Cost of a Home!

I was having a discussion with a couple of folks yesterday about housing market at various places. This is a highly complicated discussion even within various parts of the United States, let alone in other parts of the world. I don't consider myself an expert in real estate in any meaningful way, but I do own my primary residence, and also own multiple rental rental properties over 20+ years. I bought my first home when I was in graduate school with a graduate student salary (and mostly Apple stock to be honest!). Anyways, I digress.

When I decided to lookup national data, I was a bit shocked. I have been taught the 28/36 rule a while back, and I am glad to see that people still use it, but my goodness, US have become completely unaffordable for most people!

The 28/36 rule is a guideline that helps people determine how much they can afford to borrow for a mortgage. It suggests that:

Your total housing costs (including mortgage principal, interest, property taxes, and insurance) should not exceed 28% of your gross monthly income. This is known as the front-end ratio.

Your total debt payments (including housing costs and other debts like car loans and credit card debt) should not exceed 36% of your gross monthly income. This is known as the back-end ratio or debt-to-income ratio (DTI)

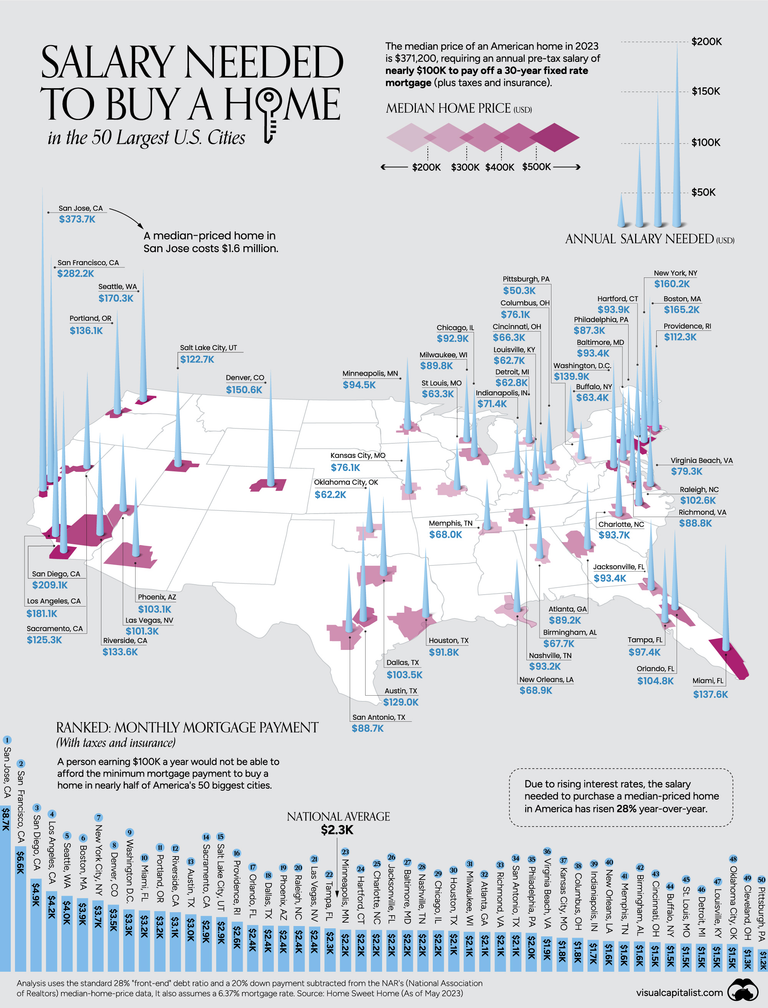

So if we follow the 28/36 rule; and we know the median single family home price (public data) at various cities (I am mostly considering urban areas in the US), we can calculate how much salary one needs to afford a single family home. The infographic below does a good job in idenfying those.

This data is from 2023, and you can call it a bit dated, but still I think it does give the 'trend' and you can add 5-10% uplift as you see fit in your local area for 2024-25. I like this infographic a lot because you can visually compare different areas of US. Also please be mindful, those salaries are minimum salaries. Chances are if you earn that much in the respective cities, you can't really afford the Median priced home! Why?

Let me give you a real example:

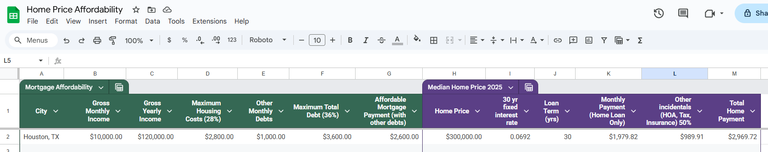

This is a simple google sheet that I made just now.

