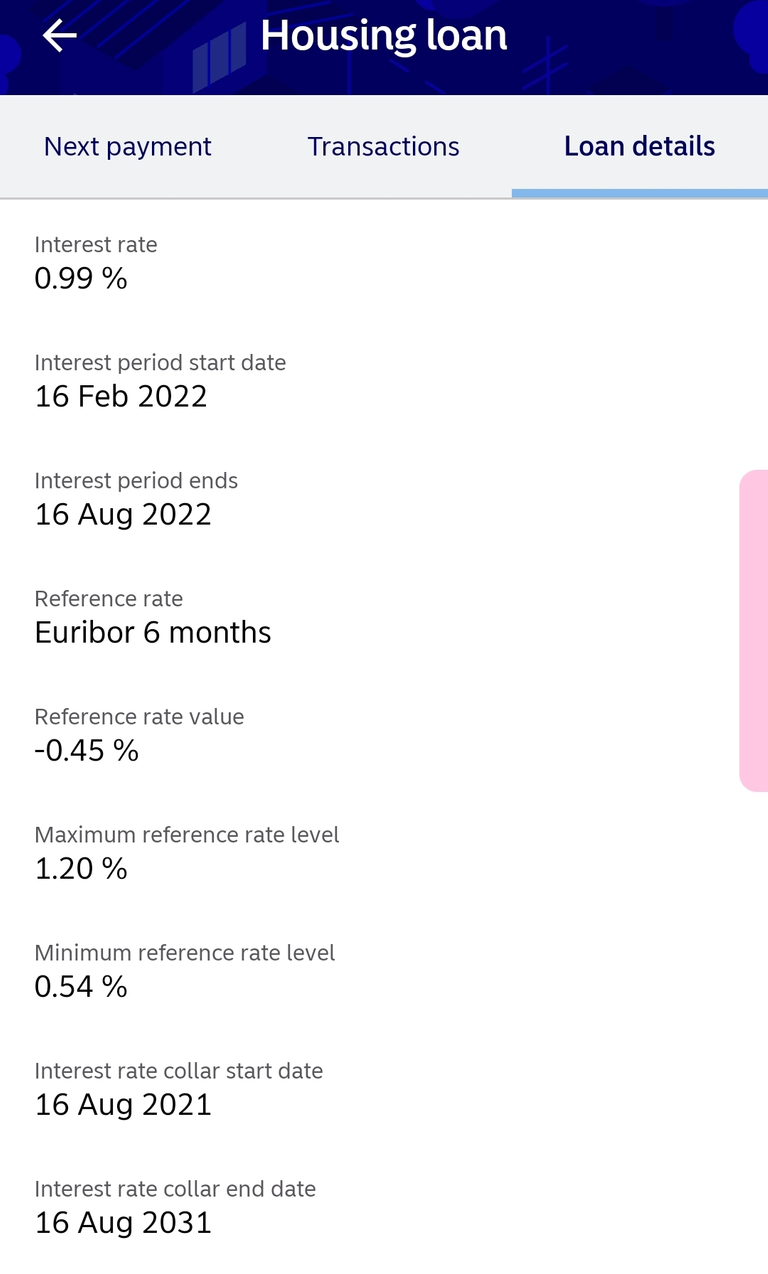

You can see this below in a snapshot from my bank app:

So, the current interest rate paid is 0.99% and as this is tied to (variable) the Euribor 6 months, with a maximum reference rate of 1.2% With the loan margin at 0.45% - it means that the maximum interest rate we will pay until 2031 is 1.74%. Currently, we are paying slightly above the market rates, but for the security of a decade cap and the interest rates being so low, even at the maximum reference, it is worth it.

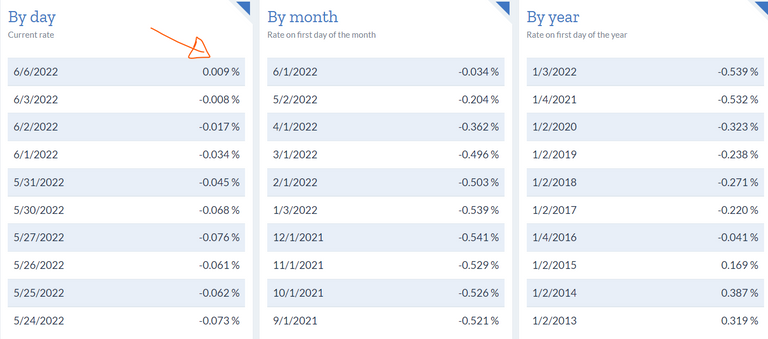

Now, the Euribor has been negative since 2016,

but just yesterday, the Euribor 6 month went positive:

