DeFi is quite an addictive ecosystem, as the yields are just so incredibly high, although the associated risks are high too - but are they equally high? Currently at least, I think there is a very heavy asymmetry between risk and reward and if relatively careful, it might be possible to make some very nice gains on held tokens.

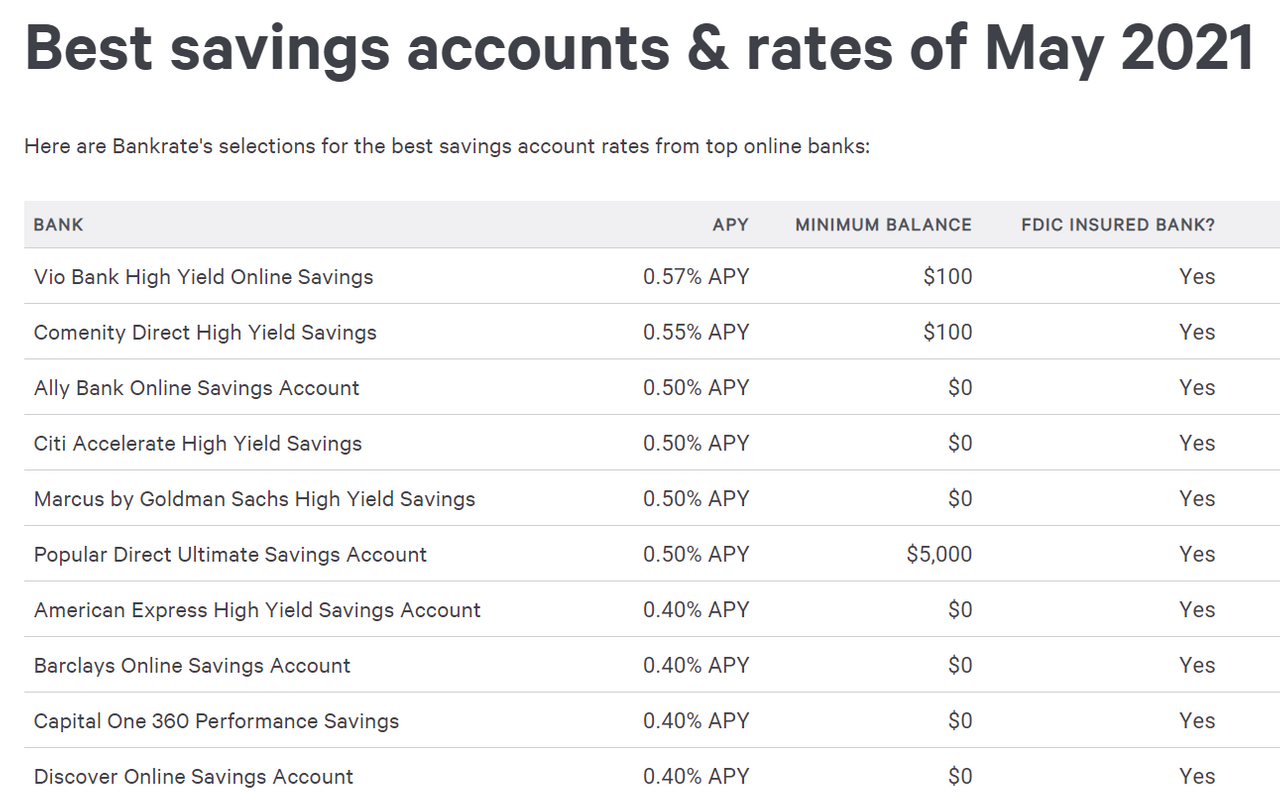

For reference, here is a googled list of the best savings accounts from top online banks:

What this means is that for the best of them, if you have one million dollars in the bank, a year later, you will have made 5,700 dollars in interest.

