There will be blood...or will there be? There is a lot of speculation, but we cannot be certain.

Changes are coming – this much we know. There have been many discussions about what will happen, what won’t happen, and what might happen, but nobody really knows. Anyone claiming that they know what will certainly happen is a fool and/or a liar. Let’s look at what’s possible.

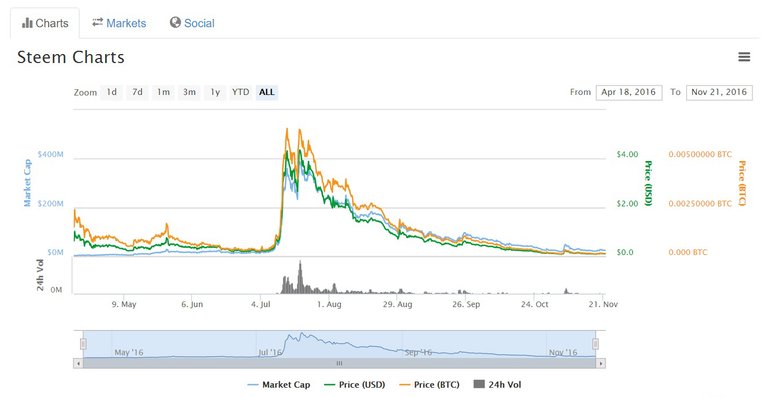

The Great Dumpening of 2016

There are a lot of people expecting widespread power downs and a large dump of Steem on the external markets once the new hard fork is implemented. Changing the power down schedule from 104 weeks to 13 weeks will definitely have an impact on current stakeholders. It’s a significant change in the Steem economics and it would be reasonable to expect some significant changes in economic behavior by anyone holding Steem. So, what can we reasonably expect?

There are many large stakeholders that have been powering down their Steem Power holdings over the last several months. It should not be surprising to see them continue to power down. The difference after the hard fork would be that they can exit their long position at a much quicker rate. All other factors being the same, this would likely drive the Steem price to new lows. This can cause other long-term investors to panic and want to begin cashing out some or all of their holdings as well – and force the price even lower.

The shorter timeline for withdrawing Steem Power will also provide an opportunity for other users and investors who were not powering down to begin withdrawing their holdings. Those people who had no intention of remaining invested in the platform and just want the money in their pocket will have the chance to take the money and run. If this happens, it will also add to the downward price pressures.

The important thing to do here is to remain calm. Investors exit short and long positions all the time. It’s a natural function of markets. Not all investors want to continue growing their long positions. Not all users on Steemit even want a long position. They will sell until they have reached a target for their holdings that makes them comfortable. There’s nothing wrong with this and there’s no reason to panic if we see the price fall after the hard fork. It’s not a sign that the fork was a mistake or that nobody wants to be invested and the project is going to fail.

To be clear – it’s possible that we will see a very large spike in accounts that are powering down. It could even look pretty grim for several weeks or a couple of months until a majority of those stakeholders have fully exited their positions or reached a level of investment that satisfies them.

It’s also possible that there won’t be a mass exodus – that long-term investors won’t feel trapped in a two-year lock-up and that they will feel more confident in the economic changes. The inflation rate will be much lower and the timeline for cashing out will be much shorter. Also, powering down will likely reduce one’s holdings at a greater rate than can be accumulated by inflation and various rewards, so large stakeholders cannot power down while mostly retaining the same level of holdings in their account. This may actually provide enough disincentive to stop them from powering down further.

Honestly – we don’t actually know what’s going to happen. We can only speculate at this point, but a sell-off is probably more likely than not. As far as Steem prices go, we should not be surprised if we see new lows after the hard fork.

The Great Awakening of 2016

Regardless of whether The Dumpening happens, it’s very possible that we also have The Awakening of Steem and Steemit. Steem’s inflation rate has been a very contentious issue for users, investors, and potential users and investors alike. There has been a lot of misunderstanding of inflation, but the mere perception of inflating the currency at such a high rate was causing a lot of concern. With that concern being mostly eliminated, we could very well see a lot more interest in the Steem currency.