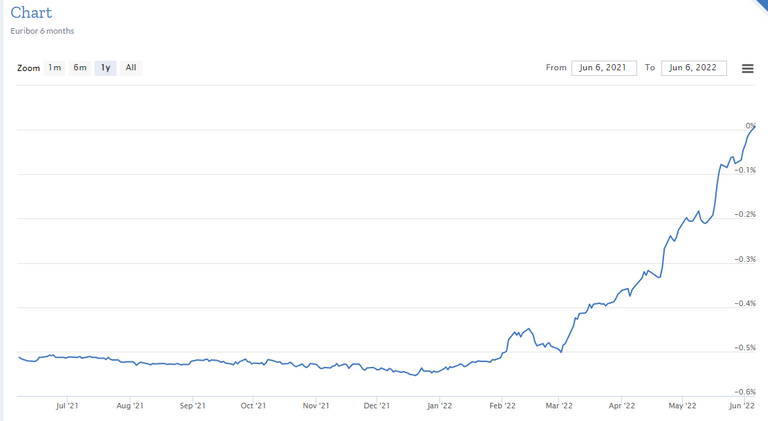

And looking at the trend since the start of 2022, I think it is going to keep climbing.

The difference on our loan in regards to monthly payments between where we are and the cap, is about 50€, but if we were to go to the 5% of 2008, the difference would be around 500€ worth. If it went to 8%, that blows out to 900€ difference per month. This makes quite a difference in the unfortunate outcome of very high interest rates, but doesn't make much difference for us to pay a little more now.

The collar is a hedge, where we have been overpaying monthly for the last year or so, because the reference value has been negative. But, once it starts to go positive and if it exceeds the minimum 0.54% - it starts to return. This gives us some peace of mind in regards to our monthly repayment schedules in the event of economic meltdown, but with money "so cheap" when we took the loan, we aren't paying a massive amount more. This leaves us in a known band of repayments, regardless of market conditions.

Now, after 10 years, it could very well be that the collar has cost us more than it has saved us, but that is the cost of the hedge and it is a price I am willing to pay over that period of time, considering how volatile the economy is getting and how all of those other costs are going to rise also. In essence, it gives my wife and I one less thing to worry about, freeing up the worry for the other million things that are inevitably going to fall onto our plates.

Looking at the rates in Australia, the comparison rate for calculation is already at 2.53% which is 0.8% above the maximum I will pay on the collar, so it is no wonder that Australians are worried about increases in the interest rates, because they are already overpaying for their loans and, the housing market has been incredibly hot over the last two years, but it is cooling off rapidly. This means they are going to be stuck with high repayments on houses that are not worth what they paid for them (possibly even after the 30% collateral they put in), meaning that even if they did want to sell to get out, they aren't going to cover their loan amount. That is stressful!

Of course ideally, the goal is to have zero loans, but that just isn't possible at this time, so low interest is the next best thing and who knows what the economy holds in the next ten years. One thing is for certain though, debt is always going to come at a cost. How much we are willing to pay for it, is the question.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

In the anglosphere they allow you to make ad hoc capital repayments, on top of your monthly payment. This has the effect of reducing the capital outstanding much quicker. And because interest is only charged on capital outstanding, you end up paying less interest too.

If I were you I'd check with your lender to see if you can make ad hoc capital repayments, and if they allow it, funnel some of your crypto profits into reducing your loan.

Yes, it is possible here to do that, but at this point, not necessary for me so much :)

I don't know how does it work over there, but here in Brazil we can (or could) take loans with a locked interest rate, those who did are protected from interest spikes, but those who did not indeed will suffer even more.

Not that it makes a huge difference anyways, our banks practice abusive interest rates, literally illegal interest rates. Although the federal interest rate is almost 13% a years (the highest in the world, even adjusted for inflation) a bank with a cheap interest rate will charge 5x that, over 50% a year interest rate a year, some banks go north of 100% a year but those risk facing lawsuits, although because of the culture even though 50% a year is considered abusive (thus not legal) because every bank does that no one faces consequences.

The people always lose one way of the other. The capitalist system is designed to transfer money and produce from the poor to the rich.

13% federal and 50+ at the bank - that is crazy!

It is not the capitalist system per se, it is the way this one is set up - it is going to collapse.

How is the capitalist system per se not designed like that? I will expand on my thought, and hope you can expand on yours.

(generalizing)We, as a society, as workers, work for someone that expects to extract surplus from our labor, so effectively we work to transfer value to the "higher ups". When we consume we need to pay a profit, again, tranfering value to the higher ups.

Both when we work (produce) and when we buy (consume) we pay a "fee" to the owners of the means of production. When we work the fee is the surplus and when we consume the fee is the profit.

What is happening is that it is not sustainable, they can't increase exploitation at this moment, they can't exploit more work or more consumers. We see crisis every now and them and the exploitation has to be exarcebated to keep the profits, because the owners of the industries just can't reduce their profits.