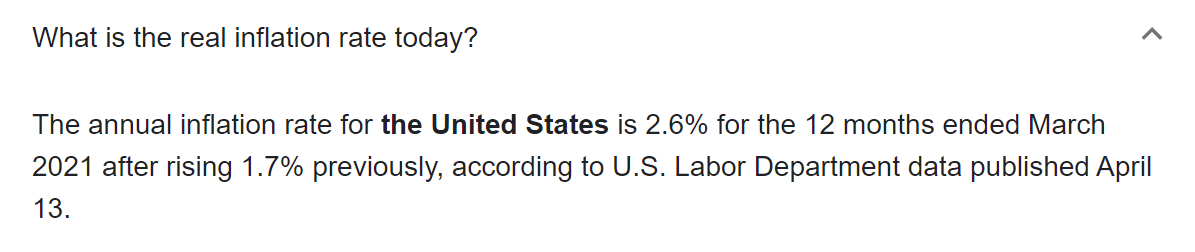

The real inflation rate in the US is sitting at 2.6% - this means that the million dollars of capital held in the bank, has 26,000 dollars less purchasing power. So, while you "made" 5,700 in interest, you actually lost 20,300 in buying value. Great deal!

0.57% APY

There are plenty of DeFi Pools out there offering over a 1% a day. What this means is that in 2.6 days, the value yielded would be the current inflation rate in the US. With 570,000 capital, it would be possible to take the entire years worth of yield of the top savings account, in a day. With 57,000 it would take 10 days, with 5,700 it would take 100 days.

What this means is that the expected yield amount from that million in the bank, could be used to create the same amount in 100 days in a DeFi pool. If it remained steady there for the year, the yield from that 5,700 would be 20,805 dollars - Which is the equivalent of having a million dollars in the bank and earning 2.08% APY on it. It is even enough to cover the inflation loss on the million dollars.

Just think about that for a moment.

Worth the risk?

What this also means at 1% a day is, taking the yield and selling without compounding at all, would see the principal value double in that 100 days. That is pretty insane and it is unlikely to last for very long under these current conditions, but if holding tokens that could be single-sided pool on an exchange, it might be worth considering.

Risk and reward have to be acknowledged when investing and there are risks involved, but there are also rewards involved. Thinking about your relationship with these two sides of the emotional equation can help consider what is worth risking and what is too much to risk. Some people are "Hail Mary all-in" and some are more reserved, putting in a percentage of their holdings to make some gains, but keeping the majority back "protected". This is crypto though, what is considered safe?

Of course, some people see "safe" as going out to fiat, but that is going to have its own issues as it still needs to be invested somewhere and since the interest rates are so poor that putting in a bank will lose money - an alternative investment is needed. Any investment is going to be open to risk, and while it is possible to minimize that risk in various ways, it isn't easy to pick a winner.

The next thing with this is, is the amount to be invested enough to make the gains significant? There is no way I can put a million dollars in the bank. There is way that I can put 5,700 dollars worth of crypto into a DeFi Pool, to potentially earn 4x as much in a year. Which would be the equivalent of having 4 million in the bank. However, I am only exposed to the inflation of what I hold, meaning that the 2.8% inflation rate is going to affect the 5700, meaning that I have very, very little inflation exposure and will still be able to earn as if I have millions in the bank. This also means that I don't need to seek 1% a day with that money, as I would effectively be able to earn about 0.3% a day on it and get the same amount as the person with a million dollars in the bank, still without the inflation exposure. This gives small capital investments superpowers, but of course there isn't the large capital sum that could be used for example, to buy a house.

This isn't trying to convince you to get into DeFi products, but it is trying to influence you into thinking about risk and return and working out whether you are using what you have wisely. For a 0.57% injection of capital into a 1% return fund would see the same gains as the best bank savings account. However, what if you put 5% in and was able to beat the inflation rate and have a little left over? Is that worth it? Of course, most of us don't have a million dollars laying around anyway - but we have the opportunity to use what we have available to us and over time and with some attention and risk exposure, we could use small amounts to make large gains that we will never have access to otherwise.

There are obviously other benefits of doing this in the crypto side of the economy too, as if "lucky", the investment isn't only going to have the yield or potential compounding gains, it is also going to benefit from token price growth, which depending on when you buy, can be significant. Also, we are in a bull market and the yields are affected by the value of the tokens in the pools, so a token that was put in at 1000 dollars worth could double or go 10x in the coming months - meaning that the yield will increase accordingly and, it can be taken as principle and sold at anytime for token profits.