If we have learned anything about cryptocurrencies over the last few years, it’s that they can be extremely volatile on nothing more than speculation alone. A currency at $0.10 today can easily spike to $20 tomorrow and $250 next week, then return to $0.10 a few days later. It would be very possible to see the Steem price spike after the hard fork or even after the announcement that the code is ready for review by the witnesses and community.

Just as I mentioned that we should not panic if the price falls, we should also not get too excited if the price quickly jumps through one or two levels of resistance. As stated, The Dumpening may not happen and prices may not fall, but that doesn’t mean that everything has been fixed and that the price will only go up from here. There is still a lot of development needed and a lot more adoption is necessary with both Steem and the various interfaces using the currency. Changing some of the economics isn’t going to make Steem the next Bitcoin.

That being said – the changes could very well lead to mid- to long-term price stability. With the continued development of different interfaces, this could bring in a new wave of investors and users, which could – in turn – lift the prices of Steem even higher. It’s very possible that we can see a scenario where the hard fork and the announcement of a new interface could give Steem and Steemit momentum into the end of the year, despite any increased desire to power down and sell from some of the larger stakeholders.

If the Steem price can show resilience, even in the face of large stakeholders exiting their positions, it would be a strong indicator to potential users and investors that the platform has a very solid footing in the crypto markets and that there is a great deal of confidence in the currency and platform going forward. This would be a huge boost for the perception of both Steem and Steemit.

Again – we don’t know if any of this will happen, but we should not be surprised if it does...or disappointed if it doesn’t.

Thoughts and Concerns

There are a couple of things that I want to mention as briefly as possible. I know that attention spans are getting shorter, so here they are.

1. The announcement from @ned and @dantheman.

Both Ned and Dan announced that they would not be powering down their personal stake during the first three months after the hard fork. While I think that this is a good idea – as the founders and the owners of Steemit, Inc. – I don’t think that this announcement is as good as everyone has thought.

I do believe that, generally, owners/founders of a project or company should not be cashing out while it’s still in development and while they’re still asking others to invest and fund development. The announcement that they have stopped powering down and selling is welcomed news. However, announcing that this will be halted only for a specified amount of time isn’t exactly beneficial. It only serves to raise more questions, such as:

Why three months?

Will the selling continue after those three months are over?

Will selling only resume if the markets are more stable?

What will be the purpose of resuming the selling?

Will this be used for project development? If so, why would you postpone selling if it’s needed to further develop the platform?

It may also affect how well the markets can price Steem. If their announcement is taken as fact that they will resume selling in three months, then it’s possible that this will be factored into the near-term interest of Steem and its price. If there is uncertainty about whether or not selling will actually resume or how much selling will take place, then we may not get any meaningful price discovery until that occurs, so they’re only delaying the inevitable. I don’t particularly like these types of announcements because they can often leave markets in limbo, especially at the low volumes we’ve been seeing and especially with such a large stake in play.

It would have been better to either continue powering down as they were or to explicitly state how much would be powered-down and sold – and when. Uncertainty is generally negative for markets and investors, and that’s where we’re mostly left with the announcement. Again, this wouldn’t be as much of a big deal if not for their rather large stakes. A little more transparency about why they have been powering down and where that money is going would have been a much more useful announcement, in my opinion.

2. Know your comfort level with your investment.

It’s important for all of us to remember that this is still a very young project, so we’re likely going to see a lot of volatility and a lot of changes being made that we may not want or even understand. If you’re investing your own money into Steem, then you need to be sure that this is money that you’d be willing to lose if the worst-case scenario were to unfold. Businesses fail all the time. Cryptocurrencies fail all the time. You need to protect yourself against these possible failures.

Being a good investor is more than just picking the right investment and choosing the right amount to invest. It also includes knowing when to cut your losses. Don’t lose all of your investment just because you were worried about losing some of your investment. If things are looking bad and you are no longer comfortable with taking losses, then get out. Live to fight – or invest – another day. It’s like that famous philosopher once wrote:

You've got to know when to hold ‘em.

Know when to fold ‘em.

Know when to walk away.