The rise in interest is related to that, because we are not producing and consuming as much due to recent world events they need to raise the interests, and that is a very direct way of extracting the fee, they don't need anyone to work and don't need to sell anything, people will have to take loans and pay them those hiked up fees.

Working and consuming is an indirect way of exploting people, it is so subtle it sometimes may not even feel like exploitation, but interest raising is a very direct way of exploitation and something the capitalist elite need to resort to when they can't be subtle.

And the system is designed like that because the rich and the industrialists own the politics and the countries. Ask the people, would the people want an interest increase? No one wants that, I would go as far as saying 90% of the population, or more, is strongly against interest rate increases, but the 90% of the people do not hold any power, the capitalists do. Because the capitalist have the power they can raise the interest. Sum it all up, capitalism is designed like that. Rich people, all over the world, from USA to Australia going through Brazil, they can control the economy even going against 90%+ of the population, they can and they did design this system like this.

The current system is not a capitalist system.

As said, the current system will collapse, but a capitalist system is about private ownership, not state. What it means is a free -market system, not a protected system like we have today where the incentives are misaligned. In a "real" capitalist system, the free market would far better manage, as it would recalibrate whenever the market thought it was necessary.

Like anarchism?

If you are trying to say anarchism without saying anarchism, I would argue that every society was born anarchist, or was anarchist at some point. The problem is that it is inevitable that some people will get richer than others, and because capitalism literally means power of the capital, soon enough the rich people will become the new government.

It is inherent to a stateless, or a weak state society, and that has happened in every society in every corner of the earth at some point.

Name one place where capitalism was born or evolved naturally and where a state was not an important aspect, where the government was almost not existent, where the state was not born from capitalism and where a state did not interfere with private means.

The recent spike in interest rates all over the world shows that every single country is looking for the well being of their capitalists, and when I say capitalists I mean the elites.

Because it is so generalized and is happening in all continents, but someone tells me that is because it is not true capitalism, to me then it goes to show that capitalism just can't be done right.

It is a natural processes. Change or overthrow the government, someone richer than the average will rule in their place and become an authoritarian government.

To me we live in a capitalist society and to me capitalism is doomed to fail, to you it seems "true capitalism" was never ever implemented? Or was it implemented but failed? And anyways, what would make a society "truly capitalism" and protect against an eventual (and in my opinion inevitable) failure?

I am not sure about this at the core, because if this is the case regardless of the rate, this is just a spectrum. If it is for elites, it is always just a factor of degrees. That means that what they are trying to do is find the balance between extracting as much as possible and revolution. This tends to be the case by the way.

I'd say that the state is more unnatural than capitalism, as say in the case of a tribe, the tribe owns all, but works in a capitalist way to maximize the outcomes for all. The state doesn't act in this way at all, it works to maximize itself, regardless of the outcomes of the people. This includes giving additional benefits to some over others, like tax reductions etc.

For me, a decentralized free market is superior, but all systems will face the same challenge as those who are better at generating value, will own more than those who are not. This means that redistribution events will always happen at some level. The difference is, at what level this happens - is it where people abandon a company like Splinterlands if it gets too greedy and forgets about its userbase or, nuclear war.

That doesn't make sense to me. Both states and capitalism are natural. States are so natural that states were born every single time in every human society, eventually. No matter how remote in time or space. Europe, Asia, Africa, even the Americas, before colonization, had states in different shapes.

The social organization doesn't necessarily relate to the organization of production. There can be a feudal state, there can be a monarchy state, there can be a republic state, there can be a socialist state, there can be a fascist state and there can also be tribes as a form of state. All of those states can use or not use capitalism in different forms because the society, production and economy are "Lego parts".

Now, tribes economy and production definitely do not work in a capitalist manner, not that they can't try but due to the social organization capitalism doesn't make sense. Tribes don't even need capital. In tribes everyone work as they can and get as they need. If tribes were capitalist the members of the tribe that could not harvest, hunt or forage would starve, and the "owners" of the tribe would not need to work, but that is not the case. The Brazilian tribes I have visited share the work and the production equally between all members that can work or that need the produce, that is possibly the opposite of capitalism.

Now in capitalism, specially due to unhealthy rent seeking behavior (like raising interests) it happens that those that can't work may not be able to eat, and those who live through interest and ownership of the financial system may be able to not only survive, but thrive and influence society without working. Capitalism, looking at both history and present, seeks not to maximize the outcome for all, but quite the contrary, seeks to minimize the outcome for most and maximize the outcome for few, because if it doesn't then people will be equal and it would become a tribe eventually. Maximize the surplus extracted from workers, maximize the profits from profits, and now maximize the yield on their capital through interests.

If there is no exploitation then capitalism would collapse because eventually people would become equal and we would become a huge tribe, why would we even need money and capitalist financial systems if everyone can work without exploitation and get their needed share of the produce? If that happens it is not capitalism. Capitalism is exploitation because without exploitation it would be a matter of time for us to become either a tribe or a socialist utopia.

