I feel like the title of this post could be a misguided and unfortunate name a of a tea lovers book. One my wife might buy on holiday from a little loose-leaf tea store, as a memory of her trip. And then a year later, one of my vising friends is browsing the shelf and it catches his eye and questions it, with my wife not understanding the connotation.

What connotation?

Anyways....

After dropping my daughter to her dance class, I went into a local café to ride the hour out and rather than the normal coffee I would get and since I am on one morning cup a day now, I took a cup of ginger tea instead. It cost €3.90 for a cup of hot water and a teabag, which while very normal these days, I feel is exorbitant for what it is. I get that they have a premises and pay staff and they definitely aren't raking in the money, but it is around 20x for what it could be bought in a supermarket for a box of teabags. But, everything has gone up in price, with no value returned.

In Finland, the average loss of purchasing power over the last three years has been two months salary. To make it easy, that means if a person earns 12,000 a year, they can now only buy 10,000 worth of goods and services. This is a massive change in buying power in such a short time, and many people are struggling. Which is why next time I drop my daughter to dance practice, I will sit in the library instead. Cafés can be reserved for more value-adding times, like when I am with family or friends.

This shouldn't be happening, should it?

If we are looking to improve quality of life, we shouldn't be scaling back the things we enjoy, we should be building the foundation so that we can enjoy more of these things. Within reason. But, this is not how the economy works, because that profit-seeking activity will always lead to a reduction in average possibility, because there is a massive increase in wealth at the top end of the distribution. That increase has to come from somewhere.

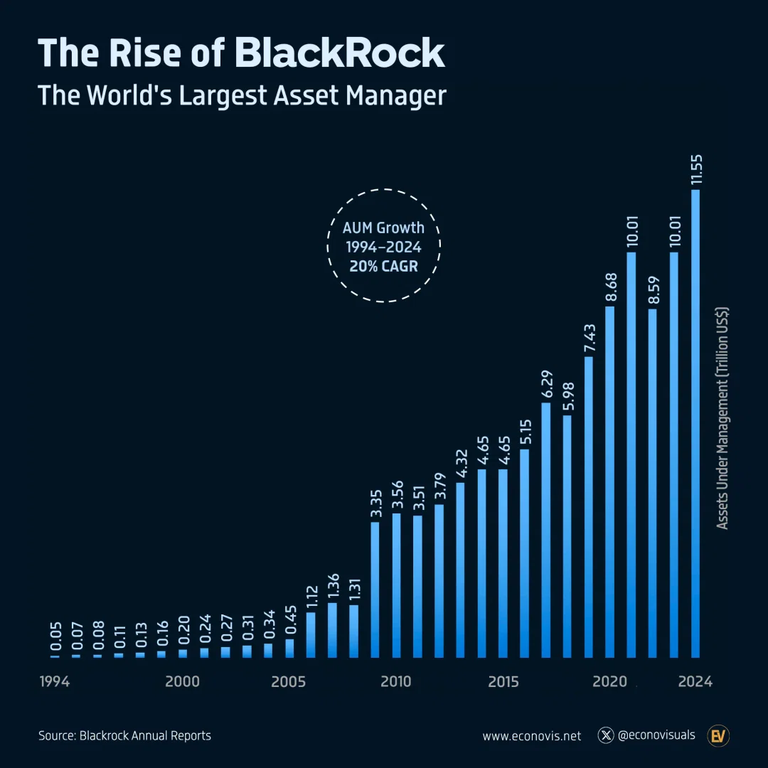

Yesterday I was reading an article from Australia where the BlackRock CEO, Larry Fink, was saying that Australia should have 30-year, fixed-rate home loans, rather than variable. This would mean that they would have a set amount to pay on their mortgage and be far less susceptible to interest rate fluctuations, which leaves more free capital to invest into the capital markets. This is what happens in the US, where the majority are on fixed-rate mortgages, which plays a big part in why Americans invest more into the capital markets.

“One of the greatest foundations of the United States is that more Americans invest in equities than any place in the world. Why? They have more confidence, they’re more hopeful. But another foundation is they don’t have to worry about the ups and downs of their mortgage payments.”

There are some merits to this, but there is also a lot of risk, as while it is true that it would eventuate in more money going into the capital markets, it also leads to overborrowing, risky lending and well, Global Financial Crises. Yet, Larry Fink doesn't have to worry about any of this.

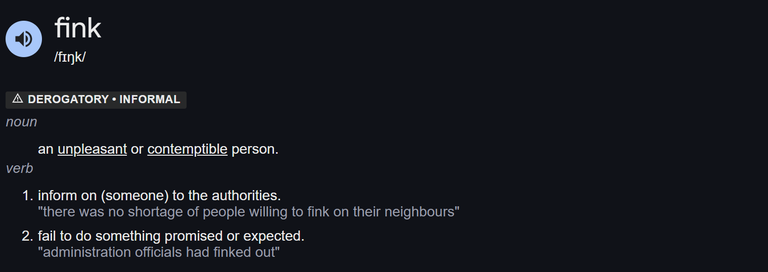

Sometimes the definitions write themselves.