And know when to run.

All of this applies to Steem. Even those users that have not invested actual money into the currency or the platform should consider how much stake they have. Not all investments are about money. Many of us have invested a lot of time and energy into creating content and building the community. We need to consider how much of our rewards we want to keep in our Steem wallets.

We’re going to see a lot of movement – probably a spike in volume on the price charts after the hard fork. If you want to reduce your long-term holdings – or increase them – to a level where you’d feel more comfortable, then do so. If you’re holding for the long-term because you truly believe in Steem and the various development projects, then don’t fret over the short-term volatility. Watching price charts all day will likely just make you sick. Don’t do it. Just check in occasionally and go with your intuition. Enter or leave your positions when Steem reaches your target prices.

If you really believe that Steem will be worth $1.00 next spring, then don’t panic because the price fell from $0.11 to $0.09. If you truly believe that Steem will be worth $5 or $10 in the next year or two, then don’t worry about the price fluctuating in a range between $0.05 and $0.50. If you believe the price is cheap and you’re comfortable with the amount of money you want to invest – and possibly lose – then don’t be scared off by a spike downward. If you have reservations and are not confident in Steem or Steemit, then you probably shouldn’t be putting your own money into this.

Here are a couple of clichés for you: Trust your gut and don’t put all of your eggs in one basket.

That’s simple investing advice that can be universally applied.

What will you be doing, @ats-david?

I’m glad you asked.

I’ve been powering up most of my post rewards over the last month and a half. I think that there is a lot of upside potential with Steem, especially if this hard fork is received well. All indications point to that being the case. I will likely continue to power up as I have been.

If the price falls through the recent support after the hard fork, I’ll probably be more inclined to convert some of my Steem Dollars to Steem and power some of that up as well. My personal bet is that Steem will likely be worth more than $0.10 at some point in the next couple of years than worth less. It will probably go lower before it goes higher, however. I’m OK with that and I’ll make my decisions as I evaluate the markets and the development of Steem interfaces.

I’ve recently started working with @steemsports as a presenter and will also be engaging the community further with another popular project that will be revived. An announcement for this latter project should be coming within the next week. I also plan to use Steem and Steemit for my business once it’s operational, particularly for international payments to my farmer friends in Central America.

There’s a lot going on and there are plenty of untapped markets for this experiment to grow. I know that I’ve questioned the development of Steemit recently and I would still like to see things moving on this platform a little more quickly – such as creating basic profile pages and features. But don’t get the wrong impression: I’m in this for the long haul and I will continue looking for ways to use this currency and platform in my own life and within my circle of friends and business partners.

Closing Thoughts

If users and investors want to leave the platform, then let them go. There is a far greater risk of abuse from toxic users and investors who are locked into a long-term investment than from those who can cash out and leave in a relatively short time frame. As stated by other users, this ability to enter and exit long positions on a shorter timeline also allows for quicker price discovery. This is needed – and combined with the other changes, I believe this hard fork will be a net positive for Steem in the long-run.

There may be blood. There may not be blood. We could see The Dumpening or we could see The Awakening. It’s actually quite likely that we’ll see both. If you can look beyond the horizon, none of this may bother you. If you’re only concerned about what’s in front of you, then you may be swayed by what could turn out to be proverbial blips on the radar. It’s all a matter of perspective and it’s mostly based on one’s immediate wants or needs in life.

There’s no meaningful prediction to be made here. There’s no right or wrong answer concerning how we should act or react to what’s coming. Do what feels right for you. Do what makes you happy. Just make sure that it’s an informed decision and that it’s not made in a panic or based on pure emotion. On that note...

The Forking is coming. Good luck!

Follow me: @ats-david

Great post! I agree with a lot of this... I think a lot of the selling was just because of the way the system was set up, the largest holders were able to power down while still collecting enough SP interest to not really lose any stake in the platform... Now that is changed. I actually expect to see a decrease in selling...

This has never been the case. The % stake always decreases from powering down. The SP balance increases but the total money supply increases even faster.

Anyway, that will be more more clear after the fork with lower inflation and faster power down. The main advantage to this fork is making the system easier to understand.

