Hi Everyone,

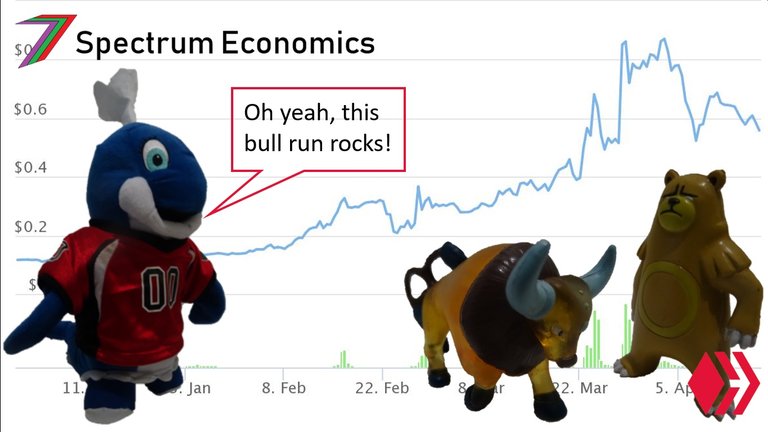

So far, in 2021, cryptocurrency markets are experiencing an amazing Bull Run. Bitcoin had a very strong 2020 but its bull run did not begin to take off until the fourth quarter. In the fourth quarter, the price went from US$11,000 (1st October) to US$29,000 (31st December). That is almost a 200% increase in just 3 months. Most other cryptocurrencies did not begin their bull run until 2021. Hive did not begin its bull run until February. When the bull run started, prices soared incredibly fast. Hive went from US$0.136 on 1st February to US$0.775 on 31st March; price even very briefly eclipsed US$1. That is over 450% increase in just 2 months. An increase of such magnitude in just 2 months is amazing. It is potentially (i.e. need to sell it to realise it) very profitable for anyone who bought Hive during the bear market (with exception to anyone who bought at the peak of the brief price spike on 27th April 2020). The higher price is good for attracting new users and bringing back former users who quit because the price fell too low for them to want to post on Hive (or Steem). The higher price can fund more initiatives and projects, which can help speed up and expand development.

My Concerns

A price increase for Hive after three years of an aggressive altcoin bear market is great news. However, understanding the reasons behind the price rise is also important. Ideally, we want people to invest in Hive because they believe it is a great long-term investment. The bull run is a great opportunity for Hive as a lot of money is entering into cryptocurrency markets through Bitcoin and several other popular altcoins. As the price of Bitcoin rises, many investors may choose to reinvest their profits into other coins. Hive would be a potential candidate.

As the price of Hive has increased and the trading volumes have increased considerably from 2020, we can strongly argue that Hive has stimulated demand. We do not know if this demand is from genuine investors or from speculators trying to make a quick profit before moving onto the next coin or to a stable coin. I believe the majority of demand is from speculators. Hive does not appear to have been singled out as a long-term investment. I believe this to be the case as demand does not appear to discriminate between coins. It is difficult to find an altcoin in the top 300 by market cap that has not experienced a significant price increase so far this year. Despite Hive’s considerable price increase, it has not improved its market cap ranking. According to Coinmarketcap.com, Hive’s market cap ranking fell from 162 on 3rd January to 173 on 4th April. Table 1 contains the price changes of several cryptocurrencies for the first quarter of 2021.

Table 1: First Quarter 2021 Price Changes

Source: Coinmarketcap

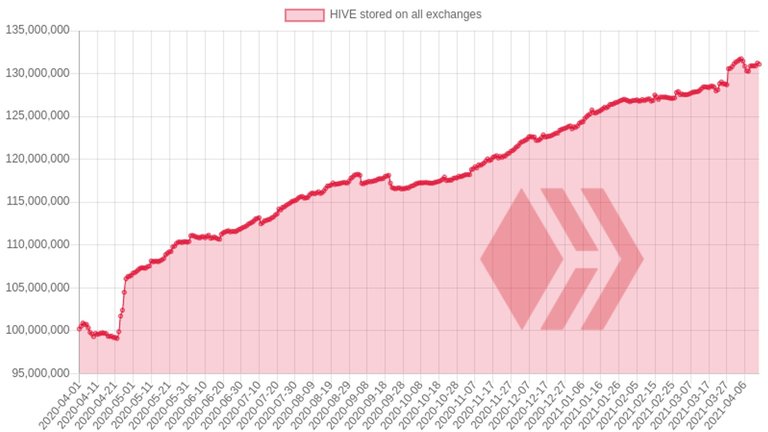

Another reason I believe Hive is being bought mostly by speculators is the increasing amount of Hive being stored on exchanges. Figure 1 is from a post by @penguinpablo

