People don't have a really good idea of how high-income that is in the US.

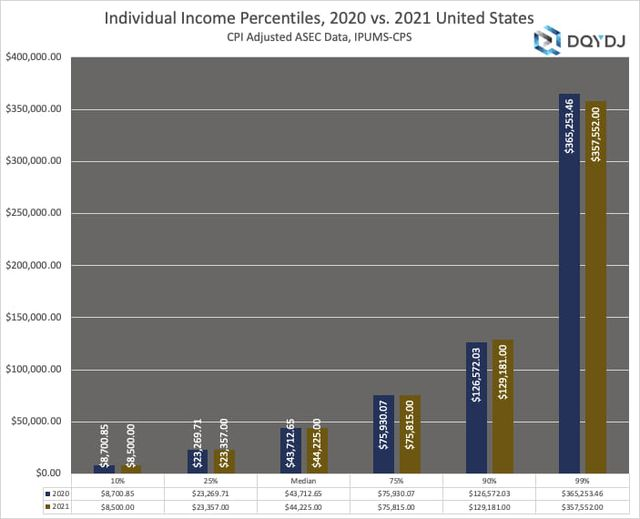

$125k is the 89th percentile of the individual income distribution. $250k household income is the 93rd percentile. Albeit most of the benefits are going to people that make under $75k, but even that is relatively high. Median individual income in 2021 was $44k. $75k is the ~75th percentile. And ~13% of the benefits are going to people in the top income quartile.

And these are gross income percentiles. The plan uses adjusted gross income, which for a lot of these high-income earners may be reduced a not insignificant amount from things like retirement contributions.

Just really bad optics that could have easily been avoided to eliminate a lot of the rhetorical weight of criticisms of the plan.

I think IDR forgiveness is overstated. The loan schedule reflects the balance and a person's income. Most will pay off their loans before forgiveness is relevant unless they have extremely high balances or do PSLF or somehow get stuck in low income work for 20 years, which is unlikely for the people with high balances.

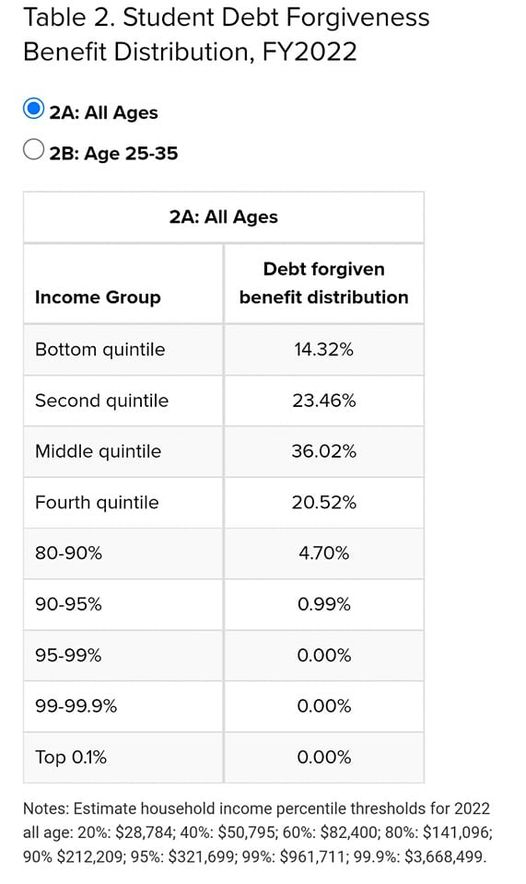

Penn Wharton updated their estimates of the student loan forgiveness benefit distribution.

You can see the technical regressivity of the plan, but also again keep in mind that the highest income quintile largely isn't receiving benefits and most of the benefits are going to the middle class.

~94% of benefits are going to people below the 80th percentile of the household income distribution. ~74% to those below the 60th percentile. ~14% to those in the lowest quintile.

My home loan identifies as a student loan…

This whole thing is a shit show to gather votes.