Yea I was wondering about that right after I posted it... I didn't word that correctly... My meaning was that total SP holdings didn't decrease from powering down not that their ownership stake didn't decrease... Thanks for pointing that out :)

I was hoping for more like a 6 month to a year power down time frame... we will see how this works out in a matter of weeks.

as it works up to now, the power down rate is slower than the interest. people will probably let a few payouts go but then power up again because they will lose vote power and curation rewards. So I think faster payouts will give people more choice and the drop in inflation will suck out more supply than powering down users will be able to put on the market. A rise in demand will make people hold more than before where powering down did not reduce their relative positions like it will after the fork.

Yep, I concur :) I look forward to the changes. I think we see much higher steem prices in the coming months.

I agree with smooth's assessment about stake vs. SP. I could have been clearer about that in my post. The way it is right now, it's possible to power down and sell Steem without necessarily losing any Steem Power from week to week - IF you are actively receiving rewards from posting and curating, and even from being a witness. And I suppose there's nothing inherently wrong with that since work is being done, but it can contribute to a seemingly endless cycle of powering down and selling from the same large SP holders.

The 13-week power down schedule effectively eliminates that possibility.

I would have liked to see Ned and Dan commit themselves to 21 months without cashing out.

When I moved my money in, it was on the understanding that the founders were committed for two years.

That said, I think they're on the level.

They've been too publicly connected with the project, to screw 10,000 strangers from all around the world and then retire quietly somewhere.

Dan and I are committed to not powering down in the 3 months effective this change and not powering down faster than the previous software rules would allow from the @ned @dan @dantheman accounts. Everyone given a large SP account to work as an employee at Steemit is also on a multi-year (at least 2 years) vesting schedule that began at earliest in March.

I didn't know that would be possible. So you'll be powering down after three months, but only on the 104-week schedule? Or am I misunderstanding this?

We're committed to not powering down faster from these accounts than would have been possible under the current software. That's approximately powering down no more than 1/8th of stake each 3 months. This is not a commitment to power down.

OK, I got it. Thanks for clarifying. I appreciate it.

It has always been possible to power down more slowly than the maximum rate (at least using the CLI wallet). I think there has been some confusion about this since the function to power down a smaller amount is not exposed in the GUI.

Thanks for your reply, Ned. It's this sort of openness and transparency which will continue to drive the platform forward.

I'm proud to be a part of it.

I guess we'll find out sooner or later.

Feel the Power of the Fork, but don't join the Dark Side of the Fork :P whatever that is.

LOL

Use the fork, Luke

Nice post. I'm also working on one but mine brings much more fear to light.

One big question with the dev's powering down:

What do you think will happen to investor confidence when the owners are exiting with a potential timeline of 13weeks? ~1 fiscal quarter?

With steemit less than 1year old, it's rediculus that the Devs are already cashing out without providing some clearity as to where the money is going, absolutely no transparency.

Sorry, but this looks like a developmental cash grab, ponzi sceme that is about to crumble. Your completely right, How can the developers seek investors when they are cashing out?

Here... Please come invest your money in this revolutionary idea while I cash it out....

It may not be good for confidence initially, but I don't believe that the "owners" are going to sell their entire stake. They still have a fairly good reason to remain as large stakeholders, unless they completely abandon the project. I don't think that's the case and I hope I'm not wrong about that. Confidence will come from investors when they see that the currency is being used to create additional/better interfaces and that the potential for widespread adoption is greater. Investors won't show up just because some people stop selling their stake. They'll show up when the currency has sound fundamentals - like actually being used in commerce.

This is my assumption ^

I like these changes---but i think its going to confuse and anger many people . Perhaps I'll be wrong though. It's happened before!

I love the word "dumpening". I think so many people are expecting a drop, that it might not happen as people hold back because they don't want to sell at depressed prices. I think the sales will happen slowly over the next six months.