Figure 1: Hive Stored on Exchanges

Source: Weekly report: How much HIVE is stored on the exchanges? - April 14, 2021

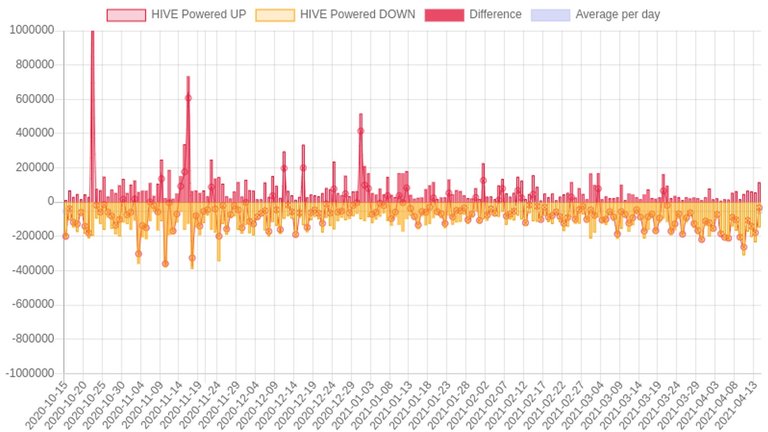

The amount of Hive stored on exchanges has been gradually increasing since its inception in March 2020. If a substantial number of long-term investors had bought Hive, we would have expected them to move Hive off the exchanges and to their accounts where they would have staked it. The amount of Hive powered up is falling while the amount of Hive powered down is increasing. See Figure 2 presenting data from @penguinpablo.

Figure 2: Hive powered up and down

Source: Daily Hive Stats Report - Thursday, April 15, 2021

Speculators do not need to discriminate based on quality. Instead, they will discriminate based on likelihood of highest short-term gains. Hive might not be the best candidate for many speculators as Hive has a higher inflation rate (i.e. higher increase in supply of coins) than many other cryptocurrencies. Much of the new supply of Hive is sold to support content creators, project proposals, operation of DApps and the blockchain. This puts downward pressure on the price of Hive restricting its ability to climb rapidly when the demand increases. I discuss factors influencing price in detail in my post Hive Price.

Does it matter who buys as long as the price increases?

A higher price is great as it can help achieve many of the goals of the blockchain. However, the type of buyers determines how sustainable the price increase will be, as buyers become future sellers. If speculators buy the majority of Hive, the price of Hive will be more volatile, as speculators will not stake their Hive and are likely to move quickly to the next opportunity thus causing the price of Hive to fall. This sudden drop could occur at any time.

Future implications of speculative buying

I would strongly argue that the price of most altcoins has been driven by speculative buying in the first quarter of 2021. If the altcoin markets continue to be dominated by speculative buying, we are likely to see almost every altcoin increase in price regardless of the value or potential value they may offer. This will make it more difficult for genuine investors to discriminate between coins, as the good and the bad could be performing almost equally well in regards to price movement. Genuine investors could be deterred by an excessive amount of speculative buying as they may foresee a potentially large price correction when the speculators decide to sell. Therefore, they may choose to wait until prices have fallen.

When the bull run comes to an end, altcoins could be facing a very aggressive bear market. Speculators are likely to buy Bitcoin, stable coins or even exit cryptocurrency markets completely. Non-speculative coin holders may follow in fear of falling prices thus pushing prices even lower. Some long-term investors may remain but many others may sell to buy back once prices have dropped significantly and stabilised. This will push prices even lower. For Hive to avoid the full brunt of an aggressive bear market, it will need long-term investors who will stay invested as prices fall.

What if demand becomes more selective?

If demand for altcoins becomes more selective in the coming months, it would be better for cryptocurrencies and blockchains as a whole. The stronger or more popular coins and blockchains will increase in market cap and in market cap ranking thus gaining more exposure and greater demand. The coins that are weaker or not popular will no longer rise in price, they will fall in market cap ranking as they are overtaken by coins that are in greater demand. Some of the stakeholders of these coins will realise that their coin is falling behind in the bull run and will trade their stake for coins that are still rising in price. This will likely lead these coins to fall in price and move even further down in market cap ranking. Price movements will become an indication of value, demand from genuine investors and speculators will be more aligned (short run price movements will resemble long run value).

Even in this scenario, a bear market is still inevitable. Altcoins that offer real value and application will still fall in price. This price drop will not be as fierce under a scenario where speculators almost indiscriminately sell off the majority of their altcoin holdings. Altcoins that did not experience significant price gains in the bull market are still likely to be hit hard by the bear market. Unless these coins/blockchains are able to make adjustments to provide value and/or real life application, they will fail. Failure is important as it helps reduce the number of coins and blockchains as well as concentrates investment on the remaining coins, which will help them achieve greater adoption. Success of stronger coins will encourage development of the remaining coins as well as provide incentive to stakeholders and developers of new coins to create value and real life application. This is also good for the reputation of cryptocurrency and blockchain technology by demonstrating there are reasons for adoption that do not revolve around speculation and short run profits

Where do I see this bull run going?