- Left is the Mortgage affordibility based on salary and 28/36 rule

- Right is the median single family home price today with todays 30 yeat fixed mortgage

So the way to read this table is as follow:

- Lets say you earn $120K in Houston/yr, you can only afford a mortgage payment $2800

- Trouble is to buy a median home, with current interest rate today you pay $2970

- For the record, $120K is much higher than median salary in Houston

- Median salary of Houston is $57K - $63K based on most estimate

So you can only afford half the house!

Something gotta give!

- You look for a less than median price home

- You look for the same home, but somehow manage a cheaper mortgage

- You increase your income or lower other debts

For most people, doing the last two in the short term is very hard, so most people do the first one. They look for a cheaper home. However, that is not easy either. So people typically move to perhaps a less desirable area, a lesser school district, or move to deeper suburbs and commute.

How does the rental work?

Well, once you own a home, you might want to look for a rental property to generate income. Trouble is in high interest rate environment, that is not easy either. Typically in my area, we follow a simple rule of thumb like 28/36 rule.

For a rental to be profitable, it must follow the 1% rule

Meaning, you must be able to rent a single family home for a monthly rent that is 1% of the total price of the home. If you can do that, then the property is cash flow positive on day 1. Trouble is, Houston, which is one of the cheaper market historically, has gotten expensive lately! I blame the migration of tech people from the West! So it is impossible to find a "1% Property" in Houston for ages. I can potentially live with a 0.8% property as well, but then the margins are not good. I rather wait and let the market come down to me. I have been waiting for 8-10 years!

PS. I am posting this on the new financial community. Do check it out!

https://peakd.com/c/hive-180505/created

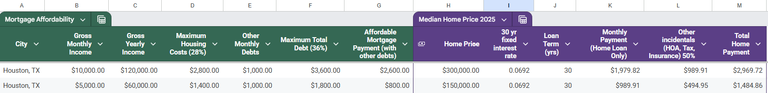

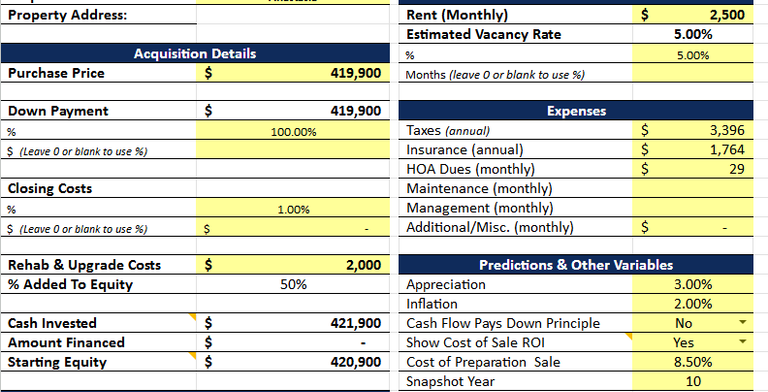

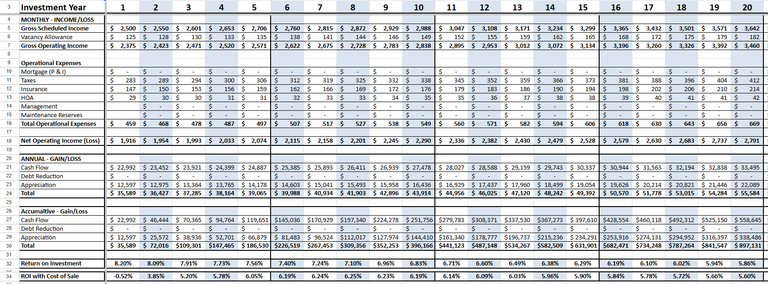

Last year I ran an investment analysis for a bunch of rental properties around WA state. The best market in terms of price to rent ratio was Olympia (state capitol).

This had the best rent to price ratio of all properties for sale in the state Rent to Price Ratio: 0.595%

Here are the assumptions:

As you can see it was full cash investment as rates were around 7% for investment properties at that time so made zero sense to get a loan as it would not cashflow at all.

Still even though this had way better rent to price ratio than most properties in Washington state it still made no sense and the investor chose to go with another fixed income investment instead.

Yeah, the problem is, if you want to invest $420K in cash, NVDA would have been a better investment at that time frame :)

The allure is real estate, at least from my point of view, is the leverage and ability of have little cash in the deal. If you put 100% cash, and especially that magnitude of cash, there are so many other things you can do with it,

A good indicator on that I found by reading an article is the "housing-debt-to-disposable-income ratio."

"It represents an after-payroll-tax cashflow from all income sources, not just wages: Household income from after-tax wages, plus income from interest, dividends, rentals, farm income, small business income, transfer payments from the government, etc...

Year-over-year: Housing debt +3.1%, disposable income +5.1%."