Very well written and thoughtful analysis. I'm excited to see what happens! As a long term hodler I'm not so concerned about the potential volatility. I'll just be happy to see some kind of shakeup of the status quo. I've been steadily accumulating a decent sized SP position and powering up all my posting rewards, in anticipation of a possible trend reversal. But as you say, maybe accelerated power downs will actually increase selling pressure until some equilibrium point is reached, so if that happens I'll be grabbing all the cheap Steem I can!

The Dumpening scenario would actually be quite healthy for the ecosystem, as it would lead to increased distribution of power across accounts, counteracting the concentration of SP in the hands of the top few, which has always been one of the platform's biggest problems. Having a new and sizeable dolphin class established once the dust settles is the outcome I'm hoping for.

I think the price will crash, and that is ok with me. It just means people who want out will no longer have to wait 2 years to do so...price will go low for a maximum of 13 weeks then it will recover.

Of course I dont know the future and this is only my personal opinion.

Maybe. I wouldn't bet on that. It may not go much lower at all...or it could go lower for a lot longer than 13 weeks. We'll have to see how the other projects pan out and how many people can be brought into the Steem economy.

Those who choose to power down still will have a week before they get their 1/13th sent. With this in mind, I suspect a news rally that might provide a double top to accompany a successful hard-fork, followed by another dump, perhaps below current levels. After that, I anticipate another pop after weak hands are shaken lose, initiating a trend reversal (if the hardfork itself is not a trend reversal event).

This is all fundamental off the top of my head, so is clearly subject to the technicals and the mob's rule of the market. Sentiment can defy logic far longer than most are able to handle.

What happens to people already on a power down schedule?

That's a really good question. I suspect that the current power-down schedule will continue until they cancel. I've been running an experiment with mine for a few weeks, to try to understand the formula for powering-down, so it will be pertinent for me. I just want to see the numbers, so power back up right away.

I'd say that this would be a fairly safe bet. Initial jump, then some selling off as the larger stakes actually begin hitting the markets after the first rounds of powering down. Then, as more info about different projects comes out and more people start buying at their price targets, things will even out a bit and start to tick upward. It'll take time and it might get pretty ugly at some point, but we'll likely look back at this and wonder why so many people were worried - then have a good laugh as we retire to our private, South Pacific islands.

lol, Another Joe approves this message.

I am wondering whether the fact that dan and ned will stop powering down is a counteraction for all the users that are planning to power down and run away. In this case, the three-month period makes sense. But I am not them... :D

RIP.. Steals my coined term! Ya bastard. :)

Not a bad article. I didn't mind it.

Yes, but I also coined "The Awakening" and "The Forking." Well, maybe the first one already existed, but the second one is all mine!

I'm not even mad sir. did enjoy the read. :)

What a great post. It is very good when someone like you as what I started referring to weeks ago as a #SteemElder or #SteemElders takes the time to fill us newer types in on things in any given "space' - I certainly appreciate it.

I have so little currency or worth on here so to speak, I have been powering up all my posts the last week, and also trading my Steem in for extra Steem Power twice in the last week also -- I believe in this platform and project and that is why. I see real potential in this for lots of reasons.

Oh and I noticed a small SP error here you may want to correct, I hope you do not mind.....(the plural form is missing in context)

And as always TY for your work on here, very much!!! Sincerely BD

"....Business fail all the time. Cryptocurrencies fail all the time. You need to protect yourself against these possible failures."

The price may very well crash a little after the fork but I am of the same mind as this article. If it gets the toxic investors out then let them go. It will bounce back and people may very well be attracted in by the ability to cash out easily if they need to

It seems some people are still dumping hard.

It helps to accumulate as much BTC as possible for the rebuy at or below .01 USD.

#playingbothsides

That sounds like a good deal.

Definitely. And I think those same people will keep dumping after the fork. We just need to let them go and keep growing and improving the Steem economy.

so m00n! definitely hitting $3.75 within 7 days of the fork. #FOMO buy!

;)

To the mooooon!!!

I've always read of the same nature but I couldn't really understand well. Maybe because I have limited idea regarding business economics. But I wanted to understand. I'm also looking forward for the brighter future of steemit and I'm not living. I'm not a money investor, and steemit has nothing to lose from a person like me but I will stay. I admit that there are times that I cash out, but its due to basic necessities and nothing more.