I think this bull run will remain mostly speculative. I believe most altcoins will achieve new all-time high prices and market caps before the bull run ends. I believe there will also be many genuine investors. It will be essential to reach these investors and display the value of the blockchain to them. Their initial investment may not cause the price to jump significantly above other altcoins that are relying on speculation for price gains but there will be a significance difference to how price responds to the bear market. There would significantly less panic selling. The price would still dip but not substantially or to the extent of many other altcoins.

When will the bull run end?

I believe many people believe the bull run will reach the end of the year or close to it; this would be consistent with previous bull runs and the four year Bitcoin cycle. However, it could end much sooner. Markets can turn very quickly and unexpectedly. I believe the bull run still has several months left but I believe it is likely to end a little sooner than most people expect. This is because people are likely to want sell off their cryptocurrency before the anticipated peak to avoid reduced gains from a sudden fall in price. If enough people do so, the bull run could end. For the 2017 bull run, less people were predicting it to end; therefore, it could have continued a little longer than what it would now as people are more familiar with the bull and bear cycles of cryptocurrency. The bull run started earlier than 4 years ago, it is possible it could also end earlier as well. I also predict that the price of Bitcoin will not fall as much (in percentage terms) as in the previous bear markets. Mass adoption should stabilise the price.

Quick Comparison between Hive and Steem

I believe it is useful to make comparisons between Hive and Steem. This is because the two blockchains split only a year ago. Hive took the majority of the developers, DApps, and community. Steemit predominantly controlled Steem through their large stake. Since the split, Hive has arguably grown at a faster rate than Steem in many areas such as blockchain upgrades, DApps, tribes, and communities. Steem has damaged its reputation by removing stake from stakeholders and increased centralisation of governance. Content creators on Steem could receive higher rewards from the distribution of Tron tokens and an exceptionally high Steem Dollar value.

In the first quarter of 2021, the price of Steem has increased by a higher percentage than Hive. However, trading volume for Hive has been higher on 54 of the past 90 days (15 th January to 15 15 April). If we adjust for price, Hive has traded more coins than Steem on 76 of those 90 days. This indicates that demand for Hive is greater than Steem but the price of Steem is rising faster because Steem holders are less willing to sell.

A significant amount of trading volume for Steem occurs on the South Korean exchange Upbit. This demand is likely to be speculative, as 99% of Steem Dollars (SBD) are traded on Upbit. The price of SBD has increased to over US$10 solely because of trading on Upbit. Speculation is the only logical reason anyone would buy SBD for a price significantly above US$1, as the price for SBD will naturally gravitate towards US$1 in the long run (supposedly stable coin). A large portion of Hive is also traded on Upbit, which we could argue is also mostly speculative buying. However, the proportion of Hive sold on Upbit compared with Steem appears significantly lower.

It is possible, if demand remains mostly speculative in this bull run, that Steem could maintain a higher price than Hive. Even if that happens, the price of Steem is likely to be significantly more vulnerable to the bear market. Hive can be expected to be in a much stronger position for the next bull run (mostly likely in 2025). Hive will be a significantly stronger long run option.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

My New CBA Udemy Course

The course contains over 10 hours of video, over 60 downloadable resources, over 40 multiple-choice questions, 2 sample case studies, 1 practice CBA, life time access and a certificate on completion. The course is priced at the Tier 1 price of £20. I believe it is frequently available at half-price.

Future of Social Media

I think you are right. The buying is based upon speculation. There are not long term hodlers in there for the most part.

The future of Hive is going to come from the applications on here and what is developed. It really is that simple. The hype and pumps are not going to pertain to Hive. Instead, we will see people getting active and staking the token for the use case.

It is a novel idea in crypto but that is the point I believe we are at. Hive has some of the best technology out there and some of the DApps being developed have a chance to break through.

Posted Using LeoFinance Beta

I think marketing should help as well. @nathanmars is working really hard on Twitter and @lordbutterfly has his marketing campaign, which is being funded again. Hive should be able to attract the attention of users, influencers, investors, etc.

Absolutely. We have active convos with a number of influencers at this moment. I will update the community once we have confirmations of onboarding. .

Awesome, great stuff. Thanks for the effort you have put in so far.

I would hope to sell out of a lot of my speculative positions over the next few months and stack some stable coins.

From there I will be in a good position to buy back into the tokens that I really want like hive when we hit the bear market.

