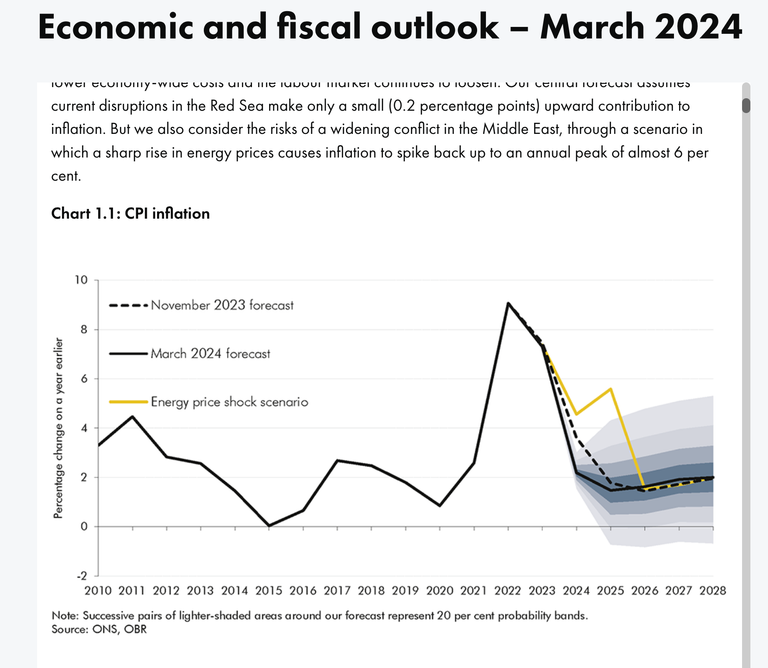

The Office for Budget Responsibility predicted, back in March 2024, that UK interest rates were expected to fall sharply in 2024...

The predicted decrease was off the back of inflation coming down to to around the 2% by mid 2024, following which the Bank of England should start to cut interest rates in response.

And lo and behold inflation was at 2% in June 2024, just last month, in the UK, according to this BBC article.

However the current Bank of England Base Rate is currently sitting at 5.25%, suggesting they are being VERY cautious about lowering them, but one feels they may come down VERY soon, the OBR's suggestion is that they going to be somewhere between 2.5% and 4.5% until 2028, fluctuating between the two.

So is it as a good time to get a 2-3 year bond or something....>?

That kind of fluctuation suggests it's a good time to shove some savings into a fixed term bond....

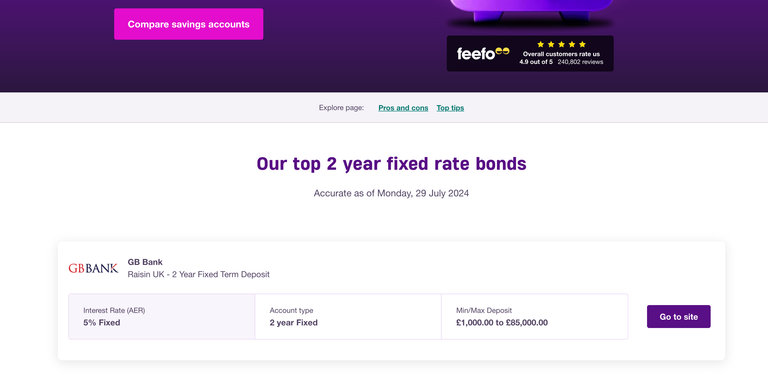

The best rates bonds...

They are currently sitting at around just over 5% so it is tempting, giving all the indicators suggesting a possible drop to below 3%, I probably wouldn't go for more than a 2 year lock...

On the other hand....?

A few months of relatively low inflation is no guarantee that inflation won't go back up again, and the recent escalation of war in the Middle East (war is mostly inflationary) and massive public sector pay rises in the UK (wage increases are also inflationary) suggests there are inflationary pressures still around.

And add to that my own pet favourite global cause of inflation.... it's simply more people moving into the middle classes in poorer countries, a development success story that means more strain on finite resources, combined with a climate crises that limits resources even further....

There's potential for both inflation and thus interest rates to remain on the high end of that 2.5% to 4.5% prediction band!

Final thoughts...

For me I think I'll move a small percentage of my cash savings into a fixed term bond, maybe 30%, that feels about right!

Even if inflation starts to creep up again and interest rates follow to 6, 7% or more, the market may not pass that on to consumers in terms of better savings rates anyway, if they do, there will be a delay for sure, because if that does happens it blows the OBR's predictions out of the water and leaves us with even more uncertainty, which markets generally don't like, so I think having something in longer term financial products makes sense.

But not too much, the reason I hold SOME cash is for the flexibility aspect, I don't rely on it for yield, it's just a matter of spreading my bets to get a decent return on what do hold, in the meantime!

Having to make the choice is defo a first world problem and we'd all do well to remember that!

Posted Using InLeo Alpha

Interest rates are dropping fast here in Canada so I locked in a bunch at 5.5 % for 5 years.

That's a pretty nice rate and time period, probably a good move!

Yeah. I am very Risk averse with the bulk of my fiat …. We have 2 kids to put though University . So I try to put 99% of my Savings into High interest GICs (Guaranteed investment Certificates) in a Tax Free Savings account …. I buy the big Bitcoin dips and other crypto with the remaining 1%

I only ever spent <5% on crypto, I don't buy any more with FIAT, but that 5% Vest meant that crypto became over 75% of my wealth.

For my part I am piling into HBD.

It's certainly tempting, a pretty decent savings strategy methinks!

As the conditions of the countries are going at the moment, if you get a good interest rate, then you can live a good life.