I wanted to understand inflation, what is it and what it's rule and function in the steemit economy? I hope you can enlighten me with it.

Good stuff. All of that sounds very calm and reasonable, and echoes a lot of what I've been thinking. Thanks!

Wow no lack of meat and potatoes in this post.

I agree with you 100%, excellent analysis sir.

Excellent post! You have put everything thing on the table and it could go anyway, and I am waiting to see what happens. But like you say, we might have a bit of both!

Excellent summary and analysis. As always, you're a great source of information for those of us trying to keep appraised but lacking the time to delve into everything going on. Keep up the good work! I'm still in it for the long-haul as well, and I'm still powering up my Steem.

Great article. Upvoted, followed and resteemed. If you're interested I've been chasing the idea of getting money from Paypal into Steem. Something which allowed 'normies' to invest easily might go a long way towards offsetting and price drop. Here's a link to the most recent part if you're interested. https://steemit.com/bitcoin/@nikflossus/4-linking-paypal-and-steemit-momentum-building

I'll check it out and give you some thoughts.

I don't think anything is crashing, but if it does, I'm going to buy more and more and more Steem! :)

That may not always be the best strategy for investing, but I appreciate your enthusiasm!

sometimes your "positivity" really amuses me :)

In economics, u can analyze only three scenarios: 1) the worst 2) nothing happens 3) the best.

you also forgot to mention that more than half of Steem belongs to Steemit inc. so there is no worst scenario. And with so high inflation Steem was always seen as short term investment. It was about time to experiment with 3 month threeshold.

my bet is the price will go a bit lower than it will go back where it was. We will know never how much Steem is worth until we see the competitors running their own platform. Only after this case, we can see what is the real value of Steem ( which I suppose will go higher).

I read halfway thru and stopped reading due to me being tired of hearing what if's as I believe in this platform and know roller coaster rides is how $uccess is made - but decided to read your conclusion and it is basically what I was going to say hehe

Let them go and they will admire our endurance and see our success(long-term). Whatever happens, I'm ready! If it g0es down, I will continue buying cheap and if it rises I will still be buying for long-term while watching my m0ney double, triple, quadruple in size ;) Hell, I was purchasing bitcoin when it was in the $400-$600's during '2014' - half 0f 0ne here, half of 0ne there! S0, Steem to me, is penny Stocks!

Nice post by the way

I've been involved in digital currencies for tw0 yrs going on three soon and this is the BEST thing since Bitcoin best believe! Zca$h is crazy in terms of where the price is@lol But Steemit(Steem) is POWERFUL STUFF!

Great article.

Oh, sorry, forgot --- RS and UV for you as usual. (:

thanks for this info my friend! upvote ;)

Great post! I think you did an excellent job providing the possibilities in a well balanced way :)

I am not really worried about the hardfork. Let the people who are going to exit do so. I am not really out of pocket for my Steem position and this could be a good time for equity in the system to become more evenly distributed. The concern is loosing users to the platform because posts are not paying. There is already frustration in people about not making any money. I have always taken a long range view on this system.

I also tend to agree with your perspective on system development. For a social network there seems to be many things that are less than attractive to the masses. I think it behooves the devs to not only add the profile pages taht you mention but to build better tools for aggregation of content and improve things like making a better editor that includes the markup generation. The current editor reminds me of my old mainframe days. It is out moded.

This post has been linked to from another place on Steem.

Learn more about and upvote to support linkback bot v0.5. Flag this comment if you don't want the bot to continue posting linkbacks for your posts.

Built by @ontofractal

Wonderful post @ats-david! I'm in for the long haul and it's going to, undoubtedly, be an interesting ride!

Only catching up on this now. Personally i think everybody is waiting for this price drop from a potential market crash before they buy in. Everybody is asking "how low can it go?" and my prediction is that we have reached that low and those who wait for the "crash" will have missed their opportunity.

There are 3 reasons I think the price is not going to get lower than after the hard fork.

Just my speculative opinion or personal prediction of course. But i think the best time to buy is before the hard fork.