The production and the work is socialized, all society participate in producing goods and services, but the result of the work, both the financial (surplus/profit) and material (products/services) are directed to the rich capitalist because they own the means of production and because the (work need for) production is socialized they own the society. The work is ours, the result is their. That is the basis of capitalism and without it in a few decades it would not be capitalism anymore. It would be awesome, but then suddenly the former owners of society would not have their privileges, because if the produces and profits were not exploited they would not have their overabundance, and that is why in capitalism the elites can not allow exploitation to end and the rate of profit to fall. If exploitation ends, or steadily decreases and we become a tribe or a socialist utopia they (capitalist elite) would not be "kings", they would have to become workers as a natural development of society.

As an example, Jeff Besos, that dude has yatches and planes but he definitely doesn't need them. He can afford that because of massive exploitation. Does he need massive yatches and planes? No. Does he produce enough to make yatches and planes? No. If he did not exploit he would never have that.

If the way tribes work maximizes the outcome for all, and our society aims to minimize the outcome for most, then to be "efficient" like a tribe the products and profits of production need to be socialized as much as the work is. Capitalism is failed because exploitation leads to the shit show we are seeing, and without exploitation it would not be capitalism anymore.

Similarly, we locked in our electricity price for 60 months. It would cost us less on a variable rate. However, prices can spike during peak demand. I unknowingly renewed right before fuel prices started climbing. The contract rate is a bit higher now. Like you, I expect that we will see an overall increase in the cost of goods and services. It doesn't make sense to have variable rates because it is unlikely our salaries will keep up.

Good move on the electricity lock - ours is heading up pretty fast at the moment, but thankfully it is summer and we don't need that much. Salaries are pretty well stagnant here.

Banks globally have been printing money and continued to jack up asset prices in a decade-long low interest rate environment. This benefits the rich the most who own the most assets.

While the common people signed their entire productive lives away by bidding up overpriced homes, it was already hard to pay back at low interest rates. Have we reached the point where a painful controlled collapse is due, to accelerate modern debt slavery, justify universal basic income, while the state and riches will buy up the remaining properties at fire sale prices.

This will complete you own nothing and be happy and solidify another 100 years of class divides.

I think the collapse has been coming for about 5 years already, but it was postponed by covid, where they just pumped more cash in to convert into ownership for the wealthy. It will catch up now though....

Dang, .5%, that is quite the jump. A lot of people might not think it is, but when you are talking about interest rates it is pretty huge. I don't think I have ever taken out a loan that has an adjustable rate. I don't know if I would. I am glad that you were able to get it sorted out and if rates keep going up you are locked in at the lower rate.

Posted Using LeoFinance Beta

It is going to get worse. I don't know what the eventual rate will be, but I am expecting that the next couple years are going to be difficult.

Glad I am locked in and all my other loans are paid off then!

Interesting. Here in South Africa, the reserve bank rate is 4.75%, that is before the banks add their portion!!

Posted Using LeoFinance Beta

What kind of percentage do the banks add?

Loans are not your friend. Here in the good old USA we are seeing rates climb. I am grateful I do not have a loan. It is smart to get out of debt, even if it means subtracting from your retirement. Thanks for sharing.

I wish I had something more in retirement to use - but what I have there can't be touched.

It is everyone dreams to be to financial free but having problems solved at times with loans can be helpful but choked up to pay back.

Posted Using LeoFinance Beta

avoid debt at all costs!

A cool cover story image. 👍

Thanks :)

Nice that you locked in that rate. I wonder how the housing market is going to react to this. Here interest rates have shot up from 1% to 3% without any central bank raises!! So it's going to get interesting for sure.

At least in Australia, I expect a heavy recalibration of housing prices, but who knows - perhaps they will find a new reason to pump more cash in.

If they do recalibrate, history tells us, that it usually isn't for very long before they continue their run up.

I have also read the raising interest rates in Australia. Conversely, they are trying to reduce interest rates in my country, which has caused hyperinflation for about six months.

I think that the raised interest rates would not affect those who already have a loan if it had not variable rate. They generally prefer fixed rate loan here, and it is profitable in case of a hyperinflation.

Most people have variable rates in Australia from what I understand, with the "locked in" periods quite short in general (two to three years)

It is optional here.

Nice post

Grateful for that good information.

👍💪🇦🇷

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations @tarazkp! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 53000 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Low interest is fine so long as you have the income to pay off the loan and I think that a similar situation is playing out in a ton of different countries. So in the end, the market is cooling off and the rates are changing.

Posted Using LeoFinance Beta

This sticks where it hurts, the bank still trying to live off from more. Debts keep getting higher and man's got to keep it to the minimal.

Posted Using LeoFinance Beta