And by the way, 20% compounded annual growth rate across thirty years is incredible.

What I find interesting is that it is very easy for the average person (like myself) to look at some kind of proposition that promises to increase the amount of money in my pocket soe that I can do more of what I enjoy, like going to a café, and agree with it. Especially when in financial hardship of some kind. It is a greed mechanism, but also a security mechanism too, but it is going to usually lead to a problem, because again it is going to equate "amount of money" to wellbeing, even if the amount of money I get is going to be at a much lower rate than the amount of money that those at the top get. This difference is the wealth gap, and rather than making people's lives better, it is making people's lives worse, because relatively, the majority are falling behind the minority.

Governments do this all the time to us with indicators like GDP and GNP, which are good at seeing how much money a country generates, but are terrible at indicating how much wellbeing has developed. This "wealth = wellbeing" equation works to some degree at the individual level because a wealthy person can afford more opportunity, but it doesn't work at the country level, because average wealth doesn't speak to the distribution of that wealth, or the purchasing power of the individuals involved. Currently, the capital markets are hitting highs, while purchasing power of real people are hitting relative lows.

We have a strange conflict as a society, because if we want to ensure our own wellbeing now and in the future, we should be looking to maximise our financial health, because that is what allows us to buy what we need (and want) for ourselves and families. Yet, to do this successfully, we would likely have to be part of a system that ultimately is going to lead to the average wellbeing of everyone else declining. What we should realise is that while the economy can work for us at a localised level, at a global level it is going to harm us.

Yet we don't think too much about this.

For instance, when we go into a sport store and find a pair of shoes we want that are on sale, we are happy. Yet, we choose not to think about the supply chain that enabled that same pair of shoes to be created, manufactured, shipped, and sold to us at a discount, and still make a profit. Did anyone get harmed along the way?

Top 5 sports brands by sales:

Major investor Nike:

Vanguard 9.0%

Blackrock 7.3%

Major investor Adidas:

Vanguard 2.82%

Vanguard Star Funds 1.28%

Vanguard Tax Managed Funds 0.78%

Major investor PUMA:

Blackrock 5.5%

Major investor Lululemon:

Vanguard Fiduciary Trust Co. 11.24%

BlackRock 6.26%

Major investor Under Armour:

Vanguard 7.9%

Blackrock 7.0%

Profit-seeking doesn't care about wellbeing, it cares about generating wealth for investors. There are lots of caveats and complications, but simply put, over the space of time, the capital markets will be a driver of wealth gaps, because those who can invest will make more than those who can't. But, having more people invest under the current system isn't the answer either, because that is going to drive up the wealth gap further, as the new money pushes wealth into the old.

Financial health seems to be a trade-off of general wellbeing, but I think that it shouldn't be this way. If we were to have a healthy economy, I think it would look to have wealth generation incentives aligned with human health outcomes for physical, mental and emotional wellbeing. This still requires a huge amount of different industries to accomplish good results, but it would likely lead to a wider distribution of wealth, and a change in focus of what industries get the majority of the investment. If people had a higher level of wellbeing, the social and geopolitical structure would shift dramatically also.

For the better?

Who knows, but the current system is definitely not improving the global environment.

Ultimately though, I am an idealist on these matters, but a realist in my estimation of change for the better actually happening. Most individuals will of course look to secure themselves first and that is going to maintain the status quo, increasing the wealth and outcome gaps even further. I don't blame them of course, because everyone wants to have better outcomes for themselves and their families, so will obviously support initiatives that promise to offer them - even if they lead to worse outcomes overall.

What I do believe I know however, is that relying on government and industries that are driven by the singular algorithm of monetary growth, is going to lead humans into a worsening situation at all levels that matter to humanity. The economy might boom, but our lives bust. Tet, all we seem to be able to do, is watch on with a cup of tea in hand.

While getting tea-bagged by the profiteers.

Taraz

[ Gen1: Hive ]

If we want to take our financial health to the next level, we need to be good financial literate. Good experience is also required in this regard. We need to talk to children about the importance of financial literacy from a young age.

The price of tea is really high. It is much more than the cost of tea we can make at home. However, the rent paid for that cafe is 5-10 times more than the rent paid for a house. Employees, employees also have social security premiums. Business owners have to take these precautions to avoid bankruptcy.

It is a big circlejerk of price gauging at all steps in the supply chain. Ultimately though, the end user pays.