I am still getting my head around all of this DeFi stuff, so don't listen to me too closely and there are things you have to be wary of, like fees, rug-pulls, hacks and tokens that will crash in price. However, it is worth exploring and doing your due diligence to see if it is suitable for you.

Buyer beware. Investor discretion advised.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

I have been really happy with the DeFi that I have been investing in. I think I might have lost a little here and there, but I have more than made up for it with what I have staked. I think as a long term hold and invest this is going to work out really well for me. I hope anyway. No matter what, it is better than putting it in the bank!

Posted Using LeoFinance Beta

I have made some terrible decisions! :D But I am still up and still learning.

The returns will drop over time, but as you can see from the numbers, even much smaller percentages can make significant differences in result. Once they start building business on top of pools, things change again.

It was crazy what I was making in that 5000% farm. Then the prices tanked and the percentage got nerfed...

Its pretty mad. Ive only been using CubDefi and its certainly an eye-opening experience. It kind of makes sense that there is so much potential reward because the technical barriers are pretty high even for those of us who have been buzzing around for a few years! I have thought about branching out in to some other Defi....but with Kingdoms coming to Cubfinance does that make it unnecessary to join other projects directly when we can have involvement via Cub?

Posted Using LeoFinance Beta

Yep. I am in a few, but I hope Kingdoms brings more people into Cub directly and branch out from there. Would like to see people using the bridge from ERC20 across to BEP20 more too :)

Posted Using LeoFinance Beta

awesome! thanks :)

Posted Using LeoFinance Beta

Ha! I get 0.7% if I make the minimum deposits, payments, transfer min. amounts to the account and then clap my hands together whilst dancing in a circle...gotta get that juicy 50 cents interest.

On a serious note though I feel some defi products risk adjusted returns are off the charts. Still learning but I feel like the APY doesn't reflect the amount of risk taken (as in we're being rewarded more than what the risk reflects). I'll be taking advantage of it whilst it lasts, because as defi stabilises and becomes the norm, that APY will be decreasing to reflect it (theoretically).

Posted Using LeoFinance Beta

I am super jealous!

For sure. It can't last this way, but it is also in the growing phases and there is a lot of "free money" floating around as the crypto space has pumped into the bull market. If they build business models on top of these (for example insurance companies) they will become far more valuable.

Posted Using LeoFinance Beta

That's true. Can't wait to see more developments in this space 😌

Posted Using LeoFinance Beta

I really need to get more involved with DeFi and CUB. All of that above sounds so incredibly enticing, and I really do loathe fiat

Posted Using LeoFinance Beta

Do your reading! :D

Posted Using LeoFinance Beta

Getting involved with Defi requires a lot of research. The reward is massive but the research keeps people away.

Posted Using LeoFinance Beta

Learning always keeps people away. Most seem to see the investment in learning a risk, since it doesn't pay back immediately.

Posted Using LeoFinance Beta

Don't even get me started on the interest these banks pay on savings. I think that's what is primarily pushing people into the crypto space in general - a lack of options

It is why so many businesses are looking this way at least. Just think about holding 1.5B in cash as Tesla - better in Bitcoin?

Posted Using LeoFinance Beta

Definitely better in my view

I have been really dismayed at bank savings rates over the past 10 years. 0.4% is the best I can get at the moment in the UK on an instant access savings account.

When I stumbed across the Crypto scene, it initially struck me as akin to share trading.

But then I discovered staking / earning. Even with Fiat GBP in Binance you can get a 5% APY return paid in "real time". I am very tempted to move some of my savings to exchanges to take advantage of the higher GBP Fiat APY rate vs banks.

The only thing stopping me from doing so at the moment is that exchanges such as Binance are not FSCS registered - so if anything happens to their liquidity (or they get hacked, etc) then our money could be at risk.

Posted Using LeoFinance Beta

Thank you. Good work

Posted Using LeoFinance Beta