That sounds like a reasonably good strategy. It will come down to how well you time your movements. Timing the selling seems more difficult as peaks drop very quickly and it's difficult to know if that actually is the peak.Gradually selling would reduce your risk.

Thanks for the well reasoned analysis. I agree there seems to be an abundance of speculators on Hive and the increasing amount deposited on exchanges which you point out, is logical to avoid the power down delays to liquidity. I also agree with you that the lack of power ups and predominance of power downs also supports this.

I think you correctly point out while HIve has a large number of Apps and developers, we need that killer app that produces earnings like DeFi platforms similar to Cubfinance to incentivize locking up Hive in smart contracts, reduce the amount on exchanges, and increase it's scarcity to drive up price slowly and consistently. I am hoping for a CDP or AMM platform in the near future.

I like the ideas of censorship resistance and to be able to earn from your content. However, it hasn't been a huge draw. It could be lack of concern about censorship. It could be that earnings have been so low people can't be bothered. A big thing is to get people to want to be here consistently without being overly concerned about payouts. It might simply be that Hive is too small. Once our user base has reached some sort of critical mass. It might grow very rapidly. This would ultimately attract investors who are less concerned about bull runs and more concerned about a quality long term investment.

One of the most comprehensive analyses I have come across recently to understand the present and the future of HIVE Coin. I really like the comic strips in between to make the read so interesting. I didn't budge for a second.

Even I think the price action of Hive is mimicking the market and not actually driving upwards organically over time. This is why I am waiting for a big fall to buy some more. :))

Thank you @spectrumecons. Really enjoyed going through this.

Posted Using LeoFinance Beta

It looks like most of the altcoins are just following the general direction of the bull run. Today is a good example with almost all the altcoin prices falling significantly. It would be great to see more coins follow their own path.

Glad you enjoyed the comic type pictures.

Right, bloodbath all over the place. Right now altcoins' prices mimic bitcoin's trajectory which sucks.

Posted Using LeoFinance Beta

Hive is a content-centered blockchain, so the key metric of actual long-term success, is the quality of content.

I think it's fair to say that the average posting quality on Hive is very bad. And the bad posts on Hive drive quality down even further by drowning out good posts, leading to a mismanaged rewards system.

This post is earning as much as many average makeup tutorials. Do the high-stake voters on these tutorials even wear makeup? No. This is the sign of a broken ecosystem

I know this blockchain styles itself as censorship resistant, which it inherently always will be, but if Hive wants to succeed then there will have to be applications with selective membership.

Content is a big part of Hive but it's a little more than that. The most successful DApp is Splinterlands, which is a game. Microblogging is becoming more popular as well. I believe Hive is flexible enough to morph towards whatever is demanded of it. Will be interesting to see what it is like here in 5 years time.

The entire marketcap for gaming is apparently under 200 billion dollars. The marketcap for social is dramatically larger & (D)PoS is the future of social (don't you agree?).

Hive is a lot of things, but insofar as Hive is social, it'll need to create a quality platform. If it doesn't, ETH2 sure will.

I agree, the social aspect of Hive has more potential to be huge. The key might not necessarily be quality. I think it has more to with what's popular. For example, that could be sharing cartoon drawings of a comic cat. I think having communities, tribes, and different DApps can make it easier for people to focus on what they really enjoy. I tend to write long posts but that's not for everyone. Therefore, my content might be more suited to a DApp focused on elaborate content.

Considering how much HIVE is on the exchanges, I do think that most of the current run is based on speculation. I think we need a large influx of users and also a demand for RCs to show people why HIVE is important. So I am waiting to see Project Blank as I expect it to get us many new users.

Posted Using LeoFinance Beta

I really hope Project Blank can be a success. It is really hard to tell sometimes what the game changers will be. With the problems with centralised social media and censorship, we should see more users in the coming months.

Yea I am also looking forward to HSC. It currently isn't being funded but development is happening on that end. Its suppose to be even more decentralized than BSC and built using HIVE as fees. Feel free to check it out as I think has a lot of potential.

https://peakd.com/dhf/@klye/proposal-hive-side-chain-hsc-development-funding-creating-a-ethereum-virtual-machine-hive-side-chain-enabling-decentralized-i

Posted Using LeoFinance Beta

Beyond a certain price-point I suspect you are correct with potential 'long term' investors, not buying in. What price that cut-off is, varies according to many factors, resulting in difficulty to closely predict. I guess the hint will be, when we see Hive suddenly being moved here from exchanges in greater volume.

I'm hoping the long term investors show up fairly soon as it could be difficult once altcoin FOMO hits hard.

well I am new to all this and that is an interesting read!

I'm glad you found it an interesting read.

Good analysis, Thank you for your nice write up...

No problem. Glad you enjoyed it.