Oh man, it wasn't even loose leaf tea? That's kind of crappy. I love my fixed rate mortgage. I think I would have to be a lot richer than I currently am for me to feel comfortable going with a variable rate mortgage. At that point though, why would I even get a mortgage to begin with!

I have the maximum collar on our loan of 10 years, then it moves to variable. I didn't realise most of the home loans in the US were fixed like that. Makes a difference to house prices too. In Sweden the prices are high as they have 100-year loans.

They kind of cracked down on a lot of those variable rate things after the housing bust back in 2008 or whenever it was. Whenever I am looking for a loan I always look for a fixed rate and I always try to make sure there isn't a penalty for paying it off early.

I think globalism is largely responsible for much of this. On the one hand, globalism realizes the economic concepts of competitive advantage and arbitrage. On the other hand, this results in the loss of local jobs and therefore the income that might have been able to pay for lower costs of goods.

As an example, if a company makes t-shirts locally, they'd have to pay local wages, increasing the unit cost of the t-shirt. However, for the same money, you can have them manufactured abroad at a much lower unit cost, which is still low enough to ship the t-shirts thousands of miles to sell domestically. This is great, except that the people who would have bought your t-shirts no longer have jobs.

It's a short-sightedness that corporations have.

Globalism is responsible because of the way it is structured, not because it is global necessarily. It has been used a a mechanism to make a small fraction very wealthy, without oversight.

I suppose structuring has some effect. But ultimately, you need countries to export products in order to import capital. I think you live in Finland. Finland has great industries in engineering-related fields like machinery, equipment, electronics, and refining materials. Much of this has no doubt been impacted by losing Russia as a market to sell products and to import petroleum.

With a higher cost of energy and reduced exports, there is less capital flowing in than flowing out. Yes, you are paying more for goods and also exporting less to afford paying higher wages. But I don't see how structuring would help. Structuring assumes you have control. But how do you control the effects of the Ukrainian war with Russia?

Without monetary growth from trade, rather than just printing money, there is less capital for building that generational wealth you suggest. Individually, we can print money by making things people want to buy. And in the aggregate, we need to manufacture things to export. You're correct in your skepticism of government and industry who focus on aggregate numbers rather than individuals.

Your writing on Hive is one way in which you are creating something of value, i.e. printing money. And I think we don't educate people enough to realize that they can make things outside of a job to make their own money. We seem to only know how to make things for others to sell at a markup.

Are you reading about "reverse migration" locally?

It has started here for a while now, perhaps slowly around 2000 tech bubble burst, and then accelarated around 2007-08. However, after Covid people have really started to jump ship.

The reason I say all that, is maybe now it is time to jump ship and leave the west to move eastward. I know for a fact, I am not retiring in the US :)

If I move any more east I am in Russia ;D

But yes, I have heard of a few people heading back to various places, because they aren't getting jobs here.

You got to leap frog :)

Cheaper, better education, better quality of life if you stay in the mountains.

the tea bagging headline was i thought leaing to a NSFW kinda thing

DAMN!

:D :D

😇

At $4 for a tea cup it makes our local restaurant price of glass of Manhattan at Vons 1000 Spirits restaurant which is $8 sound cheap and I would rather prefer stiff Whiskey vs a cup of tea from a tea-bag :)

I can't find a Manhattan here, but $8 is cheap! A basic cocktail here is between €13-16 :D

I was chatting to @azircon a few weeks ago while he was in a bottle shop, and he was sending pictures of bottles and they were less than half the price of what I pay here for the same thing. Even for European brands!

Booz is cheap here.

$8 manhattan is reasonably priced, especially considering Seattle. I consider it expensive city. I will take that Manhattan, thank you!

You can buy a kilo Black Sea tea with that money in my country.

Both tea and coffee has gone up a lot here. With the amount my wife drinks tea, we will need to take a second mortgage.

😮

I think the problem is not just high prices but an economic system that put profits above everything.

If we have to rebalance maybe we should redefine success instead of limiting it to a set of numbers.

We need to redefine success, and we need to redefine "value" from a human level. If what we value as humans and what our economy values are not aligned (as they are now), we will fail as humanity.

Of Course

I thought this post was going to be about something completely different..... do tell me it was a clickbait title, not that you don't know what teabagging is in English slang 😁

Whatever do you mean?! ;D

When I short Bitcoin and it grows, that day I drink cheap coffee from a street machine for $0.30. And when Bitcoin falls well, I drink French wine for $30. Our whole life is a game! But for some reason I drink coffee much more often than wine :)

Wine every four years :D

Better to rely on oneself than the government. They keep making the economy worst day by day. What people do especially in the US is they go to diffferent countries to acquire properties this actually prevents them from being in one boat

We are all in the same boat at the end of the day - just in different compartments.

Lolzzz exactly

impressive figures