Source:

https://wolfstreet.com/2025/02/15/here-come-the-helocs-mortgages-housing-debt-to-income-ratio-serious-delinquencies-foreclosures-in-q4-2024/

The reason I see for less issues with mortgages defaults is that due nominal inflation and 2008, people are avoiding (or more careful) to buy estate, even though their real wage increased during that time...

yes, hopefully the financial crisis of 2007-08 taught people something! Also lending practices of today are better. I haven't heard of Neg Am loans in ages!

I live about an hour outside of Orlando. When we bought our house about 23 years ago, we could barely afford it. It's value has gone up by a factor of somewhere between 3x and 4x. I couldn't afford it if I were buying it today. Not just because of how much houses themselves have gone up but also the increase in other expenses such as insurance, groceries, electricity, etc.

And Orlando is not particularly expensive, say in California or even Miami standard.

I thought Mr. Trump will fix all that on day 1. Sorry couldn’t help it :)

I actually never heard of the 28/36 rule. I learned something new. Thanks.

I was lucky enough to have bought my first home pretty young, but I wish I would have held onto it while buying my follow on property.

The rule was generated in the 80s. I am sure you likely knew about it but perhaps not the name.

Actually I don't think I did. I could do the math though and determine what I could actually afford. The rule was probably applied to me though. When I first got preapproved, it was too low to buy any house in my area. I had to get a 3rd job for like a year to increase my income level enough to be able to get pre-approved for high enough to actually buy a house.

Well, I need to check some numbers and do the math for the UK. I do have a day off Monday.

cheers! looking forward to it.

It's crazy how much people over leverage themselves these days. It's pretty bad how the real estate system takes advantage of them too. They get them pre-approved for this crazy amount and people think they are good to spend the whole wad. Then they end up in trouble. I went in with a monthly payment I knew I was comfortable making last time we bought a house and I worked within that scope.

I didn't discuss too much about down payment. I paid 20% down when I bought my first house. All these calculation assumes that you are putting 20% down payment. How many people in Caclifornia can afford a 20% down payment for a $1M home? Very few.

I think that is the case all over the place. That's why you see people getting suckered into these high interest balloon loans and stuff like that. It's pretty crazy! I don't think we did a full 20% down on this house. We had to be pretty close though. With the equity we built here, we should be able to on our next one I hope.

It is so difficult!

Not only has not enough housing being built in the US, but we now have extreme weather events (fires, floods, hail, etc) wiping out thousands of homes (12,000 in the California fires I think) and forcing insurance companies to pull out of various regions. If you can't get insurance then you can't get a mortgage.

The problem I have with investment properties these days is that I think quality builds are rare, so either you have well-built older places that need some maintenance or you have poorly-built newer places that also need maintenance, haha, all of which cuts into your ROI. I've had an apartment drop in value because a bunch of apartment buildings went up after I bought it and the area was quickly oversupplied.

Reality in the opposite :)

The only thing US is good in manufacturing, other than military equipment, is houses. US is massively over-built relative to its population. Trouble is they are cheaply built (so easily destroyed), and built at the wrong places without paying attention to proper ethical building codes. This is what you mention as well.

Hahaha, yeah, I guess being over-built doesn't actually matter if the houses aren't built where people want to actually live. I've been in the US for 9 years or so and the prices around me in Oregon have risen so dramatically (I also blame Californians for this, haha).

California is basically imploding under its own weight. Prices over there need to drop 50% at a minimum and even then it will remain relatively expensive.

People need to leave California. In very large numbers. That is the only solution.

With water becoming more of an issue for the southern states and the west coast getting way too expensive, I expect people are going to flock to the area around the Great Lakes. I imagine it'll be safest in regards to increasing extreme weather events.

Let them go to great Lakes! No problem.

Just don't send them to Texas. That is what seems to be happening!

For a person like me who has lived in the US (11+ years) and still working on owning a home, this is very helpful. Thank you very much.

you are welcome.

That should be is I guess,

Now to the house and it's cost.

it's has been a general issue even within my country of residence Nigeria, and rental houses has been on increase yearly.

Thanks for sharing.

!LUV

!PIZZA

!BEE

fixed, thank you.

You are welcome.

28/36 rule wow!!very interesting post

Mostly applicable in the United States.

I see

Question we have 80 20 rule and 95% and 5% rule. This is new to me is it the same concept?

read and you will know :)

Well, I need to check some numbers and do the math for the UK. I do have a day off Monday.

Wow, not only in Indonesia that house are expenisive.

I just do calculate to buying house or rent a house for my little family.

And yeah i decided to rent for some years,

i am afraid i cannot afford the mortage.

20 years to paying monthly around 500$/month is kinda too expensive for only 50m2 for land and 84m2 for the building

$PIZZA slices delivered:

@danzocal(6/10) tipped @azircon

techstyle tipped azircon

That's quite tough...

Another reason to work hard and make smart moves for money...

In my country, housing amongst everything has some insane pricing too so I guess it's something that happens everywhere..

!PIZZA